5 Tips for Choosing the Right Broker on MetaTrader

How to Choose a Broker on MetaTrader Choosing the right broker on MetaTrader is crucial for successful trading. With so many brokers to choose from, …

Read Article

Forex trading is a popular and potentially lucrative investment opportunity for individuals across the globe. However, before diving into the world of foreign exchange, it’s essential to understand the fees and charges involved. One of the most significant costs associated with forex trading is the commission.

In this article, we will explore everything you need to know about the forex commission, from what it is and how it works to the different types of commissions you may encounter.

Firstly, what is a forex commission?

A forex commission is a fee charged by a broker or financial institution for facilitating a trade in the forex market. It is usually a percentage of the trade’s total value or a flat fee per trade. The commission serves as compensation for the broker’s services and can vary depending on various factors, including the broker’s pricing structure, account type, and trading volume.

It’s important to note that not all brokers charge commissions. Some brokers offer commission-free trading, but they may compensate for this by widening the spreads or including other hidden fees.

How does a forex commission work?

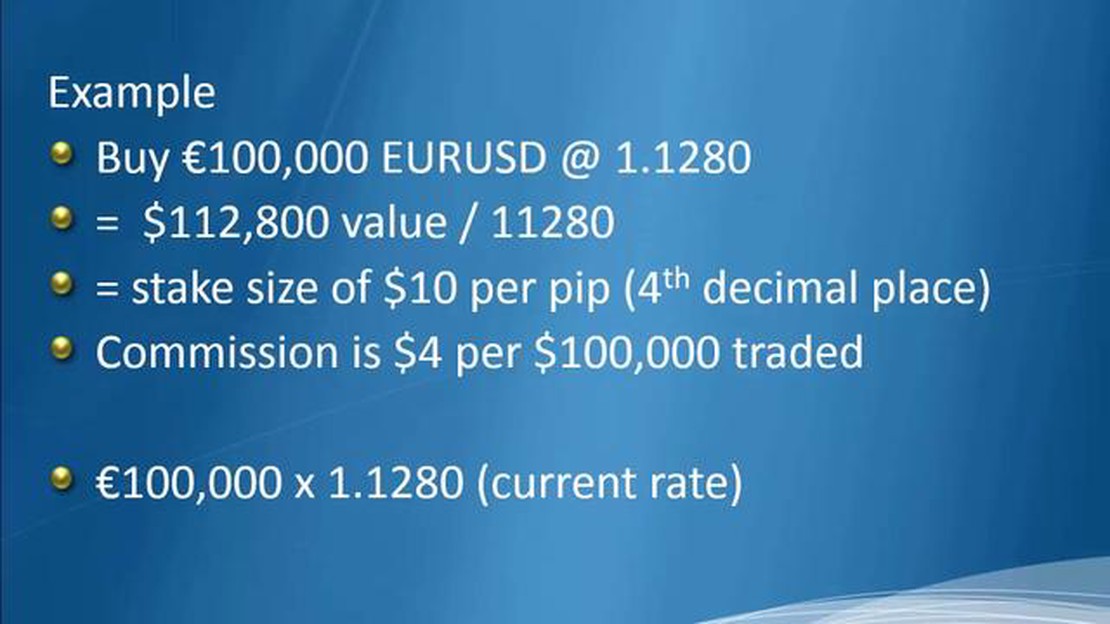

When you open a trade in the forex market, your broker will charge a commission based on the trade’s size and the commission rate. For example, if the commission rate is 0.1% and you trade $10,000, the commission fee would be $10. The commission is typically deducted from your trading account once the trade is executed.

Forex commission refers to the fee charged by brokers for executing forex trades on behalf of traders. It is an essential aspect to understand when engaging in forex trading.

Definition:

Forex commission is the cost associated with buying or selling a particular currency pair. It is usually expressed as a fixed amount or a percentage of the trade’s value.

Types of Forex Commissions:

There are mainly two types of forex commissions:

Factors Affecting Forex Commission:

Read Also: Exploring the Exponential Moving Average of TCS: Everything You Need to Know

Several factors influence the forex commission charged by brokers. These include:

Importance of Understanding Forex Commission:

Understanding forex commission is crucial for traders as it directly affects their trading costs and profitability. Traders should consider the commission when evaluating potential trades, as it adds to the overall transaction cost.

Remember, lower commission rates do not necessarily mean better trading conditions. It is essential to consider other factors such as spread, execution quality, and customer support when choosing a forex broker.

Read Also: Who Offers the Cheapest Shipping Rates? Find Out Now!

Overall, having a clear understanding of forex commission is vital for successful forex trading. It allows traders to make informed decisions and manage their trading costs effectively.

When trading on the Forex market, it is important to understand the concept of commissions. Commissions are fees charged by brokers for executing trades on behalf of traders. They can vary based on the type of commission and the broker’s pricing structure.

There are two main types of forex commission rates: fixed and variable. Fixed commission rates are a set fee charged per trade, regardless of the trade size or currency pair. This type of commission is common among brokers who offer fixed spreads. Variable commission rates, on the other hand, are based on the trade size or value. This means that the commission increases as the trade size or value increases.

Forex commission rates can be presented in different ways depending on the broker. Some brokers may charge a percentage of the trade value as a commission, while others may charge a fixed fee per lot. It is important to carefully review the commission structure of a broker before choosing to trade with them, as it can have a significant impact on trading costs.

In addition to the commission rates, brokers may also charge other fees such as spreads, swaps, and deposit/withdrawal fees. These fees can also vary among brokers, so it is important to consider the overall trading costs when comparing different brokers.

Traders should also be aware of any potential hidden commissions. Some brokers may advertise low commission rates, but then compensate for it by widening the spreads or charging additional fees. It is important to read the fine print and understand all the costs involved before opening an account with a broker.

Overall, understanding the different types of forex commission rates and fees is essential for traders. By carefully comparing the commission structures of different brokers and considering the overall trading costs, traders can make informed decisions and choose the broker that best suits their trading needs.

Forex commission is a fee that traders pay to the broker for executing their trades in the forex market.

Forex commission can be calculated in different ways depending on the broker. It can be a fixed fee per trade or a percentage based on the trade size.

The amount of Forex commission can be influenced by the broker’s fee structure, the currency pair being traded, the trade size, and the trading volume.

Yes, there are brokers who do not charge Forex commission. They make money through spreads, which is the difference between the bid and ask price.

No, Forex commission is not the only fee that traders have to pay. Traders may also have to pay other fees such as spreads, swap fees, and inactivity fees depending on the broker.

How to Choose a Broker on MetaTrader Choosing the right broker on MetaTrader is crucial for successful trading. With so many brokers to choose from, …

Read ArticleUnderstanding the Average Convergence Divergence Indicator The Average Convergence Divergence (ACD) indicator is a popular technical analysis tool …

Read ArticleUnderstanding Swap Points: An Explainer Swap points are an important concept to understand in the world of finance and foreign exchange trading. They …

Read ArticleDo Pepsi employees receive stock options? Stock options have become a popular form of compensation for employees in many companies. They provide an …

Read ArticleSetting Up a Forex Trading Room: Step-by-Step Guide Forex trading requires a focused and dedicated environment to maximize concentration and …

Read ArticleIs option selling and short selling the same? Option selling and short selling are two distinct investment strategies with different risks and …

Read Article