Discovering Dream Fox Services Limited: Your Ultimate Guide

Discovering Dream Fox Services Limited: Everything You Need to Know Welcome to Dream Fox Services Limited, the premier provider of top-quality dream …

Read Article

Options trading can be a complex and challenging endeavor, requiring a deep understanding of various factors and metrics. One such metric that plays a crucial role in options trading is Omega. Omega, also known as option sensitivity to price changes, is a measurement of the relationship between the movement of an option’s price and the movement of the underlying asset’s price.

The concept of Omega is based on the idea that different options have different levels of sensitivity to price changes in the underlying asset. This sensitivity can have a significant impact on an option’s profitability and risk. Options with a high Omega are more sensitive to price changes and therefore tend to have higher potential profitability but also higher risk.

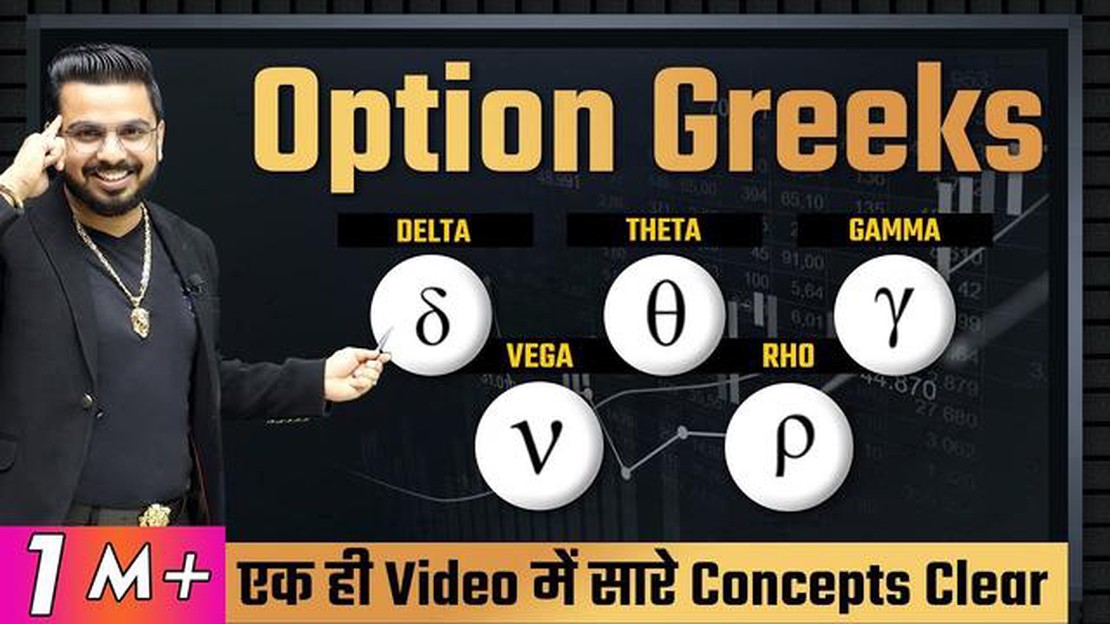

Omega is a useful metric for options traders as it helps them understand the potential risks and rewards of a particular trade. By analyzing the Omega of different options, traders can make more informed decisions about which options to trade and how to manage their positions. It can also be used in combination with other metrics, such as Delta and Gamma, to create a more comprehensive understanding of an option’s behavior.

While Omega is an important metric, it should not be the sole deciding factor in options trading. Traders should also consider other factors, such as market conditions, volatility, and their own risk tolerance, when making trading decisions. By taking a holistic approach and considering multiple metrics, options traders can increase their chances of making successful trades and managing their risk effectively.

Understanding Omega in options trading is essential for anyone looking to navigate the complex world of options. By analyzing the sensitivity of options to price changes, traders can make more informed decisions and manage their risk effectively. However, it is important to remember that Omega is just one piece of the puzzle and should be used in combination with other metrics and factors when making trading decisions.

Omega, also known as the option’s elasticity, is a measure of how an option’s price changes in relation to a change in the price of the underlying asset. It is an important concept in options trading as it helps traders assess the potential risks and rewards associated with a particular option.

The omega value can be positive, negative, or equal to zero. A positive omega indicates that the option’s price is expected to increase as the price of the underlying asset increases. On the other hand, a negative omega suggests that the option’s price is expected to decrease as the price of the underlying asset increases. A zero omega implies that the option’s price is not affected by changes in the price of the underlying asset.

Read Also: Are stock options considered assets? Find out here

Understanding omega is crucial for options traders as it provides insights into the potential profitability and risk of an option position. A high positive omega indicates that an option has a higher potential for profit, but also a higher potential for loss if the market moves against the position. Conversely, a negative omega suggests that an option has a higher potential for loss, but also a higher potential for profit if the market moves in favor of the position.

Traders can use the omega value to determine the appropriate strategy for a given market outlook. For example, if a trader is bullish on a stock and expects its price to increase, they may consider buying call options with a high positive omega. Conversely, if a trader is bearish on a stock and expects its price to decrease, they may consider buying put options with a high negative omega.

It is important to note that omega is not a standalone measure of an option’s potential profitability and risk. Other factors, such as delta, gamma, theta, and vega, also play a significant role in options trading. Therefore, traders should consider multiple factors and conduct thorough analysis before making any options trading decisions.

In conclusion, omega is a measure of how an option’s price changes in relation to the price of the underlying asset. It helps traders assess the potential risks and rewards associated with a particular option and determine the appropriate trading strategy. However, omega should be used in conjunction with other measures to make well-informed options trading decisions.

In options trading, omega, also known as the option sensitivity to price changes, is a measure of an option’s price movement in relation to changes in the underlying asset’s price. It is a dynamic measure that takes into account various factors such as time to expiration, volatility, and the option’s strike price.

Omega measures the percentage change in an option’s price for a 1% change in the price of the underlying asset. It is similar to delta, which measures the price change of an option for a $1 change in the underlying asset’s price, but omega takes into account the percentage change in the underlying asset’s price.

A higher omega value indicates that the option’s price is more sensitive to changes in the underlying asset’s price. This means that if the underlying asset’s price moves by 1%, the option’s price will likely move by a larger percentage. On the other hand, a lower omega value indicates less sensitivity to price changes.

Traders use omega to evaluate the risk and potential reward of an option. Options with higher omega values are considered more risky but also have the potential for higher returns. Conversely, options with lower omega values are considered less risky but also have lower profit potential.

Read Also: Understanding the Importance of Strike Price for Employee Stock Options

It’s important to note that omega is not a constant value and can change over time as market conditions and other factors change. Therefore, it’s crucial for options traders to regularly monitor and re-evaluate the omega of their options positions in order to make informed trading decisions.

Omega, also known as Option Elasticity, is a measure of the sensitivity of an option’s price to changes in the price of the underlying asset. It helps traders understand how much an option’s price will change for a given change in the price of the underlying asset.

Omega is calculated by taking the first derivative of the option’s price with respect to the price of the underlying asset. It represents the percentage change in the option’s price for a 1% change in the price of the underlying asset.

A high Omega value indicates that the option’s price is highly sensitive to changes in the price of the underlying asset. This means that a small change in the underlying asset’s price can result in a significant change in the option’s price.

Omega can be used by options traders to assess the risk of their positions and make informed trading decisions. Traders can use Omega to gauge the potential profitability of an option trade and determine the appropriate amount of leverage to use. A high Omega value may indicate a higher risk, while a low Omega value may suggest a lower risk.

Discovering Dream Fox Services Limited: Everything You Need to Know Welcome to Dream Fox Services Limited, the premier provider of top-quality dream …

Read ArticleWhat is the magic number in forex robot? In the world of forex trading, there is a secret to success that many traders want to know. It is called the …

Read ArticleBenefits of Axis Bank Forex Card When it comes to international travel, having a reliable and convenient payment method is essential. That’s where the …

Read ArticleIs it possible to buy stock options? Investing in the stock market can be an exciting and potentially lucrative way to grow your wealth. However, …

Read ArticleUnderstanding Forex Cycles: A Comprehensive Guide The foreign exchange market, also known as forex, is a decentralized global market where currencies …

Read ArticleIs Trading at Night Beneficial for Traders? Trading stocks at night has become increasingly popular in recent years, thanks to advancements in …

Read Article