Understanding the Distinction: Bollinger Band versus Bollinger Band Width

What is the difference between Bollinger Band and Bollinger Band width? In the world of technical analysis, traders and investors employ various …

Read Article

Foreign exchange (FX) and interest rate (IR) are two fundamental aspects of the global financial markets that have a significant impact on traders and investors. Understanding these concepts is essential for anyone looking to navigate the complexities of the financial industry and make informed decisions. This comprehensive guide aims to provide a clear explanation of FX and IR, exploring their importance and how they influence various investment strategies and trading practices.

Foreign exchange refers to the buying and selling of currencies in the global market. It plays a crucial role in facilitating international trade and investment. The value of currencies fluctuates constantly due to a multitude of factors, such as economic indicators, geopolitical events, and market sentiment. Traders and investors closely monitor these currency movements to take advantage of potential opportunities and manage risks.

Interest rates, on the other hand, are the cost of borrowing money or the return on investment. They are determined by central banks and influence various financial instruments, including bonds, loans, and savings accounts. Changes in interest rates can have a profound impact on the economy, affecting consumer spending, business investments, and inflation. Traders and investors analyze interest rate movements to identify potential trends and adjust their portfolios accordingly.

This comprehensive guide will delve into the intricacies of FX and IR, providing insights into the factors that drive their fluctuations and the strategies employed by traders and investors. From analyzing economic indicators and central bank policies to understanding currency pairs and yield curves, this guide will equip readers with the knowledge necessary to make informed decisions in the ever-changing global financial markets.

Whether you’re a seasoned trader or an aspiring investor, understanding the complexities of FX and IR is essential for success in the financial industry. This guide will serve as a comprehensive resource, equipping you with the knowledge and insights needed to navigate the world of foreign exchange and interest rates with confidence.

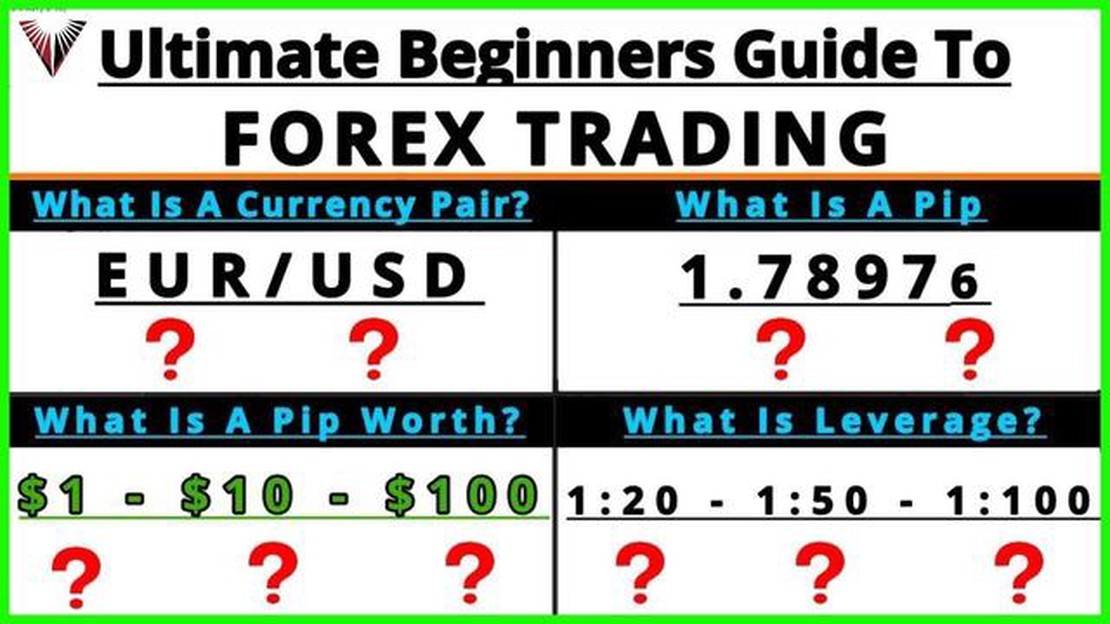

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies in the global market. It is considered to be the largest and most liquid financial market in the world, with an average daily trading volume of around $6 trillion.

Interest rates, on the other hand, play a crucial role in forex trading. They are set by central banks and have a significant impact on a country’s currency value. When interest rates rise, a currency tends to strengthen, while a decrease in interest rates can lead to the depreciation of a currency.

Traders and investors in the forex market closely monitor interest rates and make trading decisions based on their expectations of future interest rate movements. Economic indicators, such as inflation, employment data, and GDP growth, are closely analyzed to assess the likelihood of interest rate changes.

Read Also: Exploring the Different Types of Booths: A Comprehensive Guide

Understanding the relationship between forex trading and interest rates is essential for traders and investors to make informed decisions. Interest rates can create opportunities for profit but also carry significant risks. Traders need to assess the potential impact of interest rate changes on currency pairs and adjust their strategies accordingly.

Additionally, interest rates do not only impact forex trading but also other financial markets, such as stocks, bonds, and commodities. Changes in interest rates can influence investor sentiment, economic growth, and overall market conditions.

In conclusion, forex trading and interest rates are intrinsically linked. Traders and investors need to have a comprehensive understanding of interest rate dynamics and how they affect currency values. By staying informed about economic indicators and central bank policies, market participants can better navigate the complexities of the forex market and seize potential opportunities.

In the financial world, Forex, or foreign exchange, refers to the global marketplace where currencies are traded. It is a decentralized market, meaning there is no central exchange governing the trading. Instead, transactions are conducted electronically over-the-counter (OTC), which allows currencies to be traded 24 hours a day, five days a week.

The Forex market primarily exists to facilitate international trade and investment, as well as to profit from currency exchange rate fluctuations. It is the largest and most liquid financial market in the world, with an estimated daily trading volume of over $5 trillion.

So, how does Forex trading work? Essentially, it involves participants buying and selling different currencies with the aim of making a profit from the changes in their exchange rates. For example, if a trader expects the value of the euro to rise against the US dollar, they would buy euros and sell dollars. If their prediction turns out to be correct and the euro does increase in value, they can then sell the euros back for a profit. However, if their prediction is wrong and the euro decreases in value, they would incur a loss.

In Forex trading, currency pairs are traded, with the exchange rate representing the value of one currency relative to another. The most commonly traded currency pairs include the EUR/USD (euro against US dollar), GBP/USD (British pound against US dollar), and USD/JPY (US dollar against Japanese yen). Traders can choose from a wide range of currency pairs to trade, depending on their trading strategy and market analysis.

Forex trading involves various participants, such as banks, financial institutions, corporations, hedge funds, and individual traders. Additionally, the Forex market operates in different time zones, with major trading centers located in London, New York, Tokyo, and Sydney. This ensures that there is always liquidity and trading activity happening somewhere around the world.

Read Also: Understanding Gap Trading in Forex and How it Can Benefit Traders

To participate in Forex trading, individuals usually open an account with a Forex broker, who acts as an intermediary between the trader and the market. The trading platform provided by the broker allows traders to monitor the market, analyze charts, place trades, and manage their accounts.

It is important to note that Forex trading carries a high level of risk, and traders should only invest what they can afford to lose. Proper risk management strategies, such as setting stop-loss orders and using leverage wisely, are essential to protect against potential losses.

In conclusion, Forex trading involves buying and selling different currencies to profit from exchange rate movements. It is a global market, accessible 24/5, and offers numerous trading opportunities. However, it is crucial for traders to educate themselves, develop a trading plan, and practice risk management to succeed in the Forex market.

FX trading, also known as foreign exchange trading, is the buying and selling of different currencies. It is important for traders because it allows them to profit from the fluctuations in exchange rates. Traders can speculate on whether a currency will appreciate or depreciate in value and make trades accordingly.

IR trading refers to the buying and selling of interest rate derivatives, such as bonds and interest rate swaps. It involves speculating on the direction of interest rates and their impact on the price of fixed income securities. Traders can profit from changes in interest rates by correctly predicting their movements and positioning themselves accordingly.

There are several key factors that influence FX and IR markets. These include macroeconomic indicators (such as GDP growth, inflation rates, and employment figures), central bank policies, geopolitical events, and market sentiment. Traders and investors need to closely monitor these factors and assess their potential impact on currency and interest rate movements.

Traders and investors can manage risk when trading FX and IR by implementing risk management strategies such as setting stop-loss orders, diversifying their portfolio, using leverage responsibly, and staying updated with market news and analysis. It is also important to have a clear understanding of one’s risk tolerance and to only invest or trade with funds that one can afford to lose.

What is the difference between Bollinger Band and Bollinger Band width? In the world of technical analysis, traders and investors employ various …

Read ArticleDo options require a margin account? Options trading can be a lucrative endeavor for investors looking to diversify their portfolios or generate …

Read ArticleStock Based Compensation for Goldman Sachs Goldman Sachs is a global investment banking firm that is widely known for its lucrative compensation …

Read ArticleUnderstanding the Free Margin Level in Trading Forex trading involves the buying and selling of currencies in the foreign exchange market. To engage …

Read ArticleDiscovering the Safest and Most Profitable Option Strategy When it comes to investing in options, finding the safest and most profitable strategy is a …

Read ArticleUnderstanding Futures in Forex Trading Forex trading is a complex and ever-evolving market that offers countless opportunities for investors. Within …

Read Article