OFX Locations: Find Out Where OFX is Located

OFX Location: Where is OFX Located? OFX is a global money transfer service that provides fast and secure international transfers. With a presence in …

Read Article

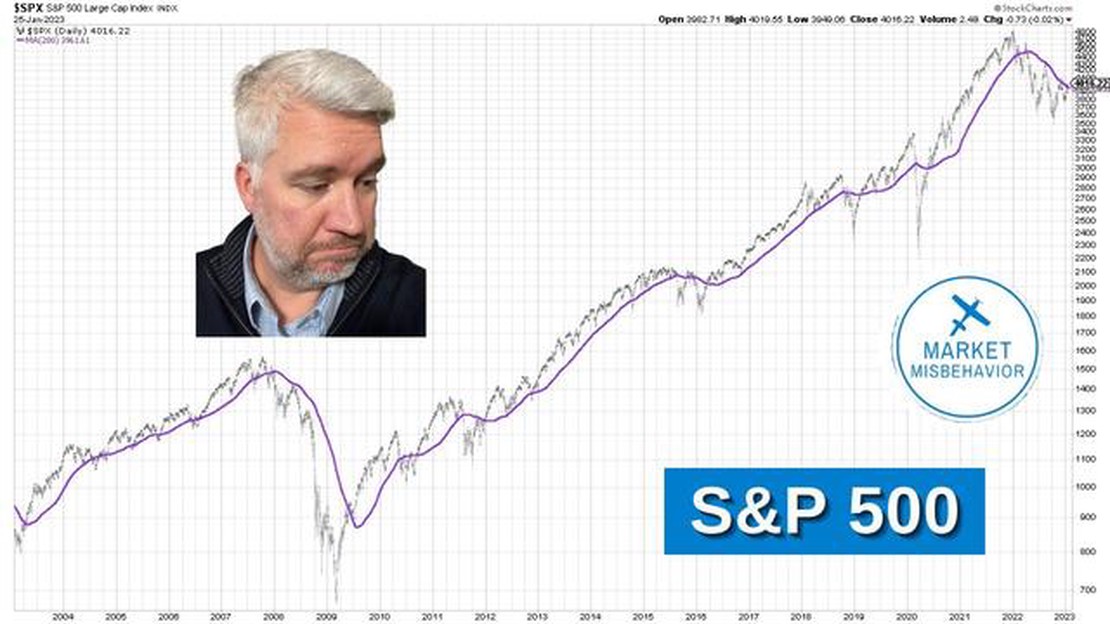

In the world of finance, understanding market trends and patterns is essential for making informed investment decisions. One such trend that traders often analyze is the moving average, which is a calculation that helps smooth out price fluctuations and provides a clearer picture of the overall direction of a stock or index. In particular, the 150-day moving average is widely used by traders to gauge the long-term trend of the S&P 500.

The S&P 500, also known as the Standard & Poor’s 500, is a market index that measures the performance of the 500 largest publicly traded companies in the United States. It is considered a benchmark for the overall health of the US stock market. Traders and investors closely monitor its movement to identify trends and potential investment opportunities.

The 150-day moving average is calculated by taking the average closing price of the S&P 500 over the past 150 trading days. This moving average acts as a trend line, helping traders identify whether the market is in an uptrend or a downtrend. When the S&P 500 is trading above its 150-day moving average, it is generally considered to be in an uptrend, indicating that the market is bullish. Conversely, when the index is trading below its 150-day moving average, it is often seen as a bearish signal, suggesting that the market is in a downtrend.

Traders use the 150-day moving average as a tool to confirm the overall trend of the market and to help filter out short-term noise and fluctuations. By relying on this longer-term moving average, traders can avoid getting caught up in market volatility and make more informed decisions based on the broader market trend.

The 150 Day Moving Average is a technical indicator used in financial markets to analyze the price trends of a security over a specific period of time. It is calculated by taking the average closing price of a security over the past 150 trading days and plotting it on a chart. The moving average smoothes out the price data, making it easier to identify the overall trend.

The 150 Day Moving Average is considered a long-term moving average, as it encompasses approximately 6 months of trading data. It is often used by traders and investors to determine the overall direction of a security’s price movement.

By comparing the current price of a security to its 150 Day Moving Average, traders can gain insight into whether the security is currently in an uptrend or a downtrend. If the price is trading above the moving average, it is generally considered to be in an uptrend, indicating that the security may continue to rise. Conversely, if the price is trading below the moving average, it is considered to be in a downtrend, suggesting that the security may continue to decline.

In addition to providing information about the direction of the trend, the 150 Day Moving Average can also act as a support or resistance level for a security’s price. If the price approaches the moving average and bounces off of it, the moving average can act as a support level, indicating that the security is likely to continue in its current trend. On the other hand, if the price breaks through the moving average, it can act as a resistance level, suggesting a potential reversal in the trend.

Overall, the 150 Day Moving Average is a widely used tool in technical analysis that helps traders and investors make decisions based on the overall trend of a security’s price. It provides a clear visual representation of the security’s price movement over a specific period and can help identify potential entry and exit points in the market.

The 150-day moving average is an essential tool for stock market investors. It provides valuable information about the trend and momentum of a stock’s price over the long term.

By calculating the average price of a stock over a span of 150 trading days, investors can gain insight into its overall performance. This moving average acts as a support or resistance level, indicating whether a stock is currently undervalued or overvalued.

Read Also: Learn the Secrets of Forex Currency Trading: Step-by-Step Guide

When a stock’s price is above its 150-day moving average, it suggests that the stock is in an uptrend and has strong buying momentum. This can be a signal for investors to buy or hold onto the stock, as it indicates a positive market sentiment.

On the other hand, when a stock’s price falls below its 150-day moving average, it may indicate a downtrend and weak selling pressure. This could be a warning sign for investors to sell or avoid the stock, as it suggests a negative market sentiment.

The 150-day moving average is also used by technical analysts to identify key levels of support and resistance. These levels can be significant in determining potential entry and exit points for trades. Traders often look for opportunities when a stock’s price crosses above or below its 150-day moving average, as it signals a potential change in trend.

Furthermore, the 150-day moving average helps smooth out short-term fluctuations in a stock’s price, providing a clearer picture of its long-term performance. It reduces the impact of daily or weekly price volatility, allowing investors to focus on the overall trend and make more informed decisions.

Read Also: What Happens When Options Mature? Understanding the Process

In summary, the 150-day moving average is important in the stock market because it helps investors understand the long-term trend and momentum of a stock’s price. It acts as a support or resistance level, provides signals for potential buy or sell decisions, and helps identify key levels of support and resistance. By incorporating this technical indicator into their analysis, investors can make more informed investment decisions and increase their chances of success in the stock market.

When analyzing and interpreting the 150 day moving average, there are several key factors to consider. Here are some steps to help you analyze and interpret this important technical indicator:

By following these steps and carefully analyzing the 150 day moving average, you can gain valuable insights into the market trend and make more informed trading decisions.

The 150-day moving average is a technical indicator used by traders and investors to analyze the price trend of a security over a period of 150 days. It is calculated by taking the average closing price of the security over the last 150 trading days.

The 150-day moving average is important for the S&P because it provides a long-term perspective on the price trend of the index. It helps traders and investors identify the overall direction of the market and make informed decisions based on the price action in relation to the moving average.

The 150-day moving average is used in technical analysis as a support and resistance level. When the price of the security is above the 150-day moving average, it is considered bullish, and when the price is below the moving average, it is considered bearish. Traders often use the moving average to confirm trends, identify reversals, and set stop-loss levels.

The reliability of the 150-day moving average depends on the trading strategy and time frame of the trader. Shorter-term moving averages, such as the 50-day or 200-day moving averages, might provide more timely signals, but the 150-day moving average is often considered more reliable in determining the overall trend of the market.

Yes, the 150-day moving average can be applied to other financial instruments, such as individual stocks, commodities, or currency pairs. It is a versatile technical indicator that can be used to analyze the price trends of various assets and provide valuable insights for traders and investors.

The 150-day moving average is used by traders and investors to determine the overall trend of the S&P 500 index over a longer period of time. It provides a smoothed line that represents the average price of the index over the past 150 trading days. By analyzing the 150-day moving average, traders can get a sense of whether the market is in an uptrend, downtrend, or consolidating.

OFX Location: Where is OFX Located? OFX is a global money transfer service that provides fast and secure international transfers. With a presence in …

Read ArticleMastering CFD Trading: A Comprehensive Guide Contracts for Difference (CFDs) have revolutionized the world of trading, offering individuals the …

Read ArticleUnderstanding the CNY USD Pair: Exploring the Chinese Yuan and US Dollar Exchange Rates The CNY USD pair is one of the most important currency pairs …

Read ArticleBenefits of Using Autoregressive Models Autoregressive models, commonly referred to as AR models, are a powerful tool in data analysis. These models …

Read ArticleCan a shooting star be green? Forex trading is a complex and volatile market, where traders are constantly looking for patterns and formations to help …

Read ArticleWhat is the minimum account to trade options? Options trading can be a highly profitable investment strategy, but it’s important to understand the …

Read Article