Is IC Markets a Legit Trading Platform? Unveiling the Truth

Discover the Truth: Is IC Markets a Real Broker? With the rapid growth of online trading, it’s important to ensure that the platform you choose is …

Read Article

For traders in the foreign exchange market, MetaTrader 4 (MT4) is a widely used trading platform. It offers a variety of features and tools to make the trading experience more efficient and convenient. One important aspect of trading on MT4 is understanding and managing the commission structure.

In MT4, brokers often charge a commission on trades made by traders. This commission is usually a small percentage of the trade volume and is deducted from the trader’s account. Understanding how this commission works is crucial for traders, as it can greatly affect their overall profitability.

The commission charged by brokers on MT4 trades can vary depending on several factors, such as the type of account, trading volume, and the currency pair being traded. Traders should carefully review their broker’s commission structure and consider how it will impact their trading strategy.

Why does the commission matter? The commission directly affects the cost of trading. Higher commission rates mean higher trading costs, which can eat into a trader’s profits. On the other hand, a lower commission can result in lower trading costs and potentially higher profits. Therefore, choosing a broker with a competitive commission structure is essential for maximizing profitability.

MT4 Commission is a fee that brokers charge traders for each trade executed on the MetaTrader 4 platform. It is an integral part of trading on MT4 and plays a crucial role in determining the overall cost of trading for traders.

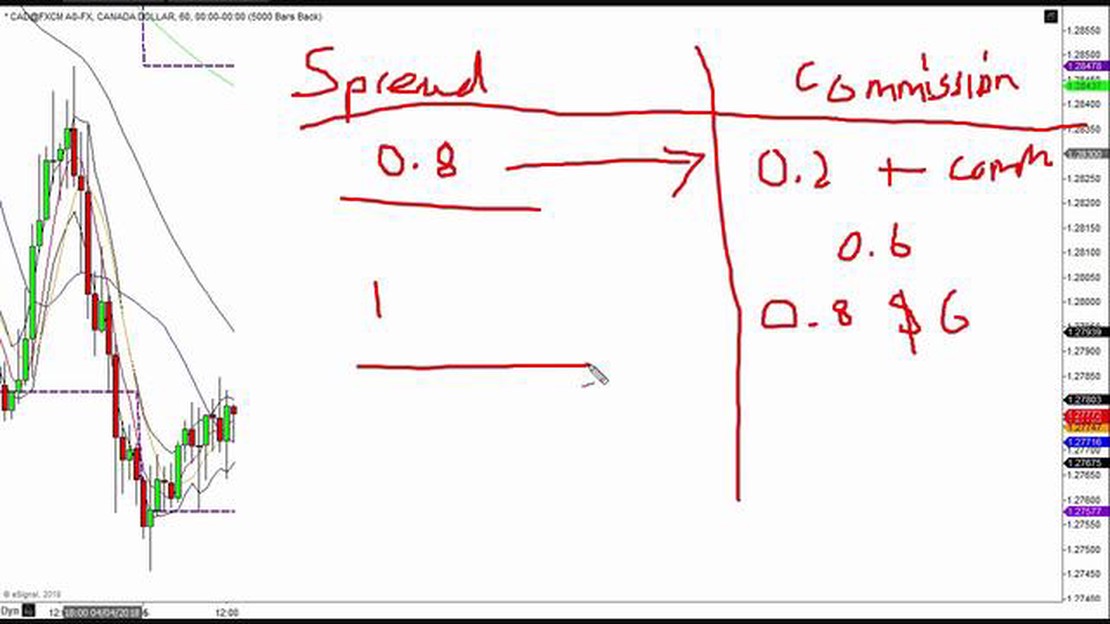

MT4 Commission typically consists of two components: the markup spread and the fixed commission. The markup spread is the difference between the bid and ask price and is usually variable, depending on market conditions. The fixed commission is a set fee that is charged per lot traded and remains constant regardless of market conditions.

Traders need to understand the MT4 Commission structure and how it affects their trading performance. While low spreads may seem attractive, it is essential to consider the commission rate as well. A broker may offer tight spreads but charge a higher commission, ultimately resulting in higher overall trading costs for the trader.

By comparing different brokers’ commission rates, traders can determine which one offers the most competitive rates for their trading needs. It is crucial to strike a balance between low spreads and reasonable commission fees to optimize trading costs and maximize profitability.

MT4 Commission plays a significant role in the broker’s revenue model. Brokers use commission fees to cover their operational costs and generate income. As such, they may offer varying commission rates based on the type of account or trading volume. Traders must understand the fee structure and factor it into their trading strategy and overall profitability.

In conclusion, MT4 Commission is a necessary cost for traders using the MetaTrader 4 platform. Understanding how it works and comparing commission rates among different brokers is crucial for optimizing trading costs and profitability. By considering both the variable markup spread and fixed commission fee, traders can make informed decisions regarding their trading strategy and choice of broker.

In the world of trading, understanding the concept of MT4 commission is crucial for both traders and brokers. MT4 commission refers to the fees charged by brokers for executing trades on the MetaTrader 4 platform. It is usually calculated as a percentage of the trade’s value or based on a fixed rate per lot.

One of the key implications of MT4 commission is its impact on a trader’s profitability. Since this commission is deducted from the trader’s profits, it directly affects the amount of money they can make from their trades. Understanding the commission structure and its potential impact on trading results is essential for traders to accurately assess the profitability of their trading strategies.

Moreover, the concept of MT4 commission can influence a trader’s choice of broker. Different brokers have different commission structures, and some may even offer commission-free trading. Traders need to evaluate the commission rates and associated costs before deciding on a broker, as this can significantly impact their overall trading costs and potential profitability.

For brokers, understanding the concept of MT4 commission is vital for effectively managing their business. Commission income is a significant revenue stream for brokers, and they need to carefully analyze and set their commission rates to ensure both profitability and competitiveness in the market. Additionally, brokers need to consider how their commission structure aligns with their target market and client base.

Read Also: Understanding the Average Bid-Ask Spread: What You Need to Know

Overall, understanding the concept of MT4 commission and its implications is essential for both traders and brokers. Traders need to consider the commission structure when evaluating the profitability of their trading strategies and choosing a broker. Brokers need to carefully set their commission rates to ensure profitability and meet the needs of their target market. By understanding and accounting for MT4 commission, traders and brokers can make informed decisions and maximize their trading success.

MT4 Commission refers to the fees charged by brokers for using the MetaTrader 4 platform. It is an important aspect to consider when trading as it directly affects your overall profitability. Understanding how MT4 commission works is essential for every trader.

MT4 commission can be calculated in different ways, depending on the broker’s pricing model. The two common types of commission structures used by brokers are:

1. Spread Mark-up: In this model, brokers add a fixed mark-up to the spread. The spread is the difference between the bid and ask price of a currency pair. The mark-up represents the commission charged by the broker. For example, if the spread on EUR/USD is 1 pip and the mark-up is 0.5 pip, the total commission would be 1.5 pips.

Read Also: Understanding Exchange Traded Options: A Comprehensive Guide

2. Per Lot Commission: In this model, brokers charge a fixed commission per lot traded. A lot represents a standardized quantity of a financial instrument. For example, if the commission per lot is $5 and you trade 2 lots, the total commission would be $10.

It is important to consider the commission structure when choosing a broker as it can significantly impact your trading costs. Brokers may offer different commission structures depending on the type of account you choose or the trading volume you generate.

Keep in mind that while low commission rates may seem attractive, other factors such as execution quality, liquidity, and customer support should also be considered when selecting a broker.

When calculating your overall trading costs, it is essential to consider both the spread and commission. Some brokers may offer low spreads but higher commissions, while others may have tighter spreads and lower commissions. It is important to find the right balance that suits your trading style and strategy.

Understanding how MT4 commission works is crucial for managing your trading costs and optimizing your profitability. By comparing commission structures and considering other factors, you can make an informed decision when selecting a broker for your MetaTrader 4 trading needs.

MT4 commission is a fee charged by brokers for each trade made on the MetaTrader 4 platform. It is usually calculated as a fixed amount per lot traded or as a percentage of the trade value.

Brokers charge commission on MT4 to cover their costs and make a profit. Providing access to the platform and executing trades requires infrastructure and resources, which the broker needs to cover somehow.

The spread is the difference between the buy and sell price of a financial instrument. It is the main way brokers make money in addition to commissions. Commission, on the other hand, is a separate fee charged per trade.

The amount of commission charged by brokers on MT4 can vary. Some brokers charge a fixed amount per lot traded, while others charge a percentage of the trade value. It is important to compare commission rates when choosing a broker.

MT4 commission is important because it affects the overall cost of trading. Higher commission rates can eat into your profits, while lower commission rates can save you money. It is important to consider commission rates when choosing a broker to trade with.

MT4 Commission is a fee charged by brokers for using the MetaTrader 4 platform. It is usually calculated based on the volume of trades executed by the trader. The commission amount can vary depending on the broker and the type of account the trader has.

Understanding MT4 Commission is important for traders because it directly affects their trading costs and profitability. By understanding how the commission is calculated and how it can impact their trades, traders can make more informed decisions and choose the most cost-effective trading strategies.

Discover the Truth: Is IC Markets a Real Broker? With the rapid growth of online trading, it’s important to ensure that the platform you choose is …

Read ArticleNegative Effects of Waste Trade Waste trade, the global practice of transferring waste materials from one country to another, has become a significant …

Read ArticleUnderstanding Forex Study: Everything You Need to Know In the world of global financial markets, the foreign exchange market, or Forex, is the largest …

Read ArticleUsing American Money in Norway: What You Need to Know Planning to visit Norway and wondering if you can use American currency during your trip? Here’s …

Read ArticleUnderstanding the Difference Between Future Trading and Option Trading When it comes to trading in the financial markets, there are several different …

Read ArticleUnderstanding the Awesome Oscillator in Forex Trading Forex trading can be an exciting and lucrative venture, but it requires an in-depth …

Read Article