Understanding EMA 200 Day Moving Average: A Guide for Traders and Investors

Understanding EMA 200 Day Moving Average When it comes to analyzing stock market trends and making informed investment decisions, one of the most …

Read Article

When it comes to trading in the forex market, understanding the commission structure of a forex broker is crucial. The commission structure determines how much a trader will pay in fees for each trade executed through the broker’s platform. It is important to have a clear understanding of how these fees are calculated and the impact they can have on your trading profits.

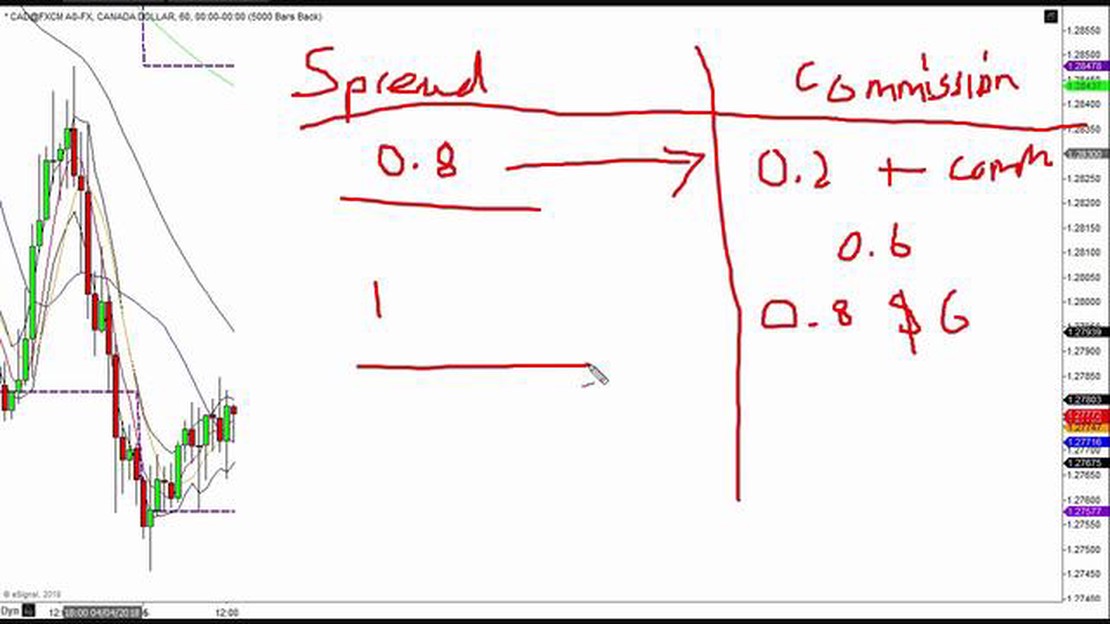

Forex brokers typically charge commissions in two ways: spread mark-up or a flat fee per trade. Spread mark-up is the difference between the bid and ask price quoted by the broker. The broker adds their commission to the spread, which essentially becomes the cost of the trade. This commission structure is commonly used by brokers who offer variable spreads.

On the other hand, some forex brokers charge a flat fee per trade, regardless of the size of the trade. This fee may be fixed or based on a percentage of the trade volume. This commission structure is commonly used by brokers who offer fixed spreads. The advantage of a flat fee structure is that it allows for easier calculation of trading costs, as the fee remains the same regardless of market conditions or trade size.

It is important for traders to consider the commission structure when choosing a forex broker. Traders who execute large volume trades may find a flat fee per trade more cost-effective, as the spread mark-up can add up over time. On the other hand, traders who execute smaller volume trades may benefit from a spread mark-up commission structure, as it allows for greater flexibility in trade size.

In conclusion, understanding the commission structure of a forex broker is essential for traders. It can have a significant impact on trading costs and ultimately on trading profitability. By carefully considering the commission structure and choosing a broker that aligns with your trading strategy and volume, you can optimize your trading experience in the forex market.

In forex trading, a commission structure refers to the system or method used by a broker to charge fees for executing trades on behalf of their clients. These fees are typically associated with the trading volume and can have a significant impact on a trader’s overall profit or loss.

Forex brokers can employ different types of commission structures, depending on their business model and the services they offer. The two most common commission structures used in forex trading are spread-based and commission-based.

In a spread-based commission structure, the broker earns their revenue by including a markup on the bid and ask prices for a currency pair. This markup, also known as the spread, represents the difference between the buying and selling price of a currency pair. The wider the spread, the more revenue the broker earns.

On the other hand, in a commission-based structure, the broker charges a fixed fee or percentage of the trade’s value for each transaction. This commission is typically separate from the spread and is charged in addition to it. The advantage of a commission-based structure is that traders know exactly how much they are paying in fees for each trade.

Both spread-based and commission-based structures have their advantages and disadvantages. Spread-based structures may be more suitable for traders who prefer to have all costs built into the spread, as there are no additional fees. On the other hand, commission-based structures may be more cost-effective for high-volume traders, as the commission fees charged on each trade may be lower compared to the wider spreads typically associated with spread-based structures.

Read Also: Forex Market Open Hours Today in India: Find the Exact Time to Trade

It is important for traders to understand the commission structure offered by their forex broker before opening an account. This will allow them to calculate the potential costs involved and choose a structure that best matches their trading style and goals. Additionally, traders should also consider other factors such as the broker’s reputation, customer support, and trading platform when selecting a forex broker.

| Spread-Based Commission Structure | Commission-Based Commission Structure |

|---|---|

| Markup on bid and ask prices | Fixed fee or percentage of trade value |

| Costs included in spread | Separate from spread |

| Wider spreads | Lower spreads |

When it comes to forex trading, understanding the different types of commission structures is essential. A commission structure refers to the way in which a forex broker charges fees for its services. These fees can vary depending on the type of commission structure employed by the broker.

Spread-based Commission: This is one of the most common types of commission structures used by forex brokers. In this structure, the broker makes money by adding a certain number of pips to the spread. The spread is the difference between the buy and sell prices of a currency pair. The wider the spread, the more the broker earns in commission. This type of commission structure is often preferred by beginners as it is easy to understand and calculate.

Read Also: Understanding the Probability of Four Options: A Comprehensive Guide

Percentage-based Commission: In this type of commission structure, the broker charges a percentage of the total trade volume as commission. For example, if the broker charges 0.1% and you trade $10,000, the commission would be $10. This type of commission structure is common among brokers who deal with large trade volumes.

Fixed-value Commission: Some brokers charge a fixed fee for each trade made by the trader. This fee remains the same regardless of the trade size or volume. This commission structure is often used by brokers who cater to retail traders and is generally considered more transparent.

Hybrid Commission: As the name suggests, this commission structure combines elements of different commission structures. For example, a broker may charge a fixed fee for each trade, but also add a certain number of pips to the spread. This type of commission structure is often used by brokers who want to offer flexibility and cater to different types of traders.

Volume-based Commission: Some brokers offer volume-based commission structures, where the commission rate decreases as the trade volume increases. This encourages traders to trade more and can be beneficial for those who trade frequently and in large volumes.

It is important for traders to understand the commission structure of their chosen forex broker, as it can have a significant impact on their trading costs and profits. By understanding the various types of commission structures, traders can make informed decisions and choose the structure that best suits their trading style and objectives.

A commission structure in forex trading refers to the fees that a forex broker charges for executing trades on behalf of the trader. It includes both the spread and the commission fee. The spread is the difference between the buying and selling price, while the commission fee is a fixed or variable charge based on the volume of the trade.

The commission structure directly affects your trading costs. If a broker has a high commission fee, it will increase your trading costs. On the other hand, a broker with a low commission fee can help in reducing the overall trading costs. Therefore, it is important to consider the commission structure of a forex broker before starting your trading activities.

Forex brokers generally offer two types of commission structures: fixed and variable. In a fixed commission structure, the broker charges a fixed fee per lot traded. This fee remains constant regardless of the volume of the trade. In a variable commission structure, the broker charges a fee based on a percentage of the trade volume. The higher the volume of the trade, the higher the commission fee.

The choice between a fixed and variable commission structure depends on your trading style and preferences. If you trade in smaller volumes, a fixed commission structure may be more cost-effective as the fee remains constant. However, if you trade in larger volumes, a variable commission structure may offer better flexibility and potentially lower costs, as the fee is based on a percentage of the trade volume.

Understanding EMA 200 Day Moving Average When it comes to analyzing stock market trends and making informed investment decisions, one of the most …

Read ArticleShould You Invest in Binary Options? Binary options have gained popularity in recent years as an alternative investment opportunity. With promises of …

Read Article12-Month Average Yield for US Treasury Securities Adjusted to One-Year Constant Maturity Index When it comes to investing in US Treasury securities, …

Read ArticleHow to Understand Lots in Forex Trading Forex trading can be a daunting endeavor, especially for beginners. One of the key concepts that every …

Read ArticleEasy Steps to Understand Forex Trading Forex trading, also known as foreign exchange trading, is the largest and most liquid financial market in the …

Read ArticleHow to Extract Stock Data from GOOGLEFINANCE When it comes to monitoring stock prices and analyzing market trends, having access to accurate and …

Read Article