Top indicators for successful binary options trading

Best Indicators for Binary Options Trading Binary options trading is a popular way to make money online, but it can also be a risky endeavor. One of …

Read Article

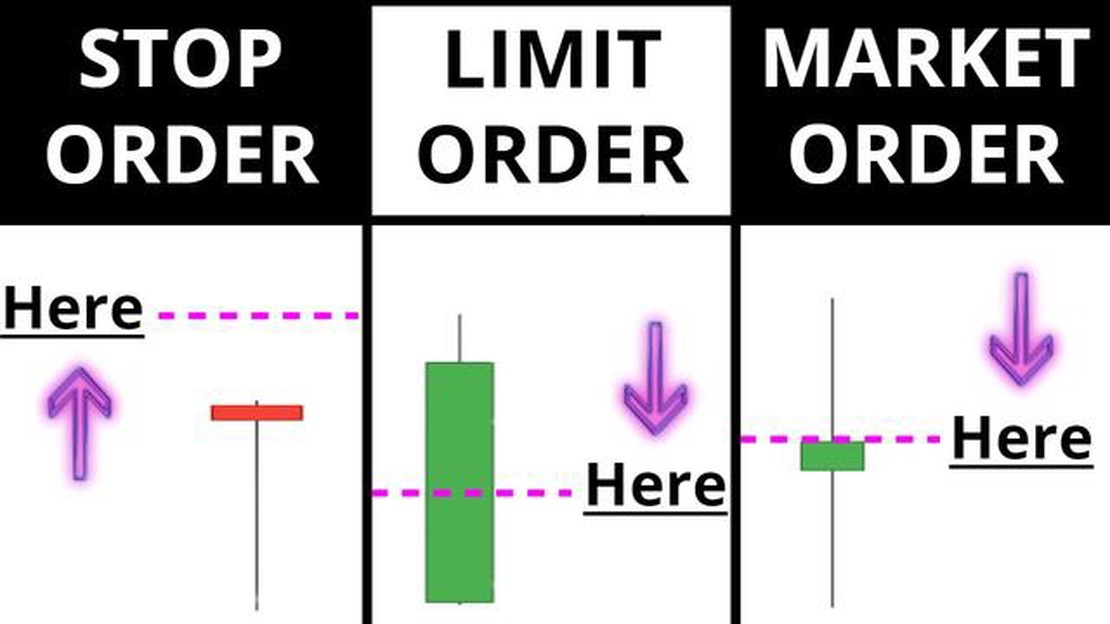

In the world of financial markets, a buy stop order is a popular tool used by traders to enter a long position at a specific price level. This type of order allows traders to automatically buy an asset if its price surpasses a certain threshold, potentially capturing a breakout or a trend reversal. Setting up a buy stop order can be a powerful strategy to capitalize on market movements, but it requires careful planning and execution.

To set up a buy stop order, follow these step-by-step instructions:

Keep in mind that setting up a buy stop order does not guarantee execution at the trigger price. In fast-moving markets or during periods of high volatility, slippage may occur, and your order may be filled at a different price than anticipated.

By following this step-by-step guide, you can set up a buy stop order effectively and take advantage of potential market opportunities. Remember to regularly monitor your orders and adjust them as needed to align with changing market conditions.

The first step in setting up a buy stop order is to open your trading platform. This can be the platform provided by your broker or a third-party trading software that you use. Make sure you have the necessary login credentials and that the software is installed and ready to use on your computer or mobile device.

Once you have opened the trading platform, you will need to log in using your username and password. This will give you access to your trading account and the ability to execute buy stop orders.

Once you have set up your trading account and chosen a platform, the next step is to select a trading pair. A trading pair refers to the two currencies that you want to trade against each other. For example, if you want to buy Bitcoin using US dollars, the trading pair would be BTC/USD.

When selecting a trading pair, it’s important to consider factors such as liquidity, volatility, and trading volume. Liquidity refers to the ease of buying or selling a particular currency without causing significant price changes. Volatility refers to the price fluctuations of a currency, which can impact your trading strategy. Trading volume refers to the number of trades being conducted on a particular trading pair, which can indicate the level of interest and activity in the market.

To select a trading pair, you will typically have access to a list of available pairs on your trading platform. This list may include popular pairs such as BTC/USD, ETH/USD, or XRP/USD, as well as other less popular pairs. You can choose a pair that aligns with your trading goals, risk tolerance, and market analysis.

Read Also: Understanding the TMA Moving Average Indicator and how to use it effectively

It’s also worth noting that different trading pairs may have different fees and spreads. Fees are charges imposed by the platform for executing trades, while spreads refer to the difference between the buying and selling prices of a currency. Consider these factors when selecting a trading pair, as they can affect your trading costs and potential profits.

Once you have selected a trading pair, you can proceed to the next step in setting up your buy stop order.

After selecting the instrument and deciding to place a buy stop order, you need to enter the order details. It’s important to fill in this information accurately to ensure that your order is executed correctly.

| Order type: | Buy Stop |

| Symbol: | Enter the symbol of the security you want to trade. |

| Quantity: | Specify the number of shares or contracts you want to buy. |

| Price: | Enter the price at which you want the buy stop order to be triggered. This should be above the current market price. |

| Validity: | Select the validity period for your buy stop order, such as day order or good till canceled (GTC). |

| Trigger price: | This is the price at which your buy stop order will be triggered and converted into a market order. |

| Stop loss: | Optionally, you can set a stop loss price to automatically sell your position if the market moves against you. |

| Take profit: | Optionally, you can set a take profit price to automatically sell your position if the market moves in your favor. |

| Order duration: | Select the duration for which you want your buy stop order to remain active. |

Read Also: Examples of Automatic Call Distribution (ACD) Systems

Once you have entered all the required details, review them carefully before submitting your order. Make sure that the information is accurate and meets your trading goals. If everything looks good, click on the “Submit” or “Place Order” button to proceed to the next step.

A buy stop order is an order placed above the current market price to buy a security when it reaches a specified price level.

To set up a buy stop order, you first need to choose a brokerage platform that offers this feature. Then, you need to select the security you want to buy and set the stop price at which you want the order to be triggered. Finally, you specify the quantity of the security you want to buy and submit the order.

A buy stop order can be used to enter a trade at a higher price than the current market price, allowing traders to capitalize on potential upward momentum and avoid missing out on a price increase.

Yes, there are certain risks associated with buy stop orders. If the price of the security gaps above the stop price, the order may be executed at a higher price than anticipated. Additionally, in fast-moving markets, the price may quickly move through the stop price, resulting in an execution at a price significantly different than expected.

No, a buy stop order is used to enter a long position, not for short selling. For short selling, a trader would use a sell stop order to trigger a sale when the security reaches a specified price below the current market price.

A buy stop order is a type of order that is used by traders to enter a long position at a specific price level that is above the current market price. It is used to limit potential losses or to capture potential gains.

Best Indicators for Binary Options Trading Binary options trading is a popular way to make money online, but it can also be a risky endeavor. One of …

Read ArticleUnderstanding the Mechanics of Equity Stock Options Equity stock options are an integral part of the financial world, offering individuals and …

Read ArticleExchange Rate in Manila: Currency to BDT The currency exchange rate refers to the rate at which one currency can be exchanged for another. In this …

Read ArticleHow to Calculate Position Size in MT4 Calculating the correct position size is crucial for successful trading in the financial markets. When trading …

Read ArticleUnderstanding the Concept of 10 Pips on a Cent Account For forex traders, understanding the concept of pips is essential. A pip, short for “percentage …

Read ArticleHow to Verify FX Royale With the growing popularity of FX Royale air rifles, it’s important to ensure that you are purchasing an authentic product. …

Read Article