Investing in Gold Futures: Pros and Cons | Ultimate Guide

Investing in Gold Futures: Should You Do It? Gold has always fascinated investors and traders alike. Its unique properties and undeniable value have …

Read Article

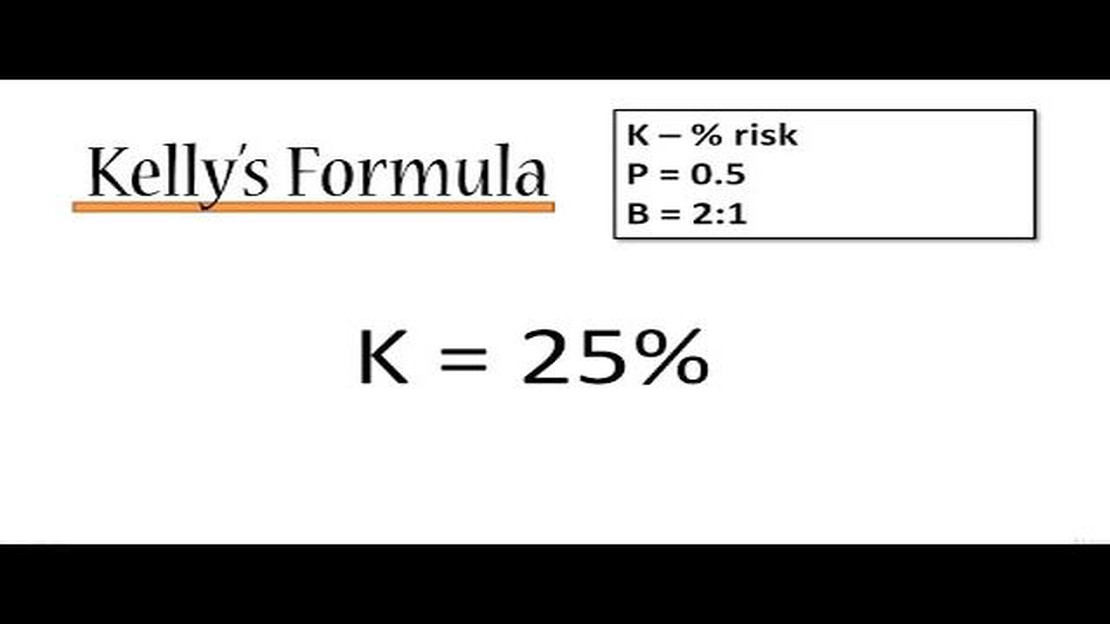

Kelly’s Formula is a mathematical formula that is widely used in financial decision making. It was developed by John L. Kelly Jr., a renowned mathematician and scientist, in the 1950s. The formula is used to determine the optimal allocation of resources or capital in order to maximize long-term growth and minimize risk.

In simple terms, Kelly’s Formula calculates the percentage of an individual’s wealth that should be bet on a certain investment or outcome, based on the probability of success and the potential return. This formula has been widely adopted by professional gamblers, investors, and traders to make sound financial decisions.

The formula itself can be expressed as: f = (bp - q) / b

Where:

By using Kelly’s Formula, individuals and organizations can calculate the optimal position size for a given investment, taking into consideration the potential return and the associated risks. This helps in achieving the delicate balance between maximizing profit and limiting potential losses.

However, it is important to note that Kelly’s Formula assumes perfect knowledge of the probabilities and returns, which is often not feasible in real-world scenarios. Therefore, it is crucial to use conservative estimates and exercise caution when applying the formula.

In conclusion, Kelly’s Formula is a powerful tool in financial decision making, enabling individuals and organizations to make informed and rational choices. Understanding this formula and its implications can greatly enhance one’s ability to allocate resources and manage risks effectively, ultimately leading to better investment outcomes.

Kelly’s Formula is a mathematical formula that provides a framework for determining the optimal amount of money to be invested in a financial opportunity. It was developed by John L. Kelly, Jr. in the 1950s and is widely used in the field of finance.

The formula takes into account the probability of achieving different outcomes and the potential returns of those outcomes. It helps investors make informed decisions by quantifying the trade-off between risk and reward.

Key Components of Kelly’s Formula

There are three key components of Kelly’s Formula:

Calculating the Optimal Investment Percentage

The Kelly’s Formula calculates the optimal investment percentage by incorporating these three components. The formula is as follows:

f = (bp - q) / b

Where:

Read Also: Understanding the 1 2 3 rule in trading and how it can impact your investments

The result of the calculation provides the investor with the percentage of their capital that should be allocated to the opportunity. This percentage indicates the optimal balance of risk and reward.

Limitations and Considerations

Read Also: Top Competitors of NYFIX: A Comprehensive Analysis

While Kelly’s Formula can provide valuable insights for decision making, it is important to consider its limitations. The formula assumes that the probabilities and profitability remain constant over time, which is often not the case in real-life financial markets. Additionally, it does not consider other important factors such as risk tolerance and diversification.

Therefore, it is advisable to use Kelly’s Formula as one of many tools in the decision-making process and to consider other factors and strategies to make informed investment decisions.

Kelly’s Formula, also known as the Kelly Criterion, is a mathematical formula developed by John L. Kelly Jr. that helps investors determine the optimal amount of capital to allocate to a particular investment opportunity. It is widely used in financial decision-making processes and is considered a fundamental tool in managing risk and maximizing returns.

The formula takes into account two key factors: the probability of an investment’s success and the potential return on investment. By considering both of these factors, investors are able to make more informed decisions about how much of their capital to invest in a specific opportunity.

One of the main advantages of using Kelly’s Formula is that it helps investors avoid overbetting or underbetting on an investment. Overbetting, or allocating too much capital to an investment, can increase the risk of significant losses. On the other hand, underbetting, or allocating too little capital, may result in missed opportunities for higher returns.

Another important aspect of Kelly’s Formula is that it provides a systematic approach to managing risk. By calculating the optimal allocation of capital based on the probability of success and potential return, investors can minimize the impact of losses and maximize the potential for gains.

Kelly’s Formula has been widely used in various fields, including gambling, sports betting, and investment management. Its application in financial decision making has been proven to be effective in optimizing investment portfolios and achieving long-term success.

In conclusion, the importance of Kelly’s Formula in financial decision making cannot be overstated. It provides a systematic and effective approach to allocating capital, managing risk, and maximizing returns. By considering the probability of success and potential return, investors can make more informed decisions and increase their chances of achieving their financial goals.

Kelly’s Formula is a mathematical formula that helps determine how much of a person’s capital should be risked in a single investment or bet in order to maximize long-term growth.

Kelly’s Formula takes into account the probability of winning and the potential payout of an investment. It calculates the optimal percentage of capital to invest by subtracting the probability of losing from the probability of winning, and then dividing the result by the potential payout.

Kelly’s Formula is important because it helps investors and gamblers make informed decisions about how much to risk in order to maximize their long-term growth potential. It helps balance the desire for higher returns with the need to protect capital.

Yes, there are risks associated with using Kelly’s Formula. It assumes complete knowledge of the probability of winning and the potential payout, which may not always be accurate. It also does not take into account other factors such as market conditions or individual risk tolerance.

Kelly’s Formula can be used for many types of investments, including stocks, options, and sports betting. However, it may not be suitable for certain types of investments, such as those with high transaction costs or limited liquidity.

Investing in Gold Futures: Should You Do It? Gold has always fascinated investors and traders alike. Its unique properties and undeniable value have …

Read ArticleCan a US citizen trade forex? Forex trading, or foreign exchange trading, is a popular investment option for many individuals around the world. …

Read ArticleBenefits of Selling a Put Option vs Buying a Call Option Options trading can be a complex and intricate strategy for investors looking to profit from …

Read ArticleWhich is better FXTM or FXCM? Choosing the right broker is essential for any trader, whether they are beginners or experienced professionals. FXTM and …

Read ArticleUnderstanding the Significance of High Option Open Interest When it comes to options trading, open interest is a key metric that traders often look at …

Read ArticleStep-by-step guide: Calculating the length of a moving average When analyzing financial data, the moving average is a popular tool used to filter out …

Read Article