Top Forex Demo Accounts: Discover the Best Option for Your Trading Needs

Choose the Best Forex Demo Account for Your Trading Are you interested in Forex trading but not quite ready to dive into the real market? A Forex demo …

Read Article

Option value refers to the benefit or advantage that an individual or business receives from having the ability to choose one option over another. It represents the potential value or opportunity that comes with having different choices and possibilities.

Option value is a concept used in various fields, such as economics, finance, and decision-making. In economics, option value is often associated with the value of flexibility or the ability to change decisions in the future.

For businesses, understanding the option value of different choices can be crucial in making strategic decisions. It involves considering the potential benefits and risks associated with each option and assessing the potential outcomes.

“Option value can also be seen as a form of insurance against future uncertainties.”

Option value can also be seen as a form of insurance against future uncertainties. By having multiple options available, individuals and businesses can adapt and respond to changing circumstances, minimizing potential losses and maximizing potential gains.

Overall, recognizing and considering the option value of different choices is essential for effective decision-making and can significantly impact the success and profitability of individuals and businesses.

Option value is a fundamental concept in finance that represents the potential benefit or downside of taking a particular action. It is a measure of the value that an option can provide to its holder.

There are several key concepts related to option value that are important to understand:

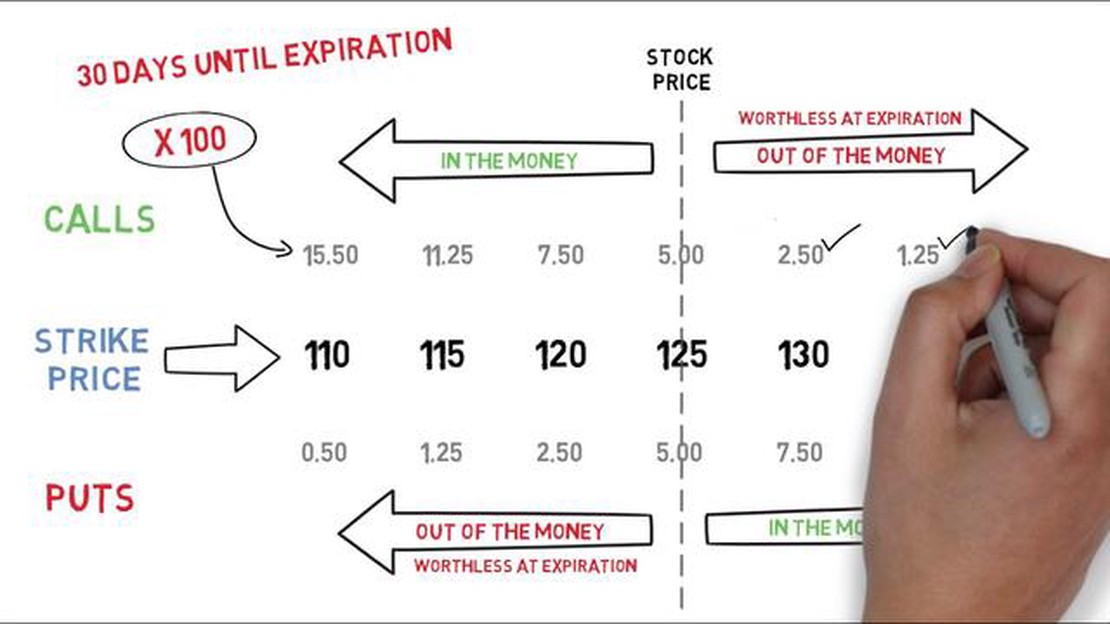

| Intrinsic value | The intrinsic value of an option is the difference between the current price of the underlying asset and the strike price of the option. It represents the immediate value that can be obtained by exercising the option. |

| Time value | The time value of an option is the difference between its total value and its intrinsic value. It represents the potential value that can be gained by holding the option until expiration. |

| Volatility | The volatility of the underlying asset affects the option value. Higher volatility increases the potential for large price swings, which can lead to higher option values. |

| Interest rates | Interest rates also influence option value. Higher interest rates reduce the present value of future cash flows, which can lower option values. |

| Implied volatility | Implied volatility is a measure of the market’s expectation for future volatility of the underlying asset. It is an important factor in determining option prices. |

By understanding these key concepts, investors and traders can assess the potential value and risk associated with different options. They can make more informed decisions about whether to buy or sell options and how to manage their options positions.

Option value is a concept used in economics and finance to describe the potential benefit or value that an individual or entity derives from having the ability to choose among different options or alternatives.

In the context of investments, option value refers to the advantage that investors have when they hold an option to buy or sell an asset at a specified price in the future. This option provides them with the opportunity to benefit from favorable price movements and protect themselves against unfavorable ones.

Option value can be influenced by various factors, including the underlying asset’s price volatility, the time remaining until the option’s expiration, and the difference between the current market price and the exercise price of the option.

Read Also: The Downside of Heiken Ashi: Understanding the Disadvantages

There are two main types of option value: intrinsic value and time value. Intrinsic value represents the current value of an option if it were to be exercised immediately, while time value is the additional value attributed to the option due to the potential for further price movements before its expiration date.

Option value plays a crucial role in decision-making processes and risk management strategies. By understanding the potential benefits and risks associated with different options, individuals and businesses can make more informed choices and optimize their outcomes.

Read Also: Is Forex Trading Legal in Turkey? Find Out Here!

| Intrinsic Value | Time Value |

|---|---|

| Represents the current value of an option | Additional value attributed to the option due to potential future price movements |

| Calculated as the difference between the current market price and the exercise price | Affected by factors such as volatility, time remaining until expiration, and interest rates |

When making decisions, it is crucial to consider the option value, which refers to the potential value of having different choices available. The concept of option value is particularly relevant in situations where there is uncertainty and the outcome is not certain.

One of the main reasons why option value is important in decision making is that it allows individuals or organizations to maintain flexibility. By keeping their options open, they can adapt and make better decisions as new information becomes available. This is especially valuable when facing dynamic or unpredictable situations.

Option value also plays a significant role in risk management. By having multiple options, individuals or organizations can hedge their bets and reduce potential losses. Having alternative choices ensures that there is always a backup plan in case the initial decision does not yield the desired results.

Furthermore, option value allows for exploration and learning. When faced with various options, individuals can explore different paths and gain new insights and experiences. This iterative process of decision making enables continuous learning and adaptation, leading to better outcomes in the long run.

Additionally, option value contributes to innovation and creativity. By having multiple options, individuals can experiment with different ideas and approaches. This freedom to explore increases the chances of coming up with novel and innovative solutions, making option value a valuable asset in the pursuit of excellence and progress.

In conclusion, understanding the importance of option value in decision making is crucial for individuals and organizations. It enables flexibility, risk reduction, exploration, and innovation. By considering the potential value of different choices, decision-makers can make more informed and strategic decisions, leading to better outcomes and achieving long-term success.

Option value refers to the potential benefit or advantage that can be gained from having the ability to choose among different alternatives or options. It represents the additional value or utility that is derived from having the freedom to make a choice.

Option value is important because it allows individuals or organizations to assess the potential impact and consequences of different options before making a decision. It helps in evaluating the costs and benefits associated with each option and aids in informed decision-making.

Sure! Let’s say you are considering whether to buy a house or rent an apartment. The option value in this case would be the potential benefits and advantages of both options. By considering the option value, you can assess factors such as long-term costs, flexibility, and potential appreciation in property value, which can help you make an informed decision.

Option value plays a crucial role in investment decisions. Investors consider the potential benefits and risks associated with different investment options before making a decision. By analyzing the option value, investors can assess factors such as potential returns, liquidity, and diversification benefits, which help them make informed investment choices.

When evaluating option value, it is important to consider factors such as potential benefits, costs, risks, flexibility, and the time value of money. These factors help in assessing the overall value and potential impact of different options, allowing individuals or organizations to make optimal decisions.

Choose the Best Forex Demo Account for Your Trading Are you interested in Forex trading but not quite ready to dive into the real market? A Forex demo …

Read ArticleUnderstanding the Fundamentals of Purchasing Put Options Investing in the stock market can be a daunting task, especially when it comes to …

Read ArticleReasons behind the decreasing forex reserves in India India, one of the world’s largest economies, is facing a concerning trend in recent years - the …

Read ArticleUnderstanding the Enron Employee Stock Purchase Plan The Enron Employee Stock Purchase Plan (ESPP) was an employee benefit program offered by Enron …

Read ArticleIs FX the same as forex? When it comes to the financial markets, there are many terms and acronyms that can be confusing for the average investor. Two …

Read ArticleUnderstanding Short Term Trades in Forex The Forex market is known for its fast-paced and volatile nature, making it an ideal place for short term …

Read Article