PHP to AED Exchange Rate in Dubai: Find Out the Latest Conversion Rate

PHP to AED Exchange Rate in Dubai Are you planning a trip to Dubai and wondering about the current exchange rate for PHP to AED? Well, look no …

Read Article

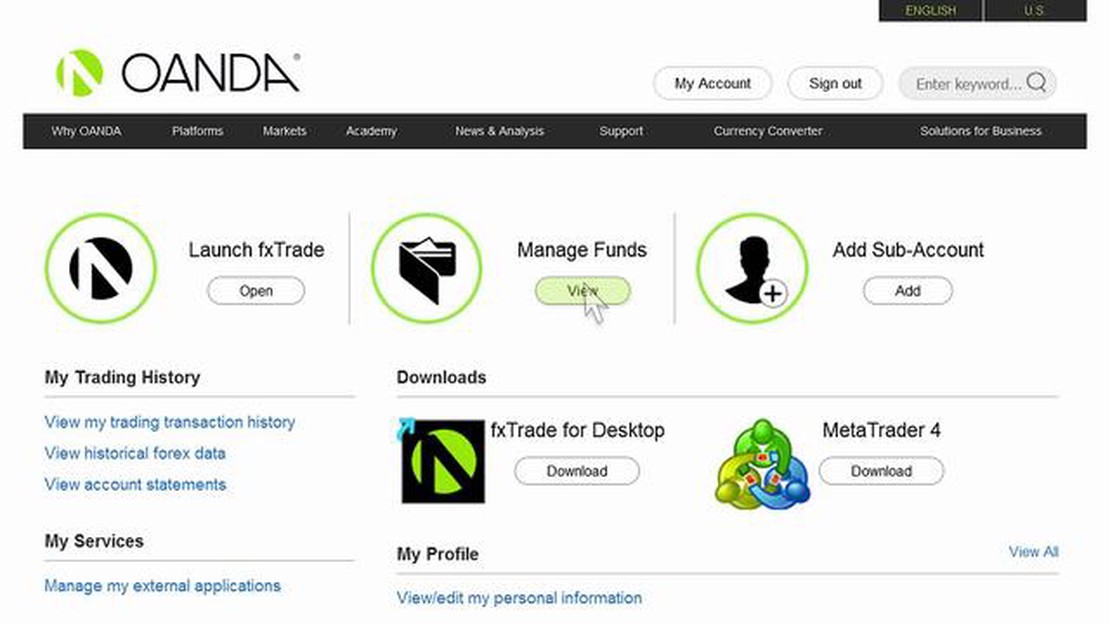

When it comes to trading in the forex market, leverage is a crucial factor that can greatly impact your trading strategy and potential profits. One of the leading forex brokers, OANDA, offers leverage to its traders, allowing them to amplify their positions and gain exposure to larger trade sizes than their initial investment.

In this comprehensive guide, we will dive deep into the concept of leverage, how it works, and why it is important to understand it before engaging in forex trading.

Firstly, leverage is essentially a loan provided by the broker to the trader, multiplying the trader’s buying power. For example, with a leverage ratio of 1:50, a trader can control a trade worth $50 for every $1 of their own capital. This means that even with a small deposit, traders have the potential to make significant profits. However, it’s important to note that leverage can also amplify losses, so proper risk management is crucial.

Secondly, understanding how leverage affects margin and margin calls is vital in forex trading. Margin is the percentage of the total trade value that a trader is required to have in their account as collateral. A margin call occurs when a trader’s account value falls below the required margin level, resulting in the need to either deposit additional funds or close some positions. Being aware of margin requirements and the potential for margin calls is crucial to avoid unwanted liquidations and account losses.

Lastly, it’s important to note that leverage availability, requirements, and ratios can vary between brokers. OANDA offers flexible leverage options, allowing traders to choose a leverage ratio that suits their risk appetite and trading strategy. Moreover, varying leverage options can be beneficial for traders with different levels of experience and account sizes.

In conclusion, understanding and utilizing leverage effectively can significantly impact your trading success. By comprehending the mechanics of leverage, the associated risks, and the broker’s specific leverage offerings, traders can make informed decisions and optimize their trading strategies in the dynamic forex market.

Leverage is a financial tool that allows traders to amplify their trading positions and potentially increase their profits. It refers to the use of borrowed capital, such as a margin account, to increase the potential return on investment. With leverage, traders can control larger amounts of currency than their own capital would allow, effectively magnifying both potential gains and losses.

For example, if a trader has a leverage ratio of 1:100, it means that for every dollar of their own capital, they can control $100 in the forex market. This gives them the ability to place larger trades and potentially generate higher profits. However, it also means that any losses will be magnified by the same ratio, which can result in significant losses.

It is crucial to understand that leverage is a double-edged sword. While it can amplify potential gains, it also comes with increased risk. Traders need to carefully manage their leverage and only use it if they fully understand the potential consequences. It is important to consider factors such as one’s risk tolerance and trading strategy before deciding on an appropriate level of leverage.

Furthermore, different brokers may offer varying leverage ratios, with some allowing traders to choose their desired level of leverage and others setting a default ratio. It is essential to research and compare different brokers and their leverage options to find the one that aligns with individual trading needs and preferences.

In conclusion, leverage can be a powerful tool for traders to enhance their potential profitability and market exposure. However, it should be used with caution and responsibility, as excessive leverage can lead to substantial losses. A thorough understanding of leverage and its implications is crucial for successful trading in the forex market.

When it comes to trading forex, leverage plays a crucial role in determining your potential profits and losses. OANDA offers leverage options that allow traders to amplify their trading positions, but it is essential to understand how leverage works and its implications.

Leverage is essentially a loan provided by your broker that allows you to control a larger position in the market with a smaller investment. OANDA provides flexible leverage options, ranging from 50:1 to 500:1, depending on the regulatory requirements of your region.

Higher leverage ratios offer the potential for higher returns, but they also come with increased risk. For example, if you have a leverage ratio of 100:1, you can control a position that is 100 times larger than your account balance. This means that a 1% price movement in the market could result in a 100% gain or loss of your investment.

Read Also: Is pyramid trading legal: a guide to understanding the legality of pyramid schemes

It is crucial to consider your risk tolerance and trading strategy when selecting a leverage ratio. While higher leverage can amplify your gains, it can also lead to substantial losses if the market moves against you. It is recommended to start with lower leverage ratios and gradually increase them as you gain experience and confidence in your trading abilities.

OANDA also offers margin calls to help manage leverage and reduce the risk of substantial losses. A margin call occurs when your account balance falls below the required margin level for your open positions, and it prompts you to either deposit more funds or close some positions to bring your account balance above the margin requirement.

Read Also: Learn about the software used by HSBC

In conclusion, understanding leverage and its implications are crucial for successful forex trading. OANDA provides flexible leverage options, but it is essential to consider your risk tolerance and trading strategy when selecting a leverage ratio. Utilizing margin calls can help manage leverage and reduce the risk of substantial losses. Make sure to thoroughly educate yourself on the topic before engaging in leveraged trading.

When trading Forex, leverage can significantly amplify both profits and losses. OANDA offers various leverage ratios depending on the account type, allowing traders to choose the level of leverage that suits their trading strategy and risk tolerance.

For OANDA’s standard accounts, leverage ratios can range from 50:1 to 100:1. This means that for every dollar in a trader’s account, they can control $50 to $100 worth of currency in the market. However, it’s important to note that higher leverage increases both potential gains and losses, so traders should carefully consider their risk management strategies.

OANDA’s margin requirements are also tied to leverage ratios. Margin is the amount of money that a trader needs to have in their account in order to open and maintain a position. Higher leverage ratios require lower margin amounts, while lower leverage ratios have higher margin requirements. Margin requirements are typically expressed as a percentage, with 2% being a common requirement for many currency pairs.

During volatile market conditions or when trading exotic currency pairs, margin requirements can increase. OANDA has a system in place that automatically adjusts margin requirements to mitigate the risk of potential losses. This mechanism, known as margin call, helps protect both traders and the company by ensuring that traders have sufficient funds to cover their positions.

Traders should always be aware of the leverage ratios and margin requirements associated with their OANDA accounts. Understanding these factors is essential for effective risk management and successful trading.

Leverage is a tool that allows traders to control bigger positions in the market with a smaller investment. It is provided by brokers and increases potential profit as well as potential loss. For example, with a 1:100 leverage, a trader can control a position of $100,000 with a margin of $1,000.

OANDA offers flexible leverage options to its clients. They provide a default leverage ratio depending on the regulatory requirements of the client’s country. In most cases, clients can choose their desired leverage up to a certain limit. The leverage limit depends on the type of account and the regulations imposed by the country’s financial authority.

The advantages of using leverage include the ability to control larger positions in the market, which can result in higher potential profits. However, leverage also amplifies potential losses, and traders may face the risk of losing more than their initial investment if the market moves against them. It is important to use leverage cautiously and with proper risk management strategies in place.

Using high leverage increases the risk of substantial losses. If a trade goes against a trader’s position, the losses will be magnified. Traders need to be cautious and use appropriate risk management techniques, such as setting stop-loss orders and not over-leveraging their positions, to mitigate the risks associated with high leverage.

Yes, OANDA allows clients to choose their preferred leverage level, up to a certain limit imposed by the regulatory requirements. However, it is important to consider the risks involved and choose a leverage level that aligns with your trading strategy and risk tolerance.

Understanding leverage in Forex trading is crucial because it allows traders to amplify their potential profits by borrowing money from their broker. However, it also increases the risk of losses, as traders will be responsible for repaying the borrowed funds even if their trades go wrong.

Leverage in Forex trading essentially allows traders to control larger positions in the market with a smaller amount of capital. For example, with a leverage ratio of 1:100, a trader can control a position worth $10,000 with just $100 of their own capital. The broker provides the additional funds needed to open the position, and the trader is responsible for any potential losses.

PHP to AED Exchange Rate in Dubai Are you planning a trip to Dubai and wondering about the current exchange rate for PHP to AED? Well, look no …

Read ArticleThe Significance of Trading in Ancient Greece Ancient Greece was a flourishing civilization that made significant contributions to art, philosophy, …

Read ArticleIs it better to exchange money in Amsterdam? When planning a trip to Amsterdam, one of the things that travelers often consider is whether it is …

Read ArticleCommodities Traded in Forex Forex, or foreign exchange, is a decentralized global marketplace where individuals and institutions can trade currencies. …

Read ArticleWhy is Form A2 required? Form A2 is an essential document that is required for any foreign currency transaction in India. It is a mandatory form that …

Read ArticleIs cTrader better than MetaTrader? When it comes to trading in the foreign exchange market, having the right platform is crucial. Two of the most …

Read Article