Level 2 vs Level 3 Options Trading on Robinhood: Understanding the Differences

Understanding the Difference between Level 2 and Level 3 Options Trading on Robinhood When it comes to options trading on Robinhood, there are two …

Read Article

Share-based payment is a common practice in today’s corporate world, and understanding its intricacies is crucial for both investors and companies. In this article, we will dive into the details of share-based payment under International Financial Reporting Standard 2 (IFRS 2) to provide you with a comprehensive understanding of this accounting framework.

IFRS 2 sets out the accounting treatment for equity-based compensation arrangements, such as stock options and employee share purchase plans. These arrangements are often used by companies to attract and retain talented employees or to incentivize them to achieve specific performance goals.

Under IFRS 2, share-based payment transactions are recognized as expenses in the financial statements, with the fair value of the equity instruments being measured at the grant date. This fair value is then expensed over the vesting period, reflecting the employees’ service period and the probability that they will meet the vesting conditions.

Furthermore, IFRS 2 requires companies to estimate the fair value of the equity instruments granted using appropriate valuation techniques. This can be a complex process, as it involves considering various factors such as the market price of the company’s shares, expected dividends, volatility, and the expected exercise behavior of the employees.

In conclusion, understanding share-based payment under IFRS 2 is essential for both investors and companies, as it provides valuable insights into the true financial position of a company and its ability to attract and retain talented employees. By following the guidelines set out in IFRS 2, companies can ensure transparent and accurate reporting of their share-based payment transactions.

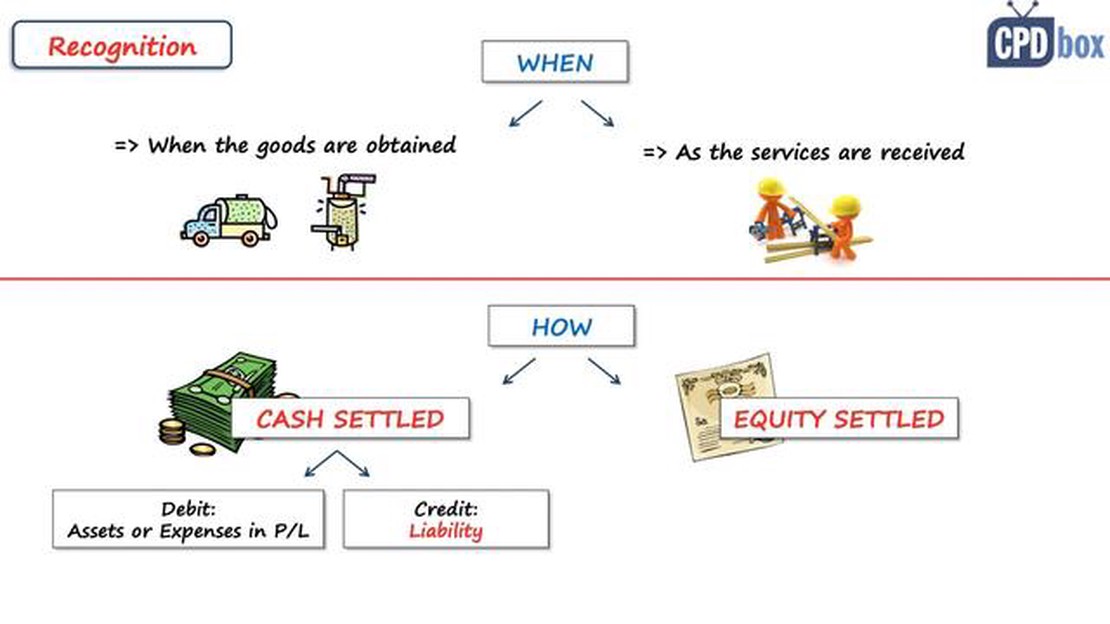

Share-based payment refers to a transaction in which an entity receives goods or services as consideration for its equity instruments or by incurring liabilities to transfer rights to those equities to other parties.

Under International Financial Reporting Standards (IFRS) 2, entities are required to account for share-based payment transactions, which include employee stock options, share appreciation rights, and restricted share plans.

One of the key aspects of IFRS 2 is the determination of the fair value of the equity instruments granted. This requires entities to use valuation methodologies and assumptions that reflect market conditions at the grant date. The fair value of the equity instruments affects the recognition, measurement, and disclosure of share-based payment transactions in the financial statements.

IFRS 2 also provides guidance on the recognition and measurement of the expense associated with share-based payment transactions. This involves determining the vesting period, which is the time over which the employees become entitled to the equity instruments granted. The expense is recognized over this vesting period, considering any non-market performance conditions that may apply.

Furthermore, IFRS 2 requires entities to disclose information about their share-based payment transactions in the financial statements. This includes details of the nature and extent of the share-based payment arrangements, the inputs used in the valuation of equity instruments, and the impact on profit or loss and equity.

It is important for entities to comply with the guidance provided by IFRS 2 to ensure the proper accounting and disclosure of share-based payment transactions. This will enhance transparency and enable stakeholders to make informed decisions regarding the entity’s financial performance and value.

Read Also: Playing Forex: A Comprehensive Guide to Forex Trading

In conclusion, understanding share-based payment under IFRS 2 is crucial for entities as it provides guidance on the accounting, measurement, and disclosure of these transactions. Compliance with IFRS 2 will ensure accurate financial reporting and improve the transparency of an entity’s share-based payment arrangements.

Share-based payment, as defined by the International Financial Reporting Standards (IFRS) 2, refers to transactions in which an entity acquires goods or services through equity instruments (such as shares or share options) as consideration. These transactions can be settled in either cash or equity, and can be classified into equity-settled or cash-settled transactions.

Equity-settled transactions involve the issuance of equity instruments to the employees or other parties as compensation for goods or services rendered. Under this method, the entity records the fair value of the equity instruments granted as an expense or capitalizes it as part of the cost of the related asset or service.

Cash-settled transactions, on the other hand, require the entity to settle the obligation through cash payments. The fair value of the liability is measured at each reporting date, with any changes in fair value impacting the income statement accordingly.

Read Also: Understanding Exponentially Weighted Moving Average in Deep Learning

Share-based payment transactions can have a significant impact on an entity’s financial statements, affecting areas such as earnings per share, income tax, and the measurement of assets and liabilities. It is therefore crucial for entities to adhere to IFRS 2 guidelines and accurately report and disclose share-based payment transactions.

IFRS 2, also known as International Financial Reporting Standard 2, is an accounting standard that addresses the accounting treatment for share-based payments. It provides guidance on how to recognize, measure, and disclose share-based payment transactions, such as stock options and equity-settled share-based payments.

Here are some key features and requirements of IFRS 2:

Overall, IFRS 2 provides a comprehensive framework for the accounting treatment of share-based payment transactions, ensuring that companies accurately reflect the economic substance of these transactions in their financial statements.

IFRS 2 is a global accounting standard that governs the recognition and measurement of share-based payment transactions. It provides guidance on how companies should account for equity-based compensation, such as stock options or share appreciation rights.

IFRS 2 requires companies to recognize the fair value of share-based payments as an expense in their financial statements. This means that companies need to record the value of the equity-based compensation they grant to employees as an expense, which can have a significant impact on their reported earnings.

IFRS 2 covers a wide range of share-based payment arrangements, including stock options, restricted stock units, and performance-based shares. It also applies to share-based payments issued to non-employees, such as consultants or suppliers.

IFRS 2 requires companies to use a valuation model to determine the fair value of share-based payments. The most commonly used valuation model is the Black-Scholes-Merton model, which takes into account factors such as the current price of the company’s stock, the exercise price of the options, the expected volatility of the stock, and the time to maturity of the options.

Yes, IFRS 2 allows for certain exemptions and practical expedients. For example, companies can choose not to apply IFRS 2 to transactions with a maximum vesting period of less than three months. Additionally, IFRS 2 provides guidance on how to account for modifications, cancellations, and settlements of share-based payment transactions.

Understanding the Difference between Level 2 and Level 3 Options Trading on Robinhood When it comes to options trading on Robinhood, there are two …

Read ArticleBuy Volkswagen Shares in India: A Comprehensive Guide Investing in the stock market can be a lucrative endeavor, especially if you make informed …

Read ArticleWhat is the Moving Average Crossover Strategy for Forex? Forex trading is a complex and ever-evolving market, where traders are constantly seeking new …

Read ArticleAre stock options transferrable? Stock options are a popular form of compensation for employees, offering them the opportunity to purchase company …

Read ArticleReasons for the Strengthening of the Zloty The Zloty, the national currency of Poland, has been experiencing a significant strengthening in recent …

Read ArticleUnderstanding MACD 5 35 5: A Comprehensive Guide The Moving Average Convergence Divergence (MACD) is a popular technical indicator used by traders and …

Read Article