Understanding the Formula for Bollinger Bands: A Comprehensive Guide

What is the formula for Bollinger Bands? If you are an investor or trader, chances are you have come across the term “Bollinger Bands” in your …

Read Article

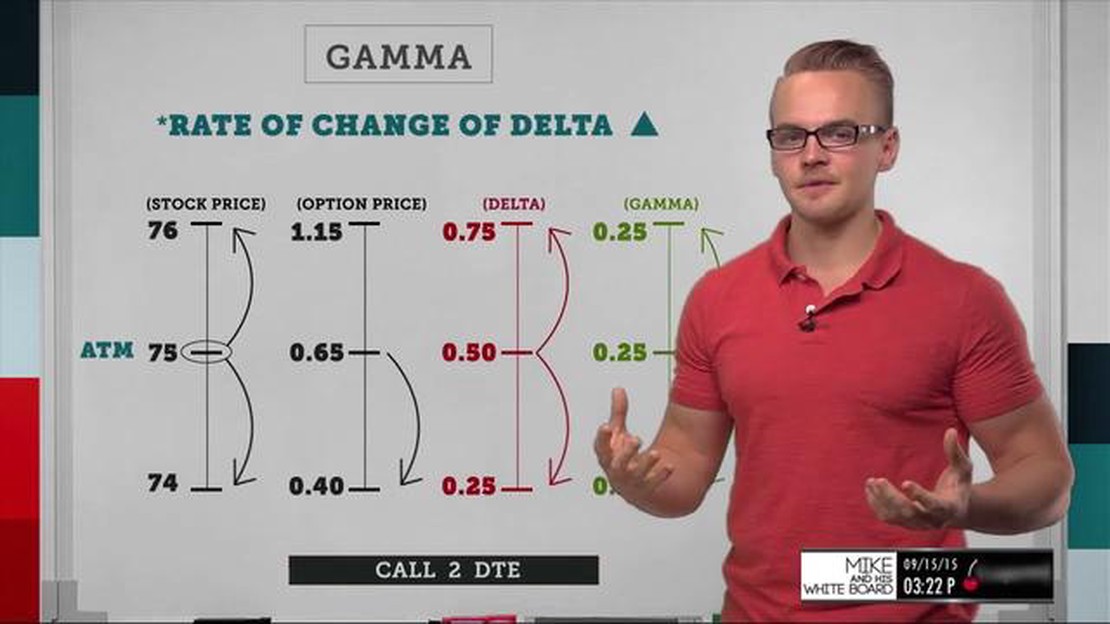

High gamma options are a key component of many advanced trading strategies. Gamma measures the rate of change in an option’s delta, which is the sensitivity of the option’s price to changes in the underlying asset price. High gamma options have a large rate of change in their delta, meaning they can quickly increase or decrease in value based on small movements in the underlying asset.

Traders who use high gamma options are looking to take advantage of volatile markets and capitalize on quick price movements. These options can provide significant profits if the underlying asset makes a large move in the right direction, but they can also result in substantial losses if the market moves against the trader’s position.

One popular strategy that utilizes high gamma options is the gamma scalping strategy. Gamma scalping involves adjusting an options position to maintain a neutral gamma, which means the trader is neither long nor short gamma. The goal of gamma scalping is to profit from the high gamma options by constantly adjusting the position to capture the option’s increasing or decreasing value as the underlying asset price changes.

Another trading strategy that takes advantage of high gamma options is the gamma squeeze. A gamma squeeze occurs when a large number of traders are holding short gamma positions and the market moves sharply in the opposite direction. This can result in a rapid and significant increase in the value of high gamma options, forcing short gamma traders to buy back their positions at higher prices, further driving up the price of the options.

Understanding high gamma options and how they impact trading strategies is essential for advanced options traders. By incorporating high gamma options into their trading strategies, traders can potentially increase their profits and take advantage of market volatility. However, it is important to carefully manage the risks associated with high gamma options and continually monitor and adjust positions to protect against potential losses.

High gamma options are a type of financial derivative that have a high sensitivity to changes in the underlying asset’s price. Gamma is one of the key components in option pricing models, and it represents the rate at which an option’s delta changes in response to a small change in the price of the underlying asset.

Options with high gamma have deltas that change more significantly with each small movement in the underlying asset’s price. This means that high gamma options can provide traders with the potential for greater profits, as they have the ability to capture larger price movements in the underlying asset.

However, high gamma options also come with higher risks. Since the delta of a high gamma option changes rapidly, it can also lead to larger losses if the price of the underlying asset moves against the trader’s position. Traders who are conservative or risk-averse may opt for options with lower gamma to reduce the potential for large losses.

High gamma options are commonly used by traders who are looking to take advantage of short-term price movements in the market. By trading high gamma options, these traders can potentially profit from rapid moves in the underlying asset’s price, while also managing their risk through careful position sizing and risk management strategies.

In summary, high gamma options are financial derivatives that have a high sensitivity to changes in the price of the underlying asset. They can offer traders the potential for greater profits but also come with higher risks. Traders interested in high gamma options should carefully assess their risk tolerance and develop appropriate risk management strategies to protect their capital.

When it comes to trading options, one of the most important factors to consider is the gamma of the option. Gamma measures how sensitive the option’s delta is to changes in the price of the underlying asset. A high gamma option means that its delta will change significantly with even small movements in the underlying asset’s price.

This high level of sensitivity can have a significant impact on trading strategies. For example, if an investor is bullish on a particular stock and believes it will increase in price, they may choose to buy call options. If these call options have a high gamma, the investor stands to make a larger profit if the stock price increases, as the option’s delta will increase rapidly. On the other hand, if the stock price decreases, the option’s delta will decrease rapidly, resulting in a larger loss.

Read Also: Is Forex Trading Tax Free in Canada? Get the Facts Here

High gamma options can also impact hedging strategies. Hedging involves offsetting the risk of a position by entering into an opposite position. For example, if an investor owns a portfolio of stocks and wants to protect against a potential decrease in their value, they may choose to buy put options. If these put options have a high gamma, the investor can more effectively hedge against a decrease in the portfolio’s value, as the option’s delta will change more rapidly.

However, it’s important to note that high gamma options can also increase risk. The high sensitivity to changes in the underlying asset’s price means that losses can be magnified if the market doesn’t move in the desired direction. This is why it’s crucial to carefully consider the risks and rewards associated with high gamma options before implementing a trading strategy.

In conclusion, high gamma options have a significant impact on trading strategies. They can provide the potential for larger profits and more effective hedging, but they also come with increased risk. Traders must carefully assess the gamma of options and consider their risk tolerance before incorporating them into their trading strategies.

When it comes to trading high gamma options, there are a few strategies that can be effective in helping traders take advantage of the potential for large price changes. Here are some strategies to consider:

Read Also: The Famous Exchange in Pakistan: A Detailed Guide

1. Short-Term Trading: One strategy is to focus on short-term trading of high gamma options. This involves taking advantage of the rapid price movements that can occur as a result of the high gamma. Traders can look to enter and exit positions quickly to capitalize on these short-term price swings.

2. Volatility Trading: Another strategy is to use high gamma options to trade volatility. When volatility increases, it can lead to larger price swings, which can benefit high gamma options. Traders can look for situations where they expect volatility to increase and take positions in high gamma options to capitalize on the potential for larger price moves.

3. Options Spreads: Using options spreads can also be an effective strategy for trading high gamma options. This involves taking positions in multiple options contracts to create a spread that can help manage risk and potential losses. By combining different options contracts, traders can create a spread that benefits from the high gamma while limiting potential downside.

4. Technical Analysis: Incorporating technical analysis into trading high gamma options can also be beneficial. By analyzing price patterns, trends, and support and resistance levels, traders can make more informed decisions on when to enter and exit positions. Technical analysis can provide valuable insights into potential price movements and help traders identify high gamma options that may be poised for significant price changes.

5. Options Education: Lastly, one of the most important strategies for trading high gamma options is to have a solid understanding of options and how they work. Educating oneself on options pricing, Greeks, and different trading strategies can help traders make more informed decisions and navigate the complexities of high gamma options more effectively.

Overall, trading high gamma options can be a high-risk, high-reward endeavor. It requires careful planning, risk management, and a solid understanding of options and market dynamics. By employing the right strategies, traders can potentially capitalize on the large price swings that high gamma options can offer.

High gamma options are options that have a high sensitivity to changes in the price of the underlying asset. They tend to have a gamma value of more than 0.5, which means their delta value can change significantly with even small movements in the underlying asset’s price.

High gamma options can have a significant impact on trading strategies as their delta value can change rapidly with small movements in the underlying asset’s price. This means that the potential profits or losses from these options can be magnified, making them more risky but also potentially more lucrative.

High gamma options are considered risky because their delta value can change significantly with small movements in the underlying asset’s price. This means that the potential profits or losses from these options can be magnified, making them more unpredictable and volatile compared to options with lower gamma values.

Traders can take advantage of high gamma options by implementing strategies that benefit from rapid changes in the underlying asset’s price. For example, they can use these options to make short-term bets on the direction of the market or to hedge their positions by taking advantage of the increased sensitivity of these options to price movements.

Some examples of trading strategies that involve high gamma options include gamma scalping, straddle strategies, and butterfly spreads. These strategies aim to profit from changes in the underlying asset’s price by taking advantage of the increased sensitivity and potential magnification of profits or losses associated with high gamma options.

What is the formula for Bollinger Bands? If you are an investor or trader, chances are you have come across the term “Bollinger Bands” in your …

Read ArticleWhat do options brokers do? Options brokers play a crucial role in the financial market, facilitating trading in options contracts. Options are …

Read ArticleHow to turn $100 into $1,000: Effective strategies and tips Do you have $100 to spare and want to turn it into $1,000? Many people dream of …

Read ArticleIs index option trading the same as stock option trading? Many investors are familiar with stock option trading, where they have the opportunity to …

Read ArticleUnderstanding the Indicator in MT5 MetaTrader 5 (MT5) is a powerful and widely used trading platform that offers a variety of technical analysis tools …

Read ArticleWhat are forex sheets made of? When it comes to the world of advertising, marketing, and signage, one material that has gained significant popularity …

Read Article