Is RoboForex really a good choice? Discover the truth about this forex broker

Is RoboForex a Good Choice for Traders? RoboForex is a popular forex broker that has been providing financial services since 2009. With its wide range …

Read Article

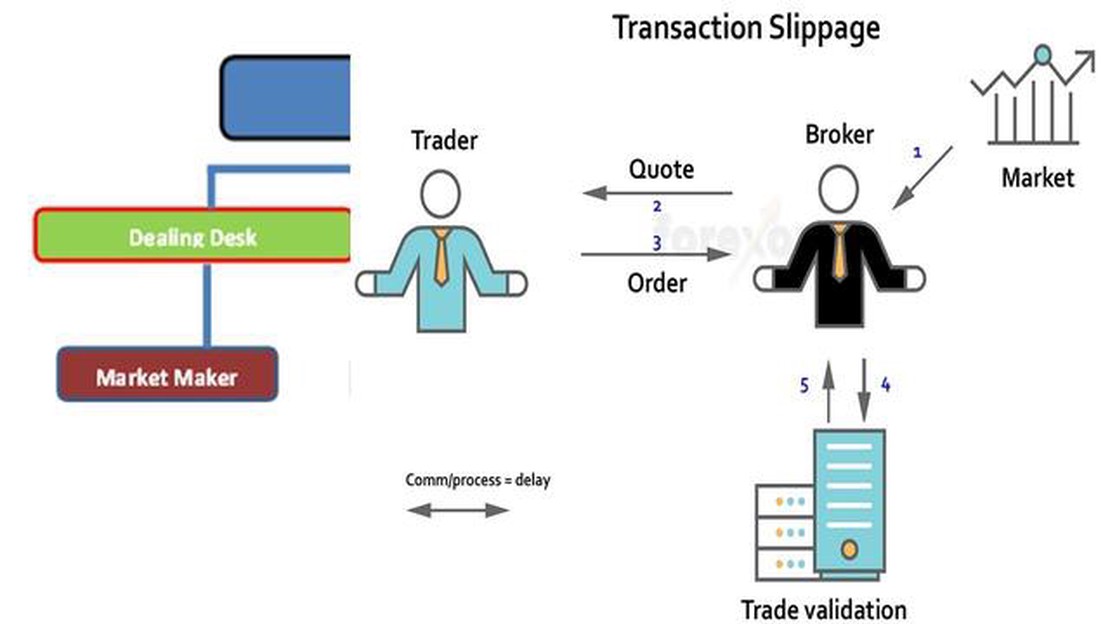

When trading in the financial markets, one concept that traders often encounter is the requote price. Requote price is a term used to describe a situation where a trader’s requested price for a trade is not available, and the broker offers a new price for the trade instead. This can happen when there is high market volatility or low liquidity.

Requote price can be a source of frustration for traders as it can result in delays and slippage in executing their trades. It is important for traders to understand why requotes occur and how they can affect their trading strategy.

There are several reasons why requotes may happen. One reason is that the market price may have moved significantly between the time the trader requested the price and the time the broker attempted to execute the trade. In such cases, the broker may not be able to fulfill the trade at the requested price and will offer a new price instead.

Another reason for requotes is low liquidity in the market. If there are not enough buyers or sellers at the requested price, the broker may not be able to execute the trade at that price and will offer a new price that reflects the available liquidity.

It is important for traders to evaluate the impact of requotes on their trading strategy. While requotes can be frustrating, they can also be an opportunity to reassess the market conditions and adjust trading decisions accordingly. Traders should also consider the broker’s requote policy and the frequency of requotes before choosing a platform for their trading activities.

Requote is a term used in trading to describe a situation where a broker is unable to execute a trade at the originally quoted price. When a trader places an order, the broker typically provides a quote indicating the current market price at which the trade will be executed. However, there are instances where the market conditions change rapidly, and the broker is unable to execute the trade at the initially quoted price.

When a requote occurs, the trader is given a new quote, usually at a slightly different price. The trader then has the option to accept or decline the new quote. If the trader accepts the new quote, the trade is executed at the revised price. However, if the trader declines the new quote, the trade is not executed, and the trader can either place a new order at a different price or choose not to execute the trade at all.

Requotes are more common in highly volatile markets where prices can change rapidly. They can occur in various financial markets, including stocks, currencies, commodities, and cryptocurrencies. Requotes can be frustrating for traders as they can result in delays or unfavorable execution prices. However, they are a common occurrence in trading and are typically the result of market fluctuations beyond the broker’s control.

| Pros of Requote | Cons of Requote |

|---|---|

| Provides traders with an opportunity to execute a trade at a revised price. | Can result in delays and missed trading opportunities. |

| Allows traders to have more control over their trades by accepting or declining the new quote. | May lead to frustration and dissatisfaction among traders. |

| Helps maintain market integrity by ensuring that trades are executed at fair and current market prices. | Can disrupt trading strategies and plans. |

Read Also: Can You Sell an IPO Immediately? Understanding the Restrictions and Limitations

Requote in trading can have a significant impact on traders. When a requote occurs, it means that the price at which a trader wants to execute a trade is no longer available, and they are presented with a new price to accept or reject.

This can be frustrating for traders because it can disrupt their trading strategy and potentially lead to missed opportunities. If a trader is trying to enter or exit a position at a specific price, a requote can prevent them from doing so and force them to either accept a less favorable price or wait for the market to move in their favor.

Requotes can also impact traders psychologically. They can cause anxiety and uncertainty as traders may question whether they are making the right decisions or if their broker is acting in their best interest. This can erode trust between traders and brokers, and potentially lead to traders seeking alternative trading platforms or brokers.

In addition, requotes can result in financial losses for traders. If a trader accepts a new price during a requote, they may be executing a trade at a less favorable price than what they intended. This can result in a smaller profit or a larger loss than expected.

Read Also: Is Avanade a Good Company to Work For? Pros and Cons of Working at Avanade

Overall, requotes can have a negative impact on traders by disrupting their trading strategy, causing psychological stress, eroding trust, and potentially leading to financial losses. It is important for traders to be aware of the possibility of requotes and to consider the potential impact on their trading activities.

Requote is a common occurrence in trading that can cause frustration and potential losses. However, there are several strategies you can employ to effectively deal with requotes and minimize their impact on your trading activities:

Overall, while requotes can be frustrating, it is important to approach them with a proactive and strategic mindset. By implementing the strategies mentioned above, you can effectively deal with requotes and continue trading with confidence.

A requote price in trading refers to the situation when a trader places an order to buy or sell a financial instrument at a certain price, but the broker is unable to execute the trade at that price and offers a new price instead.

Brokers provide a requote price when there is a delay in executing the trade at the original requested price. This delay can occur during periods of high market volatility or when there is a sudden change in the availability of the financial instrument being traded.

Traders have a few options when they encounter a requote price. They can accept the new price and proceed with the trade, or they can choose to cancel the order altogether. Some traders may also try to negotiate with the broker to get a better price or seek alternative trading opportunities.

Requotes can occur in trading, especially during periods of high market volatility or when there is a sudden surge in trading activity. However, the frequency of requotes can vary depending on the broker and the trading platform being used. Some brokers may have systems in place to minimize the occurrence of requotes.

Is RoboForex a Good Choice for Traders? RoboForex is a popular forex broker that has been providing financial services since 2009. With its wide range …

Read ArticleHow to Add a Moving Average? Data analysis plays a crucial role in understanding the trends and patterns hidden within raw data. One of the most …

Read ArticleWhat is the symbol for silver commodity? When it comes to investing or trading in commodities, it is crucial to be familiar with the various symbols …

Read ArticleUnderstanding Promotion Voucher Codes: All you need to know A promotion voucher code, also known as a promo code or discount code, is a combination of …

Read ArticleUnderstanding a Long Put in Options Trading In the world of options trading, there are various strategies that traders can employ to capitalize on …

Read ArticleCMTrading as a Market Maker: What You Need to Know When it comes to choosing a forex broker, it’s important to understand their trading model. One …

Read Article