Understanding the 90 120 Rule in Stocks: A Guide for Investors

Understanding the 90 120 Rule in Stocks Investing in stocks can be a daunting task, especially for those new to the world of finance. But …

Read Article

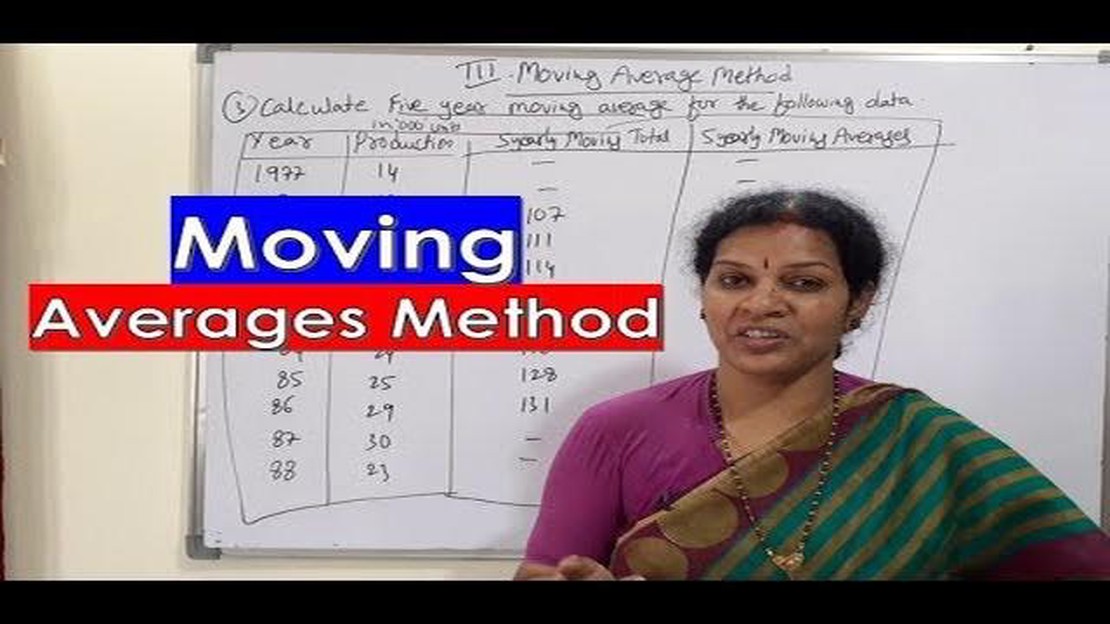

The moving average trend value is a widely used indicator in financial analysis that helps investors and traders understand the direction and strength of a stock or market trend. This indicator is based on the average price of an asset over a specific period of time, and it can provide valuable insights into the market’s behavior.

By calculating the moving average trend value, investors can identify whether a stock is trending upwards, downwards, or moving sideways. This information can be used to make informed decisions about buying or selling assets. The moving average trend value is especially useful in volatile markets, as it smooths out short-term price fluctuations and provides a clearer picture of the overall trend.

There are different types of moving averages that can be used to calculate the trend value, including the simple moving average (SMA) and the exponential moving average (EMA). The SMA gives equal weight to each price point in the calculation, while the EMA assigns more weight to recent prices. Traders often use a combination of these moving averages to get a more accurate understanding of the trend.

It is important to note that the moving average trend value is not a definitive signal to buy or sell. It should be used in combination with other indicators and analysis techniques to confirm a potential trend. False signals can occur, especially during periods of high volatility, so it is crucial to consider other factors when making trading decisions.

The moving average is a commonly used technical analysis tool in the financial markets. It is used to identify trends and potential reversal points in price movements.

A moving average is calculated by taking the average of a set number of data points over a specified time period. The time period can be as short as a few days or as long as several months, depending on the trader’s preference.

There are different types of moving averages, including simple moving averages (SMA) and exponential moving averages (EMA). The SMA gives equal weight to each data point, while the EMA gives more weight to recent data points.

The moving average line is usually plotted on a price chart, and it smooths out the price data to provide a clearer picture of the overall trend. When the price is above the moving average line, it indicates an uptrend, while a price below the moving average line indicates a downtrend.

Read Also: How to Determine Stock Price Based on Option Price: A Complete Guide

Traders often use moving averages to generate buy and sell signals. For example, when the price crosses above the moving average line, it may be a signal to buy, and when the price crosses below the moving average line, it may be a signal to sell.

Moving averages can also be used to determine support and resistance levels. When the price approaches a moving average line, it may act as a support level if the price bounces off it, or as a resistance level if the price fails to break above it.

It’s important to note that moving averages are lagging indicators, meaning they are based on past price data. They can be useful for confirming trends, but they should not be relied upon as the sole basis for making trading decisions. Traders should use moving averages in conjunction with other technical indicators and analysis techniques to get a more comprehensive view of the market.

The trend value plays a crucial role in understanding the movement and direction of a market or an asset’s price. It is a popular tool used by traders and investors to identify the overall trend and make informed decisions. The trend value is derived from the moving average, which is a widely used technical indicator.

A moving average is calculated by taking the average price of an asset over a specific period. The period can range from a few days to several months, depending on the trader’s preference. The moving average smoothes out the price data, providing a clearer picture of the underlying trend.

The trend value is determined by evaluating the relationship between the current price and the moving average. When the current price is above the moving average, it indicates an uptrend, while a price below the moving average suggests a downtrend. Traders consider these trends as strong indicators of future price movements.

Understanding the trend value is essential for making informed trading decisions. Traders often use it to determine the optimal time to enter or exit a trade. For example, if the trend value indicates an uptrend, traders may consider buying the asset in anticipation of further price increases. Conversely, if the trend value suggests a downtrend, traders may consider selling or shorting the asset to profit from potential price declines.

In addition to identifying the overall trend, the trend value can also help traders identify potential reversals or trend changes. If the price crosses above or below the moving average, it can signal a shift in the market sentiment and the start of a new trend. Traders who are actively monitoring the trend value can take advantage of these opportunities to capitalize on potential price reversals.

Read Also: Discover the Power of the Moving Average Cross Dashboard - Boost Your Trading Strategy

Overall, understanding the importance of trend value is crucial for traders and investors. It provides valuable insights into the market’s direction and helps them make informed trading decisions. By utilizing the trend value in conjunction with other technical indicators and analysis tools, traders can increase their chances of success in the financial markets.

| Advantages of Understanding Trend Value | Disadvantages of Ignoring Trend Value |

|---|---|

| * Ability to identify the overall trend |

A moving average trend value is a statistical calculation that shows the average value of a data set over a specific period of time, with the value being updated as new data becomes available. It is used to identify and track trends in data, particularly in financial markets.

While a moving average trend value can provide insights into past and current trends, it is not necessarily a reliable indicator of future trends. It is just one tool among many that can be used in combination with other analysis techniques to make predictions.

Common periods used in calculating moving average trend values include 10-day, 50-day, and 200-day periods. However, the choice of period depends on the specific application and the time frame being analyzed.

Moving average trend values can be used in trading to identify buy or sell signals. For example, when the price of an asset rises above its moving average trend value, it could be seen as a bullish signal to buy, while a price falling below the moving average trend value could be seen as a bearish signal to sell.

Understanding the 90 120 Rule in Stocks Investing in stocks can be a daunting task, especially for those new to the world of finance. But …

Read ArticleUnderstanding Forex Option Expiries and Their Significance Forex option expiries are an important aspect of trading that every forex trader should …

Read ArticleUnderstanding the Vesting Schedule for Startup Founders When it comes to startup founders and equity, understanding the vesting schedule is crucial. …

Read ArticleUsing american express cards in Cape Town: What you need to know If you’re planning a trip to Cape Town and wondering whether or not to bring your …

Read ArticleUnderstanding the Time Indicator in MT4 In the world of trading, time is a critical factor that can significantly impact decision-making and the …

Read ArticleDoes XM accept NETELLER? If you’re looking for a reliable and convenient payment method to fund your trading account with XM, you might be wondering …

Read Article