Understanding the Golden Rule of Stock Trading: A Must-Know for Investors

The Golden Rule of Stock Trading: Key Principles to Follow In the fast-paced world of stock trading, one must navigate through a complex maze of …

Read Article

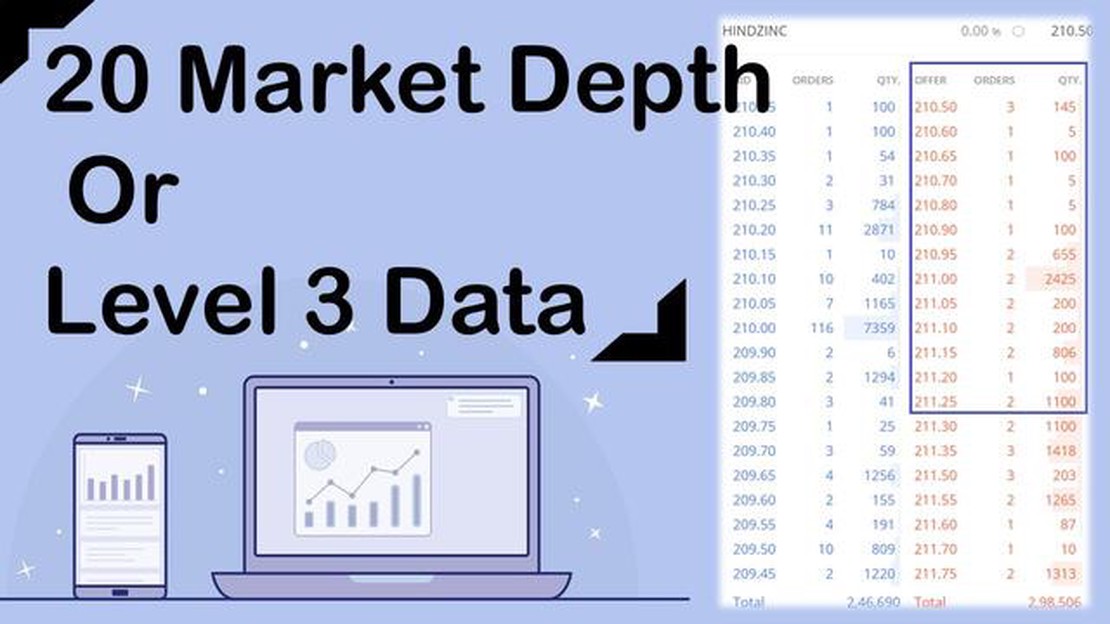

Level 3 tick data is a vital tool for traders and investors who are serious about their craft. It provides a deeper level of market insight than traditional time and sales data, allowing market participants to make more informed decisions.

But what exactly is level 3 tick data? Level 3 is a type of market data that provides detailed information about market depth and order book activity for a given security. It includes real-time updates on bid and ask prices, as well as the number of shares available at each price level.

Level 3 data is often used by professional traders and institutional investors who require a more comprehensive view of the market. It can help them identify hidden liquidity, determine the strength of supply and demand, and gauge market sentiment.

In this ultimate guide, we will delve into the intricacies of level 3 tick data, exploring its components, benefits, and how it can be used to gain a competitive edge in the market. Whether you are a seasoned trader or just starting out, this guide will help you unlock the power of level 3 tick data and take your trading to the next level.

Level 3 tick data is a type of financial market data that provides detailed information about the trading activity on an exchange. It includes the price, volume, and depth of the order book for a particular security or asset.

Level 3 tick data is often used by professional traders and institutional investors who require more granular information than what is available through standard level 1 or level 2 data. It can provide insights into market liquidity, order flow, and the behavior of market participants.

Level 3 tick data is typically provided in real-time and includes every tick or change in the order book. This allows traders to see the exact prices at which orders are placed and executed, as well as the quantity of shares or contracts being traded.

In addition to the price and volume data, level 3 tick data also includes information about the depth of the order book. This shows the number of buy and sell orders at different price levels, allowing traders to see the supply and demand dynamics in the market.

Level 3 tick data can be displayed in various formats, including charts, tables, or raw data feeds. Traders can use this data to analyze market trends, identify support and resistance levels, and make informed trading decisions.

Overall, level 3 tick data is a powerful tool for traders and investors who require detailed insights into market activity. By providing real-time information about the order book, it can help traders make more informed decisions and improve their trading strategies.

Level 3 tick data is a crucial tool for traders and analysts who want a deeper understanding of market dynamics. Unlike lower levels of tick data, which only show the best bid and ask prices, Level 3 data provides detailed information about the entire order book, including all bids and asks at different price levels.

This greater level of granularity allows traders to see the full depth of the market and make more informed decisions. With Level 3 data, traders can identify key support and resistance levels, detect hidden liquidity, and anticipate price movements with greater accuracy.

Level 3 data is particularly important for high-frequency traders, who rely on speed and precision to execute trades in a fraction of a second. By analyzing the entire order book, these traders can gain a competitive edge and capitalize on short-term price fluctuations.

Read Also: Reasons to Avoid Options Trading and Safeguard Your Investments

Furthermore, Level 3 data is essential for market makers and brokers, as it helps them manage their inventory and optimize their trading strategies. By understanding the bid-ask spread and order flow, market makers can ensure liquidity and minimize their risk exposure.

Overall, Level 3 tick data is a valuable resource for anyone involved in the financial markets. Whether you’re a day trader looking for an edge or an analyst seeking deeper insights, Level 3 data can provide the information necessary to make more informed trading decisions.

Analyzing Level 3 tick data can provide valuable insights into market dynamics and trading opportunities. Here are some key techniques and considerations for effectively analyzing Level 3 tick data:

| Step | Description |

|---|---|

| 1 | Understand the data structure |

| 2 | Identify patterns and trends |

| 3 | Monitor order flow |

| 4 | Analyze bid-ask spreads |

| 5 | Look for institutional activity |

Level 3 tick data consists of detailed information about individual trades and market depth. It includes the price, volume, timestamp, and other relevant data for each trade. It is important to have a clear understanding of the structure and format of the data before proceeding with the analysis.

By analyzing Level 3 tick data, you can identify various patterns and trends that may indicate potential trading opportunities. These patterns can include price movements, volume spikes, and changes in market depth. Look for recurring patterns and trends that can provide insights into the market’s behavior.

Read Also: Is IAS 21 still relevant today? Exploring the impact of this international accounting standard

Level 3 tick data provides information about the order flow, which can be crucial in understanding market dynamics. By monitoring the flow of buy and sell orders, you can gain insights into the supply and demand dynamics and identify potential trading opportunities.

Level 3 tick data includes information about bid and ask prices, as well as the spread between them. Analyzing bid-ask spreads can provide insights into market liquidity and the strength of the current trend. Wide spreads may indicate low liquidity or potential market inefficiencies.

Institutional investors often trade in large volumes and can have a significant impact on market dynamics. Analyzing Level 3 tick data can help identify institutional activity, such as large buy or sell orders. Monitoring institutional activity can provide insights into market sentiment and potential market reversals.

Overall, analyzing Level 3 tick data requires a combination of technical analysis skills and the ability to interpret market dynamics. By understanding the data structure, identifying patterns and trends, monitoring order flow, analyzing bid-ask spreads, and looking for institutional activity, traders can make more informed trading decisions based on Level 3 tick data.

Level 3 tick data refers to the most detailed and granular form of market data that includes not only the bid and ask prices, but also the depth of the market, i.e., the number of orders waiting at each price level. It provides traders and analysts with a deeper understanding of market dynamics and can be used to identify liquidity levels, detect hidden trends, and make more informed trading decisions.

Level 3 tick data is collected by market data providers who have direct access to the order books of various exchanges. These providers aggregate data from multiple exchanges and make it available to traders and institutions for analysis. The data is usually streamed in real-time and can be accessed through market data APIs or specialized trading platforms.

Using Level 3 tick data offers several advantages. Firstly, it provides a more complete picture of market activity, allowing traders to assess the liquidity and depth of the market. Secondly, it enables the identification of hidden trends and patterns that may not be visible in lower-level data. Additionally, Level 3 tick data can help traders execute trades more efficiently by providing insights into the order flow and the behavior of other market participants.

Yes, Level 3 tick data can be used for backtesting trading strategies. By incorporating the real-time order book information and order flow, backtesting can be performed with greater accuracy and realism. This allows traders to evaluate the performance of their strategies under various market conditions and adjust their approach accordingly. However, it’s important to note that Level 3 tick data can be resource-intensive and may require specialized software and hardware for efficient backtesting.

Yes, there are some challenges and limitations in using Level 3 tick data. Firstly, it can be expensive to access and require substantial storage capacity due to the large volume of data generated. Secondly, analyzing Level 3 tick data requires advanced quantitative skills and computational resources. Additionally, the interpretation of tick data can be complex and subject to interpretation bias. Finally, Level 3 tick data may not be available for all markets or instruments, limiting its usefulness in certain scenarios.

Level 3 tick data refers to the most detailed level of market data available for a specific security. It includes the complete order book for that security, including not only the bid and ask prices, but also the sizes of those orders.

Level 3 tick data is typically available from financial data providers or through specialized trading platforms. You may need to subscribe to a specific data feed or pay a fee to access this type of data.

The Golden Rule of Stock Trading: Key Principles to Follow In the fast-paced world of stock trading, one must navigate through a complex maze of …

Read ArticleUnderstanding the Meaning of R in Forex Trading In the world of forex trading, the concept of “R” is often used to measure risk and reward. R, also …

Read ArticleWho owns UBS? UBS Group AG, a Swiss multinational investment bank and financial services company, has a diverse ownership structure with various …

Read ArticleFlat Tax Rate for Foreigners in Korea 2023 South Korea has recently implemented a new tax policy that aims to attract foreign talent and boost the …

Read ArticleWhat is the success rate of trading bots? In today’s digital age, trading bots have become increasingly popular tools for both amateur and …

Read ArticleGBP to CZK Exchange Rate in Prague Are you planning a trip to Prague and wondering about the current exchange rate between British Pound Sterling …

Read Article