What is the Minimum Deposit in FBS? 2021 Update

Minimum Deposit in FBS: What’s the Amount? Introduction: Table Of Contents What is the Minimum Deposit in FBS? FBS: Overview Minimum Deposit in 2021 …

Read Article

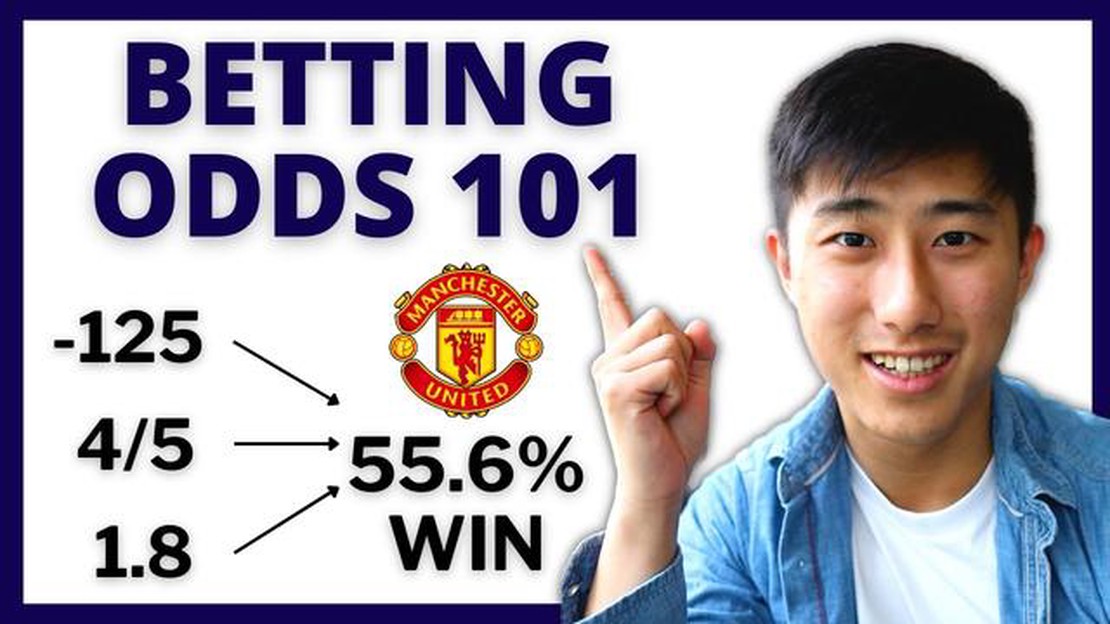

Trading in financial markets can seem overwhelming and complex, especially for beginners. However, one type of trading that offers a simplified and accessible way to participate in the markets is financial fixed odds. In this beginner’s guide, we will explore the basics of financial fixed odds trading and help you understand how it works.

Financial fixed odds trading is a form of trading where you predict the outcome of a financial market event - such as whether the price of a particular asset will rise or fall within a specified time frame. It is called “fixed odds” because the potential profit and loss are fixed and known in advance. This means that the trader knows exactly how much they stand to gain or lose before placing a trade.

One of the key advantages of financial fixed odds trading is its simplicity. Unlike other forms of trading, such as traditional stocks or forex trading, there are no complicated charts or complex analysis involved. Instead, traders only need to make a simple prediction about the direction of the market, based on their knowledge and understanding of the underlying asset.

Another advantage of financial fixed odds trading is the ability to trade in a wide range of markets, including stocks, currencies, commodities, and indices. This allows traders to diversify their portfolio and take advantage of different market opportunities, without the need for multiple trading accounts or platforms.

Financial fixed odds trading offers a beginner-friendly and accessible way to participate in the financial markets. By understanding the basics of this trading method and learning how to make informed predictions, even beginners can potentially profit from trading in various markets.

In the following sections of this guide, we will delve deeper into the mechanics of financial fixed odds trading, discuss risk management strategies, and provide tips for success. Whether you are a complete novice or have some trading experience, this guide will help you navigate the world of financial fixed odds and develop your trading skills.

Financial Fixed Odds trading is a popular method of speculating on the financial markets. It allows traders to make predictions about the future price movements of various assets and profit from their correct forecasts. Here are some of the basics to understand about this type of trading:

1. Contract

A financial fixed odds trade is conducted through a contract between a trader and a broker. The contract specifies the terms of the trade, including the asset being traded, the expiry date, and the potential payout. Traders predict whether the price of the asset will be above or below a certain level at the expiry of the contract.

2. Assets

Financial fixed odds trading allows traders to speculate on a wide range of assets, including stocks, indices, currencies, and commodities. Traders can choose the asset that they are most familiar with or interested in to make their predictions.

Read Also: Understanding BNM FEA Rules: Everything You Need to Know

3. Expiry

Each financial fixed odds trade has an expiry date and time. This is the point at which the trade is closed, and the outcome is determined. Depending on the broker and the chosen asset, the expiry can be as short as a few minutes or as long as several months.

4. Potential Payout

When entering into a financial fixed odds trade, traders are aware of the potential payout they can receive if their prediction is correct. The payout amount is predetermined and can vary depending on the chosen asset and the specific terms of the contract. Traders should carefully consider the potential payout before entering a trade.

5. Risks

Like any form of trading, financial fixed odds trading carries risks. Traders can lose their initial investment if their predictions are incorrect. It is important for traders to have a clear risk management strategy in place and to only trade with funds they can afford to lose.

Financial fixed odds trading offers an accessible way for beginners to start trading in the financial markets. By understanding the basics of this trading method, traders can make informed decisions and potentially profit from their predictions.

Financial Fixed Odds (FFOs) are a type of trading method that allows investors to speculate on the outcome of various financial markets. This trading approach is based on the concept of fixed odds betting, which is commonly used in gambling.

Read Also: Do Option Traders Receive Dividends? Exploring the Impact of Dividends in Option Trading

Unlike traditional trading methods, FFOs offer a fixed payout amount if the investor’s prediction is correct. This means that the potential profit or loss is predetermined before the trade is executed. The investor knows exactly how much they stand to gain or lose, making FFOs a relatively straightforward trading option.

FFOs can be used to trade various financial instruments, such as stocks, currencies, commodities, and indices. The investor chooses an asset they want to trade and predicts whether the price will rise or fall within a specified time frame. If their prediction is correct, they receive the predetermined payout. If their prediction is incorrect, they lose their initial investment.

One of the key advantages of FFOs is the simplicity of the trading process. Investors do not need to possess in-depth knowledge of financial markets or advanced trading strategies. FFOs offer a user-friendly interface, making them accessible to beginners and experienced traders alike.

However, it is important to note that trading FFOs carries its own risks. The fixed payout structure means that investors may not have the same potential for higher profits compared to other trading methods. Additionally, FFOs typically have expiration times, which means that investors need to carefully consider the timing of their trades.

In conclusion, Financial Fixed Odds offer a simple and straightforward way to trade various financial markets. They provide a fixed payout structure, allowing investors to know their potential profit or loss before executing a trade. While FFOs are accessible to beginners, it is essential to understand the risks involved and to carefully consider trade timing.

Financial fixed odds are a type of trading that allows investors to bet on the direction of the financial markets. They are fixed-odds bets, meaning that the investor knows the exact amount they stand to win or lose before they place the trade.

Financial fixed odds work by allowing investors to place bets on whether the price of a financial asset, such as a stock or a currency, will go up or down. Investors choose the amount they want to bet and the odds they want to bet at, and if they predict the direction of the market correctly, they win their initial bet plus the winnings specified by the odds.

Yes, financial fixed odds can be suitable for beginners because they offer a fixed-risk, fixed-reward approach to trading. This means that beginners can know the exact amount they stand to win or lose before they place a trade, which can help them manage their risk more effectively.

There are several advantages to trading financial fixed odds. Firstly, they offer a fixed-risk, fixed-reward approach, which allows traders to know the exact amount they stand to win or lose before they place a trade. Additionally, financial fixed odds can be traded on a wide range of assets, including stocks, currencies, and commodities. Finally, financial fixed odds can provide opportunities for short-term trading, allowing traders to profit from both rising and falling markets.

Yes, like any form of trading, there are risks involved in trading financial fixed odds. The main risk is that the investor’s prediction of the direction of the market is incorrect, resulting in a loss of their initial bet. It is important for investors to carefully consider their risk tolerance and only risk amounts they are willing to lose. Additionally, the odds offered by the trading platform may not accurately reflect the true probability of the market moving in a certain direction, so it is important to do thorough research and analysis before placing trades.

Minimum Deposit in FBS: What’s the Amount? Introduction: Table Of Contents What is the Minimum Deposit in FBS? FBS: Overview Minimum Deposit in 2021 …

Read ArticleAdvantages of Binary Over Text Many people in the digital world may argue that text is the go-to format for communication and data storage. However, …

Read ArticleUnderstanding the IAS 21 Standard of Accounting The International Accounting Standard (IAS) 21 is a standard formulated by the International Financial …

Read ArticleWhat is a voice trader? A voice trader plays a crucial role in the fast-paced and complex world of financial markets. While much trading occurs …

Read ArticleUnderstanding the Commodity System: Definition and Key Principles When it comes to the global economy, understanding the commodity system is crucial. …

Read ArticleMaking money from triangular arbitrage: A comprehensive guide Triangular arbitrage is a trading strategy that takes advantage of price differences …

Read Article