Understanding Spot Purchase Contracts: Everything You Need to Know

Understanding Spot Purchase Contracts A spot purchase contract is a type of agreement between a buyer and a seller for the immediate purchase of goods …

Read Article

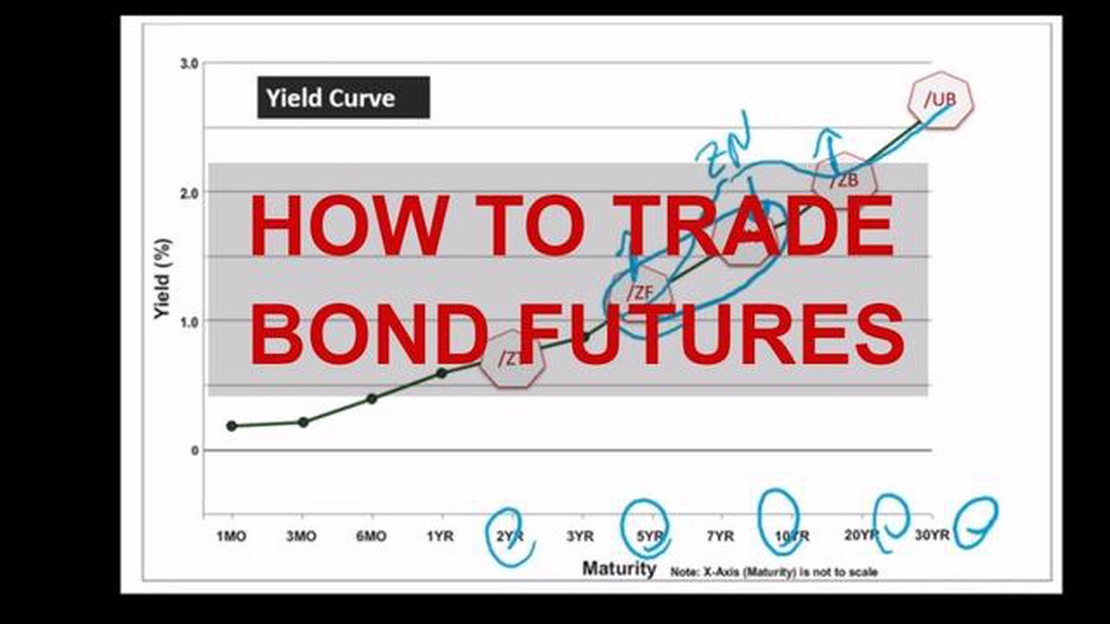

When it comes to trading in the financial market, bond futures can offer a unique and profitable opportunity. Bond futures are contracts that allow traders to speculate on the future price movements of government bonds. They are an essential tool for investors looking to hedge their portfolio against interest rate fluctuations or capitalize on economic trends.

Successful bond futures trading requires a deep understanding of market dynamics and the ability to execute effective strategies. In this article, we will explore some of the most popular strategies used by professional traders to navigate the bond futures market.

One common strategy is the trend-following approach, where traders analyze the historical price data and identify trends that can be traded profitably. By entering trades in the direction of the trend, traders aim to capture potential profit as the market continues to move in the same direction.

Another strategy is the mean reversion approach, which relies on the belief that prices tend to revert to their average over time. Traders using this strategy look for overextended price movements and take positions in the opposite direction, expecting prices to return to their mean. This strategy can be particularly effective in range-bound markets.

Additionally, spread trading is a strategy that involves taking positions in two different bond contracts simultaneously. Traders aim to profit from the price difference between these contracts, known as the spread. This strategy can be used to exploit the relationship between different maturities or bonds with different credit ratings.

These are just a few of the strategies used by professional bond futures traders. The key to success in bond futures trading lies in careful analysis, risk management, and adaptability. By understanding the various strategies and implementing them wisely, traders can increase their chances of success in this exciting marketplace.

Bond futures trading involves the buying and selling of contracts that represent a cash value based on the anticipated future value of a government or corporate bond. To successfully trade bond futures, it is important to have a clear understanding of some basic concepts.

Bond Futures:

A bond future is a standardized contract that represents a commitment to buy or sell a specific bond at a predetermined price and date in the future.

Delivery Month:

The delivery month refers to the specific month in which the bond specified in the futures contract will be delivered. Each bond futures contract has a designated delivery month.

Contract Size:

The contract size is the amount of the underlying bond that is represented by a single futures contract. It is typically expressed in terms of a multiple of the face value of the bond.

Quotation:

The quotation for a bond futures contract represents the price at which the contract can be bought or sold. It is usually quoted in terms of the percentage of the face value of the bond.

Tick Size:

The tick size is the minimum price movement for a bond futures contract. It represents the smallest increment by which the quotation can change.

Expiration Date:

The expiration date is the date on which the futures contract ceases to exist. After this date, the contract can no longer be traded.

Margin:

Margin refers to the amount of money that a trader must deposit with their broker in order to maintain an open position in a futures contract. It acts as a performance bond and ensures that traders have sufficient funds to cover potential losses.

By understanding these basic terms and concepts, traders can begin to navigate the world of bond futures trading with confidence and make informed investment decisions.

When it comes to bond futures trading, developing effective strategies is crucial for success. With the right strategies in place, traders can maximize their profits and minimize their risks. Here are some key factors to consider when developing your trading strategies:

1. Define Your Objectives:

Read Also: How to Trade in Yahoo Fantasy: A Comprehensive Guide

Before you start trading, it’s important to define your trading objectives. Are you looking to generate short-term profits or are you more focused on long-term investments? Knowing your objectives will help you develop a more targeted and effective strategy.

2. Analyze Market Trends:

Keeping an eye on market trends is essential in bond futures trading. By analyzing the movements and patterns of the market, you can make more informed decisions. Look for indicators and signals that can help you predict future market movements.

3. Risk Management:

Read Also: Is QM for Windows Free? Learn About the Pricing and Licensing of QM for Windows

Managing risk is crucial in any trading strategy. When trading bond futures, it’s important to have a clear risk management plan in place. This may include setting stop-loss orders, diversifying your portfolio, and only investing a certain percentage of your capital in each trade.

4. Stay Informed:

The bond market is dynamic and constantly changing. It’s essential to stay informed about economic news, interest rates, and other factors that can impact bond prices. This information can help you make more educated trading decisions.

5. Backtesting and Adjusting:

Once you have developed a trading strategy, it’s important to backtest it. This involves testing the strategy using historical data to see how it would have performed in the past. Based on the results, you can make adjustments to optimize your strategy.

6. Continuous Learning:

Bond futures trading is a complex and evolving field. To stay ahead of the curve, it’s important to continuously educate yourself and stay up to date with the latest market trends and strategies. Attend seminars, read books and articles, and learn from experienced traders.

By considering these factors and continuously refining your strategies, you can develop effective trading strategies for bond futures. Remember, success in trading comes from a combination of knowledge, experience, and disciplined execution.

When it comes to bond futures trading, it is essential to have a solid risk management plan in place. In this section, we will outline some best practices for managing risk and protecting your investment.

1. Set Stop-Loss Orders: One of the most important risk management techniques is setting stop-loss orders. These orders automatically get executed when the price of the bond future reaches a certain level, limiting your potential losses.

2. Diversify Your Portfolio: Spread your risk by diversifying your portfolio. Investing in a variety of bond futures that have different interest rates, maturities, and credit ratings can help mitigate the impact of adverse events on your overall portfolio.

3. Stay Informed: Keep yourself updated with the latest news and economic indicators that can potentially impact bond futures prices. By staying informed, you can make better-informed trading decisions and react quickly to market changes.

4. Practice Proper Position Sizing: Determine the appropriate position size for each trade based on your risk tolerance and account size. Avoid taking on excessive leverage, as it can amplify losses in volatile markets.

5. Use Risk Assessment Tools: Take advantage of risk assessment tools and calculators provided by your brokerage or trading platform. These tools can help you analyze the potential risk and reward of a trade before entering it.

6. Monitor and Adjust: Regularly monitor your trades and make necessary adjustments. If a trade is not going as planned, consider cutting your losses and reevaluating your strategy. On the other hand, if a trade is profitable, consider taking some profits off the table to reduce risk.

7. Consider Using Stop-Limit Orders: In addition to stop-loss orders, consider using stop-limit orders. These orders not only limit your losses but also allow you to specify a price at which you want to exit the trade, ensuring that you get a favorable price.

| Risk Management Strategies | Best Practices |

|---|---|

| Set Stop-Loss Orders | One of the most important risk management techniques |

| Diversify Your Portfolio | Spread your risk by investing in a variety of bond futures |

| Stay Informed | Keep yourself updated with the latest news and economic indicators |

| Practice Proper Position Sizing | Determine the appropriate position size for each trade |

| Use Risk Assessment Tools | Take advantage of risk assessment tools and calculators |

| Monitor and Adjust | Regularly monitor your trades and make necessary adjustments |

| Consider Using Stop-Limit Orders | In addition to stop-loss orders, consider using stop-limit orders |

By implementing these risk management strategies and best practices, you can enhance your chances of success in bond futures trading while minimizing potential losses.

Bond futures are financial contracts that obligate the buyer to purchase a bond on a specific future date at a predetermined price.

Some strategies for trading bond futures include carry trading, spread trading, and trend following.

Carry trading in bond futures involves selling low-yielding bond futures and using the proceeds to buy high-yielding bond futures. The goal is to profit from the difference in interest rates between the two futures contracts.

Trend following in bond futures trading involves identifying and following the direction of price trends in bond futures contracts. Traders aim to enter positions in the direction of the trend and exit when the trend reverses.

Understanding Spot Purchase Contracts A spot purchase contract is a type of agreement between a buyer and a seller for the immediate purchase of goods …

Read ArticleAlternatives to Moneycontrol Portfolio Management Moneycontrol Portfolio Management is a popular platform that allows users to manage their portfolios …

Read ArticleRecording Stock Options in Accounting: A Comprehensive Guide Stock options play a significant role in the world of accounting and finance. They are a …

Read ArticleTrading Futures on MetaTrader: Everything You Need to Know Are you interested in expanding your trading portfolio? Have you considered trading futures …

Read ArticleIs $1,000 a Good Open Interest? When it comes to trading and investing, one key term that often comes up is “open interest.” Open interest refers to …

Read ArticleDo You Pay Tax on SAYE Shares? Investing in employee share ownership plans can be a great way to boost your income and participate in the success of …

Read Article