Is Elliott Wave Trading Profitable? Pros and Cons of Using the Elliott Wave Theory

Is Elliott wave trading profitable? The Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, is a popular method used by traders to …

Read Article

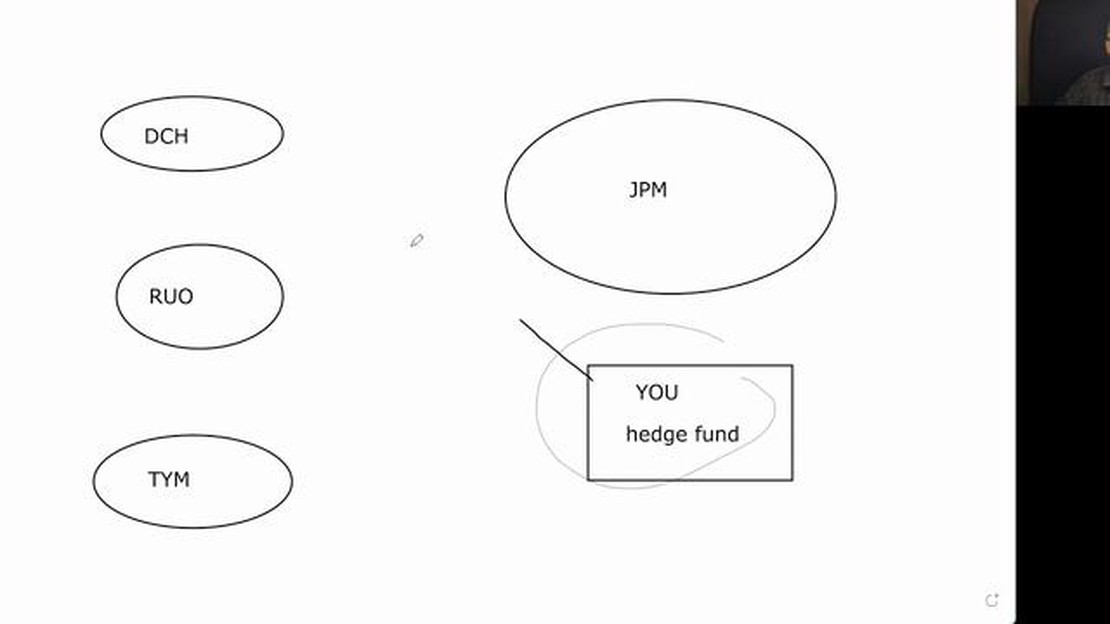

Prime brokerage risk is a term commonly used in the financial industry to describe the potential for losses associated with prime brokerage services. Prime brokerage services are offered by financial institutions to hedge funds, asset managers, and other institutional investors. These services include lending, clearing, and custody of assets, as well as providing access to capital markets.

The impact of prime brokerage risk on financial markets can be significant. When a prime broker encounters financial difficulties or fails, it can create a domino effect, where clients face difficulties in accessing their assets and liquidity. This can lead to market disruptions, as investors scramble to find alternative providers and adjust their investment strategies.

Prime brokerage risk can arise from various factors, including counterparty risk, operational risk, market risk, and legal risk. Counterparty risk is the risk that the prime broker may default on its obligations. Operational risk refers to the risk of errors, fraud, or system failures in the prime broker’s operations. Market risk is the risk of losses due to adverse market movements, such as volatility or liquidity shocks. Legal risk arises from legal and regulatory uncertainties.

It is crucial for market participants to understand prime brokerage risk and its potential impact on financial markets.

Regulatory authorities have recognized the importance of managing prime brokerage risk to maintain financial stability. They have implemented regulations to enhance risk management practices and increase transparency in prime brokerage activities. Market participants are also encouraged to conduct due diligence when selecting prime brokers and to diversify their prime brokerage relationships to mitigate the concentration risk.

By understanding prime brokerage risk and implementing appropriate risk management strategies, market participants can better navigate the challenges and potential disruptions in the financial markets, ensuring the stability and resilience of the overall financial system.

Prime brokerage risk refers to the potential danger that prime brokers, which are financial institutions that provide a range of services to hedge funds and other institutional clients, may face. These risks have the potential to impact the stability and functioning of financial markets.

One of the primary risks associated with prime brokerage is counterparty risk. This risk arises from the fact that prime brokers often engage in multiple transactions with their clients, which can expose them to potential losses if a client defaults on their obligations. The failure of a major hedge fund or institutional client could have far-reaching implications, as it could lead to a significant loss of capital for the prime broker and potentially trigger a chain reaction in the financial system.

Read Also: Understanding the Distinction: Slump vs. Recession

Another important risk is operational risk. Prime brokers are responsible for executing and settling trades on behalf of their clients, as well as providing a range of other services, such as custody and financing. If there are operational failures or errors in these processes, it can lead to financial losses for both the prime broker and their clients. These operational risks can also have a systemic impact if they are widespread in the industry, as they can erode confidence in the stability and reliability of prime brokerage services.

Market risk is another factor that can impact prime brokerage. Prime brokers are constantly exposed to market fluctuations and volatility as they provide financing and leverage to their clients. If there are sharp and sudden movements in markets, it can lead to significant losses for prime brokers, especially if their risk management practices fail to adequately protect them. These losses can then have a cascading effect on the financial system, as prime brokers may be forced to unwind positions and deleverage, leading to further market disruption.

Overall, prime brokerage risk has the potential to impact the stability and functioning of financial markets. The interconnectedness of prime brokers with hedge funds and institutional clients means that their failures or losses can have far-reaching implications. It is therefore crucial for financial regulators and market participants to closely monitor and manage these risks to safeguard the stability and integrity of the financial system.

Prime brokerage risk refers to the potential financial risks faced by prime brokers and their clients in the process of providing and utilizing prime brokerage services. With prime brokerage services, a prime broker acts as an intermediary between institutional investors, such as hedge funds or mutual funds, and various financial markets.

One of the key risks associated with prime brokerage is counterparty risk. Counterparty risk arises when one party to a transaction, such as a hedge fund, fails to fulfill its contractual obligations to another party, such as a prime broker. This can happen in cases of default or insolvency, and it can have significant implications for both the prime broker and its clients.

Another important aspect of prime brokerage risk is market risk. Prime brokers typically provide their clients with access to a wide range of financial markets and investment products. This exposes both the prime broker and its clients to the risks associated with those markets, such as changes in interest rates, currency exchange rates, or stock prices. It is crucial for prime brokers to carefully manage and monitor these risks to avoid significant losses.

Read Also: Understanding the Method of Sysmex XN 1000: Key Features and Benefits

Operational risk is another type of risk that can impact prime brokerage. Operational risk refers to the risk of loss resulting from inadequate or failed internal processes, people, and systems, or from external events. This can include errors in trade processing, technology failures, or even fraudulent activities. Prime brokers need to implement robust risk management practices and controls to mitigate these operational risks.

Lastly, liquidity risk is an important consideration in prime brokerage. Liquidity risk refers to the risk of not being able to quickly buy or sell assets at an acceptable price. As prime brokers often provide financing to their clients, they may face liquidity risks if they are unable to access sufficient funding in the market or if their clients are unable to repay their loans. Managing liquidity risk is crucial to ensure the smooth functioning of prime brokerage services.

In conclusion, prime brokerage risk encompasses various types of risks, including counterparty risk, market risk, operational risk, and liquidity risk. Understanding and managing these risks is essential for both prime brokers and their clients to ensure the stability and integrity of financial markets.

Prime brokerage risk refers to the potential losses that can arise from providing services to hedge funds and other institutional clients, such as lending securities, financing trades, and providing custodial services.

Prime brokerage risk can have a significant impact on financial markets. If a prime broker faces substantial losses or defaults, it can result in a disruption to the trading activities of its clients and a loss of confidence in the broader financial system.

Examples of prime brokerage risk include counterparty risk, funding risk, concentration risk, and operational risk. Counterparty risk arises from the potential default of a client or another counterparty. Funding risk refers to the risk of being unable to secure sufficient funding for lending or financing activities. Concentration risk arises from having a large exposure to one or a few clients or sectors. Operational risk includes risks related to internal processes and systems.

Prime brokers take several steps to manage risk, including conducting thorough due diligence on clients, diversifying their portfolios, setting strict margin requirements, stress testing their exposure, and implementing robust risk management systems and controls.

Is Elliott wave trading profitable? The Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, is a popular method used by traders to …

Read ArticleUnderstanding the implications of a high RSI When it comes to analyzing stocks, one of the key indicators that investors use is the Relative Strength …

Read ArticleIs eToro the same as Etrade? When it comes to online trading platforms, there are several options available in the market. Two popular choices among …

Read ArticleLearn how to do fundamental analysis on forex Forex, also known as foreign exchange, is one of the largest and most liquid markets in the world. …

Read ArticleIs Botswana’s Exchange Rate Fixed or Flexible? Botswana, a landlocked country in Southern Africa, has often been heralded as one of the success …

Read ArticleTrading Options on Questrade in Canada: Everything You Need to Know If you’re a Canadian investor looking to trade options, you may be wondering if …

Read Article