Complete Guide on Utilizing the ADX Indicator in Forex Trading

ADX Indicator in Forex Trading: A Comprehensive Guide The Average Directional Index (ADX) is a popular technical indicator used in forex trading to …

Read Article

When it comes to understanding compensation rates, there are a few key factors that every employee and employer should know. Compensation rates refer to the amount of money a person receives for their work, and it can vary significantly depending on various factors. By understanding these factors and how they affect compensation rates, you can make informed decisions regarding your career or your workforce.

One important factor that affects compensation rates is the level of skills and qualifications required for a particular job. Jobs that require specialized skills or advanced degrees often come with higher compensation rates. This is because individuals with these qualifications are in high demand and are essential to the success of many industries. On the other hand, jobs that require minimal skills or qualifications may have lower compensation rates.

Another important factor that affects compensation rates is the demand for a particular job or industry. Jobs that are in high demand, such as those in the technology or healthcare fields, often come with higher compensation rates. This is because employers are willing to pay more to attract and retain top talent in these competitive industries. Conversely, jobs that are in low demand may have lower compensation rates.

One more important factor to consider is the cost of living in a specific location. Compensation rates can vary significantly depending on where you live. For example, cities with a higher cost of living, such as New York or San Francisco, generally have higher compensation rates to offset the increased expenses. On the other hand, areas with a lower cost of living may have lower compensation rates.

By understanding these factors and considering them when negotiating salaries or determining compensation rates, individuals and employers can make informed decisions that align with market trends and expectations. Ultimately, understanding compensation rates is essential for both employees and employers in order to create a fair and competitive job market.

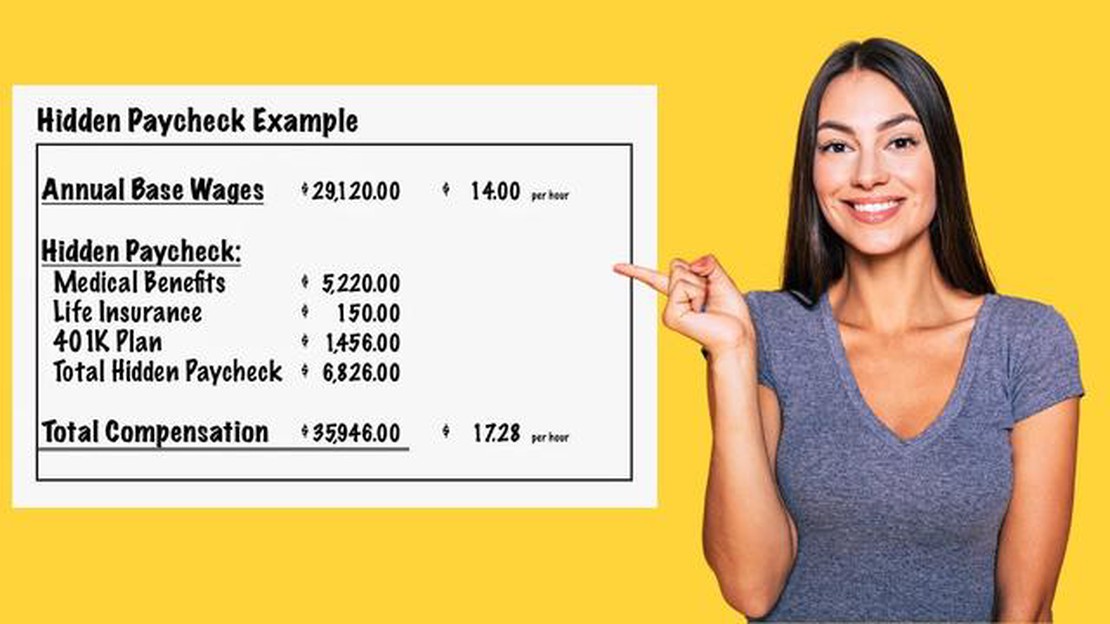

When understanding compensation rates, it’s important to delve into the various components that make up an employee’s total compensation package. This package typically includes more than just a base salary, and understanding the different components can help both employers and employees better evaluate the overall value of a job offer or compensation package.

One key component of compensation rates is the base salary. This is the fixed amount of money that an employee receives on a regular basis, usually in the form of hourly, weekly, biweekly, or monthly payments. The base salary reflects the value of an employee’s skills, experience, and job responsibilities, and it serves as a starting point for calculating other compensation components.

In addition to the base salary, employers may offer other forms of compensation, such as bonuses and commissions. Bonuses are typically one-time payments that are awarded based on an employee’s individual or team performance, while commissions are a percentage of sales or revenue that an employee generates. These additional forms of compensation can provide incentives for employees to perform well and exceed expectations.

Read Also: Step-by-Step Guide: How to Install Expert Advisors (EA) on MT4 PC?

Benefits are another important component of compensation rates. These can include various perks such as health insurance, retirement plans, paid time off, and tuition reimbursement. Benefits are often considered a valuable part of a compensation package as they help employees protect their health, plan for the future, and achieve a better work-life balance.

Finally, some employers may offer additional forms of compensation such as stock options, profit sharing, or company equity. These components can offer employees the opportunity to share in the financial success of the company and can be a significant source of long-term wealth accumulation.

By understanding the different compensation rate components, both employers and employees can have a clearer understanding of the overall value of a job offer or compensation package. It’s important to evaluate not only the base salary but also the other forms of compensation and benefits that are included. This holistic approach can help ensure that employees are fairly compensated for their skills and contributions, while employers can attract and retain top talent in a competitive job market.

When it comes to determining compensation rates, several factors come into play. Employers consider a wide range of factors to determine the appropriate compensation for a position. Here are some of the key factors that can affect compensation rates:

Read Also: Choosing the Best Indicator for a 5 Minute Chart: A Comprehensive Guide

Understanding the factors that affect compensation rates is crucial for both employers and employees. Employers need to ensure that they are offering competitive compensation to attract and retain top talent, while employees need to be aware of the factors that can influence their earning potential.

Compensation rate is the amount of money an employee receives for their work. It usually refers to the hourly or annual wage that a person earns.

The compensation rate is determined by several factors, including the level of experience and education of the employee, the industry standards, and the company’s budget. It can also be influenced by factors such as location and demand for certain skills.

Some common types of compensation rates include hourly wages, salary, commission-based pay, and bonuses. Each type has its own benefits and considerations, depending on the job role and industry.

Yes, compensation rates can vary significantly between industries. Certain industries, such as technology or finance, often pay higher wages due to the specialized skills and high demand for workers in these sectors. On the other hand, industries such as retail or hospitality may have lower compensation rates due to lower skill requirements.

Yes, there are legal requirements for setting compensation rates. These requirements include adhering to minimum wage laws, complying with equal pay regulations, and following any industry-specific labor laws. Employers should ensure they are in compliance with these regulations to avoid legal issues and protect the rights of their employees.

Compensation rates are determined by various factors including industry standards, job role and responsibilities, employee experience and qualifications, and the cost of living in a particular area.

ADX Indicator in Forex Trading: A Comprehensive Guide The Average Directional Index (ADX) is a popular technical indicator used in forex trading to …

Read ArticleTrading NIFTY Options for Intraday Gain: Tips and Strategies Options trading in the NIFTY index can be a highly profitable venture for intraday …

Read ArticleWho owns Moex? The Moscow Exchange (MOEX) is the largest exchange group in Russia and ranks among the top 30 globally in terms of market …

Read ArticleIs IPO Good or Bad? Initial Public Offerings (IPOs) are often seen as a significant milestone for private companies to go public and offer their …

Read ArticleFind the Best Place to Get FX Rates When it comes to exchanging currency, finding the best FX rates can make a big difference in your wallet. Whether …

Read ArticleUnderstanding the EU ETS in Shipping: A Comprehensive Guide The European Union Emissions Trading System (EU ETS) is a key policy tool aimed at …

Read Article