Free Ways to Master Forex Trading: Best Methods and Strategies

What is the best way to learn forex trading for free? Forex trading has gained immense popularity in recent years, attracting both experienced traders …

Read Article

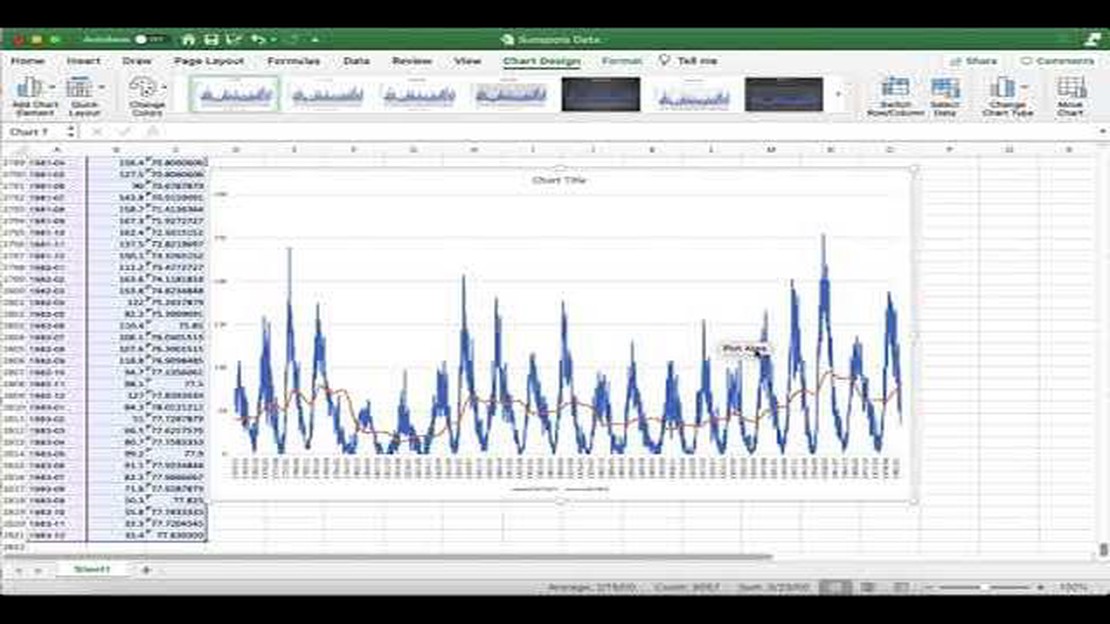

Forecasting is an important tool in the field of data analysis, helping businesses make informed decisions about the future. One popular method of forecasting is moving average, which can be especially useful when there is seasonality in the data. Seasonality refers to the recurring patterns or cycles that occur within a dataset over a fixed time period, such as daily, weekly, or yearly.

The moving average forecasting method calculates the average of a specific number of observations within a dataset, and uses that average to predict future values. This is done by continuously updating the moving average as new data becomes available. By taking into account previous observations, moving average can capture the underlying trend of the data, while also accounting for seasonality.

When dealing with seasonality, it is important to consider the length of the seasonal cycle. For example, if the data exhibits weekly seasonality, a moving average calculation should be made using a window of seven observations. By using this window size, the moving average will capture the average value for each day of the week, and can be extended to predict future values.

In conclusion, moving average forecasting with seasonality is a powerful tool to predict future values in a dataset. By considering the recurring patterns within the data, this method can provide valuable insights for businesses. However, it is crucial to choose an appropriate window size that aligns with the length of the seasonal cycle, in order to achieve accurate predictions.

Moving average forecasting is a commonly used technique in time series analysis to predict future values in a sequence of data points. It involves calculating the average of a given number of consecutive data points and using that average as a forecast for the next data point.

The purpose of using moving averages in forecasting is to smooth out short-term fluctuations and identify long-term patterns or trends in the data. By calculating the average over a specific interval, moving averages can help remove noise and highlight the underlying structure of the time series.

One of the main benefits of using moving averages for forecasting is its simplicity. It is a widely-used technique that does not require complex mathematical models or extensive statistical analysis. Moving averages provide a straightforward way to make predictions based on historical data.

Another purpose of using moving averages is to help identify and understand seasonality in the data. Seasonality refers to recurring patterns that occur at regular intervals, such as quarterly sales fluctuations or monthly temperature variations. By applying moving averages, analysts can identify and anticipate these seasonal patterns, enabling them to make more accurate forecasts and better plan for seasonal fluctuations.

Overall, the definition and purpose of moving average forecasting are to smooth out short-term fluctuations, identify long-term trends, make predictions based on historical data, and anticipate seasonality in time series data.

Read Also: Is Binary Options Trading Gambling? The Truth Behind the Risk

Moving average forecasting with seasonality offers several benefits:

However, there are also a few limitations to consider:

Overall, moving average forecasting with seasonality can be a valuable tool for understanding and predicting seasonal patterns in data, but it is important to consider its limitations and use it in conjunction with other forecasting techniques for more accurate and reliable results.

Moving average forecasting is a widely used technique in time series analysis to predict future values based on past data. It is particularly useful when trying to understand and forecast data with trends and patterns.

A moving average is calculated by taking the average of a fixed number of data points within a specific time period. This technique smooths out the fluctuations in the data and provides a clearer picture of the underlying trend. The length of the time period used to calculate the moving average is called the window size.

The basic idea behind moving average forecasting is that the future value of a variable is expected to be similar to its recent past values. By calculating the moving average, we can estimate the average value of the variable over a certain period of time and use it to forecast future values.

There are different types of moving averages, including simple moving average (SMA) and exponential moving average (EMA). SMA gives equal weight to all data points within the window, while EMA gives more weight to recent data points.

One of the advantages of moving average forecasting is its simplicity and ease of implementation. It does not require complex mathematical models or assumptions about the underlying data distribution. However, it is important to note that moving average forecasting may not be suitable for all types of time series data, especially those with high levels of volatility or seasonality.

Read Also: Understanding the Concept of Target in Forex Trading

When dealing with time series data that exhibits seasonality, it is necessary to incorporate seasonality factors into the moving average forecast. This can be done by using a seasonal moving average or by adjusting the window size to capture the seasonal pattern in the data.

In conclusion, moving average forecasting is a useful technique for predicting future values based on past data. It can provide valuable insights into trends and patterns in time series data. However, it is important to consider the limitations and adjust the methodology based on the characteristics of the data being analyzed.

Moving average forecasting with seasonality is a method used to predict future values based on the average of a fixed number of past observations, considering the regular recurrence of patterns known as seasonality.

Moving average forecasting with seasonality works by calculating the average of a specified number of past observations, taking into account the cyclic patterns or seasonality. This average is then used as a forecast for future values.

The purpose of including seasonality in moving average forecasting is to account for the regular recurring patterns in the data. By considering seasonality, the forecast can better capture and predict future values that follow similar patterns.

Examples of seasonality in data include the cyclical patterns in sales due to holidays or weather, the monthly variations in website traffic, or the quarterly fluctuations in stock prices. These patterns repeat over fixed time periods.

The advantages of using moving average forecasting with seasonality include its simplicity and flexibility. It is easy to understand and implement, and it can be adjusted to different datasets and time periods. Moreover, it can provide accurate forecasts for data with recurring patterns.

What is the best way to learn forex trading for free? Forex trading has gained immense popularity in recent years, attracting both experienced traders …

Read ArticleUnderstanding the Snake Moving Average In the world of trading, there are countless technical indicators that traders use to analyze market trends and …

Read ArticleUnderstanding the Mechanisms of Binary Options Trading Binary options trading is a popular form of investing that allows traders to speculate on the …

Read ArticleUnderstanding the ESOP Plan: A Guide for Small Businesses Employee Stock Ownership Plans (ESOPs) are becoming an increasingly popular option for small …

Read ArticleTop Profitable Commodities to Trade in Elite Dangerous Elite Dangerous is a space simulation game that offers players the opportunity to trade and …

Read ArticleRules for Forex Trading: Everything You Need to Know Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on …

Read Article