How to Successfully Trade with Pending Orders: A Step-by-Step Guide

Trading Pending Orders: A Step-by-Step Guide Trading in the financial markets can be a lucrative venture if done correctly. It requires careful …

Read Article

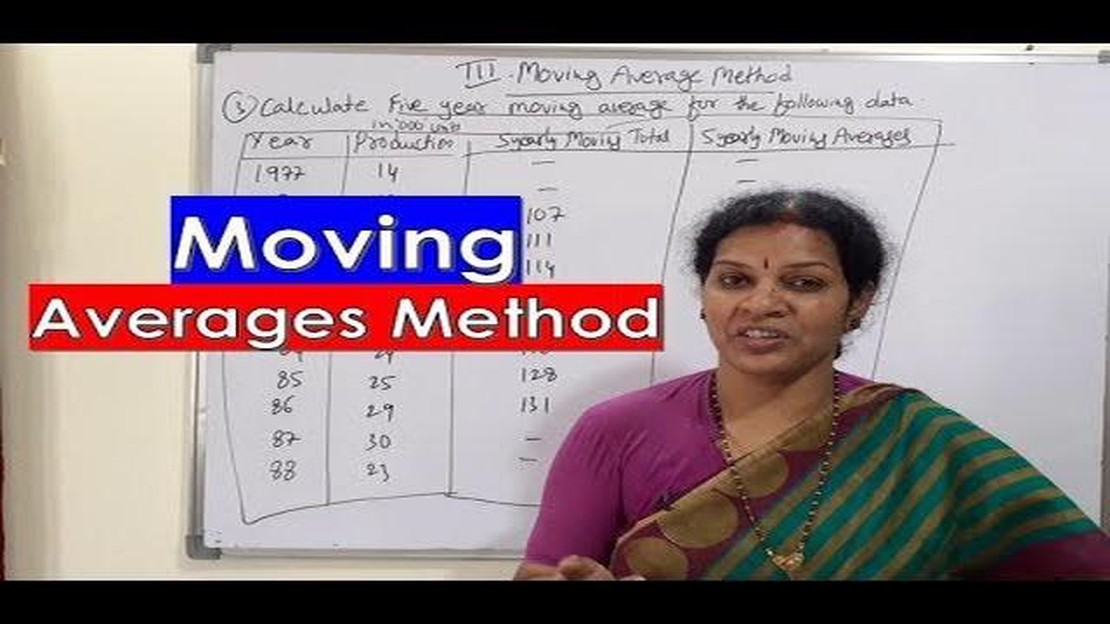

The Moving Average Method is a commonly used statistical technique in data analysis, forecasting, and time series analysis. It is a useful tool for smoothing out random variations or noisy data in order to identify underlying trends and patterns.

The Moving Average Method works by calculating the average of a series of data points over a specified period of time, and then plotting the average value on a graph. This moving average line represents the overall trend in the data, which allows analysts to better understand and interpret the patterns of the data.

One of the key advantages of using the Moving Average Method is its ability to filter out short-term fluctuations in the data, which can often be misleading or distracting when trying to identify long-term trends. By focusing on the moving average line, analysts are able to gain a clearer picture of the underlying patterns and dynamics of the data.

The Moving Average Method is particularly useful in the field of PDF analysis, where it can be used to analyze patterns and trends in the distribution of data, such as fluctuations in website traffic, sales data, or user behavior. By applying the Moving Average Method to PDF data, analysts can better understand and predict future trends, make more informed decisions, and optimize business strategies.

The moving average method is a statistical technique commonly used in data analysis to identify trends or patterns in a time series. It is especially useful for smoothing out fluctuations and reducing noise in the data, making it easier to identify underlying patterns.

The moving average method involves calculating the average of a certain number of consecutive data points, known as the window size or period. This window is then moved forward in time, calculating a new average each time, hence the name “moving average.”

One of the key advantages of the moving average method is its simplicity. It is relatively easy to apply and understand, even for those without a background in statistics. Additionally, it can be applied to a wide range of data types, including numerical, financial, and even textual data.

There are different types of moving averages that can be used, such as the simple moving average (SMA), weighted moving average (WMA), and exponential moving average (EMA). The choice of which type to use depends on the specific data set and the desired level of sensitivity to recent changes.

When using the moving average method, it’s important to consider the window size. A smaller window size will give more weight to recent data points, making the moving average more sensitive to short-term fluctuations. On the other hand, a larger window size will provide a smoother average, but with less responsiveness to recent changes. The window size should be chosen based on the specific characteristics of the data being analyzed.

The moving average method is often used for various purposes, such as identifying trends in financial markets, analyzing stock prices, predicting future values, and even filtering out noise in images or audio signals. It is a versatile and widely used method in data analysis due to its simplicity and effectiveness in smoothing out data.

In summary, the moving average method is a powerful tool in data analysis for identifying trends and patterns. By calculating the average of consecutive data points, it can provide insights into the underlying behavior of a time series. Understanding the basics of the moving average method is essential for anyone working with data analysis and seeking to extract meaningful information from their data.

Read Also: Does Robinhood Offer Weekly Options? Find Out the Details Here

The moving average method is a common statistical technique used to analyze time series data. It is particularly useful for smoothing out fluctuations or noise in the data, allowing analysts to identify underlying trends or patterns.

The method involves calculating the average value of a set of data points over a specific time period, known as the window or span. The window can be fixed, meaning it includes a fixed number of data points, or it can be variable, meaning it adjusts depending on the specific requirements of the analysis.

To calculate the moving average, the data points within the window are summed up and divided by the number of data points in the window. This process is repeated for each subsequent window, moving along the time series. The result is a series of average values, which can be plotted to visualize the trend.

The moving average method is commonly used in financial analysis, particularly in the field of technical analysis. It helps identify short-term price trends, as well as potential support and resistance levels. It is also used in forecasting models and time series analysis to predict future values based on past performance.

There are different variations of the moving average method, including the simple moving average (SMA), which gives equal weight to all data points within the window, and the weighted moving average (WMA), which assigns different weights to data points depending on their position within the window.

Overall, the moving average method provides a valuable tool for smoothing out noisy data and identifying underlying trends or patterns. It can be applied to a wide range of industries and applications, making it a versatile and widely used technique in the field of data analysis.

The moving average method is a popular technique used in data analysis and forecasting. It involves calculating the average of a subset of data points over a specified time period, and using this average to make predictions or analyze trends. When applied to PDF files, the moving average method offers several benefits and has a wide range of applications.

One of the main benefits of using the moving average method in PDF is its ability to smooth out volatility and noise in the data. PDF files often contain large amounts of data that may have variations and irregularities. By applying the moving average method, these variations can be minimized, providing a clearer and more accurate representation of the underlying trends.

Read Also: Understanding the Fair Value of Trading Securities: Key Concepts and Implications

Another advantage of the moving average method in PDF is its ability to identify and highlight long-term trends. By calculating the average over a longer time period, the method helps to filter out short-term fluctuations, allowing analysts to focus on the bigger picture. This can be particularly useful in financial analysis, where identifying long-term trends is essential for making informed decisions.

The moving average method in PDF also has applications in forecasting. By analyzing the historical data using the moving average method, analysts can make predictions about future trends and patterns. This can be valuable for businesses and organizations in various industries, as it allows them to anticipate changes in market conditions, demand patterns, and other factors that may affect their operations.

Additionally, the moving average method in PDF can be used for data smoothing and anomaly detection. By calculating the average over a specific time period, it becomes easier to identify outliers and anomalies that deviate significantly from the expected pattern. This can be helpful in identifying data errors, fraudulent activities, and other irregularities that may be hidden within the PDF files.

In conclusion, the moving average method in PDF offers numerous benefits and has a wide range of applications. It helps to smooth out volatility, identify long-term trends, make predictions, and detect anomalies. By utilizing this method, analysts can gain valuable insights from PDF files and make more informed decisions based on the underlying trends and patterns.

The moving average method in PDF is a statistical technique used to analyze and forecast time series data. It involves calculating the average of a specific number of data points within a given time period to identify trends and patterns in the data.

The moving average in PDF is calculated by taking the average of a certain number of data points within a specified time period. This is done by summing up the values of the data points and dividing by the number of data points used.

The advantages of using the moving average method in PDF include its simplicity and ease of implementation, its ability to smooth out fluctuations and noise in the data, and its ability to identify trends and patterns in the data. It is also useful for making short-term forecasts and detecting any anomalies in the data.

Yes, there are some limitations to the moving average method in PDF. One limitation is that it gives equal weight to all data points within the specified time period, which may not be appropriate if certain data points are more important or have different characteristics. Another limitation is that it may not work well if there are sudden and significant changes or outliers in the data. Additionally, it may not be suitable for long-term forecasting or analyzing non-stationary data.

Yes, the moving average method in PDF can be used for forecasting. By analyzing the trends and patterns in the data, it can provide an estimate for future values. However, it is important to note that the accuracy of the forecasts may depend on various factors such as the length of the time period used for the moving average calculation, the characteristics of the data, and the presence of any outliers or sudden changes.

Trading Pending Orders: A Step-by-Step Guide Trading in the financial markets can be a lucrative venture if done correctly. It requires careful …

Read ArticleIs Sensibull free or paid? When it comes to options trading, having the right tools can make all the difference. Sensibull is a popular options …

Read ArticleUnderstanding the Intermarket Trading System: Key Concepts and Benefits The Intermarket Trading System (ITS) is a complex network of interconnected …

Read ArticleFee to withdraw euros When travelling abroad, it’s important to have a good understanding of the fees associated with withdrawing euros. Whether …

Read ArticleUnderstanding the Mechanics of Forex Trading: How Does It Work? Forex trading, short for foreign exchange trading, is the buying and selling of …

Read ArticleSalary of professional traders in the UK Being a professional trader in the UK can be a highly lucrative career path for those who have a knack for …

Read Article