Warren Buffett's Options Trading Strategy: Insights and Tips

Warren Buffett’s Options Trading Strategy: Insights and Analysis Warren Buffett, widely regarded as one of the most successful investors of all time, …

Read Article

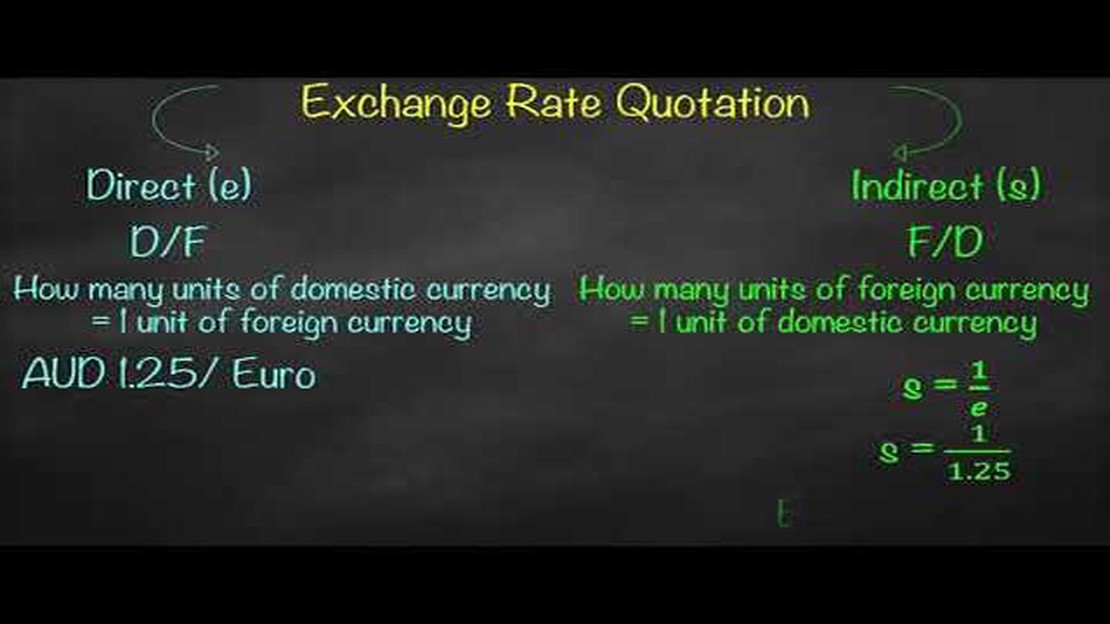

Forex trading involves the buying and selling of different currencies in the foreign exchange market. As a trader, it is essential to understand the various aspects of currency quotes, as they play a crucial role in determining the profitability of your trades. Two types of currency quotes commonly used in forex trading are direct quotes and indirect quotes.

A direct quote is a currency quote where the domestic currency is the base currency and the foreign currency is the counter currency. In other words, it tells you how much of the foreign currency you need to buy one unit of the domestic currency. For example, if the direct quote for EUR/USD is 1.10, it means that one euro is equivalent to 1.10 US dollars.

On the other hand, an indirect quote is a currency quote where the domestic currency is the counter currency and the foreign currency is the base currency. In this case, it tells you how much of the domestic currency you need to buy one unit of the foreign currency. Using the same example, if the indirect quote for EUR/USD is 0.91, it means that one US dollar is equivalent to 0.91 euros.

Understanding the difference between direct and indirect quotes is essential, as it affects the way you interpret currency prices and calculate profits or losses. It also affects the way you execute trades and manage risk in the forex market. By having a clear understanding of these two types of quotes, you can make more informed trading decisions and maximize your profits in the forex market.

In forex trading, direct quotes refer to the exchange rate of a currency pair where the domestic currency is the base currency and the foreign currency is the counter currency. This means that one unit of the domestic currency is equal to a certain amount of the foreign currency.

For example, let’s consider the currency pair EUR/USD. A direct quote for this pair would be expressed as the amount of the counter currency (USD) required to buy one unit of the base currency (EUR). If the exchange rate is 1.1000, it means that one euro is equivalent to 1.1000 US dollars.

Direct quotes are commonly used by traders and investors to determine the value of a currency and make informed trading decisions. They provide a straightforward and easily understandable representation of the exchange rate between two currencies.

| Base Currency | Counter Currency | Direct Quote |

|---|---|---|

| EUR | USD | 1.1000 |

| GBP | JPY | 150.50 |

| AUD | CAD | 0.9400 |

Direct quotes are widely used in the forex market and are an essential tool for traders to analyze currency pairs, calculate profits and losses, and identify potential trading opportunities.

In forex trading, a direct quote refers to the value of a currency in terms of another currency. It represents the amount of the quote currency required to purchase one unit of the base currency. This type of quote is also known as the price currency or the transaction currency.

Direct quotes are used when the domestic currency is the base currency and the foreign currency is the quote currency. For example, in the United States, the direct quote for the USD/EUR currency pair would be the amount of Euros required to buy one US Dollar.

The direct quote is usually presented as a ratio or fractional representation, with the base currency as the numerator and the quote currency as the denominator. For instance, a direct quote of 1.12 for the USD/EUR currency pair means that 1 US Dollar is equivalent to 1.12 Euros.

It’s important to understand direct quotes because they help traders determine the value and exchange rate between two currencies. By analyzing direct quotes, traders can make informed decisions about buying or selling currencies to profit from fluctuations in the forex market.

| Key Points about Direct Quotes: |

|---|

| - Direct quotes represent the value of a currency in terms of another currency. |

| - They are used when the domestic currency is the base currency. |

| - Direct quotes are presented as a ratio, with the base currency as the numerator and the quote currency as the denominator. |

| - Analyzing direct quotes helps traders make informed decisions in forex trading. |

Read Also: Understanding the 1% Rule in Options Trading for Beginner Investors

Overall, understanding direct quotes is essential for forex traders to accurately interpret and analyze the currency markets. By being aware of the concept and mechanics of direct quotes, traders can effectively navigate the forex market and increase their chances of making profitable trades.

In forex trading, currency rates are quoted in pairs. These currency pairs represent the exchange rate between two currencies. There are two types of currency pairs: direct quotes and indirect quotes.

Read Also: Is it worth trading Forex? Exploring the potential benefits and risks

An indirect quote is a currency pair where the domestic currency is the base currency and the foreign currency is the quote currency. This means that the value of the domestic currency is expressed in terms of the foreign currency. For example, in the EUR/USD currency pair, the USD is the domestic currency and the EUR is the foreign currency.

Indirect quotes are often used to express the value of a currency in countries where the domestic currency has a fixed exchange rate or where the domestic currency is not widely traded. These quotes are also commonly used in cross-currency transactions.

When trading with indirect quotes, it’s important to understand how the value of the currency pair is determined. If the value of the currency pair goes up, it means that the domestic currency has strengthened against the foreign currency. Conversely, if the value of the currency pair goes down, it means that the domestic currency has weakened against the foreign currency.

Indirect quotes can be a useful tool for forex traders, as they provide insights into the strength or weakness of a domestic currency relative to a foreign currency. By analyzing the trends and patterns of indirect quotes, traders can make informed decisions about when to buy or sell currencies.

Overall, understanding indirect quotes is an essential part of forex trading. By understanding how these quotes work and how the value of currency pairs is determined, traders can better analyze the forex market and make more informed trading decisions.

Direct quotes in forex trading refer to the exchange rate between two currencies where the domestic currency is the base currency. For example, in USD/EUR, the direct quote would be the number of euros required to purchase one US dollar.

Indirect quotes in forex trading refer to the exchange rate between two currencies where the domestic currency is the counter currency. For example, in USD/EUR, the indirect quote would be the number of US dollars required to purchase one euro.

Understanding the difference between direct and indirect quotes is important in forex trading because it affects the interpretation of exchange rates and the calculation of profits or losses. It also helps traders navigate the global forex market more effectively.

To determine if a currency pair is quoted directly or indirectly, you can look at the order of the currency symbols. If the domestic currency is the base currency, it is a direct quote. If the domestic currency is the counter currency, it is an indirect quote. For example, in USD/EUR, USD is the base currency, so it is a direct quote.

There are no inherent advantages to trading with direct quotes over indirect quotes or vice versa. The choice of quote type depends on the individual trader’s preferences and trading strategy.

Direct quotes in forex trading are when the domestic currency is the base currency and the foreign currency is the quote currency. Indirect quotes are when the domestic currency is the quote currency and the foreign currency is the base currency. The difference lies in which currency is being quoted and which currency is being used as a reference.

Understanding the difference between direct and indirect quotes in forex trading is essential because it determines how currency pairs are quoted and how their rates are calculated. This knowledge is crucial for traders to accurately interpret and analyze currency movements, make informed trading decisions, and manage risk effectively in the forex market.

Warren Buffett’s Options Trading Strategy: Insights and Analysis Warren Buffett, widely regarded as one of the most successful investors of all time, …

Read ArticleWhat is the payment for order flow? Payment for Order Flow (PFOF) is a practice used in financial markets that involves a brokerage firm receiving …

Read ArticleThe Development of Global Trade: A Historical Overview Global trade, as we know it today, has a long and complex history that dates back thousands of …

Read ArticleUsing Indian Debit Card in Foreign Countries: Everything You Need to Know If you’re planning to travel abroad, it’s crucial to understand how you can …

Read ArticleWhat Can You Trade on Forex? Forex, or foreign exchange, is the largest financial market in the world. It involves the buying and selling of …

Read ArticleIn which index can we do option trading? When it comes to option trading, choosing the right index is crucial for success. With so many indices to …

Read Article