Discover the Best Crypto for Trading Bots and Maximize Your Profits

What is the best cryptocurrency to use for a trading bot? Are you looking to maximize your profits in the world of cryptocurrency trading? One of the …

Read Article

Stock options are a widely used financial instrument that offer individuals the opportunity to profit from fluctuations in stock prices without actually owning the stock itself. While stock options can be complex and intimidating for beginners, understanding their pricing is essential for anyone interested in trading options.

Stock option pricing is determined by a variety of factors, including the current price of the underlying stock, the strike price of the option, the time until expiration, and the implied volatility of the stock. These variables interact in a complex way to determine the price of an option, which can be thought of as the premium that an option buyer pays to the option seller.

One key concept to understand is the difference between the intrinsic value and the extrinsic value of an option. The intrinsic value is the amount by which the option is in-the-money, while the extrinsic value represents the time value and volatility value of the option. As the option approaches expiration, the extrinsic value tends to decrease, while the intrinsic value remains constant.

Another important factor to consider is implied volatility, which is a measure of the market’s expectations for future stock price fluctuations. When implied volatility is high, option prices tend to be higher, as there is a greater likelihood of large price swings. Conversely, when implied volatility is low, option prices tend to be lower, as there is less expectation for significant stock price movements.

In conclusion, understanding stock option pricing is essential for anyone interested in trading options. By considering factors such as the current stock price, strike price, time until expiration, and implied volatility, investors can better assess the value of an option and make informed decisions. While options may seem complex at first, with practice and a solid understanding of the underlying principles, anyone can navigate the world of stock options and potentially profit from market fluctuations.

Stock options are financial derivatives that give the holder the right, but not the obligation, to buy or sell a specific amount of shares of a stock at a predetermined price, known as the strike price, within a certain time period. These options are typically traded on exchanges and can be used as a way to speculate on the future price movements of stocks.

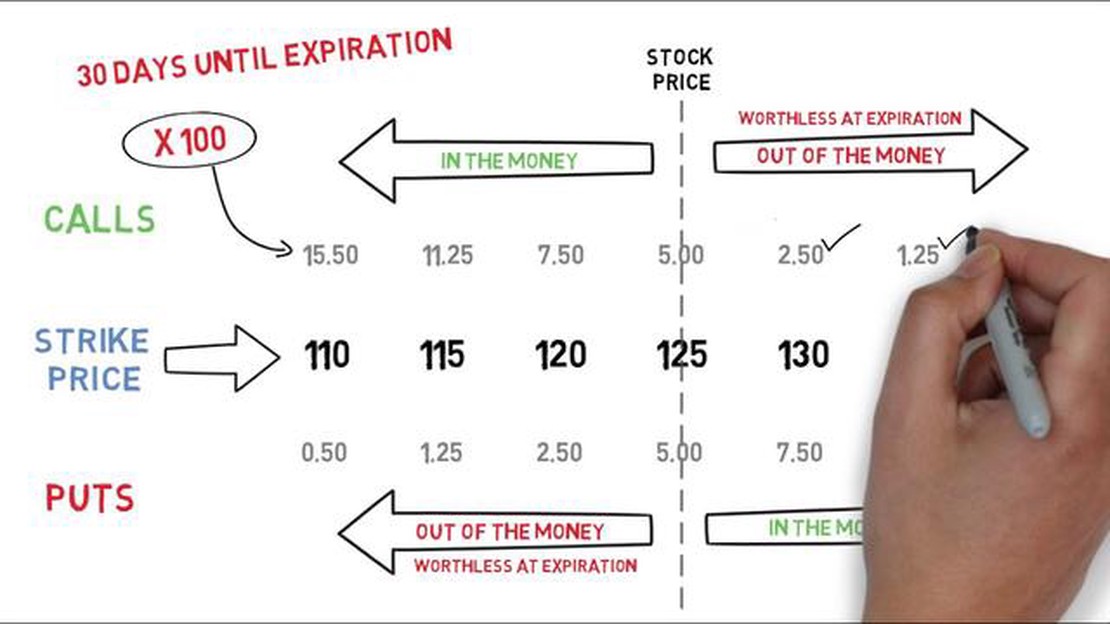

There are two main types of stock options: call options and put options. A call option gives the holder the right to buy the underlying stock at the strike price, while a put option gives the holder the right to sell the underlying stock at the strike price.

Stock options are often used as a form of compensation for employees, especially in the tech industry. They can provide employees with the opportunity to share in the growth of the company and incentivize them to work towards its success. Stock options are also used by investors and traders to hedge their positions or speculate on the price movements of stocks.

Read Also: Exploring a Basic Example of Arbitrage: Understanding the Concept and How It Works

When trading stock options, there are several important factors to consider, such as the expiration date, which is the last day on which the option can be exercised, and the premium, which is the price paid for the option. The premium is influenced by various factors, including the current price of the underlying stock, the strike price, the time remaining until expiration, and market volatility.

It is important to note that trading stock options involves risks, and it is recommended to have a good understanding of options trading strategies and the associated risks before engaging in this type of trading.

Several factors can affect the price of a stock option. Understanding these factors is essential for investors and traders to make informed trading decisions. Here are some key factors that influence stock option prices:

It is important to note that these factors are not independent and can interact with one another in complex ways. Option pricing models, such as the Black-Scholes model, take these factors into account to calculate the theoretical value of an option.

Read Also: What is the Best Monthly Dividend Stock? Top Picks for Consistent Income

By understanding the factors affecting stock option prices, investors and traders can analyze and make better-informed decisions when trading options.

Stock options are a type of financial derivative that gives the holder the right, but not the obligation, to buy or sell a specified number of shares of stock at a predetermined price, within a specified time period. They are often used as a form of compensation in the corporate world.

Stock options are priced based on several factors, including the current price of the underlying stock, the strike price, the time until expiration, the volatility of the stock, and the risk-free interest rate. These factors are used in various mathematical models, such as the Black-Scholes model, to determine the fair value of the option.

The strike price, also known as the exercise price, is the price at which the holder of a stock option can buy or sell the underlying stock. It is set at the time the option is granted and remains fixed for the duration of the option contract.

Volatility refers to the amount of uncertainty or risk associated with the price movement of a stock. Higher volatility generally leads to higher option prices, as there is a greater likelihood of large price swings in the underlying stock. Volatility is typically estimated using historical price data or implied volatility derived from option prices.

Time decay, also known as theta decay, is the erosion of the time value of an option as it approaches its expiration date. This means that the value of an option will decrease over time, even if the underlying stock price remains unchanged. Time decay accelerates as the option approaches expiration, which is why options with longer time horizons tend to be more expensive.

What is the best cryptocurrency to use for a trading bot? Are you looking to maximize your profits in the world of cryptocurrency trading? One of the …

Read ArticleIs Tokyo Forex Market Open Now? The Tokyo Forex Market, also known as the Tokyo Stock Exchange, is one of the largest and most influential financial …

Read ArticleCan you make money just trading spy? Trading the SPY, or the S&P 500 Index fund, has become increasingly popular among individual investors. With its …

Read ArticleHow do I become a FIFA referee? Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the foreign exchange …

Read ArticleUnderstanding the Vesting Schedule for Startup Founders When it comes to startup founders and equity, understanding the vesting schedule is crucial. …

Read ArticleCan you practice on forex? Forex trading, also known as foreign exchange trading, is a complex and fast-paced market. For those looking to enter the …

Read Article