Can I Use 401k to Day Trade? Exploring the Pros and Cons

Using 401k to Day Trade: What You Need to Know Day trading can be an exciting investment strategy that allows individuals to buy and sell financial …

Read Article

Successful trading in the financial markets requires a solid understanding of various strategies and techniques. One such strategy that has gained popularity among traders is the Hurst Cycle Trader Strategy. This strategy is based on the work of J.M. Hurst, a renowned market analyst who developed a method for identifying and predicting recurring patterns in the market.

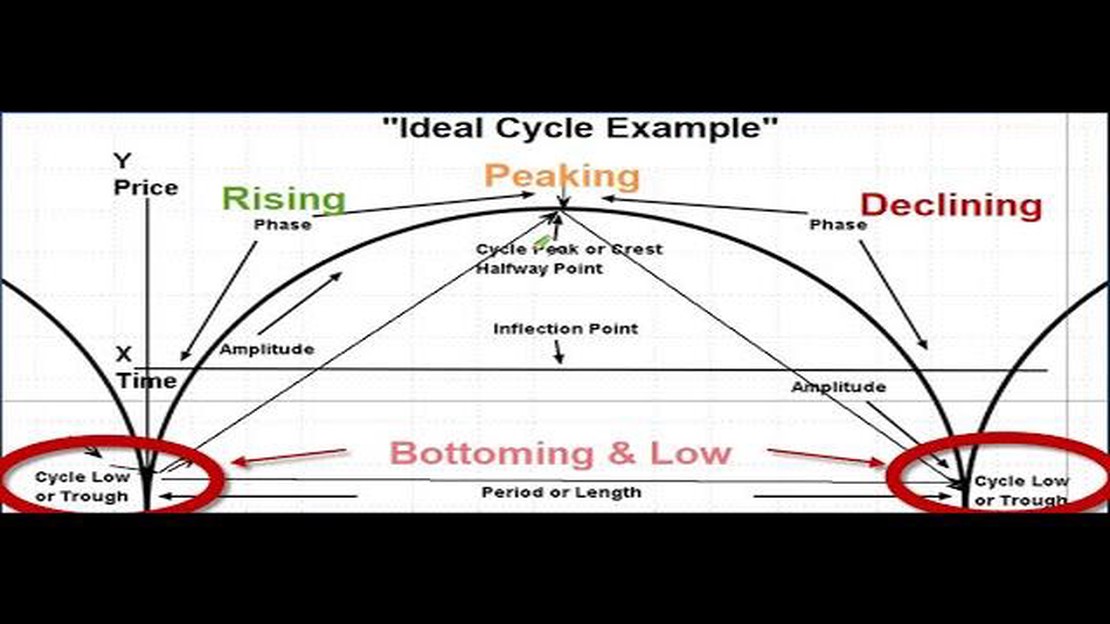

The Hurst Cycle Trader Strategy is based on the concept of cyclical movements in the market. According to Hurst, markets move in cycles that can be characterized by recurring highs and lows. By analyzing these cycles, traders can identify potential entry and exit points for profitable trades.

One of the key tools used in the Hurst Cycle Trader Strategy is the Hurst Exponent. This mathematical formula measures the fractal dimension of a time series, allowing traders to determine the strength and persistence of the cycles in the market. By applying the Hurst Exponent to historical price data, traders can identify the dominant cycles and make informed trading decisions.

Another important aspect of the Hurst Cycle Trader Strategy is the use of advanced technical analysis techniques. Traders often employ various indicators, such as moving averages, oscillators, and trendlines, to confirm the signals generated by the Hurst Exponent. By combining these techniques, traders can increase the accuracy of their predictions and improve their overall trading performance.

In conclusion, understanding and applying the Hurst Cycle Trader Strategy can be a game-changer for traders looking to increase their profitability in the financial markets. By analyzing the cyclical nature of the market and using advanced technical analysis techniques, traders can make more informed trading decisions and maximize their chances of success.

The Hurst cycle trader strategy is a trading methodology that is based on the principles of the Hurst cycle theory. The Hurst cycle theory is a technical analysis tool that uses the concept of cyclical patterns in financial markets to predict future price movements.

The strategy involves identifying and analyzing these cyclical patterns in order to identify potential trading opportunities. Traders using the Hurst cycle trader strategy aim to profit from these cyclical patterns by buying at the bottom of a cycle and selling at the top.

In order to identify these cycles, the Hurst cycle trader strategy uses a mathematical tool called the Hurst exponent. The Hurst exponent measures the long-term memory of a time series data, such as price data in financial markets. By analyzing the Hurst exponent, traders can determine the strength and duration of a cycle.

Once the cycles are identified, traders using the Hurst cycle trader strategy can then apply technical analysis tools, such as moving averages and support and resistance levels, to further refine their trading decisions. These tools can help confirm the cycle patterns and provide additional entry and exit signals.

Read Also: Should You Give Cash or Appreciated Stock as a Gift?

Overall, the Hurst cycle trader strategy is a systematic approach to trading that aims to take advantage of the cyclical nature of financial markets. By identifying and analyzing the cycles, traders can increase their chances of making profitable trades and minimize the risk of losses.

In the world of trading, understanding the Hurst cycle trader strategy can be a game-changer. This approach, developed by J.M. Hurst, provides traders with a systematic method for analyzing and predicting market cycles. By identifying recurring patterns and trends, traders can make more informed decisions and increase their chances of success.

The core principles of the Hurst cycle trader strategy revolve around the concept of cyclicality in the financial markets. Hurst believed that markets are driven by a series of cycles, ranging from short-term to long-term, which repeat over time. By identifying these cycles and understanding their characteristics, traders can gain valuable insights into market behavior.

One of the key benefits of the Hurst cycle trader strategy is the ability to predict future market movements. By analyzing historical data and applying the principles of cycle analysis, traders can identify potential trends and turning points. This allows them to enter or exit trades at the most opportune times, maximizing their profits and minimizing their risks.

Another important benefit of the Hurst cycle trader strategy is its applicability to various financial markets. Whether you’re trading stocks, commodities, or currencies, the principles of cycle analysis can be used to gain a competitive edge. This versatility makes the strategy popular among traders of all experience levels and asset classes.

Moreover, the Hurst cycle trader strategy can provide traders with a structured approach to decision-making. By following a set of rules and guidelines based on cycle analysis, traders can reduce their reliance on emotions and gut instincts. This disciplined approach helps to eliminate impulsive and irrational trading decisions, leading to more consistent and profitable results.

Read Also: Learn to Use Bollinger Bands: A Comprehensive Guide

The benefits of the Hurst cycle trader strategy extend beyond individual trades. By understanding market cycles and trends, traders can gain a broader perspective on market dynamics. This holistic view enables them to make more informed long-term investment decisions and align their trading strategies with prevailing market conditions.

In conclusion, the Hurst cycle trader strategy offers a systematic and data-driven approach to trading. By understanding and leveraging market cycles, traders can increase their chances of success and achieve more consistent and profitable results. Whether you’re a novice or experienced trader, incorporating the principles of cycle analysis into your trading strategy can be a valuable tool for achieving your financial goals.

The Hurst cycle trader strategy is a trading strategy that is based on the work of J.M. Hurst, a famous market analyst. It involves identifying cycles in the price movements of financial instruments and using this information to make trading decisions.

The Hurst cycle trader strategy works by analyzing price data and identifying repeating cycles in the market. It uses techniques such as time series analysis and spectral analysis to identify these cycles. Traders can then use this information to predict future price movements and make profitable trades.

There are several advantages of using the Hurst cycle trader strategy. Firstly, it allows traders to identify and predict market cycles, which can provide them with a significant edge in the markets. Secondly, it provides traders with a systematic approach to trading based on objective data. Finally, it can help traders to avoid emotional decision making and stick to their trading plan.

While the Hurst cycle trader strategy can be highly effective, it is not without its drawbacks. One of the main drawbacks is that identifying and analyzing market cycles can be complex and time-consuming. It requires a good understanding of technical analysis and statistical methods. Additionally, like any trading strategy, there is always the risk of losses.

To start using the Hurst cycle trader strategy, you should first familiarize yourself with the concepts and techniques involved. This may involve studying books or articles on the subject, or taking a course. Once you have a good understanding, you can start analyzing price data and identifying cycles. It can be helpful to use charting software or other tools to assist with this process. Finally, you can develop a trading plan based on the cycles you have identified and start making trades.

The Hurst cycle trader strategy is a trading strategy based on the Hurst Cycle, which is a concept in financial markets that suggests that prices move in cyclical patterns. The strategy involves identifying these cycles and using them to make trading decisions.

Using 401k to Day Trade: What You Need to Know Day trading can be an exciting investment strategy that allows individuals to buy and sell financial …

Read ArticleBest Axis Forex Card: A Comparison Guide Foreign travel and the use of forex cards have become increasingly popular in recent years. With numerous …

Read ArticleBest Ma in Forex When it comes to choosing the best Forex Moving Averages (MA’s), traders are often faced with a multitude of options. Each MA has its …

Read ArticleAnalysis for Option Trading: A Complete Guide Option trading is a popular investment strategy that offers individuals the opportunity to make …

Read ArticleUnderstanding the CTA Index: Key Concepts and Benefits In the world of marketing, one of the key metrics used to measure the effectiveness of a …

Read ArticleWhat is LBC Peso Pack? If you are looking for a reliable and convenient way to send money to the Philippines, LBC Peso Pack is the perfect solution …

Read Article