Can You Trade Options on Plus500? A Comprehensive Guide

Trading Options on Plus500: Everything You Need to Know If you’re an investor or trader looking to expand your portfolio, you may be wondering if you …

Read Article

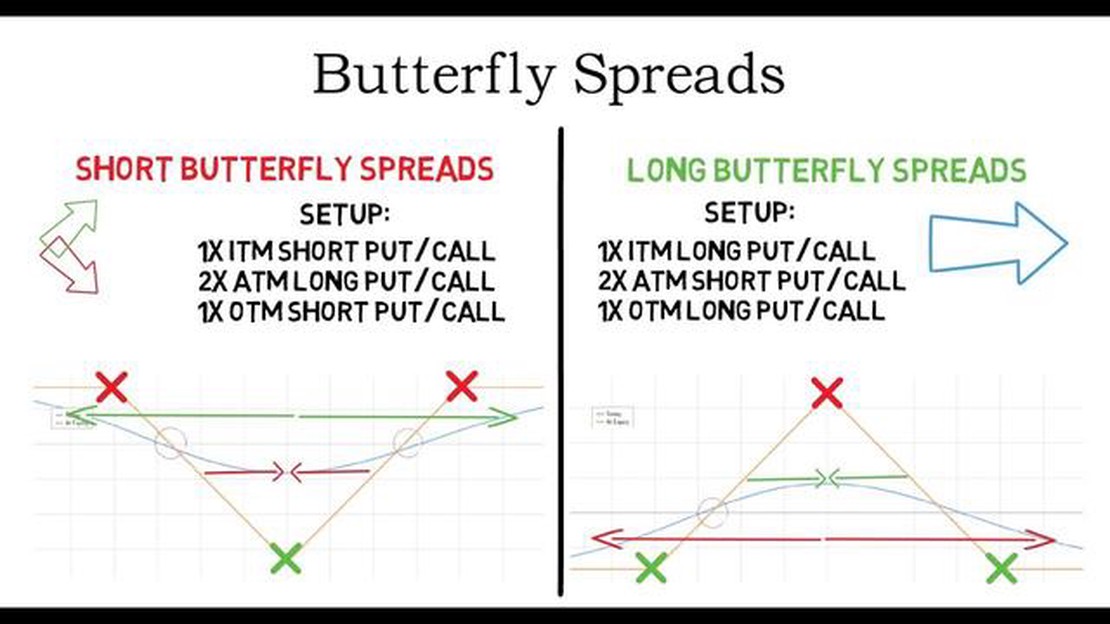

Options trading can be a complex and risky endeavor, but for those who are willing to put in the time and effort to understand the intricacies of different strategies, it can also be incredibly rewarding. One such strategy that traders often turn to is the butterfly options strategy, which involves buying and selling options contracts with different strike prices and expiration dates.

The butterfly strategy gets its name from the shape of the profit and loss graph that it creates. When plotted on a graph, the resulting image resembles a butterfly, with the potential for maximum profit occurring at a specific strike price. This strategy is often used by experienced traders who believe that the underlying asset will remain relatively stable in price over a certain period of time.

So how does the butterfly strategy actually work? First, the trader will buy a call option with a lower strike price, sell two call options with a middle strike price, and finally, buy a call option with a higher strike price. The same process would be followed for a put option, but with the trader buying and selling put options instead. The goal of this strategy is to profit from the options contracts that are sold, while minimizing the cost of the options contracts that are bought.

While the butterfly strategy can be a profitable one, it is important to note that it does come with its fair share of risks. One of the main risks is that the underlying asset may not behave as expected, resulting in losses for the trader. Additionally, the profit potential of the strategy is limited, as it is designed to be most profitable at a specific strike price. Traders who choose to employ this strategy must carefully analyze market conditions and have a strong understanding of the options market to make informed decisions.

In conclusion, the butterfly options strategy is a popular choice among experienced traders who are looking to profit from stable markets. By understanding the mechanics of this strategy, traders can take advantage of potential profit opportunities while also managing their risk. However, it is important to remember that options trading involves inherent risk, and it is always recommended to do thorough research and seek professional advice before engaging in any options trading strategy.

The butterfly options strategy is a popular trading strategy used in the financial markets. It is an advanced strategy that involves buying and selling options contracts to profit from the small movements in the price of the underlying asset.

The strategy gets its name from the profit and loss diagram that resembles the shape of a butterfly. It involves buying one in-the-money option, selling two at-the-money options, and buying one out-of-the-money option. This combination of options allows traders to profit from a limited range of price movement of the underlying asset.

The butterfly options strategy can be used in both bullish and bearish market conditions. In a bullish scenario, traders would set up a bullish butterfly by buying an in-the-money call option, selling two at-the-money call options, and buying an out-of-the-money call option. This strategy profits when the price of the underlying asset remains within a specific range.

In a bearish scenario, traders would set up a bearish butterfly by buying an in-the-money put option, selling two at-the-money put options, and buying an out-of-the-money put option. This strategy also profits when the price of the underlying asset remains within a specific range.

The butterfly options strategy limits the potential for profit, but it also limits the risk. If the price of the underlying asset moves significantly outside the expected range, the strategy can result in a loss. However, if the price remains within the range, the strategy can result in a profit.

Traders need to carefully analyze the market conditions and determine the appropriate options to use in the butterfly strategy. They also need to closely monitor the price movements of the underlying asset to determine when to enter and exit the trade.

| Pros | Cons |

|---|---|

| Limited risk | Limited profit potential |

| Can be used in both bullish and bearish market conditions | Requires careful analysis and monitoring |

| Opportunity for profit from small price movements | Potential for loss if price moves significantly outside the expected range |

In conclusion, the butterfly options strategy is a popular trading strategy used by experienced traders. It allows traders to profit from a limited range of price movement in the underlying asset. However, it requires careful analysis, monitoring, and understanding of the market conditions to be successful.

Read Also: Discover the Win Rate of Forex Trading Robots and Improve Your Investment Strategy

The butterfly options strategy is a neutral options strategy that is commonly used by traders and investors to profit from small market movements. It involves the simultaneous purchase and sale of multiple options with different strike prices and expiration dates.

The strategy gets its name from the shape it creates on a graph, which resembles a butterfly. This graph represents the potential profit and loss at different prices of the underlying asset.

Read Also: Account Types for InstaForex: A Comprehensive Guide

In a butterfly options strategy, the trader buys a lower strike price option, sells two middle strike price options, and buys a higher strike price option. The options involved can be either call options or put options, depending on the trader’s outlook for the underlying asset.

The goal of the butterfly options strategy is to have the underlying asset’s price stay within a range between the two middle strike prices at expiration. This would result in a maximum profit for the trader.

If the price of the underlying asset is below the lower strike price or above the higher strike price at expiration, the strategy will result in a loss. However, the loss is limited to the initial cost of the options.

This strategy is often used when the trader expects the underlying asset to have low volatility and trade in a narrow range. The trader can profit from the decay of time value of the options, as well as from any small price movements within the range.

It’s important for traders to carefully consider the risks and potential rewards of the butterfly options strategy before implementing it. This includes understanding the potential loss if the price of the underlying asset moves outside of the expected range.

In conclusion, the butterfly options strategy is a versatile strategy that can be used in different market conditions. It allows traders to profit from small price movements and the decay of time value. However, it’s important for traders to understand the risks and potential rewards involved before using this strategy.

The butterfly options strategy is a neutral options strategy that involves the combination of multiple options contracts with different strike prices to generate profits from a limited range of price movements in the underlying asset.

The butterfly options strategy works by purchasing two options contracts with lower and higher strike prices, and simultaneously selling two options contracts with a middle strike price. This creates a profit zone between the lower and middle strike prices and the middle and higher strike prices.

The benefits of using the butterfly options strategy include limited risk, potential for high returns if the underlying asset price stays within the profit zone, and the ability to profit from low volatility in the market.

The risks of using the butterfly options strategy include potential losses if the underlying asset price moves outside the profit zone, limited profit potential if the price remains stagnant, and the impact of time decay on the options contracts.

The butterfly options strategy is suitable for traders who believe the underlying asset price will remain within a specific range and want to generate profits by capitalizing on that range. It is also suitable for traders who expect low volatility in the market.

The butterfly options strategy is a neutral options strategy that involves the purchase of both call and put options at the same strike price, while also selling two options at a higher and lower strike price. It is called a butterfly because the profit/loss graph on a options chain resembles the wings of a butterfly.

Trading Options on Plus500: Everything You Need to Know If you’re an investor or trader looking to expand your portfolio, you may be wondering if you …

Read ArticleUnderstanding the Difference between Level 2 and Level 3 Options Trading on Robinhood When it comes to options trading on Robinhood, there are two …

Read ArticleHow to Determine if a Stock Option is Qualified or Nonqualified Stock options can be a valuable form of compensation for employees. They allow …

Read ArticleUnderstanding the Meaning of a 25% Margin Requirement In the world of trading, margins play a crucial role in determining the financial viability of a …

Read ArticleChecking the Status of My Balikbayan Box Sending balikbayan boxes is a popular way for Filipinos overseas to send gifts and necessities to their loved …

Read ArticleResetting a Waveform in LabVIEW: Step-by-Step Guide LabVIEW is a powerful programming language commonly used for data acquisition and control systems. …

Read Article