Foreign Remittance: Know the Charges and Fees

Charges for Foreign Remittance: Everything You Need to Know When it comes to sending money internationally, understanding the associated charges and …

Read Article

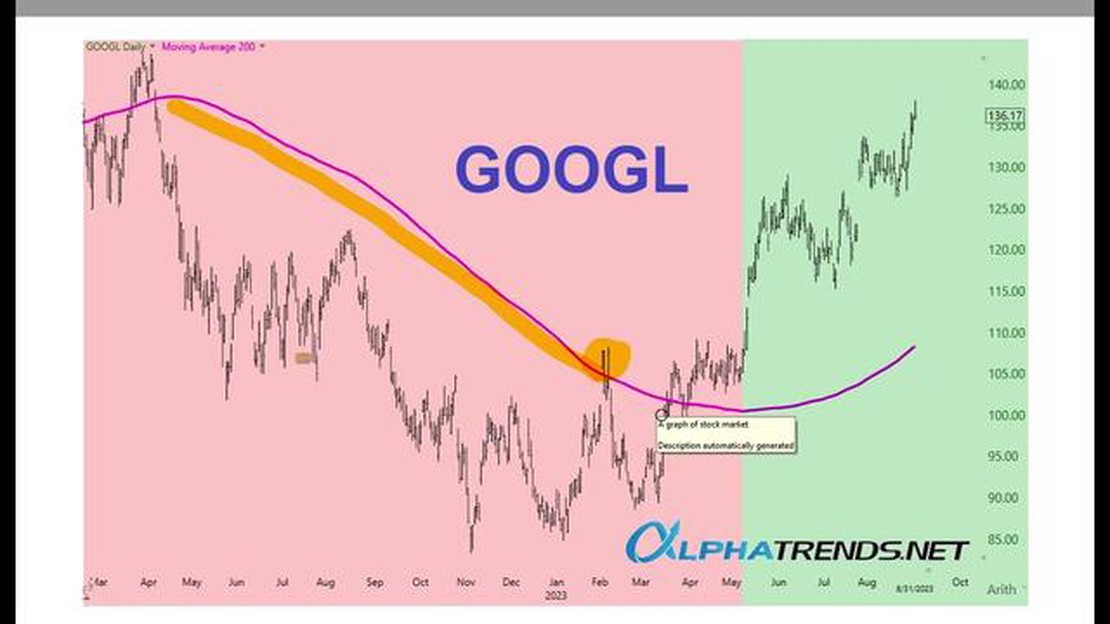

Technical analysis is a popular method used by traders and investors to make informed decisions in the stock market. One popular tool in technical analysis is the moving average, which helps identify trends and potential buy or sell signals.

The 200-day moving average is considered a significant indicator in the analysis of stock prices. It is a long-term moving average that smooths out short-term fluctuations and provides a clear picture of the overall trend. Traders often use the 200-day moving average as a reference point to determine the strength of a stock’s uptrend or downtrend.

When the price of a stock is above its 200-day moving average, it is generally considered to be in an uptrend. This indicates that the stock’s overall price trend is positive and it may be a good time to buy. Conversely, when the price falls below the 200-day moving average, it is considered to be in a downtrend, suggesting that it may be a good time to sell or avoid buying.

Furthermore, the 200-day moving average can act as a support or resistance level, providing additional confirmation of a trend. Historically, stocks have shown a tendency to bounce off the 200-day moving average, making it a reliable level to watch for potential buying opportunities.

Overall, understanding and applying the 200-day moving average analysis can be a valuable tool for traders and investors. It helps identify trends, potential buy or sell signals, and acts as a support or resistance level. By incorporating this analysis into their decision-making process, market participants can make more informed and strategic investment choices.

The 200 Day Moving Average is a popular technical indicator used in financial markets to analyze the long-term trend of a stock or security. It is calculated by taking the average closing price of a stock over the past 200 trading days, and it is commonly used by traders, analysts, and investors to make informed decisions about buying or selling a stock.

The 200 Day Moving Average is considered significant because it provides a smooth and reliable representation of the stock’s price movement over a long period of time. By using a longer time frame, the 200 Day Moving Average helps in filtering out short-term price fluctuations and noise in the market, allowing traders to focus on the overall trend.

When the stock’s price is trading above its 200 Day Moving Average, it is generally seen as a bullish signal, indicating that the stock is in an uptrend. Conversely, when the stock’s price is trading below its 200 Day Moving Average, it is considered a bearish signal, suggesting that the stock is in a downtrend.

Traders and investors often look for crossovers, where the stock’s price crosses above or below its 200 Day Moving Average, as potential entry or exit points. For example, a bullish crossover, where the stock’s price moves above its 200 Day Moving Average, could be interpreted as a buy signal. Conversely, a bearish crossover, where the stock’s price falls below its 200 Day Moving Average, could be seen as a sell signal.

Overall, the 200 Day Moving Average is a widely used tool for trend analysis and can provide valuable insights into the direction of a stock’s price movement. However, it is important to note that it should be used in conjunction with other technical indicators and fundamental analysis for a comprehensive understanding of the market.

The 200-day moving average is an important technical analysis tool that is widely used by traders and investors. It is considered a long-term trend indicator and is used to determine the overall direction of a stock’s price movement.

One of the key reasons why the 200-day moving average is important is that it helps filter out the noise and short-term fluctuations in a stock’s price. By looking at the average price over a long period of time, it provides a more accurate representation of the stock’s true value and trend.

Read Also: Is Price Action Effective for Forex Trading? Discover the Pros and Cons

Another reason why the 200-day moving average is important is that it acts as a level of support or resistance. When the stock’s price is trading above the 200-day moving average, it is considered to be in an uptrend and the moving average line serves as a support level. Similarly, when the stock’s price is trading below the 200-day moving average, it is considered to be in a downtrend and the moving average line acts as a resistance level.

Additionally, the 200-day moving average is often used to generate trading signals. When the stock’s price crosses above the 200-day moving average, it is seen as a bullish signal and may indicate a buying opportunity. Conversely, when the stock’s price crosses below the 200-day moving average, it is seen as a bearish signal and may indicate a selling opportunity.

Overall, the 200-day moving average is important because it helps traders and investors get a better understanding of the stock’s long-term trend, filter out short-term noise, identify support and resistance levels, and generate trading signals. It is a widely used tool in technical analysis and can be a valuable tool in making informed investment decisions.

The 200-day moving average (MA) is a widely used tool in financial analysis. It is a trend-following indicator that helps investors and traders identify the overall direction of a stock’s price movement over a longer period of time. By analyzing the 200-day MA, investors can make informed decisions about buying or selling a particular security.

Read Also: Pros and Cons of Hedging in Forex Trading: What Every Trader Should Know

One of the main applications of the 200-day MA in financial analysis is to determine trends. When the price of a stock is trading above its 200-day MA, it is considered to be in an uptrend. This suggests that the stock’s price is generally rising, and investors may want to consider buying or holding onto the stock.

On the other hand, when the price of a stock is trading below its 200-day MA, it is considered to be in a downtrend. This suggests that the stock’s price is generally falling, and investors may want to consider selling or avoiding the stock.

Another application of the 200-day MA is to identify support and resistance levels. When a stock’s price approaches its 200-day MA, it often acts as a strong support or resistance level. If the price of a stock breaks above its 200-day MA, it could be a bullish signal, indicating that the stock may continue to rise. Conversely, if the price of a stock breaks below its 200-day MA, it could be a bearish signal, indicating that the stock may continue to fall.

The 200-day MA can also be used in conjunction with other technical indicators to confirm trading signals. For example, if the price of a stock breaks above its 200-day MA and the relative strength index (RSI) is also indicating an overbought condition, it could be a signal to sell the stock. Similarly, if the price of a stock breaks below its 200-day MA and the moving average convergence divergence (MACD) is also indicating a bearish crossover, it could be a signal to sell the stock.

In conclusion, the 200-day moving average is a valuable tool in financial analysis. It can help investors and traders identify trends, support and resistance levels, and confirm trading signals. By incorporating the 200-day MA into their analysis, investors can make more informed decisions and improve their overall investment returns.

The 200-day moving average analysis is important because it provides a long-term trend indicator for a stock or market. It helps investors and traders to identify the overall direction of the stock or market and can be used to determine buy or sell signals.

The 200-day moving average is calculated by adding up the closing prices of a stock or market over the past 200 trading days and then dividing the sum by 200. This moving average is recalculated daily to reflect the most recent trading data.

When a stock’s price crosses above its 200-day moving average, it is considered a bullish signal. This suggests that the stock’s price may continue to rise in the future, indicating a potential buying opportunity.

No, the 200-day moving average analysis can be applied to any financial instrument, including individual stocks, stock indices, commodities, and currencies. It is a versatile technical analysis tool that can help investors and traders in various markets.

While the 200-day moving average is primarily used as a long-term trend indicator, it can also be used for shorter-term trading strategies. Some traders may use shorter moving averages, such as the 50-day or 100-day, for shorter-term trading signals, depending on their trading style and goals.

Charges for Foreign Remittance: Everything You Need to Know When it comes to sending money internationally, understanding the associated charges and …

Read ArticleWhy is my Roblox trade not working? If you’re a frequent player of Roblox, you may have encountered some issues with trading. It can be frustrating …

Read ArticleUnderstanding the Role of a SRA: All you need to know Software Requirements Analysis (SRA) is a crucial step in the software development process. It …

Read ArticleChoosing Between Options and Swaps: Which One is the Better Investment? Options and swaps are two popular financial instruments that offer investors …

Read ArticleOptions on Futures: Everything You Need to Know Options on futures are a powerful tool for traders and investors, offering a wide range of …

Read ArticleTrading Options on UVXY: Everything You Need to Know If you’re looking to trade options and want to capitalize on the volatility of the market, UVXY …

Read Article