What Profession is Forex Trading? Understanding the Role and Expertise

What is the Role of a Forex Trader? Forex trading is a profession that requires a deep understanding of the financial markets and the ability to make …

Read Article

When it comes to trading in the Forex market, one of the most important factors to consider is the cost of trading. A major component of these costs is the commission charged by Forex brokers. Understanding how Forex broker commissions work and how they can impact your trading costs is essential for any Forex trader.

Forex broker commissions can vary significantly from one broker to another. Some brokers charge a fixed commission per trade, while others charge a percentage of the trade size. Additionally, there may be other fees and charges associated with trading on certain platforms or using specific trading tools.

It’s crucial to understand how these commissions are calculated and how they can impact your overall trading costs. For example, a fixed commission per trade may be more cost-effective for traders who make larger trades, while a percentage-based commission may be more suitable for traders who make smaller trades but trade frequently.

Furthermore, traders should consider the overall quality of the services provided by a Forex broker, in addition to the commission structure. Factors such as customer support, trading platform features, and order execution speed can all influence the value for money a broker offers.

By understanding how Forex broker commissions work and considering the overall trading costs, traders can make more informed choices when selecting a broker. This can ultimately lead to more profitable trades and a better trading experience overall.

Forex broker commissions refer to the fees charged by a forex broker for executing trades on behalf of traders. When you open a forex trading account, brokers typically don’t charge a commission on each trade. However, they make money by incorporating their commission into the spread, which is the difference between the bid and ask price of a currency pair.

There are two main types of forex broker commissions:

In addition to trading commissions, brokers may also charge other fees for various services, such as overnight financing (swap) charges, account maintenance fees, or withdrawal fees. It’s important to carefully review a broker’s fee structure before choosing to trade with them to ensure you understand the costs involved.

Forex broker commissions are an important factor to consider when trading forex, as they impact your overall trading costs. While some traders may prioritize lower spreads, others may prefer a commission-based model with tighter spreads. Ultimately, the choice of commission structure depends on your trading strategy, trading volume, and preferences.

Overall, forex broker commissions play a crucial role in determining the profitability of your trades. By understanding how commissions are calculated and choosing a broker with a favorable fee structure, you can minimize your trading costs and potentially enhance your trading returns.

Commissions play a crucial role in Forex trading as they directly impact the costs associated with executing trades. When trading Forex, it is important to understand how commissions are calculated and how they can affect your overall trading expenses.

Read Also: Understanding the Taxation of Incentive Stock Options in the US

In Forex trading, commissions are fees that brokers charge for facilitating trades. They can be structured in different ways, depending on the broker and the type of trading account. Generally, commissions are either fixed or variable, and they are typically charged on a per-trade basis.

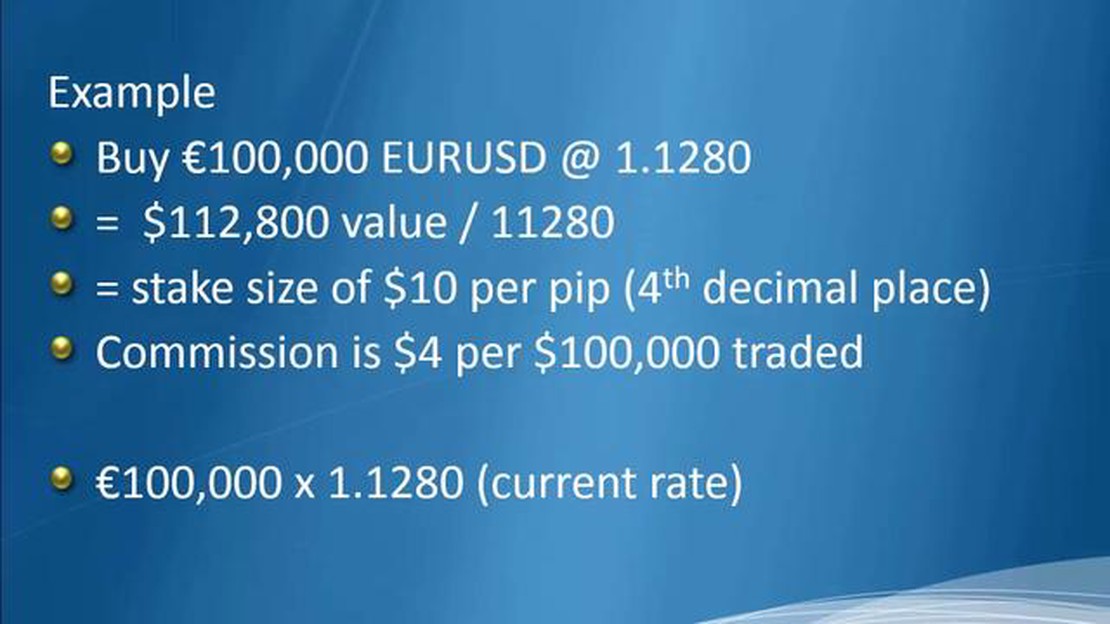

Fixed commissions are set at a specific dollar amount per trade, regardless of the size of the trade or the trading volume. This type of commission structure can benefit traders who execute larger trades, as the commission remains the same regardless of trade size. However, it can be less cost-effective for those who engage in smaller trades.

On the other hand, variable commissions are calculated as a percentage of the trade volume. This means that the commission increases as the trade size or trading volume increases. Traders who frequently engage in smaller trades may find variable commissions to be more cost-effective, as they pay a smaller commission compared to fixed commissions.

It is important to consider the impact of commissions on your trading strategy and profitability. While lower-cost commissions may seem attractive, it is essential to evaluate other factors such as spreads, execution quality, and the overall trading conditions offered by the broker.

Read Also: Understanding the Key Differences Between FX Forward and FX Collar

Additionally, traders should be aware of any hidden costs or additional fees that may be associated with certain commission structures. Some brokers may charge additional fees for account maintenance, withdrawals, or inactivity. These costs can add up and significantly impact your trading expenses.

To determine the actual cost of trading, it is recommended to calculate the total cost per trade, which includes not only the commissions but also the spreads, slippage, and any additional fees. This will provide a more accurate representation of the true expenses incurred when executing trades.

In conclusion, understanding the role of commissions in Forex trading is essential for managing your trading costs. By evaluating different commission structures, considering other trading expenses, and choosing a reputable broker, you can optimize your trading strategy and improve your overall profitability.

Forex broker commissions are fees that are charged by brokers for executing trades in the forex market. These commissions can be a fixed amount per trade or a percentage of the trade value.

Forex broker commissions can increase the overall cost of trading. If a broker charges high commissions, it can eat into your profits or increase your losses. It’s important to consider the impact of commissions when choosing a forex broker.

Yes, there are brokers that offer commission-free trading. These brokers typically make money through the spread, which is the difference between the bid and ask price of a currency pair. However, it’s important to note that commission-free trading doesn’t mean the overall trading costs will be lower, as the spread may be wider.

Fixed commissions are a set amount that is charged for each trade, regardless of the trade size. Variable commissions, on the other hand, are calculated as a percentage of the trade value. The choice between fixed and variable commissions depends on your trading style and preferences.

You can calculate the impact of commissions on your trades by considering the commission amount and the trade size. For example, if a broker charges $5 per trade and you trade a lot size of 10,000 units, the commission would be $0.50 per lot. You can then factor in the commission when calculating your overall trading costs and potential profits.

Forex broker commissions are fees charged by brokers for facilitating trading transactions in the forex market. They are typically calculated as a percentage of the trade volume or as a fixed amount per trade.

What is the Role of a Forex Trader? Forex trading is a profession that requires a deep understanding of the financial markets and the ability to make …

Read ArticleHow do you pronounce Benedictine? When it comes to pronouncing the word “Benedictine,” you may encounter some confusion. This guide aims to provide …

Read ArticleUnderstanding the Difference Between Weighted Moving Average and Simple Moving Average (SMA) When it comes to analyzing trends in data, one popular …

Read ArticleProgramming Languages for Algo Trading Algorithmic trading, also known as algo trading, has become increasingly popular in the financial markets. With …

Read ArticleCurrent exchange rate of $1 USD When it comes to currency exchange rates, the value of the US dollar is a topic of interest for many people around the …

Read ArticleIs Questrade a CFD? Questrade is a popular online brokerage platform that offers a range of investment options for traders. One question that often …

Read Article