Can I Start Trading with R100? | Everything You Need to Know

Can I start trading with R100? Have you ever wondered if it’s possible to start trading with just R100? If you’ve been interested in the world of …

Read Article

When it comes to trading in the financial markets, it’s important to have a solid understanding of the various technical indicators and settings that can be used to analyze price action and make informed trading decisions. One such setting that is commonly used by traders is the Moving Average Envelope (MAE).

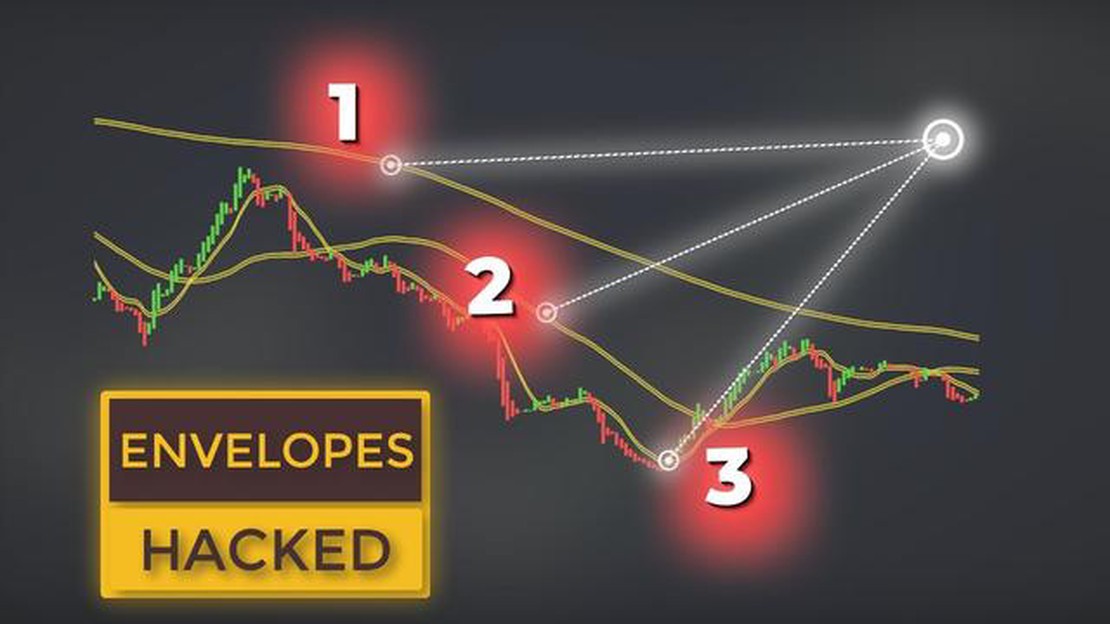

The Moving Average Envelope is a technical analysis tool that is used to identify trading opportunities and potential reversals in the market. It is created by plotting a band above and below a moving average, with the width of the band determined by a specified percentage or number of points.

By using the Moving Average Envelope, traders are able to visually identify when a market is becoming overbought or oversold. When prices move to the upper band, it is a signal that the market may be overextended and due for a reversal. Conversely, when prices move to the lower band, it suggests that the market may be oversold and due for a bounce.

It’s important to note that the Moving Average Envelope should not be used in isolation, but rather in conjunction with other technical analysis tools and indicators. By combining the MAE with other indicators such as oscillators or volume analysis, traders can increase the accuracy of their trading signals and make more informed trading decisions.

A moving average is a commonly used technical indicator in trading that helps to identify the direction of a trend and smooth out price fluctuations. It is calculated by taking the average of a set number of price data points over a specific period of time.

The moving average is plotted on a chart as a line that represents the average price over the selected time period. It is a lagging indicator, meaning that it reacts to changes in price after they have already occurred. However, it can still provide valuable insight into the market trend and potential entry or exit points for trades.

There are different types of moving averages, including the simple moving average (SMA) and the exponential moving average (EMA). The SMA calculates the average price over a specified time period, while the EMA gives more weight to recent price data, making it more responsive to current market conditions.

Traders often use moving averages to identify support and resistance levels, as well as to generate trading signals. For example, when the price crosses above the moving average, it is considered a bullish signal, indicating that the trend may be shifting upward. On the other hand, when the price crosses below the moving average, it is seen as a bearish signal, suggesting a potential downtrend.

It is important to note that moving averages work best in trending markets, where there is a clear and sustained price direction. In choppy or sideways markets, moving averages may produce false signals and lead to losses.

Overall, moving averages provide traders with a visual representation of the average price over a specific period of time, helping them to identify trends and make informed trading decisions.

There are several types of moving averages that traders use to analyze price data and identify trends. Each type of moving average has its own characteristics and is used in different trading strategies. Here are the most common types of moving averages:

Read Also: 2023 Dollar to MYR Forecast: What to Expect

Each type of moving average has its own advantages and disadvantages. Traders often experiment with different types of moving averages to find the one that works best for their trading strategy.

The envelope setting is a popular technical analysis tool used by traders to identify potential trend reversals and market entry/exit points. It is based on the concept of the moving average (MA) and involves plotting upper and lower bands around the MA line.

Read Also: International Trade System Summary: An Overview of Global Trade Policies and Practices

The moving average envelope setting consists of two components - the moving average line and the envelope bands. The moving average line is calculated by taking the average of a specified number of previous price data points. This line represents the average price over a given period of time and is used to identify the overall trend direction.

The envelope bands are plotted above and below the moving average line. The distance between the moving average line and the upper/lower bands is determined by a specified percentage or number of standard deviations. The purpose of the envelope bands is to create channels that represent price volatility. When prices move close to the upper band, it suggests that the market is overbought, while prices near the lower band indicate oversold conditions.

Traders use the envelope setting to generate trading signals. When prices touch or penetrate the upper band, it may be a signal to sell or take profits. Conversely, when prices touch or breach the lower band, it may be a signal to buy or enter the market. These signals are based on the assumption that price tends to revert to the mean, so extreme moves away from the moving average line may indicate a potential reversal or correction.

It is important to note that the envelope setting is not a standalone trading strategy, but rather a tool that can be used in conjunction with other technical indicators and analysis techniques. Traders often combine the envelope setting with oscillators, trendlines, and candlestick patterns to increase the accuracy of their trading decisions.

In conclusion, understanding the envelope setting is essential for traders looking to incorporate technical analysis into their trading strategy. By identifying potential trend reversals and market entry/exit points, the envelope setting can help traders make more informed trading decisions and improve their overall profitability.

The moving average envelope setting for trading is a technical indicator that is used to determine potential price levels that a security may reach. It involves plotting two lines above and below a moving average line, creating a channel or envelope within which the price is expected to fluctuate.

The moving average envelope setting is calculated by first determining the desired duration of the moving average line. This could be a common duration such as 20, 50, or 200 days. Then, two percentage values are chosen to determine the width of the envelope, such as 2% or 5%. These percentages are then multiplied by the moving average line to create the upper and lower lines of the envelope.

The moving average envelope setting is important for trading because it can help traders identify potential support and resistance levels. When the price moves outside of the envelope, it may indicate a reversal or breakout in the price trend, providing trading opportunities. Additionally, the envelope can help traders determine when a security is overbought or oversold.

While the moving average envelope setting can be a useful tool, there are some potential drawbacks to consider. Firstly, the envelope may not accurately predict price movements, leading to false signals. Additionally, the envelope may not work well in trending markets, as the price may stay consistently outside of the envelope. Traders should also be aware that different securities may require different envelope settings for optimal results.

Can I start trading with R100? Have you ever wondered if it’s possible to start trading with just R100? If you’ve been interested in the world of …

Read ArticleIs the forex market real or fake? The Forex market, also known as the Foreign Exchange market, is a decentralized global market where the world’s …

Read ArticleIs SMC the Best Trading Strategy? In the world of trading, there are countless strategies that traders employ to make profits in the financial …

Read ArticleIs HDFC Bank Offering Forex Cards? If you are planning a trip abroad, whether for business or leisure, having a forex card can be a convenient and …

Read ArticleUnderstanding the 2x Leveraged ETF Strategy: Explained A 2x Leveraged ETF strategy is an investment approach that involves the use of Exchange-Traded …

Read ArticleUSD to RUB Prediction: Analyzing the Exchange Rate Forecast The exchange rate between the United States Dollar (USD) and the Russian Ruble (RUB) is …

Read Article