Understanding Deferred Ordinary Shares: Everything You Need to Know

Understanding Deferred Ordinary Shares: Definition, Benefits, and Considerations Deferred ordinary shares are a type of equity security that offers …

Read Article

Transfer Pricing (TP) has become an essential aspect of international taxation and business strategy. As multinational enterprises continue to expand their operations across borders, the need for an accurate and reliable framework to determine the prices of intragroup transactions has grown. The Organisation for Economic Co-operation and Development (OECD) has been at the forefront of developing global standards for TP, and its TP Guidelines provide a comprehensive guide to the methods used in determining arm’s length prices.

The OECD TP Guidelines outline five main methods for determining arm’s length prices: the Comparable Uncontrolled Price (CUP) method, the Resale Price (RPM) method, the Cost Plus (CP) method, the Transactional Net Margin (TNMM) method, and the Profit Split method. Each method has its own unique characteristics and is suitable for different types of transactions and industries. Understanding these methods is crucial for businesses to ensure compliance with TP regulations and avoid transfer pricing disputes.

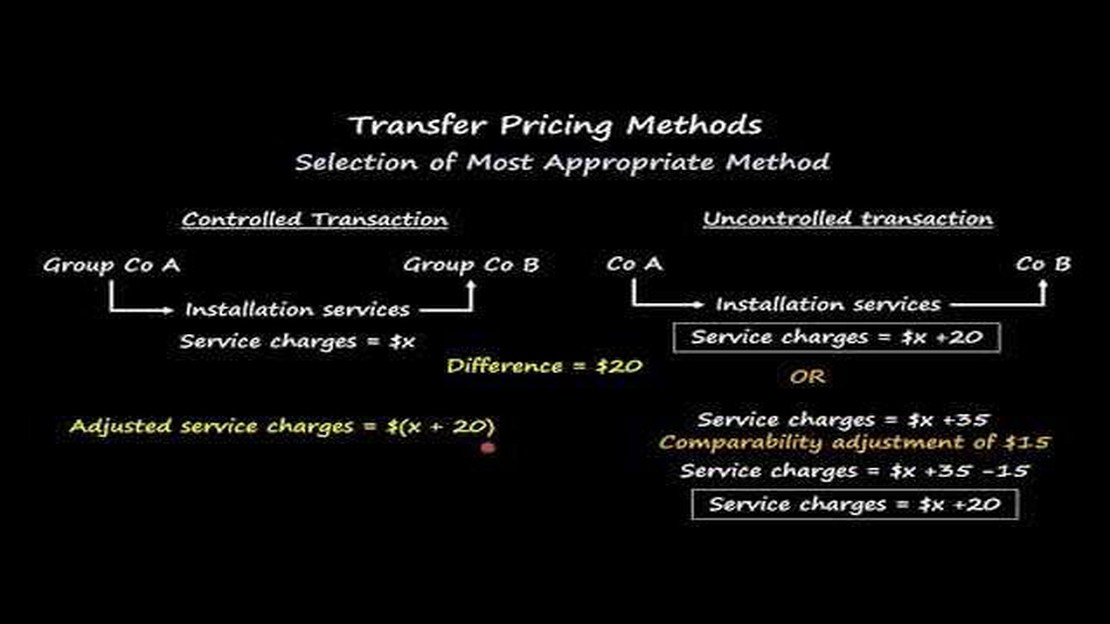

The CUP method compares the price of a controlled transaction with the price of a similar transaction between independent parties. This method requires a high degree of comparability and availability of reliable data. The RPM method, on the other hand, focuses on the resale price of goods or services and calculates an appropriate gross margin. The CP method determines the arm’s length price by adding an appropriate markup on the costs incurred by the seller. The TNMM method compares the net profit margin achieved in a controlled transaction with the net profit margin of comparable uncontrolled transactions. Finally, the Profit Split method allocates the combined profits of controlled transactions based on the relative contributions of each party.

By understanding the OECD TP methods and their application, businesses can ensure that their transfer pricing practices are in line with global standards and minimize the risk of double taxation or TP adjustments. This comprehensive guide will delve into each method in detail, providing practical examples and insights to help businesses navigate the complex world of transfer pricing and optimize their tax planning strategies.

The Organisation for Economic Co-operation and Development (OECD) Transfer Pricing Guidelines (TP Guidelines) are an internationally recognized framework used by tax authorities and multinational enterprises for determining the pricing of cross-border transactions within multinational groups. Transfer pricing refers to the way in which transactions between related entities, such as the sale of goods or provision of services, are priced. The OECD TP Guidelines provide guidance on the arm’s length principle, which is the international standard for determining transfer pricing.

The arm’s length principle requires that the pricing of transactions between related entities be comparable to transactions between independent parties under similar circumstances. The goal of the arm’s length principle is to ensure that related entities do not artificially shift profits to jurisdictions with lower tax rates and that they pay taxes on their fair share of profits in accordance with the economic activities they undertake.

The OECD TP Guidelines are not legally binding, but they have been widely adopted by countries around the world as the basis for determining transfer pricing. The guidelines provide a framework for tax administrations to assess transfer pricing arrangements, as well as for multinational enterprises to establish appropriate transfer pricing policies and documentation.

The OECD TP Guidelines consist of five different transfer pricing methods that can be used to determine arm’s length prices. These methods include the Comparable Uncontrolled Price Method (CUP), the Resale Price Method (RPM), the Cost Plus Method (CPM), the Transactional Net Margin Method (TNMM), and the Profit Split Method (PSM). Each method has its own specific applicability and requirements, and the choice of method should be based on the nature of the controlled transaction and the availability of reliable data.

Read Also: Currency Exchange Rate: Manila to BDT

Overall, the OECD TP Guidelines play a crucial role in promoting a consistent and transparent approach to transfer pricing and reducing the risk of double taxation and tax avoidance. By providing a common framework for determining arm’s length prices, the guidelines contribute to a more level playing field for multinational enterprises and help ensure that tax outcomes are aligned with the economic substance of transactions.

Understanding the OECD TP Methods can provide several benefits for multinational enterprises (MNEs) and tax authorities alike. These benefits include:

Read Also: Is IC Markets a Legit Trading Platform? Unveiling the Truth

| Improved Compliance | By understanding the OECD TP Methods, MNEs can ensure that their transfer pricing policies and practices are in line with international standards. This can help them avoid costly audits, penalties, and disputes with tax authorities. |

| Reduced Tax Risks | Knowledge of the OECD TP Methods can help MNEs identify and manage transfer pricing risks more effectively. This can lead to a lower risk of double taxation and a better ability to defend transfer pricing positions during tax audits. |

| Optimized Tax Planning | Understanding the various OECD TP Methods allows MNEs to develop tax planning strategies that are not only compliant with international standards but also tax-efficient. This can result in reduced tax liabilities and increased profits for the group. |

| Enhanced Collaboration | When both MNEs and tax authorities have a strong understanding of the OECD TP Methods, it facilitates better collaboration and communication between the two parties. This can lead to a more efficient resolution of transfer pricing disputes and a reduced risk of litigation. |

| Increased Competitiveness | By understanding and applying the OECD TP Methods effectively, MNEs can enhance their competitiveness in the global marketplace. This is because they can demonstrate to customers, investors, and regulators that their transfer pricing policies are transparent, fair, and in line with international best practices. |

Overall, understanding the OECD TP Methods is crucial for MNEs and tax authorities to navigate the complex landscape of transfer pricing. It helps ensure compliance, reduce tax risks, optimize tax planning, enhance collaboration, and increase competitiveness. Therefore, investing in the understanding of these methods is vital for any company engaged in cross-border transactions.

The OECD TP Methods are guidelines provided by the Organisation for Economic Co-operation and Development (OECD) to help countries determine transfer prices for tax purposes. These methods help ensure that transfer pricing is conducted in a fair and consistent manner across different jurisdictions.

The OECD TP Methods are important because they provide a standardized framework for determining transfer prices. This helps prevent multinational companies from artificially shifting profits to low-tax jurisdictions, known as base erosion and profit sharing (BEPS). By using the OECD TP Methods, countries can ensure that transfer prices reflect the economic reality of the transactions.

There are five main OECD TP Methods, which are outlined in the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations. These methods are the Comparable Uncontrolled Price Method (CUP), the Resale Price Method (RPM), the Cost Plus Method (CPM), the Transactional Net Margin Method (TNMM), and the Profit Split Method (PSM).

The OECD TP Methods work by comparing the transfer prices set by multinational companies with prices that would have been agreed between unrelated parties in similar circumstances. Each method has its own specific approach and criteria for determining arm’s length prices, taking into account the functions performed, risks assumed, and assets used by each party involved in the transaction. The choice of method depends on the availability and reliability of data.

Understanding Deferred Ordinary Shares: Definition, Benefits, and Considerations Deferred ordinary shares are a type of equity security that offers …

Read ArticleIs Forex Trading Legal in the UAE? Forex trading, also known as foreign exchange trading, has become a popular investment option for individuals …

Read ArticleShould I buy options on Friday? Options trading can be an exciting and lucrative venture for those who understand the risks and rewards involved. …

Read ArticleUnderstanding the 20 Day and 200 Day Moving Average The 20-day and 200-day moving averages are popular technical analysis tools used by traders and …

Read ArticleFirst Currency Trading Exchange in India India, with its rich history and vibrant culture, has long been a hub for trade and commerce. However, until …

Read ArticleWhat is a nano lot size? When it comes to trading in the foreign exchange market, understanding the concept of lot size is crucial. Lot size refers to …

Read Article