When is the right time to start trading forex? Find out here

When to Start Trading Forex: Tips and Guidelines Forex trading, also known as foreign exchange trading, is a highly popular and potentially profitable …

Read Article

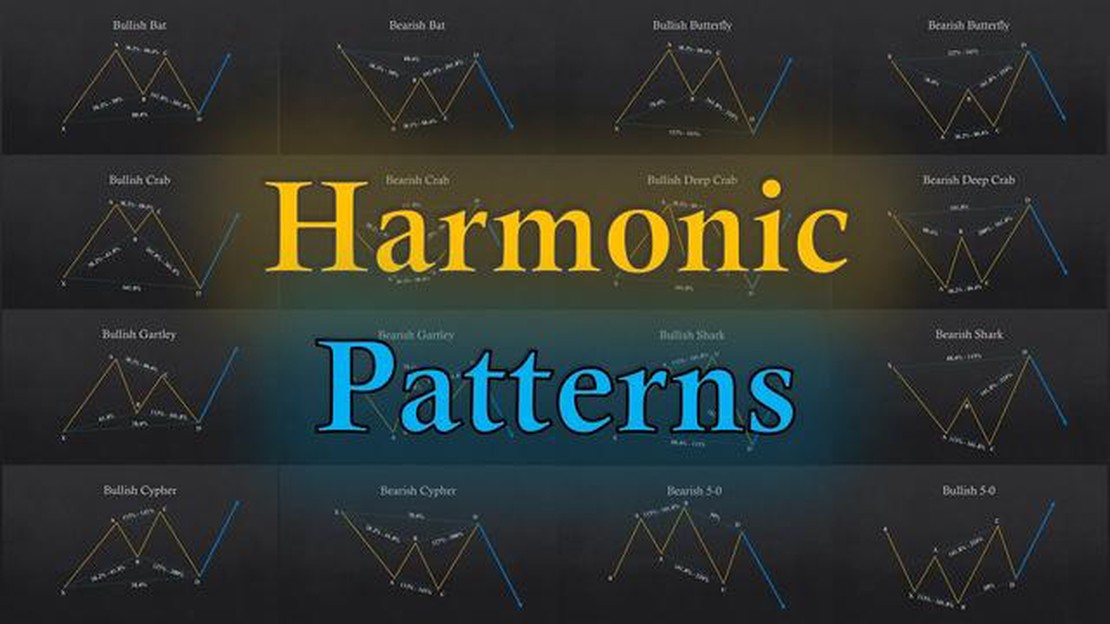

The Gartley pattern is a powerful and popular technical analysis tool that traders use to identify potential reversal points in the financial markets. Named after its creator, H.M Gartley, this pattern combines Fibonacci retracements and extensions to predict the price movements of assets.

The Gartley pattern is based on four main price swings or legs, with specific Fibonacci ratios between them. These legs are labeled as X, A, B, and C, creating a distinctive shape that resembles a butterfly or a crab. Traders believe that when the Gartley pattern forms, it can provide valuable insights into the future movement of an asset.

Depending on the configuration of the Gartley pattern, it can be considered either bullish or bearish. In a bullish Gartley pattern, the price is expected to reverse and move higher after reaching point D, which is the completion of the pattern. Traders may look for opportunities to enter long positions at this point.

On the other hand, a bearish Gartley pattern suggests that the price will reverse and move lower after reaching point D. This presents an opportunity for traders to enter short positions and potentially profit from the downward movement of the asset.

However, it’s important to note that the Gartley pattern is not infallible and should be used in conjunction with other technical analysis tools and indicators. Traders should also consider factors such as market conditions, volume, and other price patterns to confirm the validity of the Gartley pattern before making trading decisions.

In conclusion, the Gartley pattern is a widely recognized and utilized tool in technical analysis for predicting potential trend reversals. Whether it is bullish or bearish depends on the specific configuration of the pattern. By combining Fibonacci ratios and price swings, traders can gain insights into the future movement of an asset. However, it should be used alongside other tools and indicators for confirmation and validation.

The Gartley pattern is a popular technical analysis tool used by traders to identify potential reversal points in the market. It was developed by H.M. Gartley and is based on Fibonacci retracements and extensions.

The pattern consists of four distinct price swings or legs that form specific geometric shapes. These shapes are depicted by connecting various swing highs and lows with trendlines, creating a harmonic pattern. The Gartley pattern can be either bullish or bearish, depending on the specific configuration of the swings.

When a Gartley pattern forms, it signals a potential reversal in the current trend, offering traders an opportunity to enter or exit positions. Traders look for the specific Fibonacci retracement and extension levels within the pattern to confirm its validity. These levels act as support and resistance zones, providing traders with potential entry and exit points.

To identify a Gartley pattern, traders need to have a good understanding of Fibonacci levels and the ability to recognize the specific geometric shapes formed by the price swings. The pattern is considered valid if the price retracement and extension levels align with the Fibonacci ratios specified by Gartley.

In a bullish Gartley pattern, the price typically forms an “M” shape, indicating a potential reversal to the upside. Traders would look to enter long positions once the price confirms the pattern and starts to move higher. On the other hand, in a bearish Gartley pattern, the price forms a “W” shape, suggesting a potential reversal to the downside. Traders would look to enter short positions once the pattern is confirmed and the price starts to decline.

Read Also: Understanding the Simple Moving Average: The Ultimate Explanation

Successfully trading the Gartley pattern requires a combination of technical analysis skills and a solid understanding of market dynamics. Traders need to carefully analyze price action, Fibonacci retracement and extension levels, and monitor other indicators or patterns that may confirm the validity of the Gartley pattern.

In conclusion, the Gartley pattern is a powerful tool for identifying potential reversals in the market. Traders who can accurately identify and interpret this pattern may gain an edge in their trading strategies by taking advantage of these reversal points.

When analyzing the Gartley pattern, it is important to understand that it can signal both bullish and bearish market reversals.

The Gartley pattern is a specific harmonic trading pattern that consists of four swing points or legs labeled X, A, B, and C. These swing points form specific Fibonacci retracement and extension levels that help identify potential areas of trend reversal.

Read Also: What Time Do 4-Hour Candles Close? Understanding the Timing of Candlestick Charts

When the Gartley pattern is forming, it can indicate that the current trend is about to reverse. In a bullish Gartley pattern, the swing points X, A, B, and C form a configuration that suggests an upcoming bullish trend. Traders often look for a bullish Gartley pattern when they expect the price to rise after a downtrend.

On the other hand, a bearish Gartley pattern indicates a potential reversal from an uptrend to a downtrend. The swing points X, A, B, and C form a configuration that suggests a bearish trend. Traders may look for a bearish Gartley pattern when they anticipate the price to decrease after an uptrend.

It is essential to note that the Gartley pattern alone should not be the sole basis for making trading decisions. Traders often combine it with other technical analysis tools and indicators to confirm the pattern and increase the probability of a successful trade.

In conclusion, the Gartley pattern can indicate both bullish and bearish market reversals. Traders should carefully analyze the overall market conditions, price action, and other technical indicators before making any trading decisions based on the Gartley pattern.

The Gartley pattern is a harmonic trading pattern that helps traders identify potential reversal points in the market. It is formed by a series of Fibonacci retracements and extensions that create various levels of support and resistance. Traders use the Gartley pattern to anticipate market movements and make informed trading decisions.

The Gartley pattern can be both bullish and bearish, depending on its formation and the direction of the market. If the pattern is bullish, it indicates that the market is likely to reverse from a downtrend to an uptrend. On the other hand, if the pattern is bearish, it suggests that the market is likely to reverse from an uptrend to a downtrend.

The reliability of the Gartley pattern in predicting market reversals can vary. It is important to keep in mind that no trading pattern or indicator is 100% accurate, and market conditions can change rapidly. Traders often use additional technical analysis tools and indicators to confirm the signals given by the Gartley pattern before entering or exiting trades.

When identifying the Gartley pattern, traders typically look for specific Fibonacci retracement and extension levels. These levels include the 0.618 retracement (or the 61.8% retracement), the 0.382 retracement (or the 38.2% retracement), and the 1.272 extension (or the 127.2% extension). These levels help traders identify potential entry and exit points for their trades.

Yes, the Gartley pattern can be applied to any financial market, including stocks, forex, commodities, and indices. The pattern is based on Fibonacci ratios, which are universal and can be applied to any market that exhibits price movements. Traders can use the Gartley pattern to analyze various markets and potentially identify profitable trading opportunities.

The Gartley pattern is a harmonic trading pattern that helps traders identify potential price reversals. It is based on Fibonacci ratios and consists of a series of specific price movements, usually forming a “M” or “W” shape on a price chart.

When to Start Trading Forex: Tips and Guidelines Forex trading, also known as foreign exchange trading, is a highly popular and potentially profitable …

Read ArticleChoosing the Best EA Builder for MT4: A Comprehensive Guide Do you want to automate your trading strategies and make your trading experience more …

Read ArticleUnderstanding Superx Crypto: Everything You Need to Know Superx Crypto is a groundbreaking digital currency that is shaking up the world of finance. …

Read ArticleBest Sources for Real-Time Forex Data When it comes to trading on the forex market, having access to real-time data is crucial. Accurate and …

Read ArticleChoosing the Best News Source for Traders When it comes to trading in the financial markets, staying informed is key. Traders need to have access to …

Read ArticleDoes the smart money concept work in Forex? When it comes to the world of forex trading, many traders are constantly on the lookout for strategies and …

Read Article