Understanding Binary Option Payments: A Comprehensive Guide

Understanding Binary Option Payments Binary options are a popular form of trading in the financial markets. They offer traders the opportunity to make …

Read Article

When analyzing the financial performance of a business, it is essential to understand the distinction between unit cost and average cost. These two terms are often used interchangeably but have different meanings and implications. Unit cost refers to the cost associated with producing a single unit of a product or providing a service. On the other hand, average cost represents the total cost divided by the total number of units.

Unit cost is a fundamental concept in cost accounting and is used to determine the profitability of a single unit of production. It is calculated by dividing the total cost of production by the number of units produced. For example, if a company produces 100 units at a cost of $1,000, the unit cost would be $10 per unit. Understanding unit cost is crucial for pricing decisions, as it allows businesses to determine the minimum price at which they can sell their products or services to cover their costs and make a profit.

Average cost, on the other hand, provides a broader perspective on the overall cost efficiency of a business. It takes into account all costs incurred by the business and calculates the average cost per unit. Average cost can be useful for assessing the overall financial health of a company, as it reflects the impact of economies of scale. As a business produces more units, the average cost tends to decrease, as fixed costs are spread over a larger number of units. This means that the more units a business produces, the lower the average cost per unit will be.

It is important to note that while unit cost and average cost are related, they are not the same. Unit cost focuses on the cost of producing a single unit, while average cost considers the overall cost efficiency of a business. Both measures are essential for understanding and managing costs, making informed pricing decisions, and evaluating the financial performance of a business.

In conclusion, unit cost and average cost are two distinct measures that provide different insights into the cost structure of a business. While unit cost helps determine the cost of producing a single unit, average cost provides a more comprehensive view by considering the total cost divided by the total number of units. Both measures are crucial for effective cost management and financial analysis, enabling businesses to make informed decisions and optimize their profitability.

Unit cost refers to the cost of producing one unit of a product or service. It is calculated by dividing the total cost of production by the number of units produced. Unit cost is an important metric for businesses as it helps them determine the profitability of their products or services.

In manufacturing, unit cost includes not only the direct costs of materials and labor, but also the indirect costs such as overhead expenses. It provides a comprehensive view of the cost of producing a single unit. Understanding unit cost allows businesses to make informed decisions about pricing, production volumes, and overall profitability.

Unit cost can vary depending on various factors such as economies of scale, production efficiency, and input costs. It is important for businesses to monitor and analyze unit cost regularly to identify opportunities for cost savings and efficiency improvements.

Unit cost, also known as marginal cost or cost per unit, refers to the average cost associated with producing one unit of a product or service. It is an essential metric used by businesses to determine the profitability and efficiency of their operations.

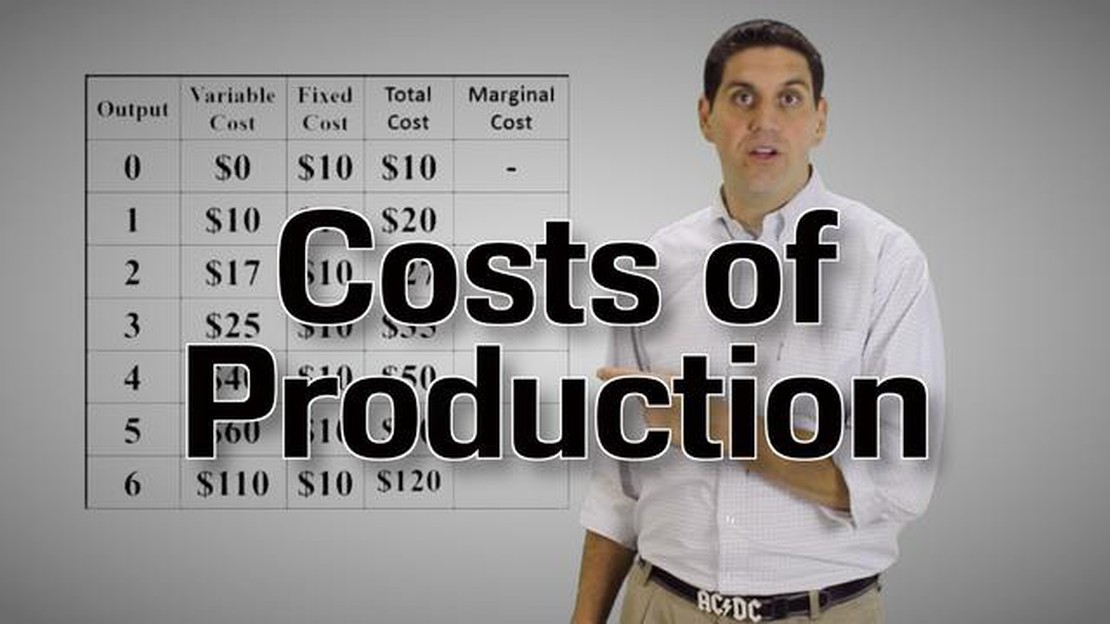

To calculate unit cost, one must divide the total cost of production by the number of units produced. This includes both variable costs, which fluctuate with the level of production, and fixed costs, which remain constant regardless of the number of units produced. Variable costs may include direct labor expenses, raw material costs, and other expenses directly related to production. Fixed costs, on the other hand, may include rent, utilities, and salaries of administrative staff.

Understanding the unit cost is crucial for businesses as it helps them make informed decisions regarding pricing, manufacturing processes, and resource allocation. By analyzing the unit cost, businesses can determine whether they need to lower production costs, increase their selling prices, or improve their operational efficiency.

Read Also: London Opening Hours: What Time Does Forex UK Begin?

Furthermore, knowing the unit cost allows businesses to compare their performance against competitors and industry benchmark standards. It provides insights into whether a business is generating sufficient profit margins and if there are opportunities for cost reduction or productivity improvement.

It is important to note that the unit cost may vary depending on the volume of production. As a business scales up its production, it may benefit from economies of scale, which can lower the unit cost. Conversely, a decrease in production volume may lead to higher unit costs due to reduced efficiency and underutilization of resources.

In summary, unit cost is a key financial indicator that helps businesses evaluate their operational efficiency, set appropriate pricing strategies, and make informed decisions regarding resource allocation. By understanding the unit cost, businesses can optimize their production processes and maximize their profitability.

Unit cost is a crucial measure in business and finance that helps determine the cost of producing or providing a single unit of a product or service. To calculate unit cost, one needs to divide the total cost by the total quantity of units produced or delivered.

The formula for calculating unit cost is:

Unit Cost = Total Cost / Total Quantity

Read Also: The Future of Robotics in 2023: Exploring Innovative Technologies and New Possibilities

For example, if a company spent $10,000 to produce 1,000 units of a product, the unit cost would be $10,000 / 1,000 = $10 per unit.

The importance of unit cost lies in its ability to provide insights into the profitability and efficiency of a business. By calculating the unit cost, companies can determine the break-even point, set prices, and make informed decisions regarding production volumes and cost management.

Understanding the unit cost is particularly important in industries where products or services have a variable cost structure. By analyzing the unit cost, businesses can identify opportunities to reduce costs, streamline operations, and improve overall profitability.

Additionally, unit cost analysis allows for comparison between different production methods, suppliers, or pricing strategies. By comparing the unit costs of different options, companies can choose the most cost-effective solution and optimize their operations.

Unit cost refers to the cost per individual unit of a product or service, while average cost is the total cost divided by the number of units produced or services provided. In simple terms, unit cost focuses on the cost of one unit, while average cost looks at the overall cost.

Unit cost is calculated by dividing the total cost by the number of units. Average cost is calculated by dividing the total cost by the number of units produced or services provided. Both calculations involve dividing the total cost by a certain quantity.

Understanding unit cost is important for businesses because it helps in determining the profitability of a product or service. By knowing the cost of producing one unit, businesses can manage their expenses, set prices, and evaluate the efficiency of their production processes.

Unit cost and average cost can be the same if every unit produced or service provided has the same cost. However, in most cases, the unit cost and average cost will be different as the cost per unit can vary depending on factors such as economies of scale, variations in production, or changes in input costs.

Businesses can reduce unit and average costs by implementing cost-saving measures such as increasing efficiency in production processes, automating tasks, negotiating better deals with suppliers, or finding ways to reduce waste. Continuously analyzing and optimizing the cost structure can help businesses lower their overall costs.

Understanding Binary Option Payments Binary options are a popular form of trading in the financial markets. They offer traders the opportunity to make …

Read ArticleChoosing the Right Moving Averages for Stock Analysis Moving averages are an essential tool for investors and traders who want to analyze the trends …

Read ArticleExploring the Most Reliable Reversal Patterns in Trading In the ever-evolving world of trading, finding reliable patterns that can signal a trend …

Read ArticleDo you need 100 shares to sell a put? When it comes to trading options, it’s important to understand the basics of buying and selling. A put option …

Read ArticleChoosing the Best Timeframe for Scalping Forex Markets Scalping is a popular trading strategy that involves making small, quick trades in order to …

Read ArticleWhat is the safest strategy in option trading to earn a 4% profit monthly? When it comes to option trading, it’s important to have a strategy that not …

Read Article