Understanding the Expiration Date of VIX and its Importance in Trading

Is there an expiration date for VIX? The VIX, or Volatility Index, is a key measure of market expectations for near-term volatility conveyed by S&P …

Read Article

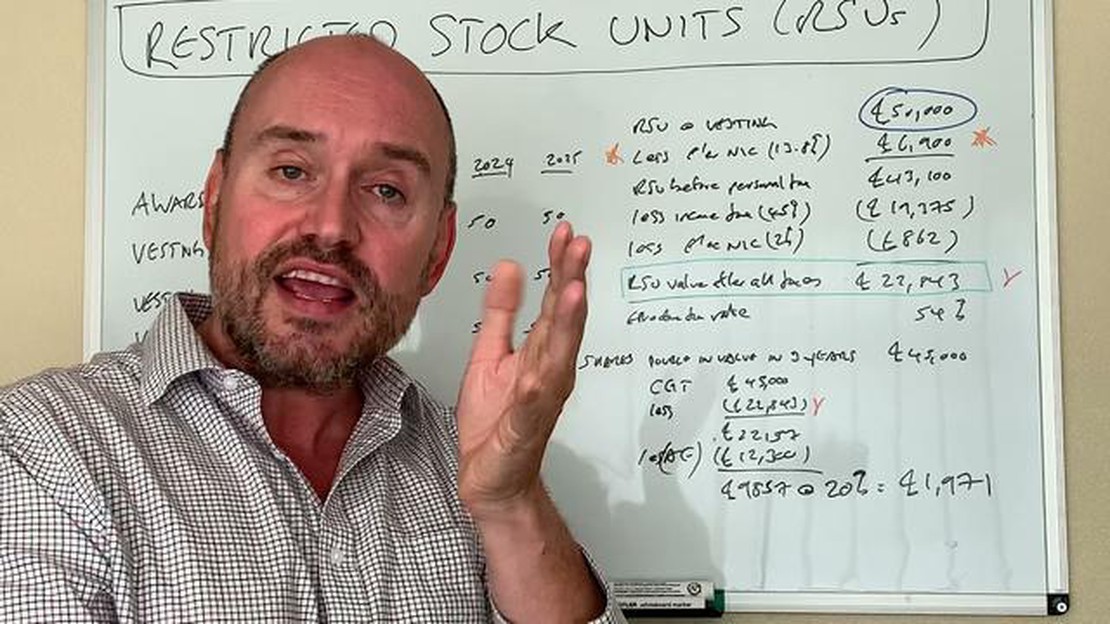

When it comes to employee compensation, one common form of reward is through the issuance of shares in the company. This is known as granting vested shares. However, it’s important to understand that receiving vested shares can have tax implications in the United Kingdom.

When an employee receives vested shares, they are essentially gaining ownership of a portion of the company. This ownership comes with certain tax responsibilities. The key factor in determining the tax treatment of vested shares is the value of the shares at the time they are granted and the value at the time they are vested.

In the UK, there are typically two types of tax that apply to vested shares: income tax and capital gains tax. The treatment of these taxes depends on several factors, including whether the shares were granted under an approved share plan or an unapproved share plan.

Under an approved share plan, such as the Enterprise Management Incentive (EMI) scheme, the tax treatment is generally more favorable. Any gains made when selling the vested shares will be subject to capital gains tax instead of income tax. However, if the shares were granted under an unapproved share plan, the gains will be subject to income tax and potentially National Insurance Contributions (NICs).

Pro tip: Conducting thorough research and consulting a tax advisor is crucial when it comes to understanding and managing the tax implications of vested shares. It’s important to be aware of the various tax rules and regulations in order to make informed decisions and avoid any surprises come tax season.

When you are granted shares by your employer as part of a performance-based incentive plan, it is important to understand the tax implications of vested shares in the UK. Vested shares refer to shares that have been granted to you, but have become fully transferable and can be sold or transferred at your discretion.

One key tax consideration when it comes to vested shares is the date of vesting. This is the date on which the shares become fully transferable and any restrictions or conditions relating to the shares lapse. At this point, the value of the shares is subject to income tax and national insurance contributions.

The tax treatment of vested shares depends on whether they are classified as “restricted securities” or “unrestricted securities”. Restricted securities refer to shares that are subject to certain conditions or restrictions, such as a holding period or performance targets, before they can be fully transferred or sold. Unrestricted securities, on the other hand, can be freely transferred and sold without any restrictions.

If your vested shares are classified as restricted securities, you will generally be subject to income tax and national insurance contributions on the value of the shares at the time of vesting. The value of the shares is typically determined by considering their market value or the amount you paid for the shares, if any. However, if you are subject to a holding period or other conditions, the actual value of the shares may be different from their market value at the time of vesting.

For unrestricted securities, the tax implications are slightly different. The value of these shares may still be subject to income tax and national insurance contributions, but the tax liability is usually deferred until you sell or transfer the shares. The tax liability is then calculated based on the market value of the shares at the time of sale or transfer.

Read Also: Trading Fixed Income: Strategies and Tips for Success

It is worth noting that there may also be additional tax considerations if you are a higher or additional rate taxpayer, as the tax rates and thresholds may differ.

In conclusion, understanding the UK tax implications of vested shares is crucial for anyone who receives shares as part of a performance-based incentive plan. The tax treatment of vested shares depends on factors such as the classification of the shares and the date of vesting. Seeking professional tax advice is recommended to ensure compliance with tax obligations and to optimize your overall tax position.

Vested shares refer to company shares that have been granted to an employee but are subject to certain restrictions or conditions before they can be fully owned by the employee. These conditions are typically time-based or performance-based and are designed to incentivize the employee to stay with the company and contribute to its success.

When you receive vested shares, you do not immediately have to pay tax on them. However, once the shares have vested, meaning the conditions have been met and you gain ownership rights, they become subject to taxation.

The tax obligations related to vested shares can vary depending on the type of shares and the specific circumstances. A common way of taxing vested shares in the UK is through the capital gains tax (CGT) when you eventually sell the shares.

If you sell your vested shares, the gain you make is subject to CGT, which is calculated based on the difference between the sale price and the original cost of the shares. The current CGT rates in the UK are 10% for basic rate taxpayers and 20% for higher and additional rate taxpayers.

Read Also: Stock Option Exercise Tax Implications: Are stock options taxable when exercised?

However, there are certain tax reliefs that you may be eligible for when selling vested shares. For example, the Enterprise Investment Scheme (EIS) and the Seed Enterprise Investment Scheme (SEIS) provide tax relief to individuals who invest in qualifying small and medium-sized companies.

In addition to CGT, you may also be subject to income tax and National Insurance contributions (NICs) on the value of the shares when they vest. The value of the shares is determined by the market value at the time of vesting.

If you receive dividends from your vested shares, these will also be subject to income tax based on your tax bracket. The current dividend tax rates in the UK are 7.5% for basic rate taxpayers, 32.5% for higher rate taxpayers, and 38.1% for additional rate taxpayers.

It is important to keep accurate records of your vested shares and any related transactions for tax purposes. Additionally, it is advisable to consult with a tax advisor or accountant to ensure you understand and meet your tax obligations when it comes to vested shares.

| Tax Obligation | Tax Rate |

|---|---|

| Capital Gains Tax (CGT) | 10% (basic rate taxpayers)20% (higher and additional rate taxpayers) |

| Income Tax | Depends on individual tax bracket |

| National Insurance contributions (NICs) | Depends on individual tax bracket |

| Dividend Tax | 7.5% (basic rate taxpayers)32.5% (higher rate taxpayers)38.1% (additional rate taxpayers) |

Vested shares are company shares that have been granted to employees, usually as part of their compensation package, and have reached a certain vesting period. Once the vesting period is complete, employees gain full ownership and control over these shares.

The tax treatment of vested shares in the UK depends on several factors, such as the type of shares and the employee’s tax residency status. In general, you may be subject to income tax and national insurance contributions when you acquire and sell the shares.

The vesting period for shares is the timeframe set by the company during which employees must wait before they gain full ownership and control over the shares. This period can vary and is typically determined by the company’s stock option plan or share incentive scheme.

In certain circumstances, you may be eligible to defer paying tax on vested shares in the UK. This can be done through the use of tax deferral schemes, such as the Enterprise Management Incentive (EMI) scheme or the Share Incentive Plan (SIP). It is important to seek professional advice to determine if you are eligible for these schemes and how they can be utilized.

Is there an expiration date for VIX? The VIX, or Volatility Index, is a key measure of market expectations for near-term volatility conveyed by S&P …

Read ArticleBuying Foreign Currency from ASB Bank: Everything You Need to Know If you’re planning to travel abroad or engage in international business, you may …

Read ArticleHow to Solve Moving Average Problems Understanding moving averages is a crucial skill for any data analyst or trader. However, many individuals …

Read ArticleUnderstanding Executive Stock Options: A Comprehensive Guide Executive stock options are an important component of compensation packages offered to …

Read ArticleWho is the owner of forex trading? Forex trading is a global decentralized market for the buying and selling of currencies. It operates 24 hours a day …

Read ArticleDiscover What GCM Forex Does GCM Forex is a leading international forex and CFD broker that provides a wide range of trading services to clients from …

Read Article