Understanding the Role of Moving Averages in Identifying Trends

Understanding the Role of Moving Averages in Identifying Trends In the world of financial analysis and trading, one of the key concepts is identifying …

Read Article

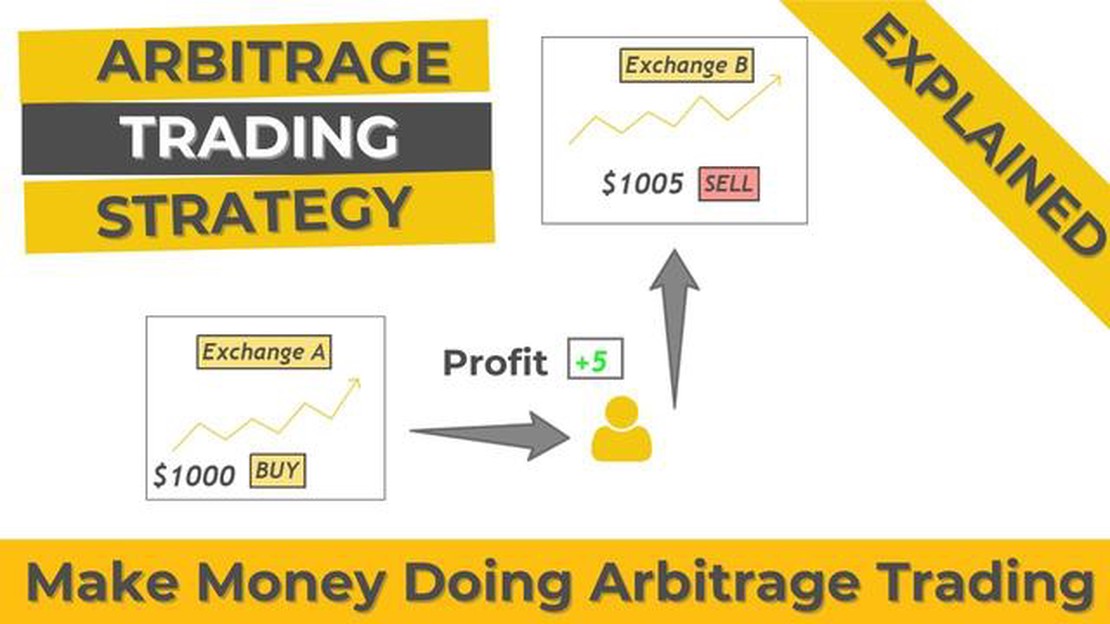

In the dynamic and rapidly changing world of forex trading, the concept of arbitrage is an important tool that allows traders to take advantage of price differences in different markets. Forex arbitrage is the practice of buying and selling currency pairs to profit from discrepancies in exchange rates between different brokers or trading platforms.

The basic principle behind forex arbitrage is that currencies are traded in pairs, and the exchange rates for these pairs can vary slightly across different platforms. This opens up an opportunity for traders to buy a currency pair at a lower price on one platform and sell it at a higher price on another platform, thus making a profit from the price difference.

To execute a forex arbitrage trade, traders need to have access to multiple trading platforms and brokers and be able to monitor exchange rates in real-time. They must be quick to identify and seize opportunities as they arise, as price differences tend to be short-lived and quickly corrected by the market.

Forex arbitrage can be classified into two main types: spatial arbitrage and temporal arbitrage. Spatial arbitrage involves taking advantage of price differences between different brokers or platforms at the same time. Temporal arbitrage, on the other hand, involves exploiting price differences that occur over time, such as when news or economic events cause significant fluctuations in exchange rates.

Overall, forex arbitrage is a complex and intricate trading strategy that requires a deep understanding of the forex market and its mechanisms. Successful arbitrage traders employ sophisticated algorithms and high-frequency trading techniques to identify and execute profitable trades in milliseconds. However, it is worth noting that forex arbitrage is not without risks, and regulatory bodies closely monitor and restrict certain forms of arbitrage to maintain market stability and fairness.

In conclusion, forex arbitrage is a strategy that allows traders to profit from price differences across different trading platforms. Understanding how forex arbitrage works and staying up-to-date with market conditions are essential for successful arbitrage trading. By identifying and exploiting these temporary price differences, traders can potentially generate consistent profits in the highly competitive and volatile forex market.

Forex arbitrage is a trading strategy that aims to take advantage of the price discrepancies between different currency pairs in the foreign exchange market. It involves buying a currency at a lower price on one market and simultaneously selling it at a higher price on another market. The goal is to profit from the difference in prices, taking advantage of the inefficiencies in the market.

This strategy is possible due to the decentralized nature of the forex market, which allows traders to buy and sell currencies from multiple markets simultaneously. Traders can exploit temporary price discrepancies that occur when there is a delay in the transmission of information between different markets or due to variations in liquidity.

Forex arbitrage can be classified into three main types: simple arbitrage, triangular arbitrage, and statistical arbitrage. Simple arbitrage involves buying and selling the same currency pair at different prices in different markets. Triangular arbitrage takes advantage of the price discrepancies among three different currency pairs. Statistical arbitrage relies on complex mathematical models to identify and exploit trading opportunities based on statistical patterns.

Read Also: Discover the top indicator for short term forex trading

Forex arbitrage is considered a low-risk trading strategy since it relies on quickly taking advantage of short-lived price discrepancies. Traders need to act swiftly and have efficient systems in place to execute trades in real-time. However, it is important to note that forex arbitrage opportunities are rare and often difficult to find. High-frequency trading algorithms and advanced technology have increased competition in the market, making it challenging for individual traders to find profitable arbitrage opportunities.

In conclusion, forex arbitrage is a trading strategy that capitalizes on the differences in prices between multiple currency pairs. It involves buying and selling currencies simultaneously to profit from temporary price discrepancies. Traders need to have a deep understanding of the market and employ sophisticated systems to successfully execute arbitrage trades.

Forex arbitrage is a trading strategy that offers several benefits to traders, including:

In conclusion, forex arbitrage offers several benefits to traders, including low risk, consistent profits, no directional exposure, high liquidity, and automation possibilities. By understanding and utilizing this trading strategy effectively, traders can increase their chances of success in the forex market.

Read Also: Top Key Terms in Forex You Must Know

Forex arbitrage is a trading strategy that takes advantage of price discrepancies in the foreign exchange market to make profits. It involves buying and selling currency pairs simultaneously in different markets to exploit differences in their exchange rates.

Forex arbitrage works by taking advantage of the inefficiencies in the foreign exchange market. Traders identify currency pairs that are traded in different markets and have different exchange rates. They then buy the currency in the market with a lower exchange rate and sell it in the market with a higher exchange rate, making a profit from the price difference.

Forex arbitrage is generally legal, but it can be subject to regulatory restrictions in some jurisdictions. It is important for traders to comply with the laws and regulations of their respective countries and ensure they are not engaging in any illegal activities. It is always advisable to consult with a legal professional or financial advisor before engaging in forex arbitrage.

There are several risks associated with forex arbitrage. The main risk is that price discrepancies can be fleeting and difficult to exploit, especially in highly liquid markets. Additionally, trading costs, such as commissions and spreads, can eat into the potential profits. There is also the risk of regulatory restrictions and the possibility of losing money if the trades are not executed properly.

Forex arbitrage offers several advantages to traders. It provides an opportunity to make profits with minimal market exposure, as positions are typically held for a short period of time. It can also be a low-risk strategy when executed properly. Additionally, forex arbitrage can help to increase market efficiency by narrowing price discrepancies between different markets.

Forex arbitrage is a trading strategy that takes advantage of small differences in exchange rates between different currency pairs.

Forex arbitrage works by simultaneously buying and selling currency pairs in different markets to take advantage of pricing discrepancies and profit from the difference in exchange rates.

Understanding the Role of Moving Averages in Identifying Trends In the world of financial analysis and trading, one of the key concepts is identifying …

Read ArticleIs Forex Trading Haram or Halal? Forex trading, also known as foreign exchange trading, has become increasingly popular in recent years. However, for …

Read ArticleShould You Pay for Trading Signals? In the world of trading, one of the biggest challenges is knowing when to buy and sell. This is where trading …

Read ArticleTrading in Nairobi Stock Exchange: A Step-by-Step Guide Investing in the stock market can be an effective way to grow your wealth and achieve your …

Read ArticleForeign Exchange Fees in Bangkok Bank When you’re traveling abroad, one of the most important things to consider is how to exchange your currency. …

Read ArticleHow to Analyze Forex Market PDF As a forex trader, it is essential to have a solid understanding of the market and be able to analyze its movements. …

Read Article