Greece Trading Partners: Discover Who Greece is Trading With

Trading Partners of Greece Greece, officially known as the Hellenic Republic, is a country located in Southeast Europe. It has a rich history and …

Read Article

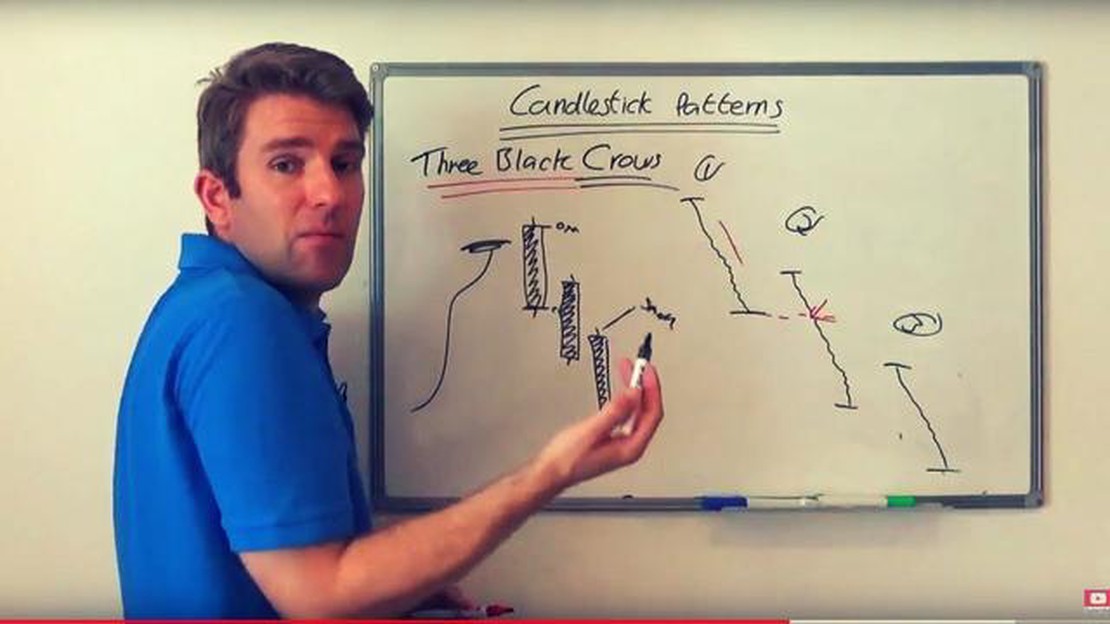

Three Black Crows is a technical reversal pattern that can be observed in stock market charts. This pattern consists of three consecutive long red (bearish) candlesticks that close at or near their lows. It is considered a sign of a potential trend reversal from bullish to bearish.

This guide aims to provide a comprehensive understanding of the meaning and significance of the Three Black Crows pattern. It will explain how this pattern is formed, what it indicates about the market sentiment, and how traders can use it to make more informed investment decisions.

The Three Black Crows pattern is derived from the underlying principle of Japanese candlestick charting, which focuses on visually representing the price movement of an asset over a specific time period. This pattern is particularly useful for technical analysts and traders who rely on chart patterns to predict future price movements.

When the Three Black Crows pattern occurs, it suggests that the bears (sellers) have taken control of the market, overpowering the bulls (buyers). This shift in market sentiment often indicates a strong downward trend and can provide valuable insights for traders looking to initiate short or put positions.

It is important to note that while the Three Black Crows pattern can be a reliable signal, it should not be used in isolation. Traders should always consider other technical indicators, fundamental analysis, and market trends to confirm their trading decisions and minimize potential risks.

By understanding the meaning and significance of the Three Black Crows pattern, traders can enhance their ability to identify potential trend reversals and make more informed trading decisions. This guide will equip traders with the knowledge and tools necessary to incorporate this pattern into their technical analysis toolkit and ultimately improve their trading performance.

Three Black Crows is a bearish candlestick pattern that is used in technical analysis to predict the reversal of an uptrend. It consists of three consecutive long black candlesticks, where each candlestick’s closing price is lower than the previous one. This formation often indicates a strong shift in market sentiment from bullish to bearish.

The pattern gets its name from the visual representation of the three candlesticks, which resemble three crows perched atop a tree. It is important to note that the pattern is most reliable when it appears after a prolonged uptrend, as it indicates a potential trend reversal.

| Candlestick | Closing Price | Signal |

|---|---|---|

| 1st Candlestick | Lower than the previous candlestick | No signal |

| 2nd Candlestick | Lower than the previous candlestick | Potential reversal signal |

| 3rd Candlestick | Lower than the previous candlestick | Confirmation of reversal signal |

When the Three Black Crows pattern appears, it suggests that the bears have taken control of the market and are pushing prices lower. Traders who recognize this pattern may consider initiating short positions or closing out their long positions to profit from the anticipated downtrend.

Read Also: Which country is CySEC? A comprehensive guide to the jurisdiction of the Cyprus Securities and Exchange Commission

However, it is essential to confirm the pattern with other technical indicators and analysis before making trading decisions. Traders should also consider the overall market context and other factors that may influence price movements. Understanding the meaning of Three Black Crows can help traders identify potential trend reversals and make informed trading strategies.

The pattern known as “Three Black Crows” is a bearish candlestick formation that indicates a potential reversal in an uptrend. It consists of three consecutive long-bodied black (or red) candlesticks with short or non-existent wicks. Each candle opens within the previous day’s body and closes near or at its low.

This pattern suggests that the bears have taken control of the market, pushing prices lower over the three-day period. The long black bodies indicate strong selling pressure, while the absence of upper wicks shows that the bears remained in control throughout each trading session.

Traders look for this pattern after a significant uptrend as it signals a potential trend reversal. The appearance of three black crows suggests that buyers are losing momentum, and sellers are taking over.

It is important to note that the pattern is considered more reliable when it occurs after a prolonged uptrend and when the market is overbought. Traders often use additional technical analysis tools and indicators to confirm the validity of the pattern before making trading decisions.

When analyzing stock charts, it’s important to understand the meaning behind different candlestick patterns. One such pattern is the Three Black Crows. This pattern is formed by three consecutive bearish (or red) candlesticks, each opening within the body of the previous candle and closing lower than the previous close. Here, we will discuss how to interpret the Three Black Crows pattern and what it may signal in terms of price movement.

The Three Black Crows pattern is typically seen as a bearish reversal pattern. It often occurs after a bullish trend and signals a potential shift in market sentiment from bullish to bearish. The consecutive bearish candlesticks suggest that sellers have taken control of the market and are driving prices lower.

Traders and analysts often look for confirmation of the Three Black Crows pattern to strengthen its interpretation as a bearish signal. This confirmation can come in the form of a significant increase in trading volume during the formation of the pattern or a break below key support levels. Additionally, other technical indicators such as moving averages or oscillators can be used to support the bearish outlook.

Read Also: Can MLB Make Trades After the Deadline? Explained

It’s important to note that the Three Black Crows pattern is not foolproof and should always be used in conjunction with other forms of analysis and indicators. Market conditions, news events, and other factors can influence price movement, so it’s crucial to consider the broader context before making trading decisions based solely on this pattern.

In conclusion, the Three Black Crows pattern is a bearish reversal pattern that can indicate a potential shift in market sentiment from bullish to bearish. Traders should look for confirmation signals and consider other factors before relying solely on this pattern to make trading decisions.

The three black crows is a bearish candlestick pattern that signals a potential reversal of an uptrend. It consists of three consecutive long-bodied black candles, each with a lower close than the previous day.

The three black crows pattern is identified by the presence of three consecutive long-bodied black candles on a stock chart. Each candle should have a lower close than the previous day, indicating a potential reversal of an uptrend.

When three black crows appear on a stock chart, it suggests that the uptrend is losing momentum and is likely to reverse. It is seen as a bearish signal and may indicate a potential downtrend or a downward price movement.

Yes, there are limitations to the three black crows pattern. It is important to consider other technical indicators and factors before making any trading decisions based solely on this pattern. It is advisable to use it in combination with other analysis tools to confirm the potential reversal.

Yes, the three black crows pattern can occur not only in stock markets but also in other financial markets, such as Forex or commodities. It is a candlestick pattern widely used by traders to identify potential reversals and to make informed trading decisions.

In trading, the meaning of three black crows is a bearish candlestick pattern that indicates a potential reversal of an uptrend. It consists of three consecutive long-bodied red or black candles with declining prices.

You can identify the three black crows pattern by looking for three consecutive long-bodied red or black candles with declining prices. These candles should open within the real body of the previous candle and close near the low of the day.

Trading Partners of Greece Greece, officially known as the Hellenic Republic, is a country located in Southeast Europe. It has a rich history and …

Read ArticleIs index option trading the same as stock option trading? Many investors are familiar with stock option trading, where they have the opportunity to …

Read ArticleWhich Bank offers the Best Forex Rates? When it comes to forex trading, finding the best rates can make a huge difference in your profits. The …

Read ArticleUnderstanding Touch Options: A Complete Guide Touch options are a type of financial instrument that offers a unique way of trading. They provide …

Read ArticleDoes RSI Divergence Fail? The Relative Strength Index (RSI) is a popular technical indicator used by traders and analysts to identify potential market …

Read ArticleWhat is the difference between AXE and IOI? When it comes to understanding the technologies behind computing and electronic systems, two acronyms …

Read Article