What to Choose: Forex or Indices? A Detailed Comparison

Choosing Between Forex or Indices: Which is Better? When it comes to investing and trading, there are a multitude of options available. Two popular …

Read Article

Forex trading requires a deep understanding of various indicators that can help traders make informed decisions. One such indicator is the current ratio, which plays a significant role in analyzing a company’s financial health and performance. In this comprehensive guide, we will delve into the details of the current ratio indicator and explore its relevance in forex trading.

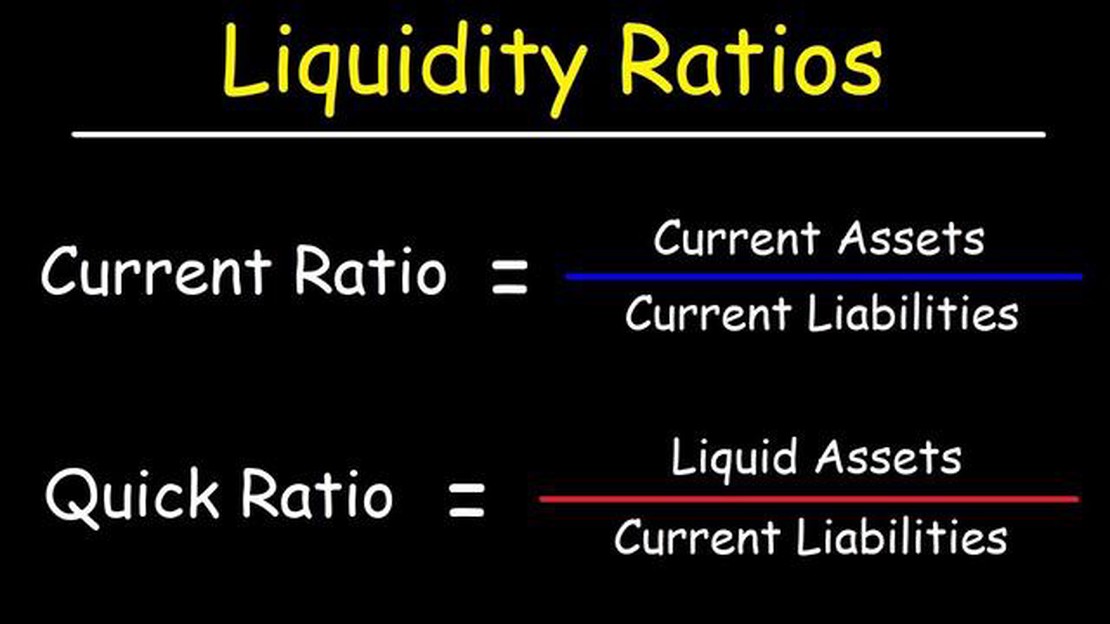

The current ratio is a liquidity ratio that measures a company’s ability to meet short-term obligations with its current assets. It is calculated by dividing current assets by current liabilities. By assessing the current ratio, forex traders can gauge the financial stability of a company and make predictions about its future performance.

In forex trading, the current ratio indicator can be used in various ways. Firstly, it can help traders evaluate the financial health of a country’s economy. By assessing the current ratio of a country’s central bank or major financial institutions, traders can gain insights into the overall economic stability and potential risks.

Additionally, the current ratio indicator can assist forex traders in analyzing individual currency pairs. By examining the current ratios of the countries involved in a currency pair, traders can gain a deeper understanding of the economic disparities and make informed trading decisions based on the potential impact on exchange rates.

In conclusion, understanding the current ratio indicator is essential for successful forex trading. By using this indicator, traders can assess the financial stability of companies or countries, and make informed decisions based on their analysis. By incorporating the current ratio into their trading strategies, traders can increase their chances of success in the forex market.

The current ratio indicator is a tool used in forex trading to assess the liquidity and financial health of a currency pair. It is calculated by dividing the total current assets of a country by its total current liabilities. This ratio is helpful in determining whether a country has enough assets to cover its short-term obligations.

A current ratio above 1 indicates that a country has more current assets than current liabilities. This suggests that the country is in a good financial position and is able to meet its short-term financial obligations. On the other hand, a current ratio below 1 indicates that a country may have difficulty meeting its short-term obligations and may be at risk of default.

The current ratio is influenced by a variety of factors, including the economic and political stability of a country, its trade balance, and its fiscal policy. For example, a country with a trade surplus and a stable political climate is likely to have a higher current ratio than a country with a trade deficit and political instability.

Forex traders use the current ratio indicator as part of their analysis to help identify potential trading opportunities and manage risk. They may look for countries with strong current ratios as potential candidates for buying their currency, as this indicates a healthier financial position. Conversely, they may avoid countries with weak current ratios, as this may indicate higher risk.

It is important to note that the current ratio indicator is just one of many tools used in forex trading, and should not be relied upon as the sole factor in making trading decisions. Traders should consider other fundamental and technical analysis indicators, as well as market conditions and trends, to make informed trading decisions.

In conclusion, understanding and interpreting the current ratio indicator can provide valuable insights into the financial health of a country and its potential impact on forex trading. By incorporating this indicator into their analysis, forex traders can make more informed trading decisions and manage risk more effectively.

Read Also: 5 Ways to Make the Most of Your $10,000 Investment in Kenya

The current ratio indicator is a valuable tool in forex trading as it provides insight into a company’s liquidity and ability to meet short-term obligations. It is calculated by dividing a company’s current assets by its current liabilities. The resulting ratio indicates whether a company has enough assets to cover its liabilities and is often used by investors and analysts to assess a company’s financial health.

Forex traders can use the current ratio indicator to gain a deeper understanding of a company’s financial position and make more informed trading decisions. A high current ratio suggests that a company has strong liquidity and is better equipped to handle unexpected financial setbacks. On the other hand, a low current ratio indicates that a company may struggle to meet its short-term obligations and could be at risk of financial instability.

Read Also: What happens to my stock at Walmart if I quit? Understanding the stock options for Walmart employees

By monitoring the current ratio of companies whose stocks they trade, forex traders can identify potential investment opportunities and make better-informed trading decisions. For example, if a company has a consistently high current ratio, it may indicate that the company is well-managed and financially stable, making it a potential investment opportunity.

However, it’s important to note that the current ratio indicator should not be used in isolation. It should be considered alongside other financial ratios and indicators to get a holistic view of a company’s financial health. Additionally, the current ratio can vary greatly between industries, so it’s essential to compare companies within the same industry to get an accurate analysis.

In conclusion, the current ratio indicator plays a crucial role in forex trading by providing insight into a company’s liquidity and financial health. By understanding this indicator and considering it alongside other financial ratios, forex traders can make more informed trading decisions and potentially capitalize on investment opportunities.

The current ratio indicator is a tool used by forex traders to assess the liquidity and solvency of a company. It is calculated by dividing the current assets of a company by its current liabilities.

The current ratio indicator helps forex traders assess the financial health of a company. If a company has a high current ratio, it indicates that it has enough current assets to cover its current liabilities, which is considered a positive sign. On the other hand, a low current ratio may suggest that a company is facing liquidity issues and may have difficulty in meeting its short-term obligations.

The current ratio indicator has some limitations. Firstly, it does not provide a complete picture of a company’s financial health as it only considers current assets and current liabilities. It does not take into account a company’s long-term assets or long-term liabilities. Secondly, the current ratio is a static measure and does not consider the timing and quality of current assets and current liabilities. Lastly, the current ratio may vary across different industries, so it is important to compare the current ratio of a company to its industry peers.

Forex traders can use the current ratio indicator as one of the factors to consider when making trading decisions. A high current ratio may indicate a financially stable company, which could be a positive sign for the company’s stock or currency. Conversely, a low current ratio may signal financial distress, and traders may want to be cautious when trading the company’s stock or currency. It is important for traders to conduct thorough research and consider other factors in addition to the current ratio before making trading decisions.

Yes, there are several other financial ratios that forex traders should consider in addition to the current ratio. Some important ratios include the debt ratio, return on equity, and profit margin. These ratios provide traders with a more comprehensive view of a company’s financial health and can help them make more informed trading decisions. It is important for traders to have a good understanding of these ratios and how they can be used in forex trading.

The current ratio indicator in forex trading is a financial metric that measures a company’s ability to pay off its short-term liabilities with its short-term assets. It is calculated by dividing the company’s current assets by its current liabilities.

The current ratio indicator is used in forex trading to assess the financial health of a company. By looking at the current ratio, traders can determine if a company has enough short-term assets to cover its short-term liabilities. This information can help traders make informed decisions about whether to invest in a particular company’s stock or not.

Choosing Between Forex or Indices: Which is Better? When it comes to investing and trading, there are a multitude of options available. Two popular …

Read ArticleUnderstanding Fair Value: An Example and Explanation When it comes to assessing the worth of an asset or liability, fair value is a key concept in …

Read ArticlePenguins 2023 Trades: A Breakdown of the Players Involved The Pittsburgh Penguins, a professional ice hockey team based in Pittsburgh, Pennsylvania, …

Read ArticleDiscovering the Volume of Options Traded Options trading is a complex and dynamic market that offers investors a plethora of opportunities. The volume …

Read ArticleIs Stock Considered an Investment? Stocks have long been a popular investment option for individuals looking to grow their wealth. However, the …

Read ArticleCalculating the Probability of 4 Options Have you ever wondered about the probability of four different options? Whether you’re a statistics …

Read Article