How to calculate a moving average in time series analysis

How to Calculate the Moving Average in Time Series Analysis Time series analysis is a statistical technique used to analyze data points collected over …

Read Article

Recording ESOP on a Balance Sheet: Step-by-Step Guide

Welcome to our step-by-step guide on recording Employee Stock Ownership Plans (ESOP) on a balance sheet. ESOPs are an increasingly popular employee benefit arrangement that can provide significant benefits for both the company and its employees. In this guide, we will walk you through the process of accounting for ESOPs on your company’s balance sheet.

Step 1: Understand the Basics

Before recording ESOP on a balance sheet, it is crucial to understand the basics of how an ESOP works. Essentially, an ESOP is a type of employee benefit plan that allows employees to become owners of the company by purchasing employer stock. The company sets up a trust to hold the stock, and employees receive shares of stock as part of their compensation. The shares are allocated based on factors such as salary, length of service, or a combination of both.

Step 2: Determine the Fair Value

In order to record ESOP on a balance sheet, you need to determine the fair value of the employer stock held in the ESOP trust. This fair value should be based on market prices or independent appraisals. It is important to note that the fair value may change over time, so regular evaluations may be necessary to ensure accurate accounting.

Step 3: Record the Liability and Equity

Once the fair value is determined, it is time to record the liability and equity related to the ESOP on the balance sheet. The liability represents the amount owed to the employees for their shares of stock, while the equity represents the ownership interest of the ESOP trust. The liability and equity should be recorded separately on the balance sheet.

Step 4: Disclose the ESOP in the Notes

Finally, it is essential to disclose information about the ESOP in the notes to the financial statements. This disclosure should include details about the fair value of the employer stock, the method used to determine fair value, and any significant assumptions or estimates made in the process. This information will provide transparency and help stakeholders understand the impact of the ESOP on the company’s financial position.

In conclusion, recording ESOP on a balance sheet requires a thorough understanding of the process and careful consideration of the fair value of the employer stock. By following these steps and providing appropriate disclosures, you can ensure accurate and transparent accounting for ESOPs.

Read Also: Master the Art of Options Trading with the Easiest Learning Path

An Employee Stock Ownership Plan (ESOP) is a type of employee benefit plan that enables company employees to become owners of company stock. With an ESOP, employees are given the opportunity to purchase shares of the company, usually at a discounted price, and thereby become shareholders. These shares are typically held in a trust and allocated to employee accounts based on criteria established by the ESOP.

ESOPs are important for several reasons:

In summary, ESOPs offer employees the opportunity to become owners of the company they work for, provide retirement savings benefits, offer tax advantages, and can be used as a succession planning tool. These factors make ESOPs an important and valuable employee benefit and ownership structure.

An Employee Stock Ownership Plan (ESOP) is a type of employee benefit plan that allows employees to become owners of a company through the allocation of company stocks. Under an ESOP, employees receive shares of stock as a form of compensation or as a result of the company’s retirement plan.

Read Also: Can You Trade Options on ETFs? Everything You Need to Know

One of the main benefits of an ESOP is that it provides employees with a direct stake in the company’s success. As owners, employees have a vested interest in the company’s performance and are more motivated to work towards its growth and profitability.

ESOPs also offer financial benefits to both the company and the employees. For the company, ESOPs can be used as a tool for attracting and retaining talented employees. It can also provide a tax advantage for the company, as contributions to the ESOP are tax-deductible.

For employees, ESOPs provide a way to accumulate wealth and generate retirement savings. As the company grows, the value of the employee’s shares increases, allowing them to benefit from the company’s success. ESOPs also offer tax advantages to employees, as the gains from the sale of ESOP shares may be taxed at a lower rate or deferred until retirement.

In addition to the financial benefits, ESOPs can also help foster a positive company culture by promoting employee ownership and participation. Employees are more likely to feel engaged and empowered when they have a direct stake in the company’s success.

Overall, ESOPs can be a valuable tool for both companies and employees. They provide financial benefits, incentivize employees, and contribute to creating a positive work environment. Implementing an ESOP requires careful planning and consideration, but can yield significant rewards for all parties involved.

ESOP stands for Employee Stock Ownership Plan. It is a type of employee benefit plan that allows employees to become owners of company stock.

Recording ESOP on a company’s balance sheet allows for transparency and better understanding of the company’s financial position. It also shows the ownership interest of employees and can be used to calculate the diluted earnings per share.

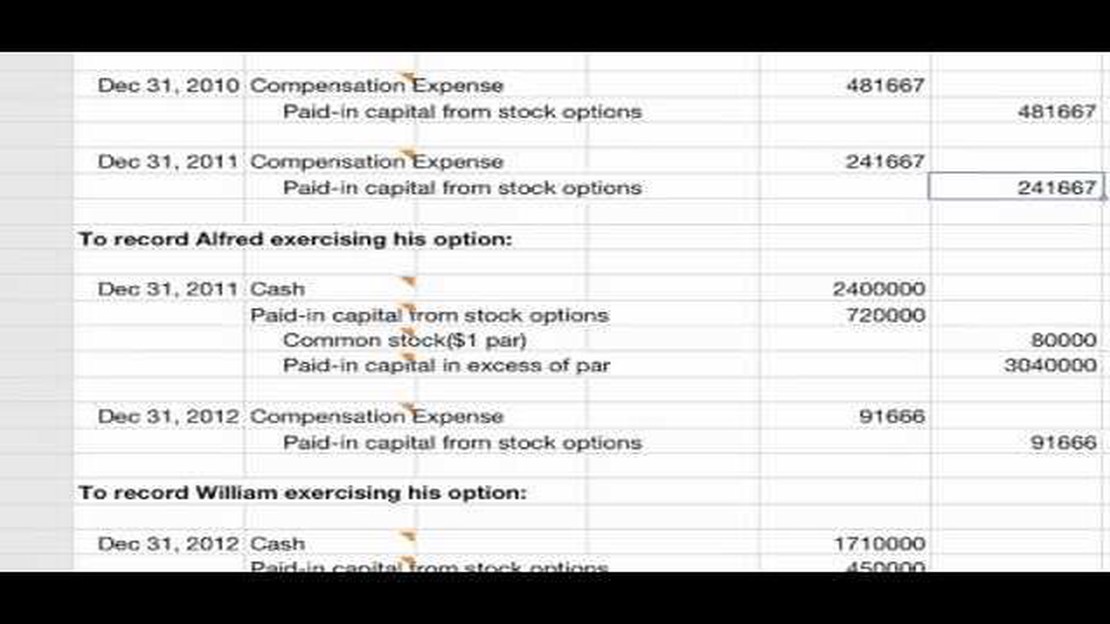

The steps to record ESOP on a balance sheet include determining the fair value of the ESOP shares, adjusting the shareholder’s equity section of the balance sheet, and recording any related transactions and expenses.

The fair value of ESOP shares can be calculated using various methods such as the market price of the stock, the book value of the stock, or by using a valuation model. This calculation should be done by a qualified appraiser.

How to Calculate the Moving Average in Time Series Analysis Time series analysis is a statistical technique used to analyze data points collected over …

Read ArticleWhere Can I Get Tick Data for Free? When it comes to trading and investing, having access to accurate and reliable tick data is essential. Tick data …

Read ArticleThe Best Places to Observe Exchange Rates Exchange rates are a crucial aspect of the global economy. They determine the value of one currency in …

Read ArticleUnderstanding the 25000 Rule for Day Trading Day trading can be an exciting and potentially lucrative way to make money in the stock market. However, …

Read Article37signals’ Worth: How Much Is It?+ 37signals, a software development company founded in 1999, has become one of the most influential players in the …

Read ArticleUnderstanding the Role of a Forex Company in the Financial Market When it comes to the world of international finance, Forex companies play a vital …

Read Article