Is Fair Market Value the Same as Present Value? Find out the Difference

Is fair market value the same as present value? When it comes to assessing the worth of an asset or investment, terms like “fair market value” and …

Read Article

When it comes to determining your income for tax purposes, you may be wondering whether stock options should be included in your calculations. Stock options can provide a valuable benefit to employees, but they can also complicate matters when it comes to reporting your income.

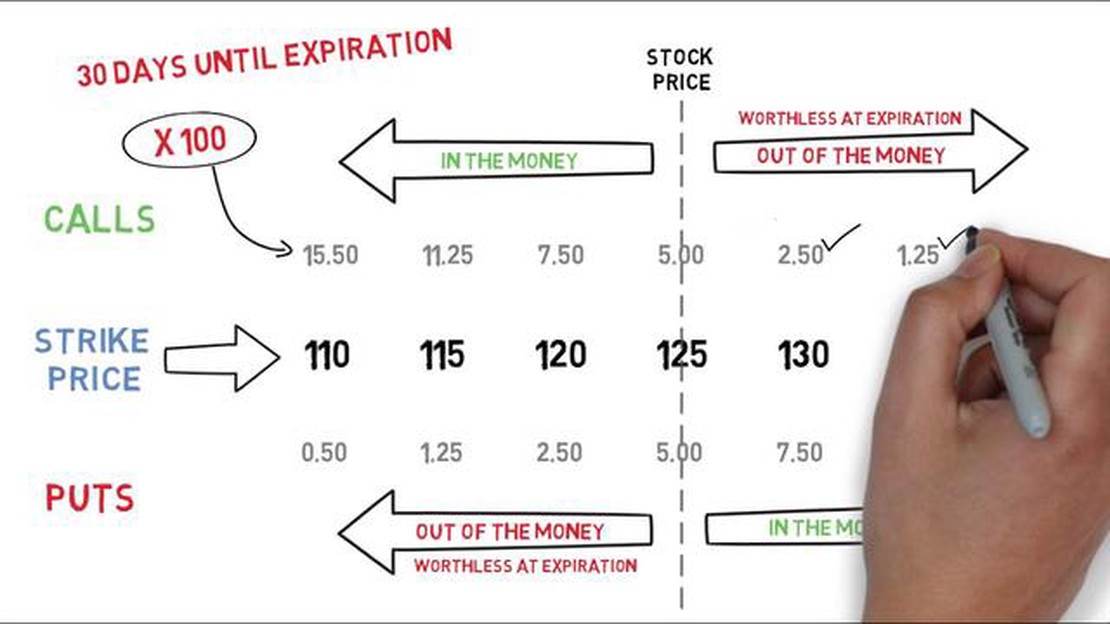

Stock options are a form of compensation that give employees the right to buy company stock at a predetermined price, known as the strike price. If the stock price increases above the strike price, employees can then sell their stock options for a profit.

While stock options can be a lucrative form of compensation, it’s important to understand how they should be treated for tax purposes. In some cases, stock options may be considered a part of your taxable income and should be included in your calculations. This is especially true if you exercise your options and sell the stock. However, there are also situations where stock options are not considered taxable income until they are sold.

The decision of whether to include stock options in your income calculation depends on several factors, including the type of options you have, when and how you exercise them, and any restrictions or conditions placed on the options.

Given the complexity of stock options and their potential impact on your income calculation, it’s always a good idea to consult with a tax professional or financial advisor. They can help guide you through the process and ensure that you are accurately reporting your income while taking advantage of any tax benefits available to you.

Stock options are a form of compensation that is commonly offered by employers, particularly in the technology industry. They give employees the right to purchase company stock at a predetermined price, typically in the future. However, when it comes to calculating income, the question arises whether stock options should be included.

Including stock options in income calculation can be a complex issue. On one hand, stock options have the potential to increase an individual’s overall compensation and provide a valuable financial benefit. By excluding them from income, it may not accurately represent the true value of an employee’s total compensation package.

Read Also: Learn How to Create an ER Diagram for a Database Step by Step

On the other hand, stock options are not guaranteed income since their value depends on the future performance of the company’s stock. They can also be subject to vesting periods, where the employee needs to continue working for the company for a certain period of time before they can exercise their options.

Another consideration is that including stock options in income calculation could create significant tax implications for employees. Since the value is not realized until the stock is sold, the inclusion of stock options in income could result in higher tax liabilities for individuals who may not have the cash flow to cover the taxes.

The decision on whether to include stock options in income calculation ultimately depends on various factors, including the individual’s financial situation and goals. It is important for individuals to consult with financial advisors and tax professionals to understand the potential impact and consequences of including stock options in their income.

| Pros | Cons |

|---|---|

| Accurately represents total compensation | Value depends on future performance of company stock |

| Can provide a valuable financial benefit | May result in higher tax liabilities |

| Can be subject to vesting periods |

Stock options are a form of compensation that gives employees the right to buy company stock at a predetermined price within a specified period. They can be a valuable component of an employee’s overall compensation package.

When employees are granted stock options, they are typically given a certain number of options, known as the grant or the strike price. This price is usually based on the current market value of the company’s stock at the time the options are granted.

Once vested, employees have the option to exercise their stock options, which means buying the company stock at the predetermined price. If the market price of the stock at the time of exercise is higher than the strike price, employees can buy the stock at a discount and potentially make a profit by selling it at the higher market price.

Stock options can be a way for companies to incentivize and retain employees. By offering employees the opportunity to share in the company’s success, it can create a sense of ownership and motivation. Additionally, stock options can provide tax advantages for both the employer and the employee.

Read Also: What Sets MT4 Expert Advisors Apart from MT5 Expert Advisors

| Pros | Cons |

|---|---|

| 1. Can be a valuable financial incentive for employees. | 1. The value of stock options is dependent on the performance of the company’s stock, which can be volatile. |

| 2. Can provide tax advantages, such as lower tax rates on long-term capital gains. | 2. Stock options may have complex rules and restrictions. |

| 3. Can create a sense of ownership and motivation for employees. | 3. Not all employees may fully understand how stock options work or the risks involved. |

It’s important for employees to carefully consider the potential risks and benefits of stock options, especially when factoring them into their overall income calculation. Consulting with a financial advisor or tax professional is recommended to fully understand the implications of stock options and their impact on personal finances.

You should include stock options in your income calculation because they represent a form of compensation that can have significant value. Including stock options in your income calculation gives you a more accurate picture of your overall financial situation.

To include stock options in your income calculation, you need to determine the fair market value of the options at the time they were granted. This can be done by consulting with a financial advisor or utilizing an online tool. Once you have the fair market value, you can add it to your total income for the year.

Yes, there are tax implications for including stock options in your income calculation. When you exercise your stock options, you may be subject to taxes on the difference between the fair market value of the options and the exercise price. It is important to consult with a tax professional to understand the tax implications specific to your situation.

There are several benefits to including stock options in your income calculation. First, it provides a more accurate representation of your overall compensation and financial situation. Second, including stock options can help you better plan for the future and make informed financial decisions. Finally, including stock options in your income calculation may be required by certain lenders or institutions when applying for loans or other financial products.

Is fair market value the same as present value? When it comes to assessing the worth of an asset or investment, terms like “fair market value” and …

Read ArticleTrading Gold in Binary Options: A Comprehensive Guide Trading gold in binary options can be a lucrative venture, especially for those who are …

Read ArticleReasons why forex companies are based in Cyprus Forex companies have been flocking to Cyprus in recent years, making it a hub for the industry. So …

Read ArticleUsing MACD Indicator for Forex Trading Introduction When it comes to forex trading, having a reliable and effective tool is essential. The Moving …

Read ArticleHow long does IDBI international transfer take? If you are planning to make an international money transfer through IDBI Bank, you might be wondering …

Read ArticleImpact of September 11, 2001 Attacks on the Stock Market The stock market crash that occurred on September 11, 2001, sent shockwaves around the world …

Read Article