How to Open a Demo Trade Account: Step-by-Step Guide for Beginners

Step-by-Step Guide: Opening a Demo Trade Account If you are new to trading and want to learn how to trade in financial markets without risking your …

Read Article

An FSA, or finite state automaton, is a mathematical model used to describe processes that can exist in a finite number of states. It is a simple yet powerful tool used in various fields, including computer science, linguistics, and artificial intelligence. Understanding how an FSA works is crucial for anyone interested in these fields, as it provides a fundamental understanding of how systems can be represented and analyzed.

At its core, an FSA consists of a set of states, a set of transitions between these states, and an input alphabet. The FSA starts at an initial state and moves from state to state based on the input it receives. Each state has one or more transitions labeled with symbols from the input alphabet, dictating which state the FSA will move to next. The transitions can be deterministic, where each input symbol uniquely determines the next state, or nondeterministic, where multiple next states are possible for a given input symbol.

The power of an FSA lies in its ability to recognize languages and patterns. By defining a set of accepting states, an FSA can determine if a given input string belongs to a specific language or matches a particular pattern. This makes FSAs useful for tasks such as parsing, pattern recognition, and data validation. They serve as the foundation for more complex models, such as regular expressions and context-free grammars.

A key concept in understanding the functioning of an FSA is the notion of determinism. Deterministic FSAs have a unique next state for each input symbol, allowing for predictable behavior. In contrast, nondeterministic FSAs can have multiple next states for a given input symbol, introducing additional complexity. Understanding how to convert nondeterministic FSAs into deterministic ones is an essential skill when working with FSAs, as it allows for more efficient and precise analysis of systems.

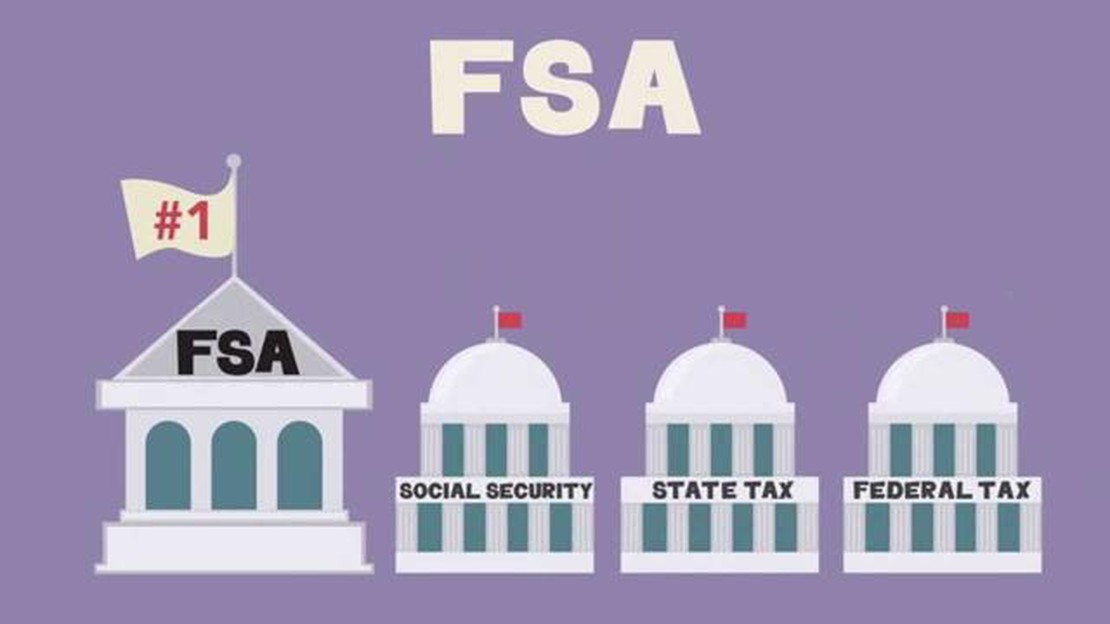

An FSA, or Flexible Spending Account, is a type of tax-advantaged savings account that allows individuals to set aside funds on a pre-tax basis to pay for eligible medical expenses. It is offered by employers as part of their employee benefits package and can provide significant savings for those who have high medical expenses.

The way an FSA works is simple. At the start of the year, employees decide how much money they want to contribute to their account for the year. This amount is deducted from their paycheck on a pre-tax basis, meaning that it is not subject to federal income tax, social security tax, and in most cases, state income tax. The money contributed to the FSA is meant to be used for eligible medical expenses that are not covered by insurance, such as copayments, deductibles, and prescription medications.

Throughout the year, as medical expenses arise, individuals can submit claims to the FSA for reimbursement. Typically, this is done by submitting a receipt or an explanation of benefits from their health insurance company. Once the claim is approved, the FSA administrator will reimburse the individual for the eligible expenses from their FSA funds.

It is important to note that FSAs operate on a “use it or lose it” rule. This means that any funds left in the account at the end of the year are generally forfeited, although some employers may allow a grace period or a carryover of a limited amount of funds. It is crucial for individuals to estimate their eligible expenses carefully to avoid losing any unused funds.

In conclusion, an FSA is a valuable tool that can help individuals save money on their medical expenses. By maximizing the pre-tax contributions and carefully planning their eligible expenses, individuals can make the most out of their FSA and reduce their overall healthcare costs.

| Advantages | Disadvantages |

|---|---|

| - Pre-tax contributions reduce taxable income- Potential for significant savings on medical expenses- Use of pre-tax funds for eligible expenses | - “Use it or lose it” rule- Funds are not portable if you change employers- Limited eligible expenses |

Using a flexible spending account (FSA) can provide individuals with numerous benefits. These benefits include:

Read Also: The Best Platforms for Paper Trading Options in India

1. Tax Savings:

Contributions made to an FSA are tax-free, which means that individuals can save money on their annual taxes. By utilizing an FSA, individuals can reduce their taxable income, resulting in fewer taxes owed at the end of the year.

2. Cost Savings on Eligible Expenses:

An FSA allows individuals to set aside pre-tax money to pay for eligible medical, dental, vision, and dependent care expenses. By doing so, individuals can save money on these expenses by using tax-free funds instead of after-tax dollars.

3. Convenient Payment Method:

Using an FSA provides individuals with a convenient way to pay for eligible expenses. Most FSAs offer individuals a debit card that can be used to make convenient and easy transactions when paying for eligible expenses. This eliminates the need to pay out-of-pocket and submit reimbursement claims.

4. Increased Affordability for Medical and Dependent Care Costs:

An FSA allows individuals to allocate a set amount of pre-tax dollars to cover medical and dependent care expenses. This can help individuals afford necessary medical treatments, medications, or dependent care services that may otherwise be financially burdensome.

Read Also: Understanding the Moving Average: Explained in Simple Language

5. Budgeting and Predictability:

By contributing to an FSA and setting aside a specific amount of pre-tax dollars, individuals can have better control over their healthcare and dependent care spending. The set contribution amount allows for better financial planning and more predictable expenses throughout the year.

6. Reduce Overall Healthcare Costs:

Using an FSA can help individuals reduce their overall healthcare costs by utilizing pre-tax dollars to pay for eligible expenses. This can help individuals avoid unnecessary costs and expenses, making healthcare more affordable and accessible.

In conclusion, utilizing an FSA can provide individuals with tax savings, cost savings, convenience, increased affordability, better budgeting, and reduced overall healthcare costs. By taking advantage of an FSA, individuals can make smarter financial decisions and improve their overall financial well-being.

An FSA, or Flexible Spending Account, is a type of savings account that allows individuals to save money for qualified medical expenses on a pre-tax basis.

An FSA works by allowing individuals to contribute a portion of their pre-tax salary into the account, which can then be used to pay for eligible medical expenses throughout the year. The money in the FSA is not subject to federal income tax, Social Security tax, or Medicare tax.

Having an FSA provides several benefits. Firstly, it allows individuals to save money on taxes as the contributions to the account are made with pre-tax dollars. Additionally, FSAs can be used to pay for a wide range of medical expenses, including doctor visits, prescription medications, and dental treatments.

Yes, there are some limitations and restrictions to keep in mind when using an FSA. Firstly, contributions made to the account cannot be refunded or carried over to the next year, so it’s important to estimate your medical expenses accurately. Additionally, there are specific rules for eligible expenses, and certain items like over-the-counter medications may require a prescription for FSA reimbursement.

In general, cosmetic procedures are not eligible for reimbursement through an FSA unless they are deemed medically necessary. However, it’s worth checking with your FSA administrator or reviewing the plan documents to see if there are any exceptions or specific guidelines for cosmetic procedures.

Step-by-Step Guide: Opening a Demo Trade Account If you are new to trading and want to learn how to trade in financial markets without risking your …

Read ArticleUnderstanding How Option Dates are Determined Option expiration dates are a crucial component of options trading. They dictate when an option contract …

Read ArticleHow much cash can you take out of Ukraine? Are you planning a trip to Ukraine and wondering how much cash you can take out of the country? It’s …

Read ArticleExploring the Exponentially Moving Weighted Average Exponentially Moving Weighted Average (EMWA) is a popular method used in statistics and finance to …

Read ArticleHow to Achieve Success in Binary Options Binary options trading offers an exciting opportunity for traders to make a profit in a relatively short …

Read ArticleTrading Price of Natural Gas Are you looking to stay up-to-date with the latest trends and prices in the natural gas industry? Look no further! Here, …

Read Article