Learn How to Trade Bitcoin like Forex | Beginner's Guide

Trading Bitcoin Like Forex: A Comprehensive Guide Welcome to the beginner’s guide on how to trade Bitcoin like Forex! Bitcoin, the first and most …

Read Article

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies with the aim of making a profit. It is a decentralized market where currency pairs are traded, and it operates 24 hours a day, five days a week. Understanding the logic behind forex trading is essential for anyone who wants to dive into the world of currency markets.

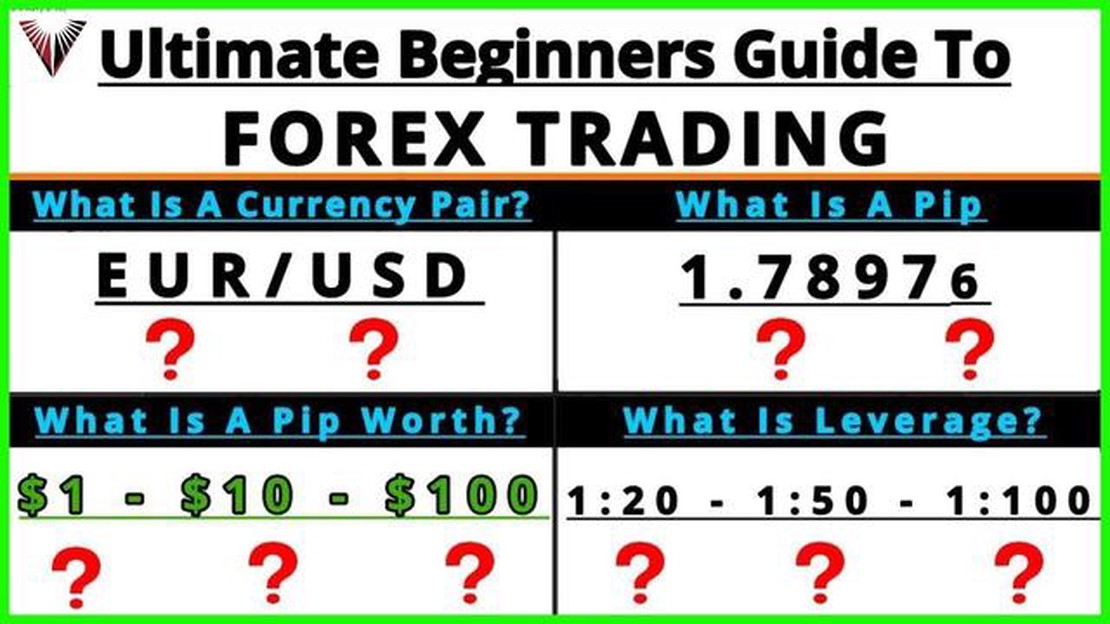

One of the key concepts in forex trading is that currencies are always traded in pairs. This means that when you buy one currency, you are concurrently selling another. The exchange rate between different currencies fluctuates constantly, and traders aim to make profit by speculating on these price movements.

Forex trading involves a range of participants, from individual retail traders to large banks and financial institutions. Transactions take place electronically, and the forex market is widely considered to be the largest and most liquid financial market in the world.

Success in forex trading requires a solid understanding of various factors that can influence currency prices. Economic indicators, geopolitical events, and central bank statements are just a few examples of the many factors that can impact the forex market. It is essential for traders to keep a close eye on these developments and use technical analysis tools to make informed decisions.

Ultimately, understanding the logic behind forex trading involves grasping the mechanics of currency markets and developing the skills to analyze and interpret various factors that can impact prices. It is a complex and dynamic field that requires continuous learning and adaptability. With the right knowledge and strategies, forex trading can offer significant opportunities for those willing to put in the effort.

In summary, forex trading is the process of buying and selling currencies with the aim of making a profit. It operates in a decentralized manner, with currency pairs being traded 24 hours a day. Success in forex trading requires a deep understanding of market dynamics and the ability to interpret various factors that influence currency prices. By mastering these skills, traders can seize the opportunities that the forex market presents.

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the global market. It is the largest and most liquid market in the world, with daily trading volumes exceeding trillions of dollars. Traders participate in forex trading to profit from the fluctuations in exchange rates between different currencies.

Understanding the logic of forex trading is crucial for anyone looking to enter the market. This introductory guide will provide you with the foundational knowledge you need to navigate the intricacies of forex trading and make informed trading decisions.

Read Also: Is Forex Trading in India Available 24/7?

By mastering the logic of forex trading, you can develop a solid foundation for understanding the complexities of the market and increase your chances of success. Practice, education, and continuous learning are key to honing your skills as a forex trader.

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies in the global market. It is the largest and most liquid financial market in the world, with an average daily trading volume of around $5 trillion. Forex trading allows individuals, institutions, and governments to benefit from fluctuations in international currency exchange rates.

The forex market operates 24 hours a day, 5 days a week, excluding weekends. It is a decentralized market, meaning that it does not have a physical location or a central exchange. Instead, currencies are traded electronically over-the-counter (OTC), which allows traders to participate from anywhere in the world.

The main participants in the forex market are commercial banks, central banks, hedge funds, multinational corporations, and individual traders. These participants trade currencies for various reasons, including speculation, hedging, investment, and conducting international business transactions.

Forex trading involves the simultaneous buying of one currency and selling of another currency. Currency pairs are quoted in terms of one currency relative to another. For example, the EUR/USD currency pair represents the euro against the U.S. dollar. Traders aim to make a profit by correctly predicting the direction in which the exchange rate will move.

Forex trading is a high-risk, high-reward market. It offers the potential for significant profits, but also carries the risk of substantial losses. Successful traders employ various strategies, including technical analysis, fundamental analysis, and risk management techniques, to make informed trading decisions.

Overall, forex trading provides opportunities for individuals and institutions to participate in the global currency market and potentially generate profit. It requires knowledge, skill, and discipline, but can be a rewarding venture for those who are willing to put in the time and effort to understand the market dynamics and develop a successful trading strategy.

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies in the foreign exchange market. It works by taking advantage of the constantly changing exchange rates between different currencies. Traders speculate on whether a currency will rise or fall in value and execute trades accordingly.

Read Also: Bank Rate Today: AUD to BDT Conversion and Exchange Rates

Forex trading can be a profitable venture if approached with the right knowledge, skills, and strategy. However, it is important to note that trading in the forex market carries a high level of risk and there is the potential to lose money. It is advisable for traders to educate themselves, practice with a demo account, and start with small investments before risking larger amounts.

Exchange rates in forex trading are influenced by a variety of factors, including economic indicators, political events, monetary policy decisions, and market sentiment. Economic indicators such as GDP, inflation, and employment data can have a significant impact on exchange rates. Political events, like elections or government policy changes, can also cause volatility in the currency markets.

There are several common forex trading strategies that traders use to make trading decisions. Some of the most popular strategies include trend following, range trading, breakout trading, and carry trading. Trend following strategies involve identifying and trading in the direction of the prevailing market trend. Range trading strategies involve buying at the bottom of a range and selling at the top. Breakout trading strategies involve entering trades when the price breaks through a significant support or resistance level. Carry trading strategies involve taking advantage of interest rate differentials between currencies.

Forex trading has several advantages compared to other financial markets. It offers high liquidity, with trillions of dollars being traded daily, which means traders can enter and exit positions quickly and at a fair price. The forex market is also accessible 24 hours a day, allowing traders to trade at any time. Additionally, forex trading allows for high leverage, meaning traders can control larger positions with a smaller amount of capital. Lastly, the forex market offers a wide range of currency pairs to trade, providing ample opportunities for profit.

Forex trading, or foreign exchange trading, is the buying and selling of currencies in the foreign exchange market. It involves trading one currency for another in the hopes of making a profit from the fluctuations in exchange rates.

Forex trading involves speculating on the price movements of various currency pairs. Traders analyze the market, looking for trends and patterns that can help predict whether a currency will appreciate or depreciate in value compared to another currency. They then make trades based on these predictions.

Trading Bitcoin Like Forex: A Comprehensive Guide Welcome to the beginner’s guide on how to trade Bitcoin like Forex! Bitcoin, the first and most …

Read ArticleWhen Does the 50-Day Moving Average Cross Above the 200-Day Moving Average? A moving average is a common technical indicator used in stock market …

Read ArticleWho is the CEO of IPC Systems? IPC Systems is a global provider of communication and networking solutions for the financial markets. With a strong …

Read ArticleIs it Possible to Trade Forex with 100 Dollars? Forex trading is a popular investment option that allows individuals to trade currencies and …

Read ArticleTop Brokers that Support MetaTrader 4 When it comes to trading platforms, MetaTrader 4 (MT4) has long been considered one of the most popular and …

Read ArticleCan you sell ISO options? ISO options (Incentive Stock Options) are a type of stock option granted to employees as part of their compensation package. …

Read Article