Are Betting Odds Fixed? Discover the Truth Behind Betting Odds Fixing

Are betting odds fixed? Betting odds fixing is a topic that has long fascinated and concerned both seasoned bettors and curious beginners. The idea …

Read Article

Money exchange tellers play a crucial role in the financial industry, providing a vital service to individuals and businesses alike. Whether you’re planning to travel abroad, sending money to a loved one in another country, or conducting international business transactions, you’ll inevitably come into contact with a money exchange teller.

These knowledgeable professionals are trained to handle various foreign currencies, ensuring that you receive the correct amount of money in the appropriate currency. They possess a deep understanding of exchange rates and can provide valuable advice on optimizing conversions. Money exchange tellers are not only responsible for converting currencies, but they also play a crucial role in detecting counterfeit money and preventing fraudulent activities.

With the increasing globalization of business and travel, the demand for money exchange tellers is higher than ever. This guide aims to provide you with a comprehensive overview of the essential role of a money exchange teller, their responsibilities, and the skills required to excel in this profession. Whether you’re considering a career in this field or simply want to understand the intricacies of currency exchange, this guide has got you covered.

A money exchange teller plays a crucial role in facilitating the exchange of currencies for customers. With the globalized economy, international travel, and trade becoming increasingly common, the need for money exchange services has grown significantly. Money exchange tellers are responsible for providing efficient and reliable services to ensure smooth currency transactions.

One of the main responsibilities of a money exchange teller is to accurately convert one currency into another. They must have in-depth knowledge of exchange rates and be able to perform calculations quickly and accurately. This ensures that customers receive the correct amount of money in the desired currency and that the exchange process is fair and transparent.

In addition to currency exchange, money exchange tellers also assist customers with other financial transactions. They may provide information about various banking services, such as wire transfers, traveler’s checks, and money orders. A money exchange teller must be familiar with the policies and procedures of their institution and adhere to regulatory guidelines to ensure compliance and prevent fraudulent activities.

Another crucial aspect of a money exchange teller’s role is customer service. They interact with a diverse range of customers, including tourists, business travelers, and individuals sending money overseas. Money exchange tellers must exhibit a helpful and professional demeanor, answering inquiries and providing assistance in a friendly and efficient manner.

Accuracy and attention to detail are essential qualities for a money exchange teller. They must carefully count and verify the currency being exchanged to avoid errors or discrepancies. Additionally, they may need to identify counterfeit or damaged money to protect both the customer and the financial institution.

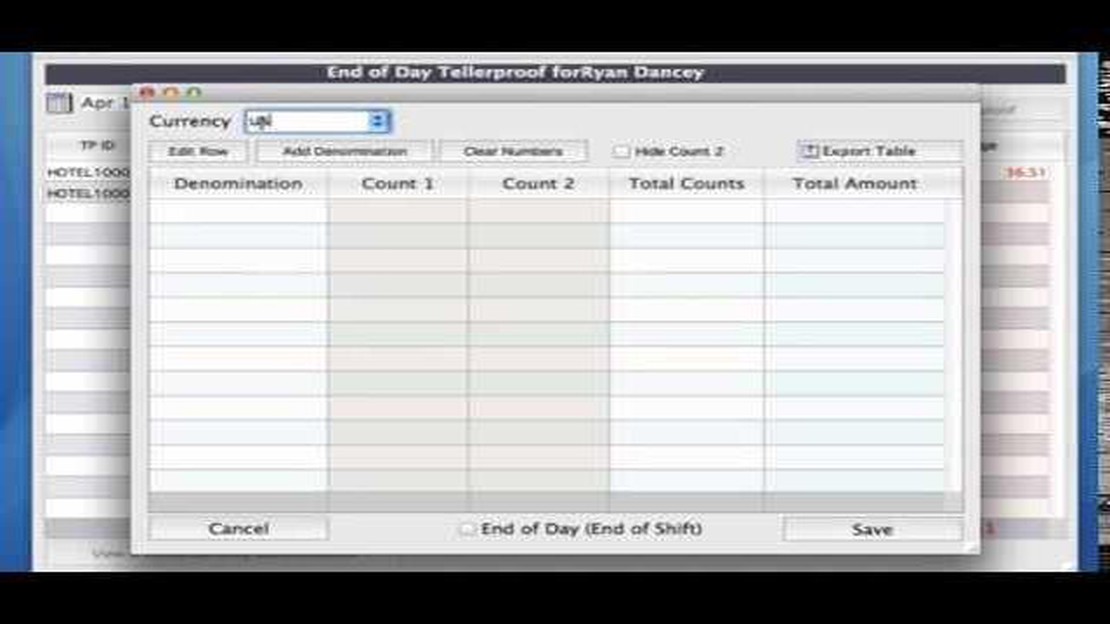

Furthermore, money exchange tellers must be skilled in using various financial software and technology. They may need to operate currency counting machines, check identification documents, and maintain accurate records of transactions. Proficiency in these areas ensures that the exchange process is efficient and secure.

In conclusion, the role of a money exchange teller is essential in providing reliable and efficient currency exchange services. They play a crucial role in the global economy by facilitating international transactions and assisting customers in their financial needs. With their knowledge, accuracy, and customer service skills, money exchange tellers contribute to ensuring a seamless and trustworthy exchange process.

Read Also: Understanding the Jurik Moving Average in MT5: An Essential Guide

In the world of global business and commerce, international transactions have become an everyday occurrence. With businesses expanding their operations across borders, the need to exchange currencies has become paramount. This is where money exchange tellers play a crucial role.

Money exchange tellers are professionals who work in banks, currency exchange offices, or financial institutions. Their primary responsibility is to facilitate the conversion of one currency into another for individuals and businesses alike. They provide an essential service by ensuring that businesses can operate smoothly across different countries and currencies.

One reason why money exchange tellers are crucial for international transactions is their expertise in foreign currencies. They have in-depth knowledge of various currencies, their exchange rates, and factors that influence them. This expertise allows them to accurately calculate the conversion rates and provide customers with the most favorable rates possible.

Additionally, money exchange tellers help in reducing the risk associated with currency fluctuations. Exchange rates are subject to constant change, and this volatility can significantly impact the value of transactions. Money exchange tellers help individuals and businesses by providing advice on the best time to exchange currencies, minimizing the risks and maximizing the returns.

Furthermore, money exchange tellers play a vital role in detecting counterfeit currencies. They are trained to identify fake bills and counterfeit money, ensuring that no illicit funds enter circulation. Their expertise in spotting counterfeit currencies helps in maintaining the integrity of financial systems and protecting businesses and individuals from financial fraud.

Lastly, money exchange tellers contribute to the overall economic stability of countries. By facilitating international transactions, they contribute to the growth of businesses and promote foreign trade. Their role ensures the smooth functioning of international commerce, which is vital for economic development and prosperity.

In conclusion, money exchange tellers are crucial for international transactions due to their expertise in foreign currencies, their ability to minimize risk, their role in detecting counterfeit currencies, and their contribution to economic stability. They play a fundamental role in facilitating global business and commerce, making them an integral part of the global financial ecosystem.

A money exchange teller plays a crucial role in the financial industry by facilitating the exchange of currencies for customers. To excel in this profession, a money exchange teller should possess a unique set of skills and qualities. Here are some of the key skills and qualities that a money exchange teller should possess:

Read Also: Cost of Starting Forex Trading in the Philippines | All You Need to Know

By possessing these skills and qualities, a money exchange teller can ensure smooth and efficient currency exchange transactions for customers, contributing to the overall success of the financial institution.

A money exchange teller is responsible for exchanging currency, handling financial transactions, and providing customer service at a money exchange booth or bank. They ensure that customers receive accurate money exchange rates and count and verify money in various currencies.

To become a money exchange teller, one needs excellent mathematical skills, strong attention to detail, and good communication skills. Knowledge of different currencies and their exchange rates is also necessary. Additionally, proficiency in using computerized cash registers can be advantageous for efficient transactions.

A money exchange teller’s daily tasks include exchanging currency for customers, processing financial transactions such as cashing checks or traveler’s checks, calculating exchange rates and fees, maintaining a balanced cash drawer, and providing excellent customer service by addressing inquiries and resolving issues.

Previous experience in a financial or customer service role can be beneficial but is not always required to become a money exchange teller. Many employers provide on-the-job training to teach the necessary skills and knowledge to perform the job effectively.

A successful money exchange teller possesses good organizational skills, the ability to work under pressure, attention to detail, accuracy in counting money and calculating exchange rates, and excellent customer service skills. They are also trustworthy and maintain high levels of professionalism and confidentiality in handling financial transactions.

A money exchange teller is responsible for handling currency exchange transactions, assisting customers with their foreign currency needs, and providing excellent customer service.

As a money exchange teller, it is important to have strong math skills, attention to detail, good communication skills, and the ability to work in a fast-paced environment. Customer service skills and knowledge of different currencies are also important.

Are betting odds fixed? Betting odds fixing is a topic that has long fascinated and concerned both seasoned bettors and curious beginners. The idea …

Read ArticleWhat percentage of people make on Forex? Forex, also known as foreign exchange, is a decentralized global market for trading currencies. With …

Read ArticleWhat Are the Current Open Forex Markets? If you are a trader looking to expand your horizons and explore new avenues of investment, there is no better …

Read ArticleTD Ameritrade Forex Spread: Complete Guide and Analysis Forex trading is a popular investment option for those looking to diversify their portfolio …

Read ArticleBeginner’s Guide: How to Trade Binary Options Binary trading is a popular and potentially profitable way to trade various financial assets online. …

Read ArticleChina’s Foreign Exchange Reserves in 2023: An Insightful Analysis In 2023, China’s foreign exchange reserves reached a new milestone, solidifying its …

Read Article