Reasonable Compensation Package: Factors to Consider and How to Negotiate

What is a reasonable compensation package? When considering a new job or negotiating a raise, one of the most important factors to consider is the …

Read Article

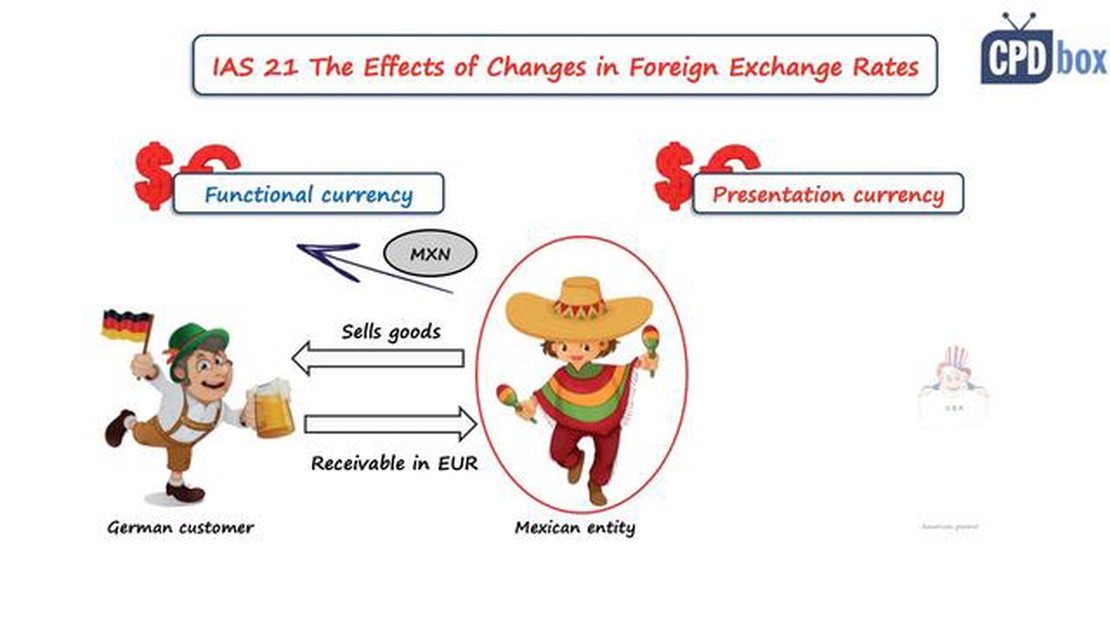

The International Accounting Standard 21 (IAS 21) was developed by the International Accounting Standards Board (IASB) to provide guidance on how to account for foreign currency transactions and operations in financial statements. It was first issued in 1983 and has since undergone various amendments to keep up with the changing global landscape.

IAS 21 is of great importance because it addresses the challenges faced by multinational companies in dealing with foreign currencies and the impact these fluctuations have on their financial statements. It provides a framework for translating foreign currency transactions into the functional currency of the reporting entity, as well as accounting for foreign currency monetary items, non-monetary items, and foreign operations.

With globalization and the increased interconnectivity of economies, the relevance of IAS 21 remains unquestionable. The standard ensures that financial statements accurately reflect the economic reality of multinational companies and enables investors, regulators, and other stakeholders to make informed decisions based on reliable and comparable financial information.

Furthermore, IAS 21 plays a crucial role in promoting transparency and consistency in financial reporting across borders. By providing clear guidelines on how to account for foreign currency transactions, it reduces the risk of misinterpretation and manipulation of financial data, facilitating fairer comparisons between entities operating in different jurisdictions.

However, it is worth exploring whether IAS 21 adequately addresses the challenges and complexities of today’s global business environment. The increased volatility in currency markets, the rise of digital currencies, and the growing number of cross-border transactions call for a review of the standard to ensure its continued relevance and effectiveness.

Therefore, this article will delve deeper into the impact of IAS 21 in the current global accounting landscape, examining its strengths, weaknesses, and potential areas for improvement. By critically evaluating the standard, we can better understand its role in enabling accurate and transparent financial reporting in an ever-changing global economy.

IAS 21, also known as International Accounting Standard 21, provides guidance on how to account for foreign currency transactions and operations in financial statements. In today’s globalized world, where companies often engage in business transactions across borders, IAS 21 plays a crucial role in ensuring accurate and consistent accounting practices.

Read Also: Are Forex EA's Profitable? Discover the Truth About Automated Trading Systems

One of the key reasons why IAS 21 remains relevant in the modern accounting environment is its ability to promote transparency and comparability in financial reporting. The standard requires companies to translate foreign currency transactions into their functional currency using the exchange rate at the transaction date. This ensures that financial statements reflect the economic substance of the transactions and allow users to make meaningful comparisons between companies operating in different currencies.

Another importance of IAS 21 is its impact on multinational companies’ financial performance analysis. By using the standard’s guidelines, companies can isolate the effects of changes in exchange rates on their financial statements, providing valuable insights into their performance in different geographic regions. This is particularly important for informed decision-making by management and investors, as it allows them to assess the risks and opportunities associated with foreign exchange fluctuations.

Furthermore, IAS 21 helps companies manage foreign currency risk by providing guidance on accounting for foreign exchange gains and losses. The standard requires companies to recognize these gains or losses in the income statement, ensuring that they are accurately reflected in the financial statements. This helps companies assess the impact of foreign exchange fluctuations on their overall financial performance and take appropriate measures to mitigate any potential risks.

In summary, IAS 21 continues to be of great importance in the modern accounting environment. Its guidelines ensure transparent and comparable financial reporting for companies engaged in foreign currency transactions. By adhering to the standard, companies can effectively analyze their performance and manage foreign currency risk, enabling better decision-making and ultimately enhancing the credibility of financial statements.

IAS 21, the International Accounting Standard on The Effects of Changes in Foreign Exchange Rates, was first issued in 1983 and has been revised several times since then. Over the years, it has played a significant role in providing guidance on how to account for foreign currency transactions and the translation of financial statements into a reporting currency.

In today’s globalized business environment, where companies operate across borders and engage in international trade, IAS 21 continues to be highly relevant. This standard ensures that companies accurately record and report their foreign currency transactions, allowing stakeholders to understand the impact of exchange rate fluctuations on financial statements.

One of the primary reasons why IAS 21 is still relevant today is the increasing globalization of business operations. With the expansion of international trade and the rise of multinational corporations, companies are exposed to exchange rate risk on a daily basis. IAS 21 provides guidance on how to measure and report this risk, ensuring transparency and comparability in financial statements across companies and industries.

Furthermore, IAS 21 helps companies in making informed business decisions. By providing standards for dealing with foreign currency transactions, it allows companies to accurately assess the financial impact of exchange rate fluctuations on their operations. This information is crucial for businesses to manage their foreign exchange exposure effectively and make strategic decisions to mitigate any potential risks.

Read Also: Understanding Goldman Sachs Stock Based Compensation: What You Need to Know

IAS 21 also plays a crucial role in harmonizing global accounting practices. As an international accounting standard issued by the International Accounting Standards Board (IASB), it promotes consistency and comparability in financial reporting across different countries. This harmonization is significant for investors, regulators, and other stakeholders who rely on financial statements to assess the financial health and performance of companies operating in multiple jurisdictions.

In conclusion, IAS 21 continues to be highly relevant in today’s global business environment. With its guidance on accounting for foreign currency transactions and the translation of financial statements, this international accounting standard ensures transparency, comparability, and informed decision-making for companies operating across borders. As businesses continue to expand internationally, the importance of IAS 21 cannot be overstated.

IAS 21 is an international accounting standard that sets out guidelines for how to account for foreign currency transactions and operations in financial statements. It provides rules for translating foreign currency amounts into functional currency, recognizing exchange differences, and presenting foreign currency transactions in the financial statements.

IAS 21 is important because it helps ensure that financial statements accurately reflect the financial position and performance of an entity when dealing with foreign currency transactions and operations. It provides consistency and comparability in financial reporting, which is crucial for investors, creditors, and other financial statement users to make informed decisions.

IAS 21 has a significant impact on multinational companies as it affects the way they report foreign currency transactions and operations. It requires them to translate foreign currency amounts into their functional currency using the exchange rates at the transaction date or an average rate. It also requires recognition of exchange differences in the income statement or as a separate component of equity. Compliance with IAS 21 helps multinational companies accurately report their financial results and manage their foreign exchange risks.

Yes, there are criticisms of IAS 21. Some argue that it is too complex and difficult to apply in practice, especially for companies with significant foreign operations. Others believe that it does not provide enough guidance on certain issues, such as the treatment of forward exchange contracts. Additionally, there are concerns about the subjectivity involved in choosing exchange rates for translation and the potential impact on financial statements. Despite these criticisms, IAS 21 remains a relevant and widely-used accounting standard.

What is a reasonable compensation package? When considering a new job or negotiating a raise, one of the most important factors to consider is the …

Read ArticleHow Long Does It Take to Get Balikbayan Box from Canada to Philippines? Shipping a balikbayan box from Canada to the Philippines can take anywhere …

Read ArticleAddress of PKO Bank in Poland If you are looking for the address of a PKO Bank branch in Poland, you have come to the right place. PKO Bank Polski is …

Read ArticleStockPlan Connect: Everything You Need to Know Are you a professional trader or investor looking for a comprehensive stock planning tool? Look no …

Read ArticleComparing Heiken Ashi and Japanese Candlestick Charts: Which is Superior? When it comes to analyzing market trends and making informed trading …

Read ArticleExploring the Process of Hedge Funds Buying Options Options are a popular investment vehicle for hedge funds. They offer flexibility and a potential …

Read Article