Understanding index options trading: A comprehensive guide

Understanding Index Options Trading: A Beginner’s Guide Your guide to index options trading starts here. Whether you are a novice trader looking to …

Read Article

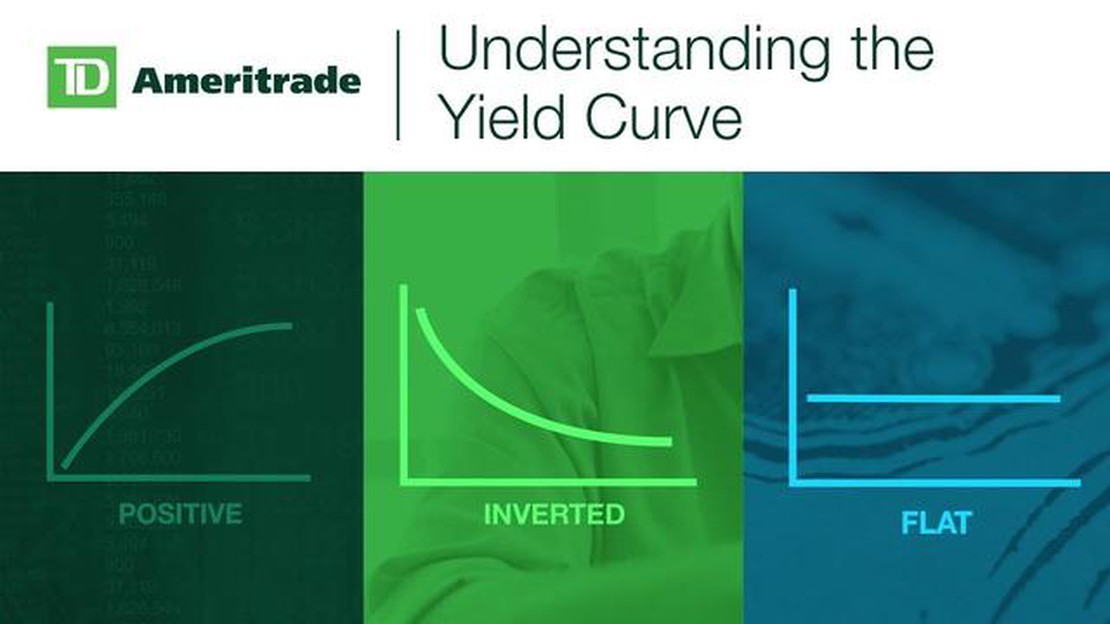

An inverted swap curve occurs when long-term swap rates are lower than short-term swap rates. This phenomenon is considered unusual because it goes against the normal shape of the yield curve. The yield curve is typically upward sloping, indicating that investors expect higher yields for longer-term investments. However, when the swap curve inverts, it suggests that market participants have different expectations for the future.

There could be several reasons for an inverted swap curve. One possible explanation is an impending economic downturn or recession. When investors anticipate a weaker economic environment, they tend to demand longer-term fixed rates in order to protect themselves from potential interest rate declines. This increase in demand drives down long-term swap rates, causing an inversion in the curve.

Another factor that can contribute to an inverted swap curve is central bank policies. If a central bank signals that it will reduce short-term interest rates in the future, market participants may anticipate lower rates and be less willing to lock in fixed rates for longer terms. This would result in lower long-term swap rates and an inverted curve.

The implications of an inverted swap curve are significant. It can signal a lack of confidence in the economy and serve as a warning sign for potential economic downturns. Additionally, an inverted swap curve can impact financial institutions and investors who rely on swap rates for pricing and hedging purposes. They may need to adjust their strategies in response to this unconventional market behavior.

In conclusion, understanding the reasons and implications of an inverted swap curve is essential for market participants and policymakers. It provides valuable insights into market expectations and can help inform investment decisions and monetary policy actions. Monitoring the shape of the swap curve can be a useful tool in assessing the health and stability of the economy.

An inverted swap curve refers to a situation in which the yields on longer-term interest rate swaps are lower than the yields on shorter-term interest rate swaps of the same credit quality. In other words, it is a scenario where the yield curve for interest rate swaps is inverted, with shorter-term swaps yielding higher returns than longer-term swaps.

The swap curve is a graphical representation of the yields on interest rate swaps of varying maturities. It is typically used as a benchmark for pricing other fixed income securities and is an important indicator of market expectations for future interest rate movements. In a normal market environment, the swap curve is upward sloping, meaning that longer-term swaps have higher yields than shorter-term swaps.

However, when the swap curve becomes inverted, it suggests that market participants have a negative outlook on the economy and expect interest rates to decline in the future. This can occur for a variety of reasons, such as concerns about economic growth, inflation, or geopolitical risks. Investors may be willing to accept lower yields on longer-term swaps in anticipation of lower interest rates, while demanding higher yields on shorter-term swaps due to the perceived risks associated with the current economic environment.

An inverted swap curve has several implications for market participants. Firstly, it can signal an impending economic downturn or recession. Historically, an inverted yield curve has been a reliable predictor of recession, as it indicates that investors have a pessimistic outlook and are fleeing to safer investments. The inverted swap curve can also impact the pricing and valuation of other fixed income securities, such as bonds and corporate debt, as their yields are often benchmarked against the swap curve.

Furthermore, the inverted swap curve can impact the profitability and risk profile of financial institutions that rely on interest rate swaps for hedging or trading purposes. Banks and other market participants often engage in swap trading strategies to manage interest rate risk or capitalize on interest rate differentials. An inverted curve can complicate these strategies and potentially lead to losses or reduced profitability.

Read Also: Understanding the Role and Importance of the Foreign Exchange Department in Banks

Overall, an inverted swap curve is an important indicator of market sentiment and can have significant implications for the economy and financial markets. It is closely monitored by investors, analysts, and policymakers as a signal of potential economic trends and risks.

There are several factors that can contribute to the formation of an inverted swap curve. These factors are influenced by market dynamics and economic conditions and can vary depending on the specific context. The following are some common factors that can lead to an inverted swap curve:

Read Also: Understanding RSU in Canada: A Complete Guide

It is important to note that these factors are not exhaustive and that the formation of an inverted swap curve can be influenced by a combination of different factors. Moreover, the relationship between these factors and the shape of the swap curve can be dynamic and change over time as market conditions and economic expectations evolve.

An inverted swap curve is a situation where short-term interest rates are higher than long-term interest rates, which is the opposite of the normal yield curve.

There are several reasons for an inverted swap curve. One possible reason is market expectations of future interest rate movements. If investors expect interest rates to decline in the future, they may be willing to lock in higher rates in the short-term through swaps, which can lead to an inverted curve. Another reason could be a flight to safety, where investors seek the relative safety of longer-term instruments during uncertain economic times, driving down long-term rates.

An inverted swap curve can have several implications. It can signal a potential economic slowdown or recession, as investors may be seeking the safety of longer-term bonds in anticipation of a weaker economy. It can also impact borrowing costs for businesses, as the cost of long-term debt may be lower than short-term debt, which can affect investment decisions and overall economic activity.

The normal yield curve is a situation where short-term interest rates are lower than long-term interest rates. This is typically caused by expectations of future economic growth and inflation, which leads investors to demand higher yields for holding longer-term bonds.

The inverted swap curve is different from the inverted yield curve. While an inverted yield curve refers to the relationship between short-term and long-term government bond yields, an inverted swap curve refers to the relationship between swap rates of different maturities. Both can indicate market expectations of future interest rates and economic conditions, but they reflect different aspects of the fixed income market.

The inverted swap curve occurs when short-term interest rates are higher than long-term interest rates. This is opposite to the normal shape of the yield curve, where long-term rates are typically higher than short-term rates.

There can be multiple reasons for the inverted swap curve. One reason could be an expectation of future economic downturn, leading investors to anticipate lower interest rates in the future. Another reason could be increased demand for long-dated bonds, which drives down their yields.

Understanding Index Options Trading: A Beginner’s Guide Your guide to index options trading starts here. Whether you are a novice trader looking to …

Read ArticleRepresenting a System in a Use Case Diagram A use case diagram is a powerful tool for visualizing and documenting the interactions between different …

Read ArticleUnderstanding the Sell Stop Function in Forex Trading In the world of forex trading, it is crucial to have a thorough understanding of the various …

Read ArticleUnderstanding the utilization of moving averages method Moving averages is a widely used method in financial analysis that helps identify trends and …

Read ArticleBenefits of issuing warrants instead of shares for companies When it comes to raising capital, companies have various options to consider. While …

Read ArticleSPWR Long Term Forecast: Prediction and Analysis Investing in energy stocks has always been an enticing opportunity, as the world moves towards …

Read Article