Is Cebuana a Bank? Everything You Need to Know

Is Cebuana a Bank? When it comes to managing our finances, it is essential to have a clear understanding of the financial institutions we interact …

Read Article

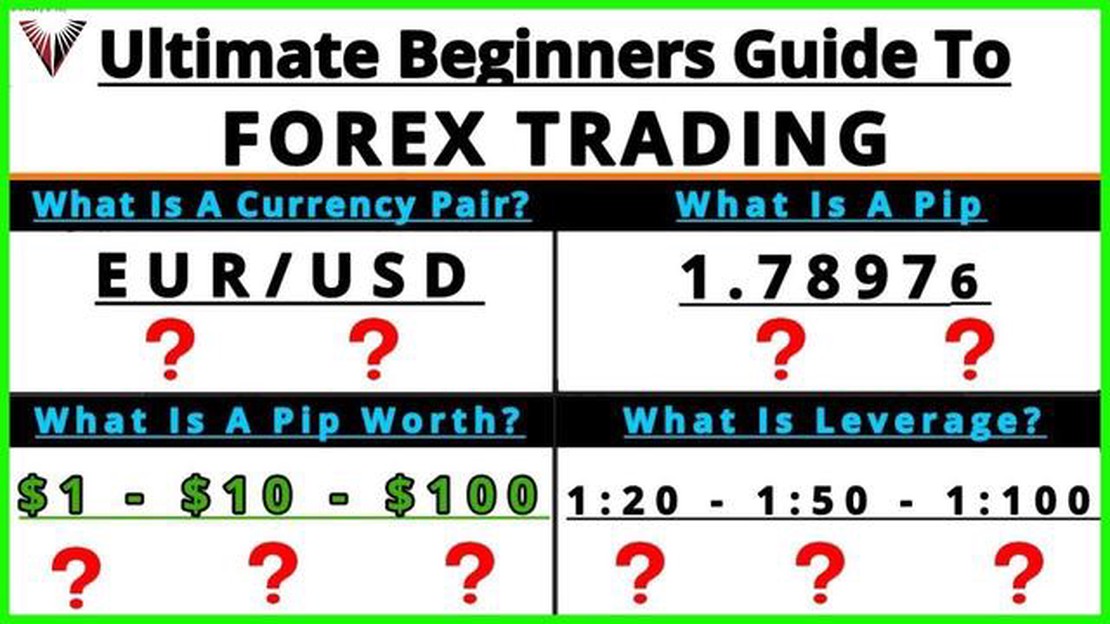

Foreign exchange, or forex, is a global market where currencies are bought and sold. It is the largest financial market in the world, with trillions of dollars worth of trades occurring every day. In order to participate in the forex market, traders need to understand how positions work.

A forex position refers to the amount of a particular currency that a trader holds at any given time. There are two types of positions: long and short. A long position means that a trader has bought a currency with the expectation that its value will rise. A short position, on the other hand, means that a trader has sold a currency with the expectation that its value will decrease.

When a trader enters a long position, they are essentially betting that the base currency will increase in value relative to the quote currency. For example, if a trader buys 1000 euros with US dollars, they are hoping that the value of the euro will increase in relation to the dollar. If this happens, they can sell their euros for more dollars at a later time, making a profit.

On the other hand, when a trader enters a short position, they are betting that the base currency will decrease in value relative to the quote currency. In this case, the trader would sell a currency that they don’t own, with the intention of buying it back at a lower price in the future. The difference between the selling and buying price would be their profit.

Forex, also known as foreign exchange or FX, refers to the global marketplace for buying and selling currencies. It is the largest and most liquid financial market in the world, with trading volumes surpassing trillions of dollars per day.

The forex market operates 24 hours a day, five days a week, allowing participants to trade currencies at any time. Unlike other financial markets, forex does not have a centralized exchange or physical location. Instead, it operates through an electronic network of banks, financial institutions, and individual traders located in different time zones around the world.

The primary purpose of the forex market is to facilitate international trade and investment. Businesses engage in forex transactions to convert one currency into another for the purpose of buying or selling goods and services in foreign markets. Additionally, investors and speculators participate in the forex market to take advantage of fluctuations in exchange rates and profit from currency price movements.

Currencies are traded in pairs, with the value of one currency relative to another. The most actively traded currency pairs include the US dollar (USD), euro (EUR), Japanese yen (JPY), British pound (GBP), Swiss franc (CHF), Canadian dollar (CAD), Australian dollar (AUD), and New Zealand dollar (NZD).

Forex trading involves analyzing economic indicators, geopolitical events, and market trends to make informed trading decisions. Traders can profit from both upward and downward movements in currency prices, also known as going long or short.

The forex market offers a range of trading instruments, including spot forex, forwards, options, and futures. Spot forex transactions involve the immediate exchange of currencies at the current market price, while forwards, options, and futures contracts allow traders to hedge against currency risk or speculate on future price movements.

Overall, forex trading offers opportunities for individuals and institutions to participate in the global currency market and potentially generate profits. However, it is important to understand the risks involved and to have a solid trading strategy in place.

In the foreign exchange market, a forex position refers to an open trade in a particular currency pair. It represents the amount of a specific currency held by a trader or an investor at a given point in time.

Read Also: Trading in GT: The Ultimate Guide to Getting Started

Forex positions are typically expressed in terms of quantities of base currency and counter currency. The base currency is the currency being purchased or sold, while the counter currency is the currency used to buy or sell the base currency.

There are two types of forex positions - long and short. A long position refers to buying the base currency and selling the counter currency, with the expectation that the value of the base currency will increase. On the other hand, a short position involves selling the base currency and buying the counter currency, anticipating a decrease in the value of the base currency.

Forex positions are measured in lots, which are standardized units of currency. A standard lot consists of 100,000 units of the base currency, while a mini lot represents 10,000 units and a micro lot represents 1,000 units.

Traders can open and close positions at any time, allowing them to take advantage of price fluctuations in the forex market. The profit or loss on a forex position depends on the difference in exchange rates between the time the position is opened and when it is closed.

| Position Type | Description |

|---|---|

| Long Position | Buy the base currency and sell the counter currency |

| Short Position | Sell the base currency and buy the counter currency |

| Lot Size | The standardized unit of currency for measuring positions |

Understanding forex positions is essential for navigating the forex market effectively. It allows traders to analyze and manage their risk, as well as make informed decisions about when to enter and exit trades.

In the world of Forex trading, understanding positions is essential for success. A forex position refers to the amount of a particular currency held by a trader. It represents the trader’s exposure to that specific currency in the forex market.

When traders enter a forex trade, they can take one of two types of positions: long or short. A long position means that the trader expects the value of the currency to increase in relation to another currency. On the other hand, a short position indicates the trader expects the value of the currency to decrease.

Read Also: Understanding the Pattern of ABCD: Everything You Need to Know

Forex positions are measured in lots. A standard lot represents 100,000 units of the base currency, while a mini lot represents 10,000 units, and a micro lot represents 1,000 units. The position size depends on the trader’s risk tolerance and account size.

It’s important to note that forex positions are not necessarily held overnight. Traders can open and close positions within seconds, minutes, hours, or days, depending on their trading strategy. In addition, forex positions can be held for longer periods, known as swing trading or position trading.

Managing a forex position involves monitoring the market, setting stop-loss and take-profit levels, and making strategic decisions based on market analysis. Traders can also use leverage to magnify their positions, but this comes with increased risk.

In conclusion, understanding forex positions is crucial for navigating the forex market. By comprehending the different types of positions, position sizing, and risk management techniques, traders can make informed decisions and increase their chances of success in the competitive world of forex trading.

A forex position refers to a trade that a trader has taken in the foreign exchange market. It represents the amount of a particular currency pair that a trader has bought or sold.

To determine your forex position, you need to consider the amount of currency you have bought or sold in a particular currency pair. If you have bought more of a currency than you have sold, you have a long position. If you have sold more than you have bought, you have a short position.

Holding a forex position carries several risks. One of the main risks is currency exchange rate fluctuations, which can lead to losses if the exchange rate moves against your position. Additionally, there are geopolitical and economic factors that can impact currency prices. It is important to carefully monitor your positions and have risk management strategies in place.

Yes, you can close your forex position early. This is known as taking a profit or a loss. By closing the position, you are effectively exiting the trade and realizing any gains or losses. It is a common practice to close positions if the market conditions change or if you have achieved your desired profit or loss.

A long forex position refers to buying a currency with the expectation that its value will rise. A trader profits from a long position if the exchange rate of the currency pair increases. On the other hand, a short forex position refers to selling a currency with the expectation that its value will decrease. A trader profits from a short position if the exchange rate of the currency pair goes down.

A forex position refers to the amount of a currency that a trader owns and holds in their trading account.

Forex positions are traded in the foreign exchange market, where traders buy and sell different currencies with the aim of making a profit.

Is Cebuana a Bank? When it comes to managing our finances, it is essential to have a clear understanding of the financial institutions we interact …

Read ArticleHow to Enable Short Selling on IBKR Short selling is a popular strategy in the stock market where traders bet on the decline of a stock’s price. …

Read ArticleDiscover Effective Forex Trading Strategies Forex trading is a dynamic and fast-paced market where traders buy and sell currency pairs with the aim of …

Read ArticleCan you trade Forex on Yahoo Finance? Yahoo Finance is a popular platform that provides a wide range of financial information, including stock quotes, …

Read ArticleMonitoring with a Tracking Signal: Everything You Need to Know Monitoring signals is crucial for maintaining efficient operations and identifying …

Read ArticleWhat is the rule of 3 in hematology? Hematology is a branch of medicine that focuses on studying blood and its diseases. It plays a critical role in …

Read Article