SPX Options Commission Rates at Interactive Brokers: Everything You Need to Know

How much does Interactive Brokers charge for SPX options? Interactive Brokers is a popular online brokerage firm known for its low commission rates …

Read Article

Options on stock indices and currency are powerful financial instruments that allow investors and traders to profit from movements in the broader market. Whether you’re an individual investor or a professional trader, understanding how these options work is crucial to success in the world of finance.

Stock index options give investors the right, but not the obligation, to buy or sell a basket of stocks that make up a specific index, such as the S&P 500 or the Dow Jones Industrial Average. These options are often used as a way to hedge or speculate on the overall direction of the stock market. Understanding the factors that affect the value of stock index options, such as interest rates, dividend payments, and market volatility, is essential for making informed trading decisions.

Currency options, on the other hand, give investors the right, but not the obligation, to buy or sell a specific amount of a foreign currency at a predetermined exchange rate. These options are frequently used by multinational corporations to manage their foreign exchange risk or by speculators looking to profit from fluctuations in currency exchange rates. Understanding the unique characteristics of currency options, including the impact of interest rates, economic indicators, and geopolitical events, is crucial for navigating the complex world of global finance.

Whether you’re looking to diversify your investment portfolio or want to take advantage of opportunities in the global currency markets, understanding options on stock indices and currency is essential. This comprehensive guide will explain the basics of options, including how they are priced, the different types of options available, and the strategies used by professional traders. By the end of this guide, you’ll have the knowledge and confidence to incorporate options on stock indices and currency into your investment or trading strategy.

In the world of finance, options on stock indices offer investors a unique way to gain exposure to the broader stock market. A stock index represents a basket of stocks that are used to track the overall performance of a specific market or sector. Options on stock indices allow investors to trade the performance of an entire index, rather than just one individual stock.

Options on stock indices work in a similar way to options on individual stocks. They give the holder the right, but not the obligation, to buy or sell the underlying index at a specified price on or before a certain date. However, instead of the underlying asset being a single stock, it is an entire index.

There are two main types of options on stock indices: call options and put options. A call option gives the holder the right to buy the underlying index at a specified price, while a put option gives the holder the right to sell the underlying index at a specified price.

When trading options on stock indices, investors can use various strategies to take advantage of different market conditions. For example, an investor who is bullish on the stock market may choose to buy call options on a stock index, in order to profit from an increase in the index’s value. On the other hand, an investor who is bearish on the stock market may choose to buy put options on a stock index, in order to profit from a decrease in the index’s value.

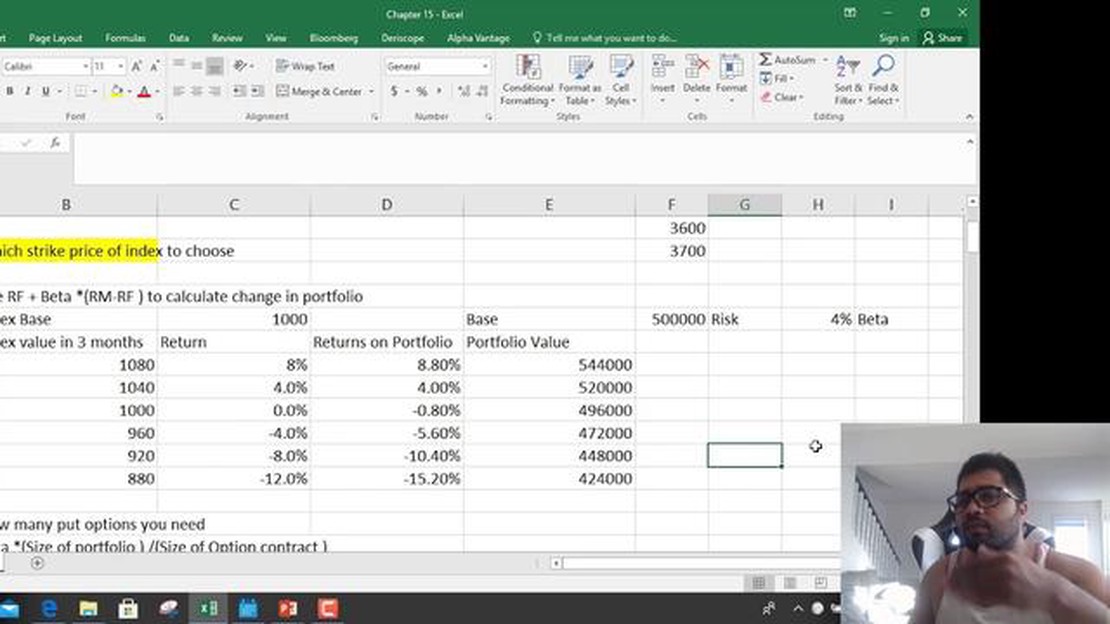

Options on stock indices can be used for hedging purposes as well. For example, a fund manager who holds a portfolio of stocks may choose to buy put options on a stock index as a form of insurance against a market downturn. If the stock market declines, the put options will increase in value, offsetting some of the losses on the portfolio.

Overall, options on stock indices offer investors a flexible and efficient way to gain exposure to the broader stock market. They allow investors to tailor their investment strategies to suit their individual needs and risk tolerance. However, it is important for investors to understand the risks associated with options trading and to carefully consider their investment objectives and risk appetite before trading options on stock indices.

Options on stock indices are financial derivatives that give the buyer the right, but not the obligation, to buy or sell a specific stock index at a set price within a designated time period. Stock indices are a representation of the overall performance of a specific group of stocks, such as the S&P 500 or the Dow Jones Industrial Average.

Read Also: Is MLM Good or Bad? Exploring the Pros and Cons of Multi-Level Marketing

Options on stock indices provide investors with the opportunity to speculate on or protect their portfolios against movements in the broader market. They allow traders to gain exposure to a diversified portfolio of stocks without having to buy each individual stock. Additionally, options on stock indices can be used as a hedging tool to manage risk and mitigate potential losses.

There are two main types of options on stock indices: call options and put options. A call option gives the buyer the right to buy the underlying stock index at a specified price, known as the strike price, before the option’s expiration date. On the other hand, a put option gives the buyer the right to sell the underlying stock index at the strike price before the option expires.

Read Also: Easy Steps to Purchase US Dollars in Mumbai

Options on stock indices are typically cash-settled, meaning that no physical delivery of the underlying assets occurs upon exercise or expiration. Instead, the options are settled in cash based on the difference between the strike price and the value of the underlying index at expiration.

When trading options on stock indices, investors should carefully consider factors such as the strike price, expiration date, and volatility of the underlying index. These factors can greatly impact the value and potential profitability of the options. It is also important to understand the risks associated with options trading, including the potential for loss of the entire investment.

In conclusion, options on stock indices are a versatile financial instrument that allow investors to gain exposure to broader market movements and manage risk in their portfolios. They provide flexibility, diversification, and potential profit opportunities, but also carry inherent risks. It is important for investors to thoroughly educate themselves on options trading and consult with a financial professional before engaging in these types of transactions.

Options on stock indices and currency are financial derivatives that give the holder the right, but not the obligation, to buy or sell a specific stock index or currency at a predetermined price within a specified period of time.

Options on stock indices and currency work by providing traders with the opportunity to speculate on the future price movements of stock indices and currency. The buyer of the option pays a premium to the seller and, in return, receives the right to buy or sell the underlying stock index or currency at a predetermined price on or before the expiration date of the option.

There are several benefits to trading options on stock indices and currency. First, options provide leverage, allowing traders to control a large amount of underlying assets with a relatively small investment. Second, options offer the potential for significant returns, as they allow traders to profit from both upward and downward price movements. Third, options can be used as a hedging tool to protect against adverse price movements in the stock market or currency exchange rates.

Trading options on stock indices and currency carries certain risks. The buyer of the option risks losing the premium paid if the price of the underlying asset does not move in the anticipated direction. Additionally, options have a limited lifespan and can lose value as the expiration date approaches. There are also risks associated with market volatility and changes in interest rates.

There are several strategies that traders can employ when trading options on stock indices and currency. Some common strategies include buying call options to benefit from upward price movements, buying put options to profit from downward price movements, and using options spreads to limit risk and maximize potential returns. It is important for traders to carefully analyze market conditions and have a clear understanding of their risk tolerance before implementing any trading strategy.

Stock indices options are financial derivatives that give investors the right to buy or sell a specific stock index at a specific price within a specific timeframe. Currency options, on the other hand, are financial derivatives that give investors the right to buy or sell a specific currency at a specific price within a specific timeframe.

How much does Interactive Brokers charge for SPX options? Interactive Brokers is a popular online brokerage firm known for its low commission rates …

Read ArticleWill SDC Stock Recover? With the recent downturn in the stock market, investors of SDC stock have been left wondering if their investment will ever …

Read ArticleUnderstanding the Forex Bonus: What You Need to Know If you’re interested in trading on the foreign exchange market, you’ve likely come across the …

Read ArticleThe Evolution of the World Trade Organization The World Trade Organization (WTO) is one of the key international organizations that regulate global …

Read ArticleUnderstanding Apple’s 200-Day Moving Average When it comes to analyzing the stock market, there are numerous indicators and tools that investors use …

Read ArticleWhat is employee stock option policy accounting? Employee stock options (ESOs) are an increasingly popular form of compensation used by many companies …

Read Article