Trade of the Olmecs: Evidence and Implications | Ancient Mesoamerican Civilization

Trade in the Olmec Civilization: Uncovering Ancient Networks The Olmecs, a pre-Columbian civilization that thrived in Mesoamerica from 1200 BCE to 400 …

Read Article

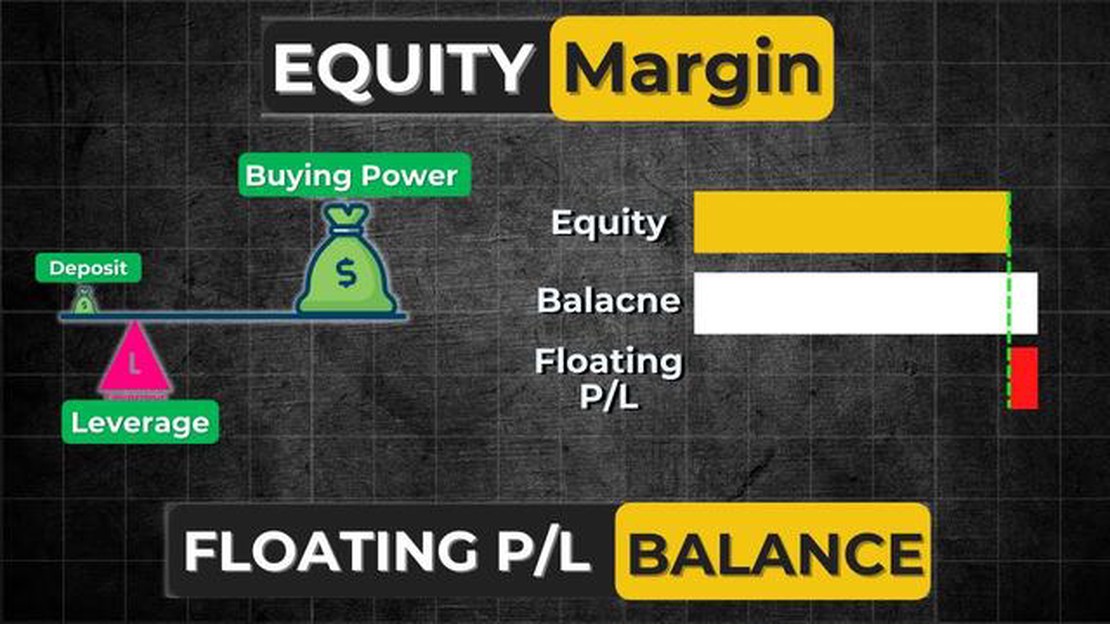

When it comes to finance and accounting, understanding the concept of floating P and L (profit and loss) is crucial. Floating P and L refers to the unrealized gains or losses that can occur when the value of an asset changes over time. It is important for businesses and investors to understand this concept as it can have a significant impact on their overall financial position.

One key concept to understand is that floating P and L is different from realized P and L. Realized P and L refers to gains or losses that have been actually incurred and can be attributed to a specific transaction. On the other hand, floating P and L refers to gains or losses that have not yet been realized because the asset has not been sold or settled.

Calculation methods for floating P and L can vary depending on the type of asset and the market in which it is traded. For example, in the stock market, floating P and L is often calculated by taking the current market price of a stock and subtracting the purchase price. This calculation can be used to determine the unrealized gains or losses for a particular stock position.

Another important calculation method for floating P and L is known as mark-to-market valuation. This method involves regularly revaluing assets to reflect their current market value. By using this method, businesses and investors can accurately track their floating P and L and make informed decisions about when to buy or sell assets.

Overall, understanding floating P and L is essential for anyone involved in finance and accounting. It provides valuable insights into the potential gains or losses that can occur as the value of assets fluctuate. By mastering the key concepts and calculation methods, businesses and investors can effectively manage their financial position and make informed decisions.

Floating P and L, also known as floating profit and loss or unrealized profit and loss, refers to the profit or loss that is derived from open positions that have not been closed yet. It is the difference between the current market value of an open position and its original cost.

Floating P and L can be positive or negative. When the market value of an open position increases, it results in a positive floating P and L. On the other hand, if the market value decreases, it leads to a negative floating P and L.

Floating P and L is not considered as realized profit or loss since it only represents the potential gain or loss on open positions. It becomes realized when the position is closed and the profit or loss is actually locked in and added to the overall account balance.

Traders and investors need to closely monitor their floating P and L to assess the profitability and performance of their open positions. It provides insight into the financial health of their trading activity and helps in making informed decisions regarding when to close positions to secure gains or limit potential losses.

Read Also: Understanding the Exponential Moving Average Filter: A Comprehensive Guide

Floating P and L calculations vary depending on the financial instrument and trading platform used. However, in general, it is calculated by subtracting the original cost of the position from its current market value.

In summary, floating P and L represents the unrealized profit or loss from open positions and provides insight into the profitability and performance of these positions. Monitoring and managing floating P and L is crucial for successful trading and investing.

Floating Profit and Loss (Floating P&L) refers to the unrealized profits or losses incurred by an investor or trader on open positions that have not been closed. It is a measurement of the current value of an open position, taking into account the market price movements.

Floating P&L is an essential concept in financial analysis because it provides insight into the potential risks and rewards of an investment or trading strategy. By monitoring the Floating P&L, investors and traders can assess the performance and value of their open positions in real-time, allowing them to make informed decisions and adjust their strategies accordingly.

Understanding Floating P&L is particularly crucial in volatile markets where asset prices can fluctuate rapidly. It helps investors and traders to gauge the profitability of their open positions and determine whether to take profits or cut losses. By regularly monitoring the Floating P&L, market participants can assess the overall health of their portfolios and identify potential opportunities or risks.

Calculating Floating P&L involves multiplying the difference between the current market price and the entry price by the position size. If the difference is positive, it represents an unrealized profit, while a negative difference indicates an unrealized loss. The Floating P&L is constantly changing as market prices fluctuate, and it only becomes realized once the position is closed.

Read Also: Understanding the Relationship: Stock-Based Compensation and Deferred Tax Assets

In conclusion, Floating P&L is a crucial metric in financial analysis as it allows investors and traders to assess the value and performance of their open positions in real-time. By monitoring Floating P&L, market participants can make informed decisions and adjust their strategies accordingly, enhancing their overall profitability and risk management.

Floating P and L, or profit and loss, refers to the constantly changing financial gains or losses that a business experiences over a given period of time. It is the result of subtracting expenses from revenue. In the context of trading, it specifically refers to the unrealized gains or losses on open positions.

Understanding the key concepts of floating P and L is essential for traders and businesses to effectively manage their finances and make informed decisions. By monitoring and analyzing their P and L, they can identify trends, assess the success of different strategies, and make adjustments to improve their financial performance.

Floating P and L, also known as floating profit and loss, refers to the unrealized gains or losses on open positions in a trader’s account. It represents the profit or loss that would be realized if the positions were closed at the current market price.

Floating P and L is calculated by taking the difference between the current market price and the price at which the position was opened, and then multiplying that difference by the position size.

Floating P and L represents unrealized gains or losses on open positions, while realized P and L represents the actual gains or losses realized when a position is closed.

Floating P and L can be used to monitor the profitability of open positions and make informed decisions about whether to close the positions or hold them for further gains. It can also be used to set stop-loss and take-profit levels to limit potential losses or lock in profits.

Floating P and L can be affected by changes in market prices, volatility, interest rates, and other factors that impact the value of the underlying instruments. It is important to keep track of these factors and their potential impact on Floating P and L when trading.

Trade in the Olmec Civilization: Uncovering Ancient Networks The Olmecs, a pre-Columbian civilization that thrived in Mesoamerica from 1200 BCE to 400 …

Read ArticleUnderstanding the Currency Strength Indicator in MetaTrader When it comes to forex trading, understanding the strength of different currencies can be …

Read ArticleWhat is an example of a currency carry trade? When it comes to investing in the foreign exchange (forex) market, one popular strategy that traders …

Read ArticleUnderstanding the High and Low of the Day When it comes to financial markets, understanding the concepts of “high of the day” and “low of the day” is …

Read ArticleIs grant date the same as vesting date? When it comes to equity compensation plans, such as stock options or restricted stock units (RSUs), there are …

Read ArticleTrading Oil on Forex: Is it Possible? Forex trading has long been associated with currency pairs and the global foreign exchange market. However, many …

Read Article