Convert 25,000 Japanese Yen to Singapore Dollars (SGD) - Current Exchange Rate

Conversion rate: 25,000 yen to sgd Are you planning a trip to Japan or Singapore? Do you need to convert Japanese Yen (JPY) to Singapore Dollars …

Read Article

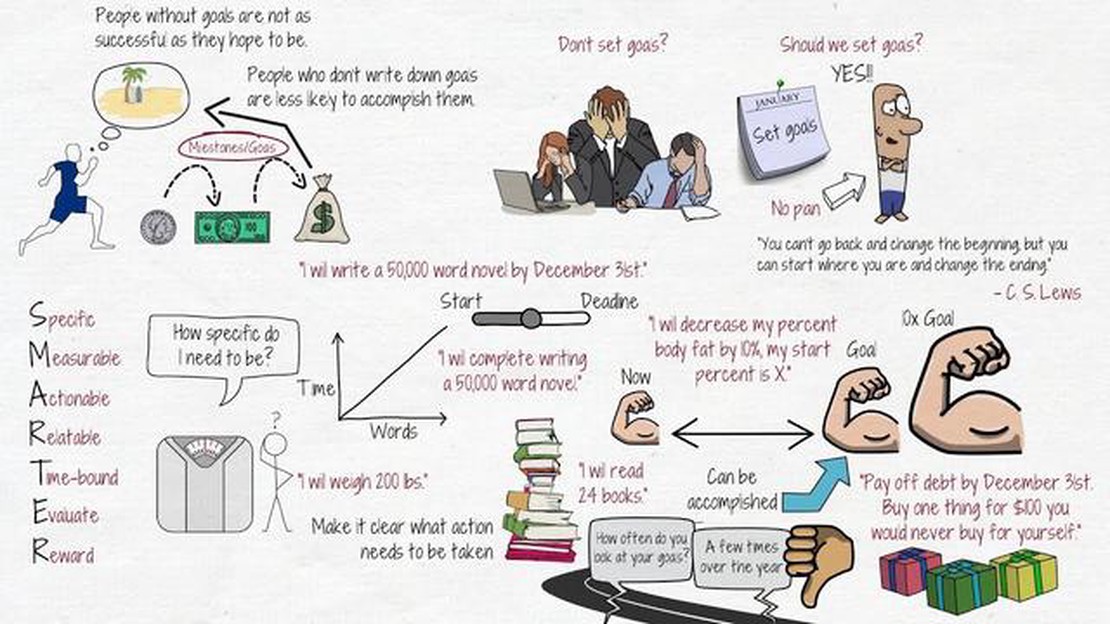

Setting goals is an essential part of achieving success in any endeavor, and trading in the foreign exchange market, or Forex, is no exception. Whether you are a beginner or an experienced trader, having clear and achievable goals can help you stay focused, motivated, and on track.

When it comes to setting goals in Forex, it is important to keep in mind that each trader’s goals may be different. However, there are some common goals that many traders strive to achieve. These goals often include things like increasing profits, minimizing losses, improving trading skills, and developing a consistent trading strategy.

Increasing profits is one of the most common goals for Forex traders. After all, the primary objective of trading in the Forex market is to make money. Setting a specific financial target, such as a certain percentage increase in profits, can help you stay motivated and make better trading decisions.

Minimizing losses is another important goal in Forex trading. Losing trades are inevitable, but minimizing losses can help protect your capital and keep you in the game. Setting a maximum acceptable risk per trade or a maximum acceptable drawdown can help you avoid making impulsive decisions and prevent significant losses.

Improving trading skills is a goal that should be on every trader’s list. The Forex market is constantly evolving, and staying up-to-date with the latest market trends, strategies, and techniques is vital for success. Setting aside time for continuous learning, practicing new trading methods, and analyzing past trades can help you improve your skills and make more informed trading decisions.

In addition to these goals, it is also important to develop a consistent trading strategy. A well-defined trading strategy, based on thorough research and analysis, can provide structure and discipline to your trading activities. Setting specific rules for entry and exit points, risk management techniques, and trade management can help you become a more disciplined and successful trader.

Remember, setting goals in Forex is not just about achieving financial success; it is also about personal growth and continuous improvement. By setting clear and achievable goals, you can establish a roadmap to success and stay motivated on your trading journey.

Goal setting is an essential part of successful forex trading. Without clear and achievable goals, traders may find themselves aimlessly navigating the forex market, leading to poor decision-making and ultimately, financial losses. By setting specific and measurable goals, traders can enhance their focus, discipline, and overall trading performance.

1. Provides Direction: Setting goals helps traders define their purpose and provides them with a clear direction in their trading journey. Goals act as a roadmap, enabling traders to make informed decisions based on their desired outcomes.

2. Enhances Motivation: Having well-defined goals can significantly enhance motivation levels in forex trading. By setting achievable targets, traders have something to strive for, which can increase their determination to succeed and put in the necessary effort to achieve their goals.

3. Improves Discipline: Forex trading requires discipline and the ability to stick to a trading plan. By establishing clear goals, traders can develop self-discipline, which is crucial for adhering to trading strategies, risk management protocols, and controlling emotions during volatile market conditions.

4. Measures Progress: Setting measurable goals allows traders to evaluate their progress over time. Regularly reviewing and analyzing the performance against set goals can help traders identify areas for improvement and make necessary adjustments to their trading strategies.

Read Also: Understanding the Generalized Linear Autoregressive Moving Average Model

5. Manages Risk: Goal setting is vital for managing risk in forex trading. Traders can set goals related to risk management, such as limiting losses or maintaining a certain risk-to-reward ratio. This helps traders stay disciplined and avoid impulsive decisions that could lead to significant financial losses.

In conclusion, goal setting plays a crucial role in forex trading. It provides direction, enhances motivation, improves discipline, measures progress, and helps manage risk. Traders who establish clear and achievable goals are more likely to experience long-term success in the highly competitive forex market.

Read Also: Learn the Formula for Volume Weighted Average

When it comes to setting goals in forex trading, it’s important to be specific and measurable. This means that your goals should be clear and well-defined, and they should also have a way to track your progress and determine whether or not you’ve achieved them.

One common mistake that traders make when setting goals is being too vague. For example, setting a goal to “make more money” is not specific enough. Instead, you might set a goal to increase your monthly profits by a certain percentage or dollar amount.

Another important aspect of setting specific and measurable goals is making them realistic. It’s great to have ambitious goals, but they should also be attainable. Setting unrealistic goals can lead to frustration and disappointment, which can negatively impact your trading performance.

Once you have set specific and measurable goals, it’s important to track your progress regularly. This can help you stay accountable and motivated, and it can also allow you to make any necessary adjustments along the way.

To track your progress, you can use tools such as trading journals or spreadsheets to record your trades and monitor your profits and losses. You can also set milestones or smaller goals that will help you reach your larger goals. By breaking down your goals into smaller steps, you can make the process more manageable and increase your chances of success.

In conclusion, setting specific and measurable goals is crucial for success in forex trading. By being clear and well-defined, you can focus your efforts and work towards achieving your goals. Regularly tracking your progress can also help you stay on track and make any necessary adjustments. So take the time to set specific and measurable goals, and watch your trading performance improve.

Yes, goals are extremely important in Forex trading. Without clear goals, it is difficult to stay focused and disciplined, and it becomes easy to make impulsive decisions based on emotions rather than a well-thought-out strategy.

To set realistic goals in Forex trading, it is important to start by assessing your current trading skills and experience. Consider your risk tolerance, time commitment, and capital availability. From there, you can set specific and measurable goals, such as achieving a certain percentage return on investment or increasing your trading capital by a certain amount within a specific time frame.

Setting short-term goals in Forex trading allows you to track your progress more frequently and make adjustments to your trading strategy if needed. By achieving smaller milestones along the way, you can stay motivated and build confidence in your trading abilities.

One common mistake is setting unrealistic goals that are not based on a thorough understanding of the Forex market and one’s own trading abilities. Another mistake is failing to regularly review and adjust goals as market conditions change. Lastly, some traders may set goals that are too vague or broad, making it difficult to measure progress or determine if the goal has been achieved.

Yes, it is beneficial to set both short-term and long-term goals in Forex trading. Short-term goals help you stay focused and motivated in the present, while long-term goals provide a clear direction and roadmap for your overall trading success. It is important to strike a balance between these two types of goals to maintain a consistent and disciplined trading approach.

Conversion rate: 25,000 yen to sgd Are you planning a trip to Japan or Singapore? Do you need to convert Japanese Yen (JPY) to Singapore Dollars …

Read ArticleConvert $1000 Singapore to USD Are you planning a trip to Singapore or interested in the current exchange rate between the Singapore dollar (SGD) and …

Read ArticleUnderstanding the 4h Time Frame for Trading When it comes to trading on the foreign exchange market, having a solid understanding of different time …

Read ArticleWhat Happens to Your Shares When a Company Goes Private? Investing in the stock market can be a thrilling and sometimes unpredictable endeavor. As a …

Read ArticleCAD vs USD: What’s the Current Battle? The exchange rate between the Canadian Dollar (CAD) and the US Dollar (USD) is a topic of great interest for …

Read ArticleIs the CBOE still in operation? The Chicago Board Options Exchange (CBOE) has a long history in the financial industry, serving as a central hub for …

Read Article