Reasons why certain stocks do not provide options trading

Reasons why certain stocks do not have options available Options trading is a popular investment strategy that allows traders to speculate on the …

Read Article

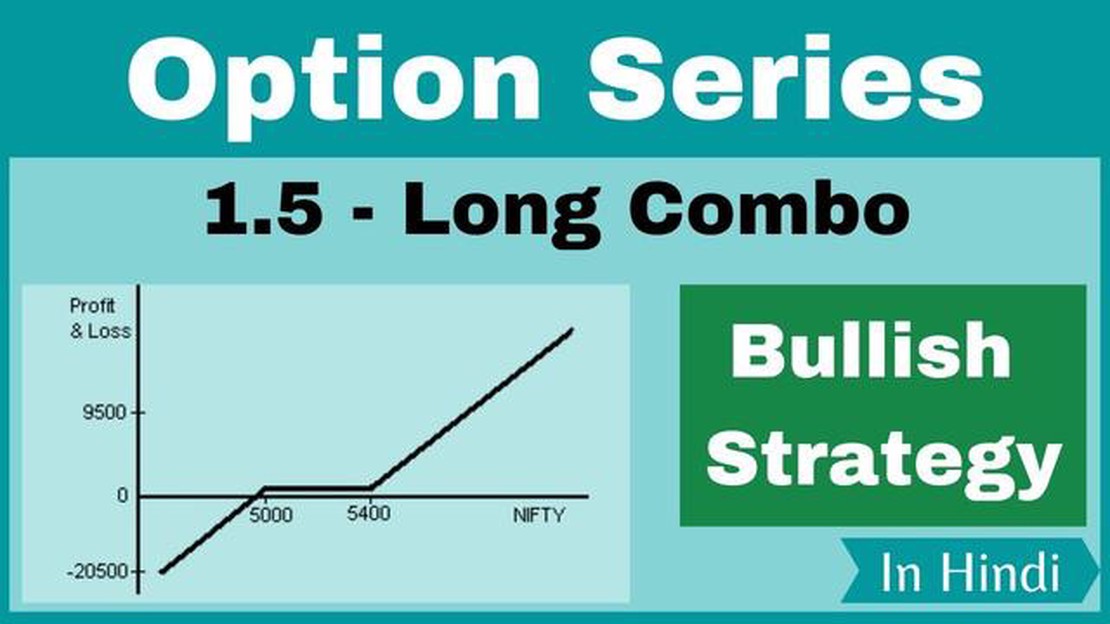

Options trading can be a complex and often risky endeavor, but for those willing to put in the time and effort to learn, it can also be a highly profitable one. One strategy that experienced traders often turn to is the long combo option strategy. This comprehensive guide will take you through everything you need to know about this unique strategy.

The long combo option strategy is a bullish strategy that involves buying both a call option and a put option with the same strike price and expiration date. This strategy is often used when a trader believes that the underlying stock will make a significant move in either direction, but they are uncertain about the direction of the move.

By buying both a call and a put option, the trader is able to profit from a large move in either direction. If the stock price increases, the trader can exercise the call option and profit from the increase. If the stock price decreases, the trader can exercise the put option and profit from the decrease. The risk with this strategy is limited to the cost of buying both options.

However, it’s important to note that the long combo option strategy is not without its risks. If the stock price remains relatively unchanged, the trader can lose the entire premium paid for both options. Additionally, the strategy involves the payment of two premiums, which can increase the overall cost of the trade.

Overall, the long combo option strategy is a versatile strategy that can be used in a variety of market conditions. It allows traders to take advantage of large moves in either direction, while also limiting their risk. By understanding the ins and outs of this strategy, traders can add another tool to their trading arsenal and potentially increase their profitability.

The long combo option strategy is a type of options trading strategy that involves buying both call options and put options on the same underlying asset with the same expiration date. This strategy is also known as a synthetic long stock position, as it mimics the risk and reward profile of owning shares of the underlying stock.

The key concept behind the long combo option strategy is to take advantage of a potential big move in the price of the underlying asset while limiting the risk. This strategy is typically used when an investor expects a significant amount of volatility in the price of the underlying asset but is unsure about the direction of the price movement.

By combining both call options and put options, the long combo strategy allows investors to profit from a price increase in the underlying asset with the call options, while also benefiting from a price decrease with the put options. This strategy provides a level of flexibility and allows investors to potentially profit in both bullish and bearish market conditions.

In order to execute the long combo option strategy, an investor needs to buy the call options and put options with the same strike price and expiration date. The number of contracts to buy will depend on the desired level of exposure to the underlying asset. The total cost of the options will be the initial investment for this strategy.

If the price of the underlying asset increases, the call options will increase in value, offsetting the loss on the put options. On the other hand, if the price of the underlying asset decreases, the put options will increase in value, offsetting the loss on the call options. The maximum loss for this strategy is the initial investment, while the potential profit is unlimited if the price of the underlying asset makes a significant move in either direction.

Read Also: Essential Things Every Trader Should Know: Expert Tips and Insights

It is important to note that the long combo option strategy involves higher transaction costs compared to simply buying or selling the underlying asset. Additionally, this strategy requires a thorough understanding of options and their associated risks.

In conclusion, the long combo option strategy is a versatile strategy that allows investors to profit in both bullish and bearish market conditions. By combining call options and put options, this strategy offers a level of flexibility and potential for unlimited profits while limiting the risk to the initial investment.

The long combo option strategy is a complex options trading strategy that involves the simultaneous use of two different option contracts. This strategy is typically used by experienced traders and investors who are looking to take advantage of market volatility and potentially earn higher returns.

The long combo option strategy involves the purchase of a call option and the sale of a put option on the same underlying security. The call option gives the holder the right to buy the underlying security at a specific price, called the strike price, within a certain period of time. The put option, on the other hand, gives the holder the right to sell the underlying security at the strike price within a certain period of time.

Read Also: Understanding the Concept of Spread in Trading - A Comprehensive Guide

By combining these two options, the long combo strategy allows traders to profit from both bullish and bearish market movements. If the price of the underlying security increases, the call option will increase in value and the trader can sell it for a profit. If the price of the underlying security decreases, the put option will increase in value and the trader can buy it back at a lower price, also earning a profit.

One of the key advantages of the long combo option strategy is its flexibility. Traders can adjust the strike price and expiration dates of the options to create a strategy that best suits their market outlook and risk tolerance. Additionally, the use of options allows traders to limit their potential losses to the premiums paid for the options contracts.

However, it’s important to note that the long combo option strategy is a high-risk strategy and may not be suitable for all investors. It requires a good understanding of options trading and market dynamics, as well as careful analysis and monitoring of the underlying security. Traders should also be prepared for the possibility of losing the entire investment if the market moves against their position.

In summary, the long combo option strategy is a complex trading strategy that involves the simultaneous use of a call option and a put option. It allows traders to profit from both bullish and bearish market movements and offers flexibility in terms of strike price and expiration dates. However, it’s important to understand the risks involved and carefully manage the position to minimize potential losses.

The long combo option strategy is a comprehensive trading strategy that involves buying both call and put options on the same underlying security, with the same expiration date.

The long combo option strategy works by taking advantage of both bullish and bearish market conditions. By buying both call and put options, the trader can profit from price movements in either direction.

The advantages of the long combo option strategy include the potential for unlimited profit potential, the ability to profit from both bullish and bearish market conditions, and the flexibility to adjust the strategy as market conditions change.

Some risks associated with the long combo option strategy include the possibility of losing the entire investment if the market doesn’t move in the expected direction, the potential for significant losses if the market moves sharply against the trader’s position, and the risk of time decay eroding the value of the options.

To implement the long combo option strategy, you would need to open an options trading account with a brokerage firm, conduct thorough analysis of the underlying security and market conditions, and then buy both call and put options on the same security with the same expiration date. It’s important to carefully consider the strike prices and the premium costs of the options.

Reasons why certain stocks do not have options available Options trading is a popular investment strategy that allows traders to speculate on the …

Read ArticleGuide on how to become a broker in Cyprus Becoming a broker in Cyprus can be a lucrative and rewarding career choice. However, the process can be …

Read ArticleUnderstanding Trade Coding: A Comprehensive Guide In today’s digital age, the global market is more interconnected than ever before. This connectivity …

Read ArticleIs Forex Trading tax free in India? Forex trading has become increasingly popular in India, with many individuals looking to make profits from …

Read ArticleWhat is the average 10 year Treasury rate? When it comes to investing, one of the key indicators that many investors look at is the 10-year Treasury …

Read ArticleSimple Example of Arbitrage Arbitrage is a concept that has gained popularity in the financial world, but many people still find it difficult to …

Read Article