Discover the Best Strategy for EMA: Expert Insights and Tips

Best Strategy for EMA When it comes to trading, having a reliable strategy is crucial for success. One popular strategy that many traders swear by is …

Read Article

When it comes to understanding the intricacies of tax law, there are many terms and concepts that can be confusing. One such concept is the difference between gross-up and non gross-up. While these terms may sound similar, they actually have very different meanings and implications.

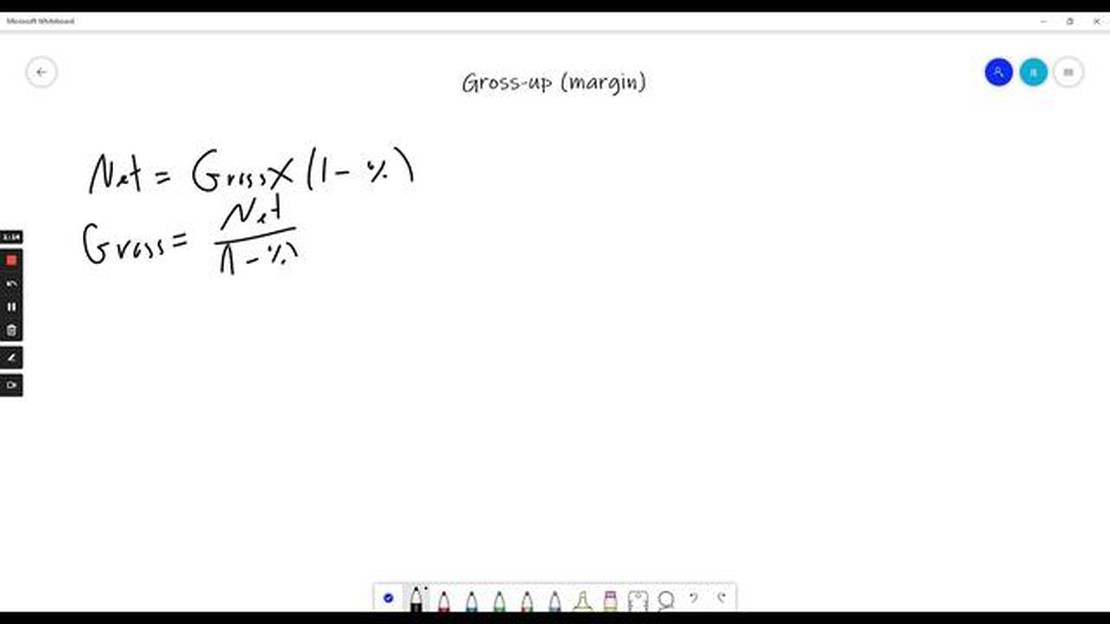

A gross-up refers to the practice of adding an additional amount to an employee’s salary or income in order to cover the taxes they will owe on that income. Essentially, it is a way for employers to ensure that their employees receive the full amount of their salary, even after taxes have been deducted. This can be particularly useful in situations where an employee is receiving a one-time bonus or other form of additional income.

On the other hand, non gross-up refers to a situation where an employee’s income is not adjusted to account for the taxes they will owe. In this case, the employee is responsible for paying their own taxes out of their original salary or income. Non gross-up is the more common arrangement, as it places the burden of tax payment on the employee rather than the employer.

Understanding the difference between gross-up and non gross-up is important for both employers and employees. For employers, it is crucial to know which method is being used in order to accurately calculate and report income and taxes. For employees, it is important to understand how their income is being adjusted for taxes so they can accurately budget and plan for their financial obligations.

Overall, while the difference between gross-up and non gross-up may seem small, it can have significant implications for both employers and employees. By understanding these terms and their implications, individuals can ensure that they are properly accounting for taxes and receiving the full amount of their income.

When it comes to determining the tax implications of various financial transactions, it’s important to understand the difference between gross-up and non gross-up. These terms refer to different methods of handling taxes and can have a significant impact on the final amount a person owes.

Gross-up refers to the practice of increasing the amount of a payment to account for taxes that will be owed on that payment. For example, if an employer offers a bonus to an employee, they may choose to gross up the bonus by adding an additional amount to cover the taxes that will be deducted. By doing this, the employee receives the full intended amount without having to worry about the tax consequences.

On the other hand, non gross-up means that taxes are not factored into a payment or transaction. The recipient of the payment is responsible for handling the taxes themselves and must set aside the necessary funds to cover their tax obligations. This can often result in a lower net amount received compared to a gross-up arrangement.

One of the primary reasons why gross-up arrangements are used is to provide individuals with a more accurate understanding of the true value of a payment. By grossing up a payment, the recipient can see exactly how much they will receive after taxes rather than having to calculate the amount themselves. This can be particularly useful for employees who receive bonuses or other types of supplemental income.

Non gross-up arrangements, on the other hand, are typically used when it is not feasible or practical for the payer to gross up a payment. This might be the case in situations where the payer is an individual rather than an employer or if the payment is a one-time occurrence. In these instances, the recipient must be aware that they will need to set aside additional funds to pay the taxes on the payment.

Read Also: What Happened to Knight Trading? A Look at the Rise and Fall of a Wall Street Giant

In conclusion, understanding the difference between gross-up and non gross-up is important for individuals who are receiving payments or involved in financial transactions. By understanding how taxes are handled in each situation, individuals can better prepare for their tax obligations and ensure they are receiving the full amount intended.

When it comes to understanding the difference between gross-up and non gross-up, it’s important to explore the key distinctions between the two. While both terms are related to taxes and compensation, they have different implications and purposes.

A gross-up is a financial consideration provided by an employer to compensate for the additional tax liability that an employee may incur due to receiving a particular benefit or perk. This means that the employer increases the employee’s compensation to “gross up” the amount, ensuring that the employee receives the full value of the benefit or perk after taxes. The gross-up amount will differ based on the employee’s tax bracket and the value of the benefit or perk.

In contrast, a non gross-up compensation does not include the additional financial consideration to cover the tax impacts. Instead, the employee is responsible for paying taxes on the full value of the benefit or perk received. This means that the employee may incur a larger tax liability and potentially receive a lower net value compared to a gross-up compensation.

The key distinction between the two lies in the responsibility for paying taxes. With a gross-up, the burden of taxes shifts partially or entirely to the employer, who provides the additional compensation to cover the tax liability. On the other hand, with a non gross-up, the burden of taxes rests solely on the employee.

Another distinction is the purpose behind each type of compensation. A gross-up is typically used to provide a tax-neutral benefit to the employees, ensuring that they receive the expected value of the benefit without being significantly impacted by taxes. On the other hand, a non gross-up compensation is more cost-effective for the employer, as they do not provide additional compensation to cover the taxes.

Understanding these key distinctions is essential for both employers and employees. Employers need to make informed decisions when structuring their compensation plans and benefits packages, taking into account the tax implications and the desire to provide tax-neutral benefits. For employees, knowing whether their compensation is grossed up or not can help them better understand their tax liabilities and make more informed financial decisions.

When it comes to taxes, understanding how gross-up works can save you from unexpected surprises. Gross-up refers to the process of increasing the amount of taxable income to account for taxes that will be owed on that income. This is commonly used in situations where an employer provides a benefit or perk to an employee that is subject to taxation.

Read Also: Is Fibonacci a Good Strategy? The Truth Behind Using the Fibonacci Sequence in Trading

The concept of gross-up is important because it ensures that the employee receives enough net income to cover the taxes on the benefit or perk. Without gross-up, the employee would be responsible for paying the taxes out of their own pocket, which can significantly reduce the value of the benefit or perk.

Gross-up calculations can be complex, as they involve taking into account the tax rate, the type of benefit or perk being provided, and any deductions or exemptions that may apply. Employers typically use specific formulas or software to determine the appropriate gross-up amount.

It’s also worth noting that gross-up can apply to different types of income, such as bonuses, relocation expenses, or even stock options. In these cases, the employer may choose to gross-up the income to ensure that the employee doesn’t bear the full tax burden.

Overall, understanding the concept of gross-up can help you navigate the complexities of taxation and ensure that you receive the full value of any benefits or perks provided by your employer. It’s always wise to consult with a tax professional or human resources representative to fully understand how gross-up applies to your specific situation.

Gross-up and non-gross-up refer to two different methods of calculating taxes. In a gross-up scenario, the employer pays the employee’s taxes on their behalf, while in a non-gross-up scenario, the employee is responsible for paying their own taxes.

In a gross-up scenario, the employer calculates the employee’s tax liability and adds that amount to the employee’s salary or wage. The employer then pays both the salary and the taxes on behalf of the employee. This means that the employee receives their full salary without any deductions.

The advantage of gross-up for employees is that they receive their full salary without any deductions. This can be especially beneficial for high-income earners who would have a significant amount of taxes deducted from their paycheck. Additionally, it simplifies the tax process for employees as they do not have to worry about calculating and paying their own taxes.

The disadvantage of gross-up for employers is that they have to bear the cost of the employee’s taxes. This can increase the employer’s expenses and affect their bottom line. Additionally, it requires the employer to accurately calculate the employee’s tax liability and ensure that the proper amount is withheld from the employee’s salary.

Best Strategy for EMA When it comes to trading, having a reliable strategy is crucial for success. One popular strategy that many traders swear by is …

Read ArticleHow to Withdraw Money from Binary Options Withdrawal of funds is an essential part of trading binary options. Once you have made profits and want to …

Read ArticleUnderstanding a Cashless Exercise Before IPO Before an Initial Public Offering (IPO), companies often provide their employees with stock options as a …

Read ArticleUnderstanding LH in trading In the world of finance, there are numerous terms and abbreviations that can seem confusing to those who are new to …

Read ArticleFind Out If You Can Hire a Professional Forex Trader and Leave the Trading Process to Them Foreign exchange, or forex, trading is a complex and …

Read ArticleWhat is the best rate for USD to SGD? Are you planning a trip to Singapore or doing business with Singaporean partners? One of the things you need to …

Read Article