Trade in India before British Rule: A Look into the Commodities and their Significance

Trade in India before British Rule: A Historical Perspective India has been a hub of trade for centuries, with a rich history of commerce that …

Read Article

In today’s complex and interconnected world, the need for accurate and reliable data is more important than ever. The Orbiting Carbon Observatory (OCO) is a groundbreaking satellite mission that aims to provide scientists with a better understanding of carbon dioxide (CO2) emissions and their impact on climate change.

OCO functions by measuring the concentration of CO2 in the Earth’s atmosphere from space. This data is crucial for scientists to monitor and analyze the sources and sinks of CO2, which are essential for predicting future climate patterns and developing effective policies to mitigate climate change.

The OCO satellite is equipped with advanced instruments that can detect the subtle differences in the distribution of CO2 molecules in the atmosphere. By measuring the sunlight reflected off the Earth’s surface, OCO is able to identify the specific wavelengths of light that are absorbed by CO2. This information is then used to calculate the concentration of CO2 in the atmosphere.

The data collected by OCO is not only important for climate scientists, but also for policymakers, businesses, and individuals who are seeking to make informed decisions regarding carbon emissions. By understanding the functioning of OCO and the significance of its data, we can take meaningful steps towards reducing our carbon footprint and preserving the health and stability of our planet for future generations.

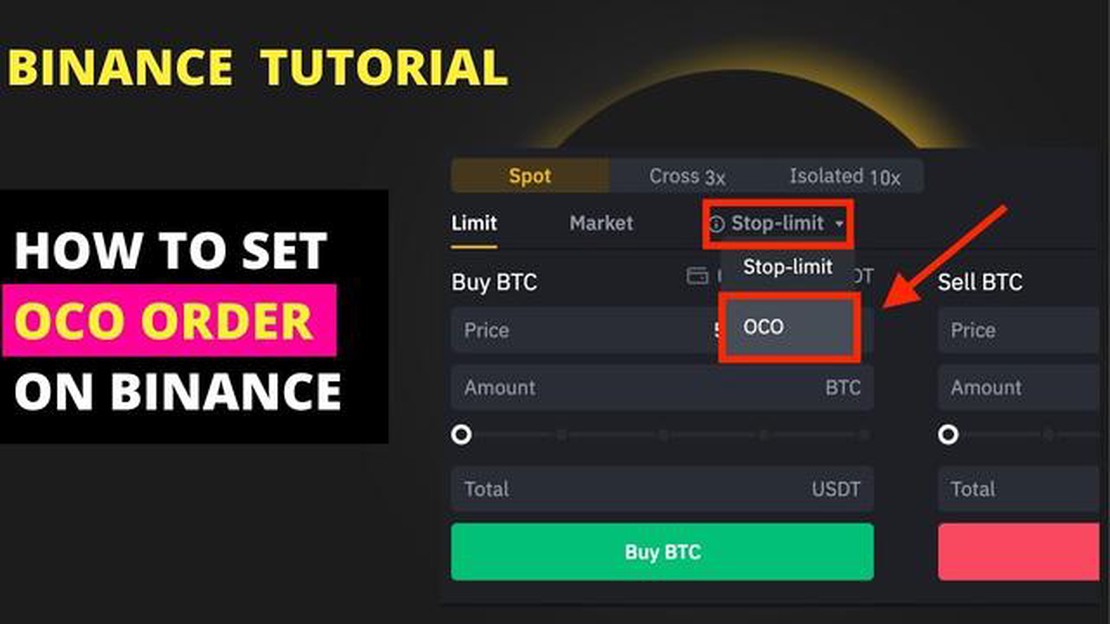

OCO stands for “One-Cancels-the-Other,” and it is a trading strategy that allows traders to place two orders at the same time. These orders are designed to automatically cancel each other out based on specific criteria, which traders define in advance.

The OCO strategy is commonly used in volatile markets, where price movements can change rapidly. By using the OCO strategy, traders can protect themselves from potential losses by setting up two orders that limit their exposure to risk.

Here’s how the OCO strategy works:

The OCO strategy provides traders with more control over their trades, allowing them to enter and exit positions automatically without constantly monitoring the market. It is an efficient and effective way to manage risk and optimize trading outcomes.

OCO, which stands for One Cancels the Other, is a type of order commonly used in trading to manage risk and maximize potential profits. It is a conditional order that combines a stop order with a limit order.

When placing an OCO order, traders set two price levels: the stop price and the limit price. The stop price is designed to limit potential losses, while the limit price is set to capture potential gains. If one of the price levels is reached, the order is executed and the other order is automatically canceled, hence the name “One Cancels the Other.”

Here’s how it works:

The use of OCO orders can be particularly beneficial for traders who are actively managing their positions and want to protect their investments or take profits while minimizing their exposure to potential losses. By setting both a stop and a limit price, traders can establish predetermined exit points for their trades, ensuring they can react quickly to market movements.

Important Note: It is crucial for traders to understand that OCO orders are not a guarantee that their desired outcomes will be met. Market conditions may cause execution delays or slippage, resulting in trades being executed at prices different from the desired stop or limit levels.

In summary, OCO orders provide traders with a versatile and efficient way to manage risk and maximize potential profits. By combining a stop order and a limit order into a single order, traders can protect their investments and capture gains while minimizing potential losses.

Read Also: Do

OCO, or Order Cancels Order, is a powerful trading functionality that offers several benefits for traders and investors. By understanding these benefits, users can effectively implement OCO strategies to enhance their trading experience and optimize results.

Read Also: What is the M1 in trading? Learn about the M1 chart and its significance2. Reduces Emotional Decision-Making: OCO eliminates the need for constant monitoring and decision-making by automating the process of managing multiple orders. This removes the emotional factor from trading decisions and ensures that orders are executed based on predetermined criteria, reducing the chances of making impulsive and irrational decisions. 3. Provides Flexibility: OCO offers traders the flexibility to simultaneously execute multiple trading strategies without the need for constant manual monitoring. This allows traders to pursue different opportunities in the market, diversify their portfolio, and make more informed decisions based on their trading goals and risk appetite. 4. Enhances Efficiency: By streamlining the trading process, OCO enhances efficiency and saves time for traders. OCO allows for automated execution of orders based on predefined conditions, eliminating the need for manual intervention. This frees up time for traders to focus on other important aspects of their trading strategy. 5. Mitigates Losses: OCO can also be used to mitigate losses by implementing stop-loss orders. Traders can set up OCO orders to automatically cancel the position if the price falls below a certain threshold, limiting potential losses in volatile market conditions. 6. Optimizes Trading Strategies: With the ability to automate order execution and manage multiple orders simultaneously, OCO enables traders to optimize their trading strategies. Traders can set entry and exit points, define profit targets, and closely monitor market conditions to make informed decisions, resulting in improved trading performance.

Overall, the benefits of OCO make it an essential tool for traders and investors looking to maximize their trading potential. By leveraging the advantages of OCO, users can minimize risk, reduce emotional decision-making, enhance efficiency, and optimize their trading strategies to achieve their financial goals.

OCO stands for Order Cancels Order. It is a type of trading order in which the execution of one order automatically cancels another order.

When you place an OCO order, you specify two orders: a main order and a secondary order. If the main order is executed, the secondary order is automatically canceled.

OCO orders can help traders manage risk by setting predefined exit points. They also provide flexibility in a volatile market, allowing traders to capture gains or limit losses.

Some common strategies include placing a stop-loss and take-profit order simultaneously or using an OCO order to hedge against a potential market reversal.

OCO orders can be used in various markets, including stocks, futures, and forex. However, it is important to understand the specific rules and regulations of each market before using OCO orders.

OCO stands for “One Cancels the Other” and it is an order type used in trading to automatically place two orders simultaneously, where the execution of one order cancels the other.

In trading, OCO allows traders to place two orders at the same time - one is a stop loss order (to limit potential losses) and the other is a take profit order (to secure profits). If one of the orders is executed, the other one is automatically cancelled.

Trade in India before British Rule: A Historical Perspective India has been a hub of trade for centuries, with a rich history of commerce that …

Read ArticleDiscover the Best Exchange Rate in the World When planning your next international trip or business venture, finding the best currency exchange rate …

Read ArticleCost of KCB Dollar Account Charges Welcome to KCB’s guide on fees for dollar accounts. We understand that as a valued customer, you may have questions …

Read ArticleWhat Can You Trade on Forex? Forex, or foreign exchange, is the largest financial market in the world. It involves the buying and selling of …

Read ArticleGuide to buying bonds in Pakistan If you’re looking to invest in the Pakistani bond market and take advantage of the steady returns it offers, you’ve …

Read ArticleUnderstanding the Concept of a Displaced Formula Displaced formulas are a fundamental concept in mathematics and physics, playing a crucial role in …

Read Article