Understanding Forex Technical Analysis: A Comprehensive Guide

Understanding Forex Technical Analysis When it comes to trading in the forex market, having a solid understanding of technical analysis is crucial. …

Read Article

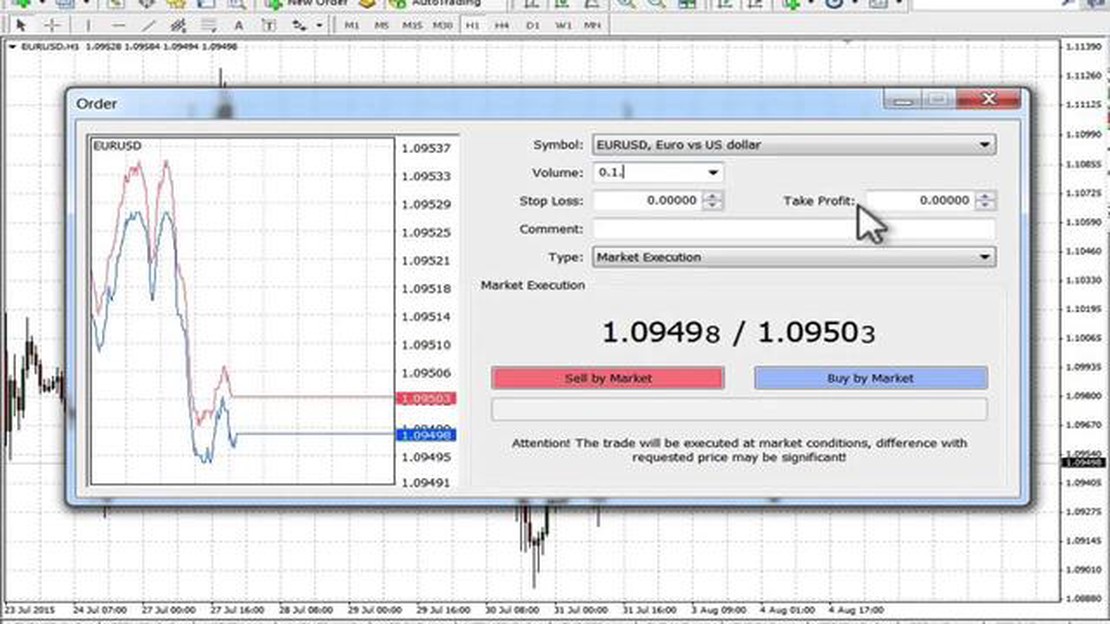

Placing a new order on the Forex market can be a daunting task for beginners. With so many options and unfamiliar terminology, it’s easy to feel overwhelmed. However, with the right guidance, anyone can learn how to navigate the world of Forex trading and place their first order.

Firstly, it’s important to understand the different types of orders that can be placed on the Forex market. The two most common types are market orders and limit orders. A market order is executed immediately at the current market price, while a limit order is executed when the price reaches a specified level.

Once you have decided on the type of order you want to place, the next step is to choose the currency pair you wish to trade. This could be any combination of two currencies, such as USD/EUR or JPY/GBP. It’s important to research and analyze the currency pair you choose, as different pairs can have different levels of volatility and liquidity.

After selecting the currency pair, you will need to determine the size of your order. This is typically measured in lots, with each lot representing a certain amount of currency. It’s important to consider your risk tolerance and trading strategy when determining the size of your order.

Finally, you will need to decide on your entry and exit points. These are the prices at which you will enter the market and exit your position. This decision should be based on technical analysis, such as support and resistance levels, as well as any other indicators or patterns you may be using in your trading strategy.

Placing a new order on the Forex market may seem intimidating at first, but with a step-by-step approach and a solid understanding of the basics, beginners can confidently enter the world of Forex trading. By selecting the appropriate type of order, currency pair, order size, and entry and exit points, beginners can begin to navigate the Forex market and take their first steps towards becoming successful traders.

Forex trading is the buying and selling of currencies on the foreign exchange market. It offers traders the opportunity to profit from the fluctuations in currency prices. Understanding the basics of forex trading is crucial for beginners who seek to enter this market.

Firstly, it is important to know that forex trading is decentralized and operates 24 hours a day, five days a week. This means that it is accessible to traders from all around the world at any time. Additionally, forex trading involves the use of currency pairs, which consist of a base currency and a quote currency. The base currency represents the currency that is being bought or sold, while the quote currency is the currency used to purchase or sell the base currency.

Forex traders aim to make profits by speculating on the movement of currency prices. This can be done by taking either a long or short position on a currency pair. A long position means buying a currency pair with the expectation that its value will increase, while a short position involves selling a currency pair with the expectation that its value will decrease. Traders can enter and exit positions at any time they believe is most opportune.

Leverage is an essential aspect of forex trading. Leverage allows traders to open positions larger than their account balance, thus amplifying potential profits. However, it is important to use leverage wisely, as it also magnifies potential losses. Risk management is crucial in forex trading, and traders should use stop-loss orders to limit their potential losses.

Read Also: What is the brokerage for options trading in Sharekhan?

In conclusion, understanding the basics of forex trading is vital for beginners. By grasping key concepts such as currency pairs, long and short positions, leverage, and risk management, traders will be better equipped to navigate the forex market and make informed trading decisions.

When it comes to entering the world of Forex trading, choosing a reliable broker is crucial. A good broker can make a significant difference in your trading experience and ultimately your success.

Here are some important factors to consider when selecting a Forex broker:

Regulation: Ensure that the broker is regulated by a reputable financial authority. Regulation provides protection for traders and ensures that brokers adhere to certain ethical standards.

Trading Platform: The trading platform is the software that you will use to execute trades. Look for a broker that offers a user-friendly and intuitive platform with a range of features and tools to assist you in making informed trading decisions.

Asset Selection: Different brokers offer different ranges of financial instruments to trade. Consider the types of assets you are interested in trading and choose a broker that provides a wide selection of those assets.

Spreads and Fees: Spreads refer to the difference between the buying and selling price of a currency pair. Lower spreads mean lower trading costs, so it’s essential to choose a broker that offers competitive spreads and reasonable fees.

Deposits and Withdrawals: Check the broker’s policies regarding deposits and withdrawals. Look for brokers that offer convenient and secure payment methods and ensure that the withdrawal process is smooth and hassle-free.

Read Also: Unveiling the Mystery: What Really Happened to Forex

Customer Support: Good customer support is crucial, especially for beginners. Look for brokers that offer prompt and reliable customer support through various channels, such as phone, email, or live chat.

Educational Resources: Consider if the broker provides educational materials and resources for beginners. A reliable broker should offer tutorials, webinars, and other educational materials to help you improve your trading skills.

By considering these factors, you can ensure that you choose a reliable Forex broker that meets your trading needs and helps you achieve your investment goals.

Forex trading is the buying and selling of currencies on the foreign exchange market. It involves buying one currency and simultaneously selling another. Traders aim to make a profit by speculating on the future direction of currency prices.

To place a new order on Forex, you need to have a broker account. Once you have opened an account, you can use a trading platform to place your order. Simply choose the currency pair you want to trade, select the type of order you want to place, enter the desired trade size, and click on the “Buy” or “Sell” button to execute the trade.

A currency pair is the quotation of two different currencies. It represents the value of one currency in terms of the other. For example, the EUR/USD currency pair represents the value of the euro in terms of the U.S. dollar. Currency pairs are traded on the forex market and are the basis for forex trading.

A market order is an order to buy or sell a currency immediately at the best available price. It is executed at the current market price. A limit order, on the other hand, is an order to buy or sell a currency at a specified price or better. It is executed only if the market reaches the specified price or better.

The size of your trade is typically measured in lots. A lot is a standardized quantity of a currency pair. The size of your trade depends on your trading strategy and risk tolerance. It is important to consider factors such as your account balance, leverage, and risk management rules when determining the size of your trade.

Forex trading refers to the act of buying and selling currencies in the foreign exchange market. It is the largest financial market in the world and involves trading in major currency pairs such as EUR/USD, GBP/USD, and USD/JPY.

Understanding Forex Technical Analysis When it comes to trading in the forex market, having a solid understanding of technical analysis is crucial. …

Read ArticleUnderstanding the Options Contract Fee: What You Need to Know Investing in options can be a complex and risky endeavor. There are many factors to …

Read ArticleForeign Currency Options: Exploring the Possibilities Options on foreign currency are financial instruments that allow investors to trade or speculate …

Read ArticleExhibition in Jaipur in March 2023 Jaipur, the capital city of the vibrant state of Rajasthan in India, is known for its rich cultural heritage, …

Read ArticleUnderstanding Kaufman Adaptive Moving Average in MQL5 The Kaufman Adaptive Moving Average (KAMA) is a technical indicator that is used to smooth out …

Read ArticleDoes Pokemon X and Y Have GTS? Pokemon X and Y were released in 2013 as the first installment in the sixth generation of the Pokemon series. With its …

Read Article